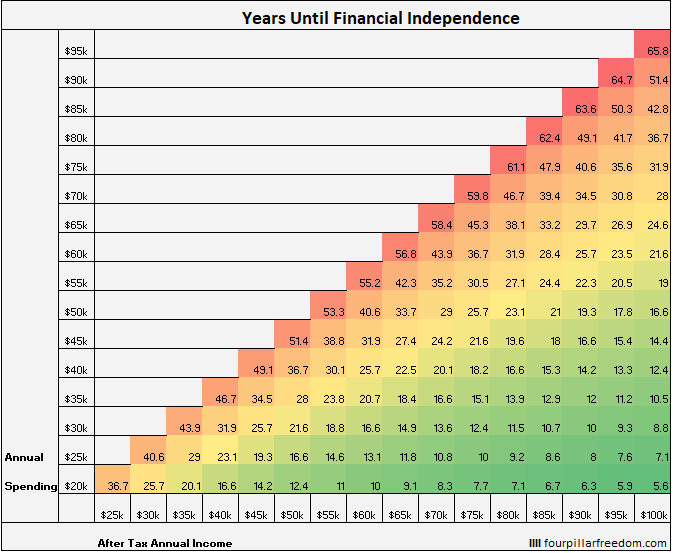

Behold. The Early Retirement Grid.

This grid shows how many years it will take you to reach financial independence based on your current annual income and annual spending. This grid assumes you earn 5% annual returns on investments and you will be withdrawing 4% of your money each year once you reach financial independence. It also assumes you have no other savings already. Let’s walk through an example:

Suppose you make $50,000 per year. After taxes, you might bring home around $40,000. Let’s then say your annual spending is $30,000. From the grid above we can see that it will take you 31.1 years to reach financial independence.

How did we reach that number? Well, if you earn $40,000 and only spend $30,000 that leaves you with $10,000 left to invest every year. Assuming you earn a 5% annual return on your investments, it will take you 31.1 years to have enough money where you can withdraw 4% of your portfolio and never go broke.

The Power of the Income – Spending Gap

Clearly from this grid you can see the importance of making the gap between your income and spending as wide as possible. If you can earn $90,000 per year and only spend $20,000 you only need to work for 6 years to have enough money to support you for the rest of your life. But if you earn $90,000 and are spending $85,000 it will take you over 60 years to retire.

I think the real value of this grid is within the $40,000 – $60,000 income range. This is where most income earners are. If you earn $50,000 per year and you are spending $40,000 per year, it will take you about 36 years to reach financial independence. But if you can cut your spending to $30,000 per year you would reach financial independence in 21 years.

That’s a 15 year difference!

For people in the middle class, cutting spending by a mere $5,000 – $10,000 each year leads to a huge decrease in the amount of time it takes to reach financial independence.

My favorite free financial tool I’ve been using since 2015 to manage my net worth is Personal Capital. Each month I use their free Investment Checkup tool and Retirement Planner to track my investments and ensure that I’m on the fast track to financial freedom.

My favorite place to find new personal finance articles to read is Collecting Wisdom, a site I created that collects the best personal finance articles floating around the web on a daily basis.