When I first started managing my own money, I used a tedious process to track the balances in all of my various accounts.

On the first day of each month, I would log in to several different websites, check my account balances, and record them all manually in an Excel spreadsheet. I would create my own bar graphs and line charts to visualize changes in my income, expenses, and net worth each month.

Even for someone like me who enjoys creating visuals and tracking my net worth, this was an annoying and time-consuming process.

Fortunately, I found a solution back in 2015 in the form of Personal Capital. They are a free online platform that aggregates all your financial accounts in one place so you can get a holistic view of your money. The company is based in San Francisco and currently serves over 165 million users (including myself!) with over $300 billion in tracked accounts.

Thanks to Personal Capital, it only takes me about 15 minutes each month to get a quick view of my account balances, total income, and total expenses each month.

If you want to optimize and simplify your finances, I recommend signing up with Personal Capital. It’s easy to set up, easy to use, and best of all it’s free.

Six Reasons to Join Personal Capital

1. Simplicity. Arguably the best reason to join Personal Capital is to simplify your financial life. Instead of logging into a dozen different accounts to check your brokerage accounts, 401(k) account(s), IRAs, checking accounts, and savings accounts, you can simply link all of your financial accounts to Personal Capital and gain the ability to see all of your account balances in one simple dashboard. This is a huge time saver. Also, it’s helpful to get a holistic view of your overall financial life so you know where you’re doing well and where you have room to improve. This brief video shows a snapshot of the dashboard:

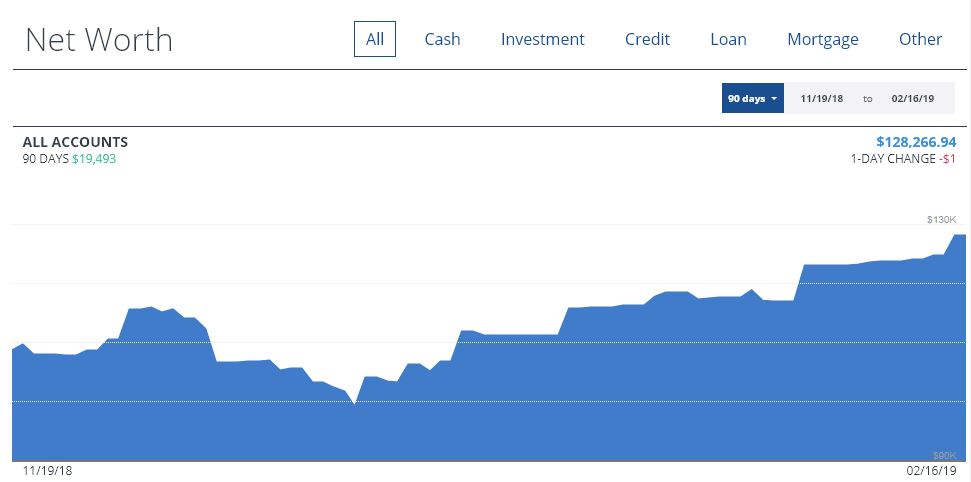

2. Net Worth Tracking. Personal Capital makes it super easy to track your net worth. Each time you sign into your account, each of your linked account balances automatically updates and Personal Capital aggregates each of these balances into a simple net worth chart. This is one of my favorite parts of the dashboard because I no longer have to manually log in to each of my accounts and add up the balances in an Excel spreadsheet. Personal capital does all of the heavy lifting for me.

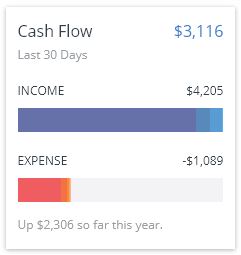

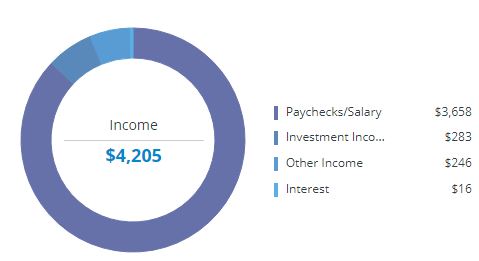

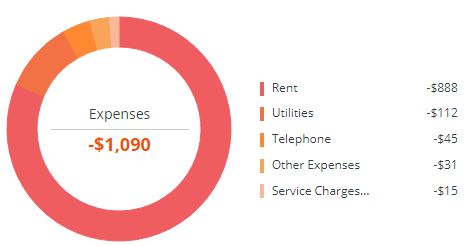

3. Cash Flow Tracking. One of the best ways to get ahead financially is to know exactly how much you’re earning and spending each month. After all, the wider the gap between your income and spending, the faster you can reach your financial goals. Luckily, Personal Capital simplifies the process of tracking your cash flow by showing you exactly how much you earned and spent each month by displaying a list of transactions along with some simple charts to summarize your transactions.

4. Portfolio Allocation Tracking. Under the Investing > Allocation tab, you can see your total investment allocation across all of your accounts, i.e. what percentage of your investments are in stocks, bonds, real estate, etc. This is useful because if your goal is to maintain a 90% stock allocation (or whatever amount), this chart helps you see if you’re at, or near, this desired allocation. If you see that you’re far off from your desired allocation, you can make necessary adjustments.

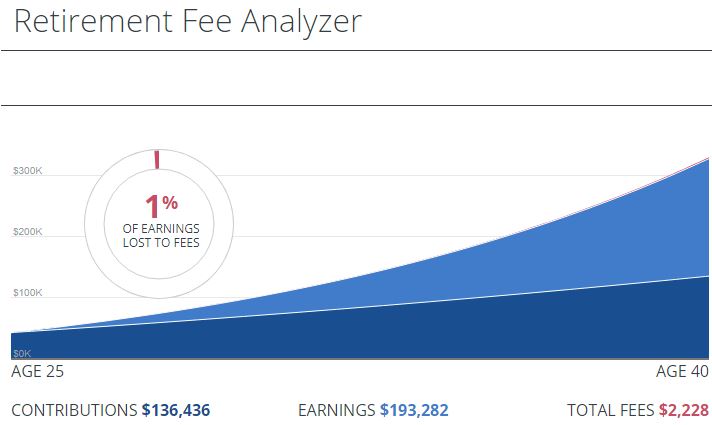

5. Minimize Fees. Personal Capital has a neat Retirement Fee Analyzer that lets you see how much you’re paying in investment fees based on your current investments across your accounts. This is an incredibly helpful tool because it helps you see if you’re overpaying in fees on any of your funds. This tool also shows you exactly how much you’ll lose due to fees over the course of several decades.

6. Maximize Investment Efficiency. Another neat visual that Personal Capital offers is an Efficient Frontier Curve, which lets you see whether or not your current allocation offers you decent returns with minimal risk.

Use Personal Capital to Simplify and Optimize Your Finances

Without a doubt, creating a free account on Personal Capital is one of the best financial decisions I’ve ever made. It has made tracking, managing, and optimizing my cash flow and my net worth so much easier and more convenient.

If you want to optimize and simplify your finances, I recommend signing up with Personal Capital. It’s easy to set up, easy to use, and best of all it’s free.