Visualizing the S&P 500

An Exploration of Warren Buffett's Favorite Stock Market Index

The S&P 500 is a U.S. stock market index composed of 500 large U.S. companies based on market capitalizations. Market capitalization simply refers to the size of a company. The larger the company, the larger the market cap. In the case of the S&P 500, companies with larger market caps make up a larger portion of the index.

Warren Buffett is a longtime advocate of the S&P 500, claiming most common investors are better off investing in an S&P 500 index fund instead of actively managed stock market funds.

Today I want to explore the stocks that make up the S&P 500 and highlight some interesting facts about the size of some of these stocks in relation to each other.

Let's dive in!

Visualizing Every Stock in the S&P 500 as Tiny Circles

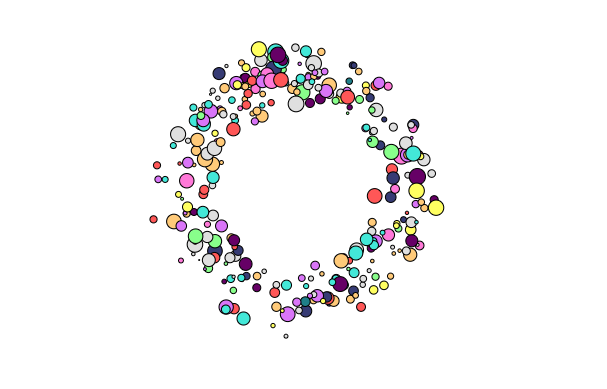

To visualize every single stock in the S&P 500, I use tiny circles. Each of the 506 circles below represents a unique stock. Some companies issue more than one 'class' of stock, which explains why there are more than 500 stocks total. An example of this is Under Armour, who has both 'Class A' and 'Class C' stocks.

The size of the circle represents the market cap of the stock and the color represents the economic industry the stock is in. Hover over individual circles to display information about the stock.

SORT STOCKS BY

Some Interesting Observations

The three largest stocks in the S&P 500 are all in the Information Technology Industry: Apple, Microsoft, and Facebook. These three giants alone make up over 8% of the entire S&P 500.

When sorting the stocks by market cap, it becomes apparent just how massive the largest stocks are in comparison to their peers. For example, Apple is over five times larger than Walt Disney Company and six times larger than McDonald's.

It's also interesting to sort the stocks by industry. For example, there are only four stocks in the entire index that come from the Telecommunications industry, two of these being cellphone provider giants AT&T and Verizon.

The industry with the smallest stocks, on average, is real estate. Those are the tiny yellow circles. Conversely, the industry with the largest stocks, on average, is information technology.

For me, the most surprising aspect of this visualization is just how large some of these stocks are in comparison to others. Some houshold company names like Goodyear Tire and Tractor Supply look like Mom and Pop shops compared to some of the tech companies. Let's take a closer look at just how large (and how small) these companies are in relation to each other...

A Closer Look at the Behemoths

Apple

The largest stock in the S&P 500 is Apple. It's massive.

In fact, it's so large that it's equal in size to the 109 smallest stocks in the S&P 500. (Hover over each tiny circle below to see the names of these 109 stocks)

What makes this so incredible is that the names of some of these so called "small" stocks are well-known companies, including Macy's, Chipotle, and Advance Auto Parts.

The Three Tech Giants

The three largest stocks are Apple, Microsoft, and Facebook. Together they compose 8.42% of the entire S&P 500.

They're equivalent in size to the smallest 191 stocks in the index.

The Top Ten

The ten largest stocks make up nearly 20% of the entire S&P 500.

These ten are equivalent in size to the smallest 311 stocks in the index.

Not as Diversified as Advertised

One of the reasons many investors like the S&P 500 is because it offers a "diversified" method of investing, since buying a single share in the S&P 500 exposes you to 506 unique stocks. This mitigates some of the risk that inherently comes with investing in a single stock. But from the visualizations here we can see that the S&P 500 might not be quite as diversified as you think.

Due to the weighted nature of the index, many of the large companies make up a disproportionately large percentage of the index. This means a bad year for Apple would have a considerably larger impact on the performance of this index fund compared to a bad year for Royal Caribbean Cruises.

The S&P 500 is also top-heavy with information technology stocks, which means it isn't as diversified across economic industries as investors might think. This may or may not be a bad thing depending on how this individual industry performs.

Hopefully this exploration offers an insightful look at the exact composition of the stock market fund that Warren Buffett loves so much.

Notes

The stock weightings used in this analysis were current as of September 10th, 2017. All information about stock names, industry, and market cap size can be publicly found on Yahoo Finance.

I used Microsoft Excel and R to prepare the data for this analysis. I used vanilla javascript and D3.js for all visualizations and interactive features. For the sorting functionality in the first graph I utilized the comparator function and the grid layout function created by Jeremy Stucki.

Company,size,Sector,id,color,y 3M Company,0.593972,Industrials,1,#ffca79,106 A. O. Smith Corporation,0.03981,Industrials,2,#ffca79,70 Abbott Laboratories,0.415229,Health Care,3,#ff5757,134 AbbVie Inc.,0.640057,Health Care,4,#ff5757,88 Accenture Plc Class A,0.393101,Information Technology,5,#43e8d8,124.5 Activision Blizzard Inc.,0.226276,Information Technology,6,#43e8d8,146.5 Acuity Brands Inc.,0.03147,Industrials,7,#ffca79,103.5 Adobe Systems Incorporated,0.360387,Information Technology,8,#43e8d8,83 Advance Auto Parts Inc.,0.031932,Consumer Discretionary,9,#dfdfdf,70.5 Advanced Micro Devices Inc.,0.049166,Information Technology,10,#43e8d8,141.5 AES Corporation,0.034237,Utilities,11,#ff79d8,149.5 Aetna Inc.,0.240402,Health Care,12,#ff5757,62.5 Affiliated Managers Group Inc.,0.048118,Financials,13,#d975f8,81.5 Aflac Incorporated,0.153805,Financials,14,#d975f8,126 Agilent Technologies Inc.,0.099327,Health Care,15,#ff5757,69.5 Air Products and Chemicals Inc.,0.151675,Materials,16,#660066,122 Akamai Technologies Inc.,0.038438,Information Technology,17,#43e8d8,144.5 Alaska Air Group Inc.,0.040946,Industrials,18,#ffca79,59 Albemarle Corporation,0.069256,Materials,19,#660066,52.5 Alexandria Real Estate Equities Inc.,0.050391,Real Estate,20,#ffff61,68 Alexion Pharmaceuticals Inc.,0.149188,Health Care,21,#ff5757,102.5 Align Technology Inc.,0.062765,Health Care,22,#ff5757,121 Allegion PLC,0.036494,Industrials,23,#ffca79,64 Allergan plc,0.336082,Industrials,24,#ffca79,94.5 Alliance Data Systems Corporation,0.048167,Information Technology,25,#43e8d8,141.5 Alliant Energy Corp,0.045107,Utilities,26,#ff79d8,97.5 Allstate Corporation,0.154712,Financials,27,#d975f8,104 Alphabet Inc. Class A,1.297788,Information Technology,28,#43e8d8,112 Alphabet Inc. Class C,1.295076,Information Technology,29,#43e8d8,64.5 Altria Group Inc.,0.555484,Consumer Staples,30,#363b74,101.5 Amazon.com Inc.,1.799505,Consumer Discretionary,31,#dfdfdf,149.5 Ameren Corporation,0.066158,Utilities,32,#ff79d8,113 American Airlines Group Inc.,0.089257,Industrials,33,#ffca79,72 American Electric Power Company Inc.,0.164597,Utilities,34,#ff79d8,119.5 American Express Company,0.303704,Financials,35,#d975f8,145 American International Group Inc.,0.250212,Financials,36,#d975f8,68 American Tower Corporation,0.280177,Real Estate,37,#ffff61,100.5 American Water Works Company Inc.,0.068276,Utilities,38,#ff79d8,79 Ameriprise Financial Inc.,0.098489,Financials,39,#d975f8,145 AmerisourceBergen Corporation,0.061227,Health Care,40,#ff5757,59.5 AMETEK Inc.,0.071456,Industrials,41,#ffca79,81.5 Amgen Inc.,0.632522,Health Care,42,#ff5757,51.5 Amphenol Corporation Class A,0.118818,Information Technology,43,#43e8d8,100 Anadarko Petroleum Corporation,0.113378,Energy,44,#88ff8b,137.5 Analog Devices Inc.,0.145607,Energy,45,#88ff8b,69.5 Andeavor,0.070156,Energy,46,#88ff8b,91.5 ANSYS Inc.,0.048827,Energy,47,#88ff8b,86 Anthem Inc.,0.223042,Health Care,48,#ff5757,73 Aon plc,0.170825,Financials,49,#d975f8,52 Apache Corporation,0.073463,Energy,50,#88ff8b,148 Apartment Investment and Management Company Class A,0.032624,Real Estate,51,#ffff61,142 Apple Inc.,3.814297,Information Technology,52,#43e8d8,107.5 Applied Materials Inc.,0.239462,Information Technology,53,#43e8d8,55.5 Archer-Daniels-Midland Company,0.116509,Consumer Staples,54,#363b74,101.5 Arconic Inc.,0.04672,Industrials,55,#ffca79,104.5 Arthur J. Gallagher & Co.,0.050439,Financials,56,#d975f8,131 Assurant Inc.,0.024033,Financials,57,#d975f8,85 AT&T Inc.,1.093362,Telecommunication Services,58,#1F7F89,101 Autodesk Inc.,0.11561,Information Technology,59,#43e8d8,97.5 Automatic Data Processing Inc.,0.224184,Information Technology,60,#43e8d8,111 AutoZone Inc.,0.071599,Consumer Discretionary,61,#dfdfdf,124.5 AvalonBay Communities Inc.,0.116044,Consumer Discretionary,62,#dfdfdf,88.5 Avery Dennison Corporation,0.040358,Materials,63,#660066,126.5 Baker Hughes a GE Company Class A,0.074056,Materials,64,#660066,93 Ball Corporation,0.066186,Materials,65,#660066,52 Bank of America Corporation,1.134707,Financials,66,#d975f8,121 Bank of New York Mellon Corporation,0.250976,Financials,67,#d975f8,72 Baxter International Inc.,0.149414,Health Care,68,#ff5757,147.5 BB&T Corporation,0.168559,Financials,69,#d975f8,90 Becton Dickinson and Company,0.204227,Health Care,70,#ff5757,60.5 Berkshire Hathaway Inc. Class B,1.639008,Financials,71,#d975f8,65 Best Buy Co. Inc.,0.06643,Consumer Discretionary,72,#dfdfdf,73 Biogen Inc.,0.312741,Health Care,73,#ff5757,131.5 BlackRock Inc.,0.249455,Financials,74,#d975f8,114.5 Boeing Company,0.652539,Industrials,75,#ffca79,141.5 BorgWarner Inc.,0.045565,Consumer Discretionary,76,#dfdfdf,52.5 Boston Properties Inc.,0.08568,Real Estate,77,#ffff61,144 Boston Scientific Corporation,0.182873,Health Care,78,#ff5757,143 Brighthouse Financial Inc.,0.026281,Financials,79,#d975f8,60 Bristol-Myers Squibb Company,0.480157,Health Care,80,#ff5757,79 Broadcom Limited,0.472659,Information Technology,81,#43e8d8,146.5 Brown-Forman Corporation Class B,0.049529,Consumer Staples,82,#363b74,98.5 C. R. Bard Inc.,0.107532,Industrials,83,#ffca79,81 C.H. Robinson Worldwide Inc.,0.047609,Industrials,84,#ffca79,71 CA Inc.,0.047976,Industrials,85,#ffca79,114.5 Cabot Oil & Gas Corporation,0.057918,Energy,86,#88ff8b,86.5 Cadence Design Systems Inc.,0.051633,Energy,87,#88ff8b,144 Campbell Soup Company,0.042524,Consumer Staples,88,#363b74,125.5 Capital One Financial Corporation,0.181168,Financials,89,#d975f8,68.5 Cardinal Health Inc.,0.097192,Financials,90,#d975f8,148 CarMax Inc.,0.059541,Consumer Discretionary,91,#dfdfdf,69.5 Carnival Corporation,0.123693,Consumer Discretionary,92,#dfdfdf,55.5 Caterpillar Inc.,0.342081,Industrials,93,#ffca79,94.5 CBOE Holdings Inc.,0.055549,Financials,94,#d975f8,117.5 CBRE Group Inc. Class A,0.051407,Real Estate,95,#ffff61,106 CBS Corporation Class B,0.099674,Consumer Discretionary,96,#dfdfdf,98 Celgene Corporation,0.521422,Health Care,97,#ff5757,69 Centene Corporation,0.071991,Health Care,98,#ff5757,121.5 CenterPoint Energy Inc.,0.059106,Utilities,99,#ff79d8,131.5 CenturyLink Inc.,0.047334,Telecommunication Services,100,#1F7F89,142 Cerner Corporation,0.10224,Health Care,101,#ff5757,136.5 CF Industries Holdings Inc.,0.038132,Materials,102,#660066,75.5 Charles Schwab Corporation,0.227503,Financials,103,#d975f8,119 Charter Communications Inc. Class A,0.340184,Consumer Discretionary,104,#dfdfdf,95 Chesapeake Energy Corporation,0.017125,Energy,105,#88ff8b,97 Chevron Corporation,1.025891,Energy,106,#88ff8b,68.5 Chipotle Mexican Grill Inc.,0.035326,Consumer Discretionary,107,#dfdfdf,78 Chubb Limited,0.310777,Financials,108,#d975f8,72 Church & Dwight Co. Inc.,0.060155,Consumer Staples,109,#363b74,145 Cigna Corporation,0.212593,Health Care,110,#ff5757,82 Cimarex Energy Co.,0.046594,Energy,111,#88ff8b,84 Cincinnati Financial Corporation,0.052858,Financials,112,#d975f8,72.5 Cintas Corporation,0.053602,Industrials,113,#ffca79,105.5 Cisco Systems Inc.,0.756657,Information Technology,114,#43e8d8,128.5 Citigroup Inc,0.901842,Information Technology,115,#43e8d8,111.5 Citizens Financial Group Inc.,0.08476,Financials,116,#d975f8,75.5 Citrix Systems Inc.,0.051175,Information Technology,117,#43e8d8,67 Clorox Company,0.081608,Consumer Staples,118,#363b74,104 CME Group Inc. Class A,0.207409,Financials,119,#d975f8,97.5 CMS Energy Corporation,0.060884,Utilities,120,#ff79d8,123.5 Coach Inc.,0.052798,Consumer Discretionary,121,#dfdfdf,138.5 Coca-Cola Company,0.822928,Consumer Discretionary,122,#dfdfdf,136 Cognizant Technology Solutions Corporation Class A,0.198807,Information Technology,123,#43e8d8,96 Colgate-Palmolive Company,0.299207,Consumer Staples,124,#363b74,79.5 Comcast Corporation Class A,0.816331,Consumer Discretionary,125,#dfdfdf,135.5 Comerica Incorporated,0.058759,Financials,126,#d975f8,87.5 Conagra Brands Inc.,0.065738,Consumer Staples,127,#363b74,57 Concho Resources Inc.,0.084465,Energy,128,#88ff8b,63 ConocoPhillips,0.269166,Energy,129,#88ff8b,112 Consolidated Edison Inc.,0.118369,Utilities,130,#ff79d8,114.5 Constellation Brands Inc. Class A,0.16244,Consumer Staples,131,#363b74,91 Cooper Companies Inc.,0.053014,Health Care,132,#ff5757,148 Corning Inc,0.125654,Health Care,133,#ff5757,99.5 Costco Wholesale Corporation,0.329824,Consumer Staples,134,#363b74,144 Coty Inc. Class A,0.036363,Consumer Staples,135,#363b74,65.5 Crown Castle International Corp,0.193158,Consumer Staples,136,#363b74,138 CSRA Inc.,0.024202,Information Technology,137,#43e8d8,138 CSX Corporation,0.220012,Industrials,138,#ffca79,67.5 Cummins Inc.,0.122862,Industrials,139,#ffca79,117.5 CVS Health Corporation,0.394054,Consumer Staples,140,#363b74,132.5 D.R. Horton Inc.,0.059119,Consumer Discretionary,141,#dfdfdf,141.5 Danaher Corporation,0.246493,Health Care,142,#ff5757,134.5 Darden Restaurants Inc.,0.048228,Consumer Discretionary,143,#dfdfdf,53 DaVita Inc.,0.042888,Consumer Discretionary,144,#dfdfdf,121 Deere & Company,0.183483,Industrials,145,#ffca79,148 Delphi Automotive PLC,0.126364,Industrials,146,#ffca79,62.5 Delta Air Lines Inc.,0.148158,Consumer Discretionary,147,#dfdfdf,137 DENTSPLY SIRONA Inc.,0.062358,Health Care,148,#ff5757,136.5 Devon Energy Corporation,0.082629,Health Care,149,#ff5757,108.5 Digital Realty Trust Inc.,0.112137,Energy,150,#88ff8b,92 Discover Financial Services,0.104768,Financials,151,#d975f8,93 Discovery Communications Inc. Class A,0.014664,Financials,152,#d975f8,139.5 Discovery Communications Inc. Class C,0.020099,Financials,153,#d975f8,83 DISH Network Corporation Class A,0.056106,Consumer Discretionary,154,#dfdfdf,102 Dollar General Corporation,0.093391,Consumer Discretionary,155,#dfdfdf,136.5 Dollar Tree Inc.,0.091911,Consumer Discretionary,156,#dfdfdf,127.5 Dominion Energy Inc,0.234313,Utilities,157,#ff79d8,52 Dover Corporation,0.065905,Industrials,158,#ffca79,143 DowDuPont Inc.,0.761148,Materials,159,#660066,90 Dr Pepper Snapple Group Inc.,0.078639,Consumer Staples,160,#363b74,146 DTE Energy Company,0.091946,Consumer Staples,161,#363b74,86 Duke Energy Corporation,0.279817,Utilities,162,#ff79d8,53.5 Duke Realty Corporation,0.048421,Real Estate,163,#ffff61,52 DXC Technology Co.,0.111905,Information Technology,164,#43e8d8,96.5 E*TRADE Financial Corporation,0.053787,Financials,165,#d975f8,88.5 Eastman Chemical Company,0.059261,Materials,166,#660066,66 Eaton Corp. Plc,0.160953,Materials,167,#660066,147 eBay Inc.,0.178694,Industrials,168,#ffca79,110.5 Ecolab Inc.,0.1595,Information Technology,169,#43e8d8,77 Edison International,0.120781,Materials,170,#660066,115 Edwards Lifesciences Corporation,0.109196,Health Care,171,#ff5757,119.5 Electronic Arts Inc.,0.172393,Information Technology,172,#43e8d8,92 Eli Lilly and Company,0.369359,Information Technology,173,#43e8d8,71.5 Emerson Electric Co.,0.189599,Information Technology,174,#43e8d8,127 Entergy Corporation,0.065117,Utilities,175,#ff79d8,54 Envision Healthcare Corp.,0.023266,Health Care,176,#ff5757,144 EOG Resources Inc.,0.25023,Energy,177,#88ff8b,107.5 EQT Corporation,0.050979,Energy,178,#88ff8b,124 Equifax Inc.,0.052901,Industrials,179,#ffca79,102 Equinix Inc.,0.163662,Real Estate,180,#ffff61,86 Equity Residential,0.114102,Real Estate,181,#ffff61,150 Essex Property Trust Inc.,0.078593,Real Estate,182,#ffff61,135 Estee Lauder Companies Inc. Class A,0.114978,Real Estate,183,#ffff61,137 Everest Re Group Ltd.,0.04294,Consumer Staples,184,#363b74,149.5 Eversource Energy,0.090184,Utilities,185,#ff79d8,76 Exelon Corporation,0.166666,Utilities,186,#ff79d8,55.5 Expedia Inc.,0.079227,Consumer Discretionary,187,#dfdfdf,96 Expeditors International of Washington Inc.,0.047683,Industrials,188,#ffca79,56.5 Express Scripts Holding Company,0.163844,Health Care,189,#ff5757,76.5 Extra Space Storage Inc.,0.045586,Real Estate,190,#ffff61,148.5 Exxon Mobil Corporation,1.581928,Energy,191,#88ff8b,73 F5 Networks Inc.,0.035142,Information Technology,192,#43e8d8,87.5 Facebook Inc. Class A,1.902894,Information Technology,193,#43e8d8,101.5 Fastenal Company,0.058779,Industrials,194,#ffca79,88.5 Federal Realty Investment Trust,0.042038,Real Estate,195,#ffff61,92 FedEx Corporation,0.24639,Industrials,196,#ffca79,139.5 Fidelity National Information Services Inc.,0.141881,Information Technology,197,#43e8d8,99 Fifth Third Bancorp,0.09475,Financials,198,#d975f8,72 FirstEnergy Corp.,0.064597,Utilities,199,#ff79d8,96.5 Fiserv Inc.,0.12254,Information Technology,200,#43e8d8,58.5 FLIR Systems Inc.,0.025035,Information Technology,201,#43e8d8,62.5 Flowserve Corporation,0.025037,Industrials,202,#ffca79,96 Fluor Corporation,0.025745,Industrials,203,#ffca79,106 FMC Corporation,0.056484,Materials,204,#660066,70.5 Foot Locker Inc.,0.021982,Consumer Discretionary,205,#dfdfdf,116.5 Ford Motor Company,0.213353,Consumer Discretionary,206,#dfdfdf,146 Fortive Corp.,0.098131,Industrials,207,#ffca79,86.5 Fortune Brands Home & Security Inc.,0.045128,Industrials,208,#ffca79,51.5 Franklin Resources Inc.,0.065552,Financials,209,#d975f8,63.5 Freeport-McMoRan Inc.,0.08893,Materials,210,#660066,106.5 Gap Inc.,0.028862,Consumer Discretionary,211,#dfdfdf,79.5 Garmin Ltd.,0.027903,Consumer Discretionary,212,#dfdfdf,115.5 Gartner Inc.,0.052727,Information Technology,213,#43e8d8,141 General Dynamics Corporation,0.263124,Industrials,214,#ffca79,101.5 General Electric Company,0.974827,Industrials,215,#ffca79,95 General Mills Inc.,0.149341,Consumer Staples,216,#363b74,51.5 General Motors Company,0.235945,Consumer Discretionary,217,#dfdfdf,120 Genuine Parts Company,0.059079,Consumer Discretionary,218,#dfdfdf,56.5 GGP Inc.,0.06113,Consumer Discretionary,219,#dfdfdf,133.5 Gilead Sciences Inc.,0.500148,Health Care,220,#ff5757,102.5 Global Payments Inc.,0.067937,Information Technology,221,#43e8d8,98.5 Goldman Sachs Group Inc.,0.383082,Financials,222,#d975f8,105 Goodyear Tire & Rubber Company,0.037541,Consumer Discretionary,223,#dfdfdf,133.5 H&R Block Inc.,0.025199,Industrials,224,#ffca79,71.5 Halliburton Company,0.172618,Energy,225,#88ff8b,148.5 Hanesbrands Inc.,0.042956,Consumer Discretionary,226,#dfdfdf,120.5 Harley-Davidson Inc.,0.039445,Consumer Discretionary,227,#dfdfdf,139.5 Harris Corporation,0.072933,Information Technology,228,#43e8d8,128.5 Hartford Financial Services Group Inc.,0.093023,Information Technology,229,#43e8d8,90.5 Hasbro Inc.,0.048882,Consumer Discretionary,230,#dfdfdf,91.5 HCA Healthcare Inc,0.102394,Consumer Discretionary,231,#dfdfdf,141 HCP Inc.,0.062559,Real Estate,232,#ffff61,67.5 Helmerich & Payne Inc.,0.02429,Energy,233,#88ff8b,105 Henry Schein Inc.,0.058281,Health Care,234,#ff5757,113 Hershey Company,0.071556,Consumer Staples,235,#363b74,144 Hess Corporation,0.052842,Energy,236,#88ff8b,108.5 Hewlett Packard Enterprise Co.,0.104174,Information Technology,237,#43e8d8,90.5 Hilton Worldwide Holdings Inc,0.063442,Information Technology,238,#43e8d8,74.5 Hologic Inc.,0.04839,Health Care,239,#ff5757,52 Home Depot Inc.,0.864546,Consumer Discretionary,240,#dfdfdf,67.5 Honeywell International Inc.,0.488774,Consumer Discretionary,241,#dfdfdf,117 Hormel Foods Corporation,0.039151,Consumer Staples,242,#363b74,139.5 Host Hotels & Resorts Inc.,0.063146,Real Estate,243,#ffff61,144.5 HP Inc.,0.15145,Information Technology,244,#43e8d8,93 Humana Inc.,0.161272,Health Care,245,#ff5757,68 Huntington Bancshares Incorporated,0.066208,Financials,246,#d975f8,150 IDEXX Laboratories Inc.,0.065644,Health Care,247,#ff5757,142 IHS Markit Ltd.,0.080405,Industrials,248,#ffca79,132.5 Illinois Tool Works Inc.,0.214606,Industrials,249,#ffca79,54.5 Illumina Inc.,0.138861,Health Care,250,#ff5757,111.5 Incyte Corporation,0.092049,Health Care,251,#ff5757,100.5 Ingersoll-Rand Plc,0.10676,Industrials,252,#ffca79,136 Intel Corporation,0.815984,Information Technology,253,#43e8d8,83.5 Intercontinental Exchange Inc.,0.181574,Financials,254,#d975f8,74 International Business Machines Corporation,0.582452,Information Technology,255,#43e8d8,119 International Flavors & Fragrances Inc.,0.052716,Information Technology,256,#43e8d8,61 International Paper Company,0.110503,Materials,257,#660066,137 Interpublic Group of Companies Inc.,0.036905,Consumer Discretionary,258,#dfdfdf,143 Intuit Inc.,0.164283,Materials,259,#660066,149 Intuitive Surgical Inc.,0.181566,Health Care,260,#ff5757,82 Invesco Ltd.,0.063878,Financials,261,#d975f8,53 Iron Mountain Inc.,0.049083,Financials,262,#d975f8,73 J. M. Smucker Company,0.057843,Industrials,263,#ffca79,144.5 J.B. Hunt Transport Services Inc.,0.04185,Industrials,264,#ffca79,138 Jacobs Engineering Group Inc.,0.031913,Industrials,265,#ffca79,59.5 Johnson & Johnson,1.688643,Health Care,266,#ff5757,53.5 Johnson Controls International plc,0.169771,Industrials,267,#ffca79,133.5 JPMorgan Chase & Co.,1.537914,Financials,268,#d975f8,136 Juniper Networks Inc.,0.048599,Information Technology,269,#43e8d8,113.5 Kansas City Southern,0.052857,Industrials,270,#ffca79,135 Kellogg Company,0.076385,Consumer Staples,271,#363b74,119.5 KeyCorp,0.092415,Financials,272,#d975f8,137.5 Kimberly-Clark Corporation,0.201585,Consumer Staples,273,#363b74,132 Kimco Realty Corporation,0.037992,Real Estate,274,#ffff61,84.5 Kinder Morgan Inc Class P,0.174338,Energy,275,#88ff8b,84.5 KLA-Tencor Corporation,0.074351,Information Technology,276,#43e8d8,73.5 Kohl's Corporation,0.037127,Information Technology,277,#43e8d8,121.5 Kraft Heinz Company,0.224469,Consumer Discretionary,278,#dfdfdf,136 Kroger Co.,0.088197,Consumer Staples,279,#363b74,147.5 L Brands Inc.,0.043833,Consumer Discretionary,280,#dfdfdf,134 L3 Technologies Inc.,0.068692,Industrials,281,#ffca79,100.5 Laboratory Corporation of America Holdings,0.072014,Health Care,282,#ff5757,129 Lam Research Corporation,0.133724,Information Technology,283,#43e8d8,99 Leggett & Platt Incorporated,0.028261,Consumer Discretionary,284,#dfdfdf,99.5 Lennar Corporation Class A,0.048983,Consumer Discretionary,285,#dfdfdf,90 Leucadia National Corporation,0.037092,Financials,286,#d975f8,66 Level 3 Communications Inc.,0.071694,Telecommunication Services,287,#1F7F89,71 Lincoln National Corporation,0.075782,Financials,288,#d975f8,107.5 LKQ Corporation,0.048984,Consumer Discretionary,289,#dfdfdf,76 Lockheed Martin Corporation,0.354909,Industrials,290,#ffca79,119 Loews Corporation,0.061104,Financials,291,#d975f8,110.5 Lowe's Companies Inc.,0.304305,Financials,292,#d975f8,122.5 LyondellBasell Industries NV,0.145781,Materials,293,#660066,102.5 M&T Bank Corporation,0.109412,Financials,294,#d975f8,120 Macerich Company,0.026873,Real Estate,295,#ffff61,95.5 Macy's Inc,0.030925,Real Estate,296,#ffff61,148.5 Marathon Oil Corporation,0.046813,Energy,297,#88ff8b,104 Marathon Petroleum Corporation,0.127618,Energy,298,#88ff8b,141.5 Marriott International Inc. Class A,0.156979,Energy,299,#88ff8b,133.5 Marsh & McLennan Companies Inc.,0.196001,Financials,300,#d975f8,88 Martin Marietta Materials Inc.,0.058714,Materials,301,#660066,137.5 Masco Corporation,0.055679,Industrials,302,#ffca79,111.5 Mastercard Incorporated Class A,0.619044,Information Technology,303,#43e8d8,63.5 Mattel Inc.,0.023458,Consumer Discretionary,304,#dfdfdf,71.5 McCormick & Company Incorporated,0.054633,Consumer Staples,305,#363b74,104.5 McDonald's Corporation,0.59328,Consumer Discretionary,306,#dfdfdf,103 McKesson Corporation,0.145873,Health Care,307,#ff5757,147 Medtronic plc,0.511633,Health Care,308,#ff5757,90 Merck & Co. Inc.,0.839355,Health Care,309,#ff5757,120.5 MetLife Inc.,0.244585,Financials,310,#d975f8,116 Mettler-Toledo International Inc.,0.076621,Health Care,311,#ff5757,134.5 MGM Resorts International,0.078535,Consumer Discretionary,312,#dfdfdf,97 Michael Kors Holdings Ltd,0.032556,Consumer Discretionary,313,#dfdfdf,101.5 Microchip Technology Incorporated,0.097168,Information Technology,314,#43e8d8,92.5 Micron Technology Inc.,0.18661,Information Technology,315,#43e8d8,109 Microsoft Corporation,2.703617,Information Technology,316,#43e8d8,113 Mid-America Apartment Communities Inc.,0.0562,Information Technology,317,#43e8d8,112.5 Mohawk Industries Inc.,0.074105,Consumer Discretionary,318,#dfdfdf,137.5 Molson Coors Brewing Company Class B,0.07345,Consumer Staples,319,#363b74,55 Mondelez International Inc. Class A,0.284641,Consumer Staples,320,#363b74,69.5 Monsanto Company,0.243903,Materials,321,#660066,74.5 Monster Beverage Corporation,0.108633,Consumer Staples,322,#363b74,60.5 Moody's Corporation,0.106134,Financials,323,#d975f8,64 Morgan Stanley,0.313639,Financials,324,#d975f8,72 Mosaic Company,0.033662,Materials,325,#660066,139.5 Motorola Solutions Inc.,0.064836,Information Technology,326,#43e8d8,53 Mylan N.V.,0.077527,Health Care,327,#ff5757,72 Nasdaq Inc.,0.040036,Health Care,328,#ff5757,126 National Oilwell Varco Inc.,0.061966,Energy,329,#88ff8b,104.5 Navient Corp,0.019779,Financials,330,#d975f8,67 NetApp Inc.,0.052537,Information Technology,331,#43e8d8,104 Netflix Inc.,0.371683,Information Technology,332,#43e8d8,80 Newell Brands Inc,0.09598,Consumer Discretionary,333,#dfdfdf,149.5 Newfield Exploration Company,0.025259,Energy,334,#88ff8b,71.5 Newmont Mining Corporation,0.094536,Materials,335,#660066,80 News Corporation Class A,0.02275,Consumer Discretionary,336,#dfdfdf,140 News Corporation Class B,0.006854,Consumer Discretionary,337,#dfdfdf,141 NextEra Energy Inc.,0.322309,Utilities,338,#ff79d8,62 Nielsen Holdings Plc,0.062328,Industrials,339,#ffca79,147 NIKE Inc. Class B,0.32601,Consumer Discretionary,340,#dfdfdf,132 NiSource Inc,0.039756,Consumer Discretionary,341,#dfdfdf,97.5 Noble Energy Inc.,0.05989,Energy,342,#88ff8b,70.5 Nordstrom Inc.,0.024924,Consumer Discretionary,343,#dfdfdf,78.5 Norfolk Southern Corporation,0.172621,Industrials,344,#ffca79,121.5 Northern Trust Corporation,0.088597,Financials,345,#d975f8,146.5 Northrop Grumman Corporation,0.225914,Industrials,346,#ffca79,103.5 NRG Energy Inc.,0.035276,Utilities,347,#ff79d8,116.5 Nucor Corporation,0.081721,Materials,348,#660066,144.5 NVIDIA Corporation,0.523154,Information Technology,349,#43e8d8,113.5 Occidental Petroleum Corporation,0.21919,Energy,350,#88ff8b,148 Omnicom Group Inc,0.079698,Consumer Discretionary,351,#dfdfdf,145 ONEOK Inc.,0.099245,Energy,352,#88ff8b,123 Oracle Corporation,0.675103,Information Technology,353,#43e8d8,79 O'Reilly Automotive Inc.,0.083033,Consumer Discretionary,354,#dfdfdf,131.5 PACCAR Inc,0.115696,Consumer Discretionary,355,#dfdfdf,135.5 Packaging Corporation of America,0.051074,Materials,356,#660066,60 Parker-Hannifin Corporation,0.108713,Industrials,357,#ffca79,144 Patterson Companies Inc.,0.014241,Health Care,358,#ff5757,136 Paychex Inc.,0.086681,Information Technology,359,#43e8d8,147 PayPal Holdings Inc,0.335781,Information Technology,360,#43e8d8,67 Pentair plc,0.051605,Industrials,361,#ffca79,120 People's United Financial Inc.,0.027581,Financials,362,#d975f8,92 PepsiCo Inc.,0.761219,Consumer Staples,363,#363b74,140.5 PerkinElmer Inc.,0.034399,Health Care,364,#ff5757,120.5 Perrigo Co. Plc,0.052558,Health Care,365,#ff5757,109.5 Pfizer Inc.,0.984686,Health Care,366,#ff5757,138.5 PG&E Corporation,0.164659,Utilities,367,#ff79d8,64.5 Philip Morris International Inc.,0.833943,Consumer Staples,368,#363b74,73.5 Phillips 66,0.178047,Energy,369,#88ff8b,129.5 Pinnacle West Capital Corporation,0.044941,Utilities,370,#ff79d8,134 Pioneer Natural Resources Company,0.108254,Energy,371,#88ff8b,81.5 PNC Financial Services Group Inc.,0.292669,Financials,372,#d975f8,100 PPG Industries Inc.,0.129486,Materials,373,#660066,101.5 PPL Corporation,0.123988,Utilities,374,#ff79d8,67.5 Praxair Inc.,0.180635,Materials,375,#660066,77 Priceline Group Inc,0.425548,Materials,376,#660066,55.5 Principal Financial Group Inc.,0.077859,Financials,377,#d975f8,108 Procter & Gamble Company,1.117324,Consumer Staples,378,#363b74,113.5 Progressive Corporation,0.12879,Financials,379,#d975f8,135 Prologis Inc.,0.158713,Real Estate,380,#ffff61,85 Prudential Financial Inc.,0.20797,Financials,381,#d975f8,58.5 Public Service Enterprise Group Inc,0.107326,Utilities,382,#ff79d8,124 Public Storage,0.149171,Real Estate,383,#ffff61,83.5 PulteGroup Inc.,0.034857,Consumer Discretionary,384,#dfdfdf,122 PVH Corp.,0.047786,Consumer Discretionary,385,#dfdfdf,143 Qorvo Inc.,0.043774,Information Technology,386,#43e8d8,60 QUALCOMM Incorporated,0.359258,Information Technology,387,#43e8d8,70 Quanta Services Inc.,0.025585,Industrials,388,#ffca79,121.5 Quest Diagnostics Incorporated,0.065063,Health Care,389,#ff5757,119.5 Quintiles IMS Holdings Inc.,0.067121,Health Care,390,#ff5757,130.5 Ralph Lauren Corporation Class A,0.024164,Health Care,391,#ff5757,78.5 Range Resources Corporation,0.020069,Energy,392,#88ff8b,105 Raymond James Financial Inc.,0.049032,Financials,393,#d975f8,97.5 Raytheon Company,0.249392,Industrials,394,#ffca79,138 Realty Income Corporation,0.074206,Real Estate,395,#ffff61,77.5 Red Hat Inc.,0.0897,Information Technology,396,#43e8d8,146 Regency Centers Corporation,0.043113,Real Estate,397,#ffff61,96 Regeneron Pharmaceuticals Inc.,0.152663,Health Care,398,#ff5757,125.5 Regions Financial Corporation,0.079282,Financials,399,#d975f8,89 Republic Services Inc.,0.071636,Industrials,400,#ffca79,105.5 ResMed Inc.,0.052098,Health Care,401,#ff5757,86.5 Robert Half International Inc.,0.028449,Industrials,402,#ffca79,72.5 Rockwell Automation Inc.,0.106502,Industrials,403,#ffca79,50.5 Rockwell Collins Inc.,0.09858,Industrials,404,#ffca79,58 Roper Technologies Inc.,0.113051,Industrials,405,#ffca79,62 Ross Stores Inc.,0.11203,Consumer Discretionary,406,#dfdfdf,103.5 Royal Caribbean Cruises Ltd.,0.094926,Consumer Discretionary,407,#dfdfdf,117.5 S&P Global Inc.,0.186997,Consumer Discretionary,408,#dfdfdf,76.5 salesforce.com inc.,0.303048,Information Technology,409,#43e8d8,118.5 SBA Communications Corp. Class A,0.081415,Real Estate,410,#ffff61,68 SCANA Corporation,0.038126,Utilities,411,#ff79d8,114 Schlumberger NV,0.440174,Energy,412,#88ff8b,134.5 Scripps Networks Interactive Inc. Class A,0.037364,Consumer Discretionary,413,#dfdfdf,58.5 Seagate Technology PLC,0.043665,Information Technology,414,#43e8d8,138 Sealed Air Corporation,0.037838,Materials,415,#660066,70.5 Sempra Energy,0.136692,Utilities,416,#ff79d8,68 Sherwin-Williams Company,0.129466,Materials,417,#660066,93.5 Signet Jewelers Limited,0.018824,Consumer Discretionary,418,#dfdfdf,68 Simon Property Group Inc.,0.232105,Real Estate,419,#ffff61,136.5 Skyworks Solutions Inc.,0.092803,Information Technology,420,#43e8d8,117 SL Green Realty Corp.,0.045636,Real Estate,421,#ffff61,79 Snap-on Incorporated,0.039123,Consumer Discretionary,422,#dfdfdf,69.5 Southern Company,0.231956,Utilities,423,#ff79d8,102 Southwest Airlines Co.,0.136915,Industrials,424,#ffca79,62 Stanley Black & Decker Inc.,0.107345,Consumer Discretionary,425,#dfdfdf,125.5 Staples Inc.,0.000241,Consumer Discretionary,426,#dfdfdf,82.5 Starbucks Corporation,0.368137,Consumer Discretionary,427,#dfdfdf,63.5 State Street Corporation,0.166674,Financials,428,#d975f8,68.5 Stericycle Inc.,0.027339,Industrials,429,#ffca79,127 Stryker Corporation,0.214254,Health Care,430,#ff5757,58.5 SunTrust Banks Inc.,0.125108,Financials,431,#d975f8,57 Symantec Corporation,0.098768,Information Technology,432,#43e8d8,134.5 Synchrony Financial,0.101136,Financials,433,#d975f8,107 Synopsys Inc.,0.056531,Information Technology,434,#43e8d8,92 Sysco Corporation,0.121814,Consumer Staples,435,#363b74,85 T. Rowe Price Group,0.095178,Financials,436,#d975f8,148.5 Target Corporation,0.150809,Consumer Discretionary,437,#dfdfdf,86 TE Connectivity Ltd.,0.135695,Information Technology,438,#43e8d8,96 TechnipFMC Plc,0.056354,Energy,439,#88ff8b,96.5 Texas Instruments Incorporated,0.399861,Information Technology,440,#43e8d8,91 Textron Inc.,0.065412,Industrials,441,#ffca79,128.5 Thermo Fisher Scientific Inc.,0.353267,Health Care,442,#ff5757,55 Tiffany & Co.,0.042865,Consumer Discretionary,443,#dfdfdf,111.5 Time Warner Inc.,0.370176,Consumer Discretionary,444,#dfdfdf,62.5 TJX Companies Inc,0.21558,Consumer Discretionary,445,#dfdfdf,95 Torchmark Corporation,0.040139,Financials,446,#d975f8,63 Total System Services Inc.,0.051307,Information Technology,447,#43e8d8,79 Tractor Supply Company,0.037507,Consumer Discretionary,448,#dfdfdf,78 TransDigm Group Incorporated,0.061347,Industrials,449,#ffca79,122.5 Travelers Companies Inc.,0.156759,Financials,450,#d975f8,52.5 TripAdvisor Inc.,0.022765,Consumer Discretionary,451,#dfdfdf,98 Twenty-First Century Fox Inc. Class A,0.131288,Consumer Discretionary,452,#dfdfdf,118.5 Twenty-First Century Fox Inc. Class B,0.053571,Consumer Discretionary,453,#dfdfdf,90.5 Tyson Foods Inc. Class A,0.08921,Consumer Staples,454,#363b74,119.5 U.S. Bancorp,0.393897,Financials,455,#d975f8,91.5 UDR Inc.,0.047087,Real Estate,456,#ffff61,149 Ulta Beauty Inc,0.060763,Real Estate,457,#ffff61,55.5 Under Armour Inc. Class A,0.01401,Consumer Discretionary,458,#dfdfdf,65.5 Under Armour Inc. Class C,0.01317,Consumer Discretionary,459,#dfdfdf,101 Union Pacific Corporation,0.420778,Industrials,460,#ffca79,54 United Continental Holdings Inc.,0.069105,Industrials,461,#ffca79,101 United Parcel Service Inc. Class B,0.373946,Industrials,462,#ffca79,50.5 United Rentals Inc.,0.050737,Industrials,463,#ffca79,93 United Technologies Corporation,0.392811,Industrials,464,#ffca79,60 UnitedHealth Group Incorporated,0.875782,Industrials,465,#ffca79,133.5 Universal Health Services Inc. Class B,0.04452,Industrials,466,#ffca79,142 Unum Group,0.052483,Financials,467,#d975f8,107 V.F. Corporation,0.092735,Consumer Discretionary,468,#dfdfdf,81 Valero Energy Corporation,0.149393,Energy,469,#88ff8b,112.5 Varian Medical Systems Inc.,0.046316,Health Care,470,#ff5757,127 Ventas Inc.,0.11197,Real Estate,471,#ffff61,62.5 VeriSign Inc.,0.043594,Information Technology,472,#43e8d8,141.5 Verisk Analytics Inc,0.058064,Industrials,473,#ffca79,115 Verizon Communications Inc.,0.936835,Telecommunication Services,474,#1F7F89,96 Vertex Pharmaceuticals Incorporated,0.17954,Health Care,475,#ff5757,71 Viacom Inc. Class B,0.0445,Consumer Discretionary,476,#dfdfdf,111.5 Visa Inc. Class A,0.897134,Information Technology,477,#43e8d8,128 Vornado Realty Trust,0.058723,Real Estate,478,#ffff61,57 Vulcan Materials Company,0.070398,Materials,479,#660066,70.5 W.W. Grainger Inc.,0.042949,Materials,480,#660066,55 Walgreens Boots Alliance Inc,0.348272,Consumer Staples,481,#363b74,106 Wal-Mart Stores Inc.,0.545114,Consumer Staples,482,#363b74,123 Walt Disney Company,0.707739,Consumer Discretionary,483,#dfdfdf,143 Waste Management Inc.,0.147186,Industrials,484,#ffca79,77.5 Waters Corporation,0.068639,Health Care,485,#ff5757,115.5 WEC Energy Group Inc,0.095475,Utilities,486,#ff79d8,139.5 Wells Fargo & Company,1.109112,Financials,487,#d975f8,139 Welltower Inc.,0.125169,Real Estate,488,#ffff61,144.5 Western Digital Corporation,0.12193,Information Technology,489,#43e8d8,147.5 Western Union Company,0.041117,Information Technology,490,#43e8d8,91 WestRock Co.,0.066638,Information Technology,491,#43e8d8,148 Weyerhaeuser Company,0.115937,Materials,492,#660066,56 Whirlpool Corporation,0.059172,Consumer Discretionary,493,#dfdfdf,136.5 Williams Companies Inc.,0.117158,Consumer Discretionary,494,#dfdfdf,123.5 Willis Towers Watson Public Limited Company,0.094976,Financials,495,#d975f8,144 Wyndham Worldwide Corporation,0.049529,Consumer Discretionary,496,#dfdfdf,144.5 Wynn Resorts Limited,0.05479,Consumer Discretionary,497,#dfdfdf,118.5 Xcel Energy Inc.,0.114482,Utilities,498,#ff79d8,132.5 Xerox Corporation,0.032023,Information Technology,499,#43e8d8,78 Xilinx Inc.,0.081603,Information Technology,500,#43e8d8,97.5 XL Group Ltd,0.048683,Financials,501,#d975f8,75 Xylem Inc.,0.053392,Industrials,502,#ffca79,95 Yum! Brands Inc.,0.121638,Consumer Discretionary,503,#dfdfdf,92.5 Zimmer Biomet Holdings Inc.,0.108027,Health Care,504,#ff5757,109 Zions Bancorporation,0.041665,Financials,505,#d975f8,65 Zoetis Inc. Class A,0.148098,Health Care,506,#ff5757,144

Company,size,Sector,id,color,y Apple Inc.,3.814297,Information Technology,50,#43e8d8,107.5 Microsoft Corporation,2.703617,Information Technology,200,#43e8d8,113 Facebook Inc. Class A,1.902894,Information Technology,350,#43e8d8,101.5

Company,size,Sector,id,color,y Apple Inc.,3.814297,Information Technology,10,#43e8d8,107.5 Microsoft Corporation,2.703617,Information Technology,55,#43e8d8,113 Facebook Inc. Class A,1.902894,Information Technology,95,#43e8d8,101.5 Amazon.com Inc.,1.799505,Consumer Discretionary,127,#dfdfdf,149.5 Johnson & Johnson,1.688643,Health Care,155,#ff5757,53.5 Berkshire Hathaway Inc. Class B,1.639008,Financials,180,#d975f8,65 Exxon Mobil Corporation,1.581928,Energy,205,#88ff8b,73 JPMorgan Chase & Co.,1.537914,Financials,230,#d975f8,136 Alphabet Inc. Class A,1.297788,Information Technology,255,#43e8d8,112 Alphabet Inc. Class C,1.295076,Information Technology,280,#43e8d8,64.5