4 min read

In this post, I share my favorite platform for investing in both individual stocks and stock index funds: M1 Finance.

What is M1 Finance?

M1 Finance is an investment management platform that acts as a hybrid between a robo-advisor and a traditional brokerage account.

With a robo-advisor, you’re typically asked a series of questions to determine your risk tolerance and your investment goals and then your investments are automatically chosen for you based off your responses.

With a traditional brokerage account, you have the complete freedom to invest in whatever you’d like. This might include stocks, bonds, REITs, or other asset classes.

M1 Finance offers a nice balance between these two – it allows for some automation and the freedom to choose your own investments. The best part of all is that M1 Finance is completely free to use. There are no management fees, no commissions, and no trading fees.

Note: The reason M1 Finance is able to offer free services is because they earn revenue in other ways like their premium M1 Plus membership and interest on marginal loans they offer through M1 Borrow.

The company was established in 2015 by CEO and Founder Brian Barnes and is registered with the SEC as a broker dealer. Despite being a relatively young company, M1 Finance has experienced impressive growth in the past few years. Currently they have over 25,000 accounts and hold over $100 million in client assets.

Getting Started with M1 Finance

Getting started with M1 Finance is dead simple:

1. Set up an account by choosing an email and password.

2. Choose which investments to include in your portfolio.

3. Choose a type of investment account (IRA or brokerage account) and fund it.

That’s it.

Create Your Pie

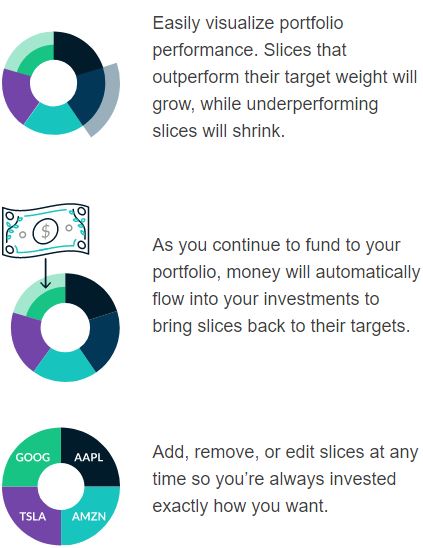

M1 refers to portfolios as “pies” and they use pie charts to help you visualize your investments. When you create your own pie, you can choose to include individual stocks, ETFs, pre-made expert pies, or a combination of all three.

Before you choose to add any stock or ETF to your pie, you can view its historical performance, price history, expense ratios, and other helpful details.

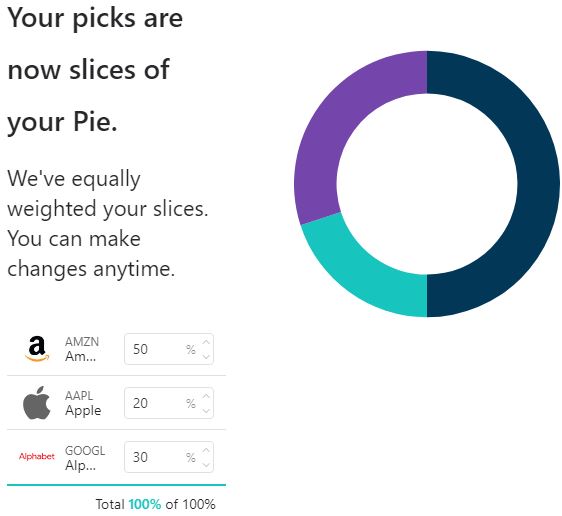

Once you’ve picked which securities to include, you can then choose your target allocation for each security:

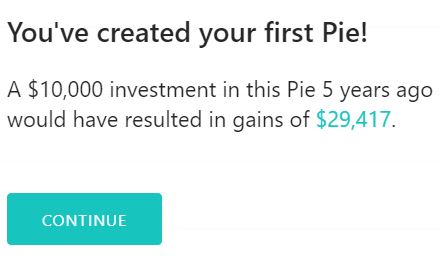

Once you’ve created your pie, M1 Finance then tells you the amount of gains that an investment in your pie 5 years ago would have yielded:

Specify Your Account and Fund It

Once you’ve set up your pie, you then need to decide what type of investment account you’d like use. As long as you’re a U.S. resident with a current domestic address, you can choose between an IRA (individual retirement account) and a brokerage account.

Next, you’ll fill in some personal information that M1 Finance is required to collect by law based on the USA Patriot Act along with information about your income and assets that is required by the SEC.

Lastly, you’ll fund your M1 Finance account by linking a bank account. You’ll then be able to directly transfer funds in and out of your M1 Finance account as well as set up automatic recurring transfers.

To start an investment account, you’ll need to add a minimum of $100 to your account. M1 Finance then uses fractional shares to invest in the securities you selected in the exact proportions you specified.

Each time you add money to your account, M1 Finance will automatically invest in the appropriate securities to ensure that your allocation remains exactly as you specified. You can also change your allocation and add or delete securities from your “pie” whenever you’d like.

Benefits of Using M1 Finance

There are many perks of M1 Finance that make investing with them a great experience:

No trading fees. Most financial platforms will charge $7 – $10 each time you buy or sell an individual security. Since M1 Finance earns revenue through premium services, they’re able to offer free trades.

No annual fee. Some financial platforms charge an annual maintenance fee on your account; M1 Finance does not.

Fractional shares. Since M1 Finance invests using fractional shares, this means your money will never be sitting in your account idle until you have enough to purchase a full share.

Automatic target-allocated investing. Each time more funds are added to your account, M1 Finance automatically invests in the appropriate securities to ensure that you’re invested in the exact allocation that you specified.

Smart selling. When you choose to cash out of any investments, M1 Finance employs a strategy to ensure that you pay minimal taxes. First, it sells securities that have no taxable gain. Then, it sells any securities that have long-term capital gains followed by those that have short-term capital gains. This ensures that you pay as little in taxes as possible when you sell securities.

Sleek interface. M1 Finance has one of the best interfaces of any financial platform out there. Their pie charts make it easy to visualize your portfolio and the entire site is easy to navigate and understand.

Drawbacks of M1 Finance

Despite the many perks, M1 Finance does have a few drawbacks that might deter potential investors.

No mutual funds. Although you can choose to invest in over 6,000 individual stocks and ETFs, M1 Finance does not offer the option to invest in mutual funds.

No tax-loss harvesting. Although M1 Finance employs a strategy to minimize the amount you pay in taxes when you sell securities, it does not offer tax-loss harvesting, which is the process of selling securities that have experienced a loss and replacing them with other securities to keep a portfolio balanced.

U.S. platform only. Unfortunately, M1 Finance currently only offers accounts for U.S. citizens.

Should You use M1 Finance?

I personally use M1 Finance to invest because it offers free trades, no management fees, and automated-allocation investing. The pie charts also offer an easy way for me to visualize my portfolio holdings and the design of the site makes the investing experience enjoyable.

If you’re interested in investing a portion of your net worth in stocks, M1 Finance offers one of the best ways to do so. It’s completely free, easy to set up, and simple to use. For all of these reasons, I recommend checking it out.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.