4 min read

It seems that the rising cost of college is mentioned in the news and in media outlets constantly. However, according to a recent report from Child Aware of America, there’s one common expense that is often just as expensive, if not more expensive than college, that flies under the radar: childcare.

Related: Visualizing Average Student Loan Debt per Graduate By State

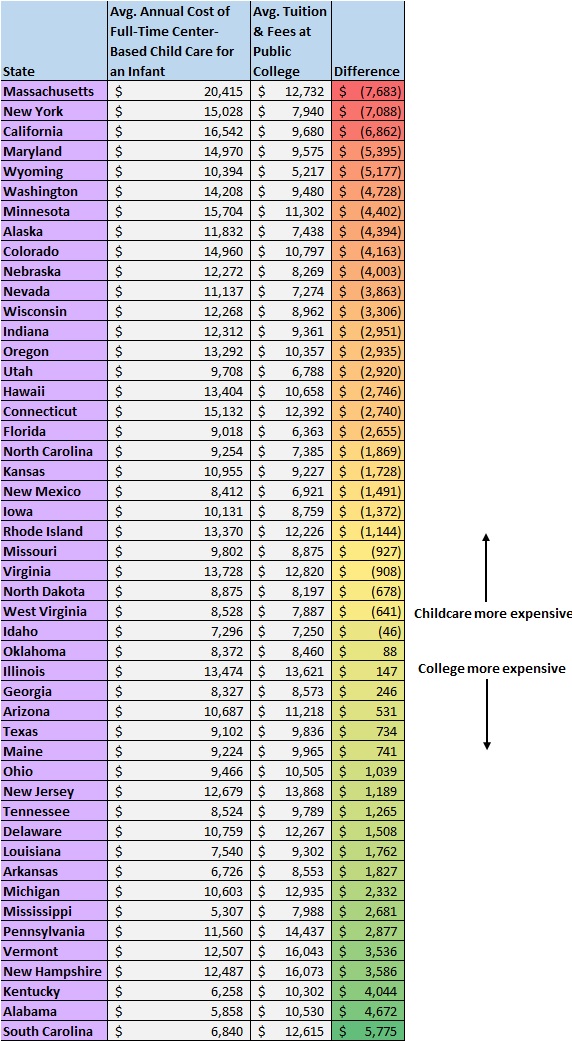

The report uses data gathered from a Child Aware of America January 2018 nationwide survey on childcare costs along with 2017 tuition numbers from the College Board Trends in College Pricing to compare the average annual center-based childcare costs for infants with the average annual tuition and fees at public universities.

The most shocking finding from the report is that average childcare costs are higher than average public college tuition and fees in 28 U.S. states.

The table below shows the average annual cost of full-time center-based childcare for an infant along with the average public college tuition and fees for every U.S. state:

Note: Data was unavailable for Montana and South Dakota

Massachusetts has the highest difference between childcare and college costs, with average childcare costs exceeding average public college costs by $7,683 annually.

On the flip side, South Carolina has the most favorable difference with college costs exceeding childcare costs by $5,775 annually.

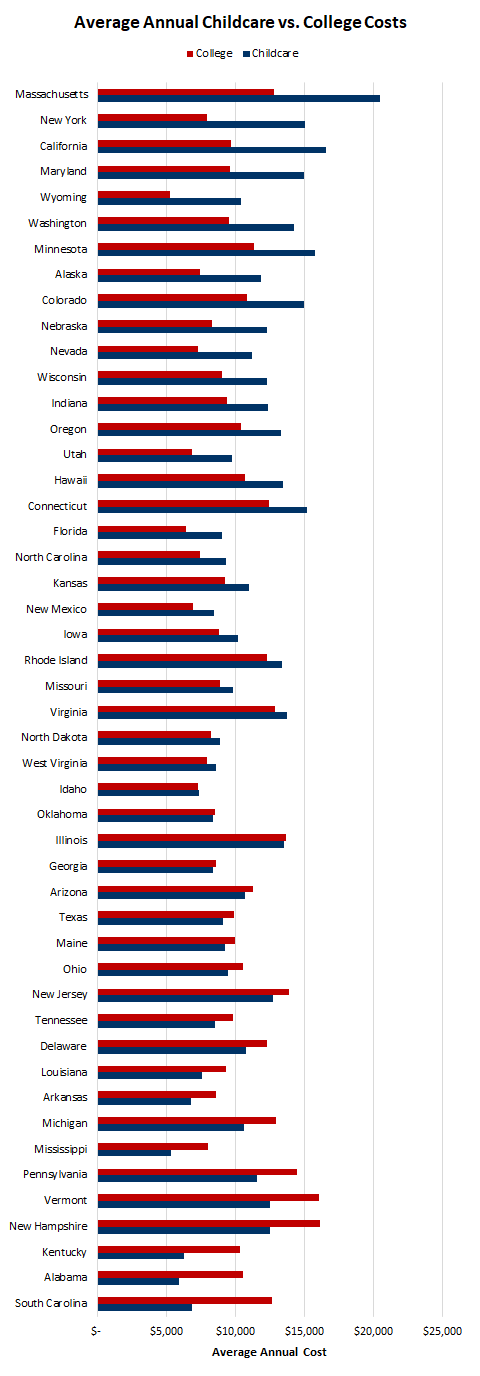

Here’s a visual look at childcare vs. college costs for each state:

In general, childcare is least expensive in the southeastern states like South Carolina, Alabama, Kentucky, Mississippi, Arkansas, and Louisiana. It tends to be most expensive in states along the northeast coast as well as states along the west coast.

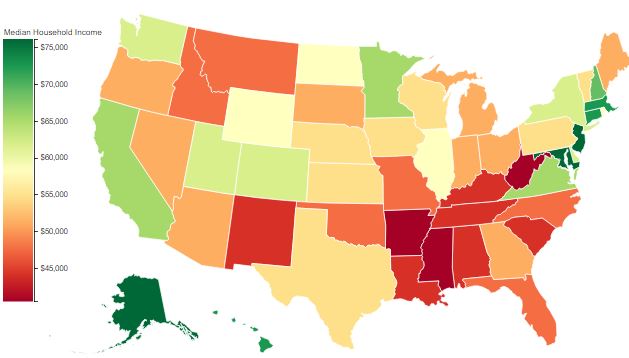

Intuitively these numbers make sense. The states with lower average childcare costs tend to be lower on both the income and the cost of living scale as well. For example, consider this map I created that shows median household income by state:

The states with lower incomes on the map tend to have lower childcare costs in the table above. Conversely, high-income states tend to have higher annual childcare costs.

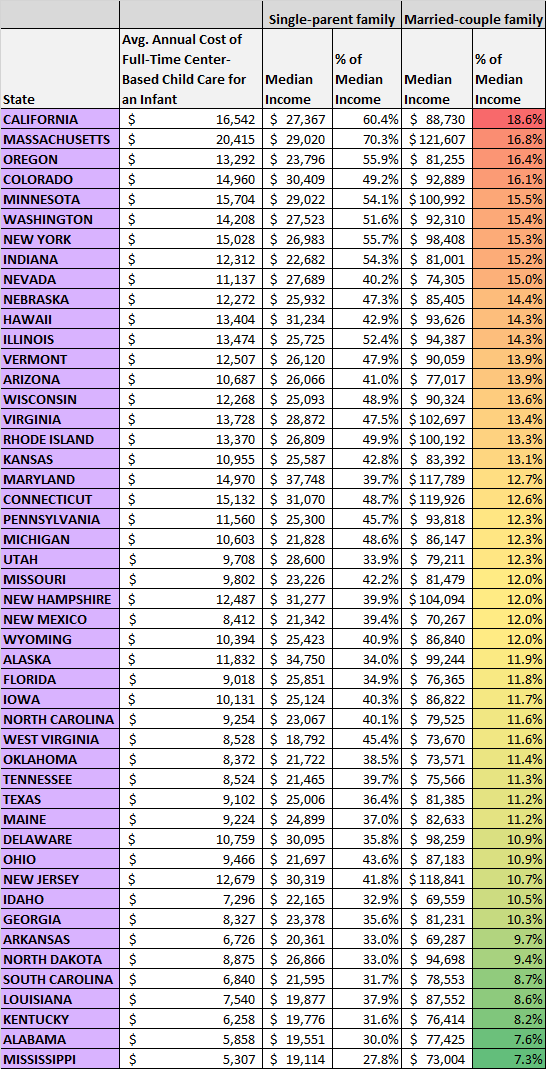

This begs the question, how expensive is childcare relative to the median household income in each state? Fortunately, the report from Child Aware of America provides these numbers. The table below shows the average annual childcare costs along with the median income for single-parent families and married-couple families by state:

It turns out that even though incomes are higher in states with higher childcare costs, those childcare costs are still expensive relative to the incomes. In California, nearly one-fifth of the median income for a married couple could be absorbed childcare costs alone each year. Contrast that with southeastern states like Mississippi and Alabama where annual childcare costs only absorb a little over 7% of the median income for a married couple.

The Effect of High Childcare Costs

Rising childcare costs are having a real impact on family dynamics. According to a recent New York Times survey, the number one reason people said they expect to have fewer children than they considered ideal is because childcare is too expensive.

This brings up an interesting question: for couples, does it make sense for one partner to be a stay-at-home parent to avoid paying for childcare?

Obviously this is more than just a financial decision, but as a personal finance blogger I like to look at these questions from a financial perspective.

On one hand, if one partner earns a fairly low income, it might not make sense for them to remain employed if the annual cost of childcare eats up a huge percentage of their income.

On the other hand, if that partner does decide to be a stay-at-home parent for a few years and then enters the workforce again once the child enters the school system, this time away from work can have a massive impact on that partner’s lifetime earnings.

To see the true impact of taking time away from work, the Center for American Progress built a fascinating calculator that shows the potential income loss over the course of a career for someone who decides to take time away from work to be a stay-at-home parent.

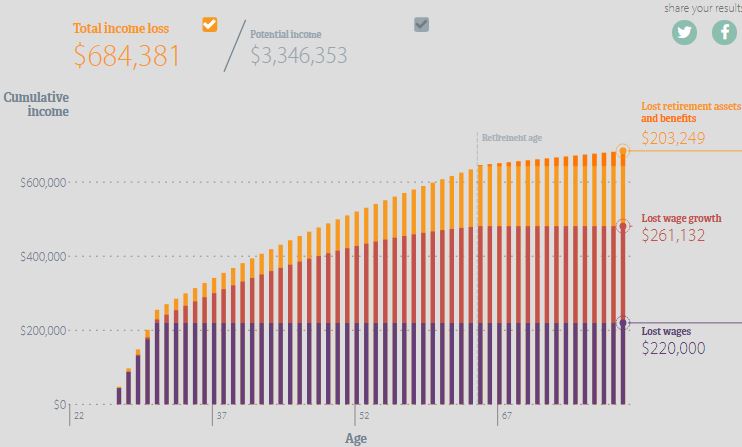

According to the calculator, for a woman who is age 26, started working at age 22, currently earns $44,000 per year, and plans to be out of the labor force for five years, she would potentially lose out on $684,381 in income assuming she doesn’t retire until age 65:

Keep in mind that this calculator is only making estimates based on national averages. It’s entirely possible that someone could re-enter the workforce after being a stay-at-home parent and increase their income much more rapidly than this calculator estimates.

Also, this calculator assumes that the stay-at-home parent would earn zero dollars in income each year. Thanks to the internet, though, there are many ways to earn income online now, so it’s possible that a stay-at-home parent could earn a decent chunk of income without holding down a traditional office job.

Also, this calculator assumes that you won’t retire until age 65. If the same woman in the example above instead retired at age 40, she would only lose out on $381,000. That’s still a significant amount but not nearly as much as $684,381.

Conclusion

Before reading this report, I didn’t realize just how expensive childcare has become. As someone who is not yet a parent, this is an expense that I haven’t had to consider but it’s one that I’ll keep in mind when the time comes.

To those who are parents out there: Have you found a cost-effective solution for childcare? I’d love to hear your thoughts in the comments below.

Data source: childcare & college tuition

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Nice write up Zach. There are two aspects of the way these numbers are reported that I think need more attention:

One aspect is that numbers are always quoted on different scales. Specifically, the median child care cost is quoted in AFTER tax dollars, while the income is quoted in PRE tax numbers. Suppose you pay a 20% tax and you live in Massachussetts (nice numbers). Now your pretax income required to sustain $20,000 a year in child care is actually $25,000. Which is actually 21% of the married couple’s gross income, and 86% of the single parent income.

And if that’s not bad enough, the second aspect is that averages are reported statewide. The median income in the state actually ranges from $61,000 to $110,000 (wikipedia) (2013 numbers but you can see the scale, maybe its $70k to 121k now). Infant care is rarely reported by county so we are left with an average number that overstates rural care cost and understates urban care cost. Doing a quick google search, the average care cost in the Boston Metro area seems to be more like $2,500 to $3,000 per month. So on the low end we are looking at $30,000 after tax, and on the high end $36,000 after tax. Wrapping this into my earlier comment – thats $38,000 before tax and $45,000 before tax respectively. Now thats more than the single parent in both cases and 31% and 37% of the median state family income respectively. Some people here might realize that this is more than you are recommended to spend per year on a home. To throw a final wrench into the analysis, the median Boston metro family income is actually $80,000 which means the real cost of child care in eastern Massachusetts is around 50% of your median household income.

All this to say, great write up. We desperately need more attention on this issue.

Hey Handy Millennial, thanks for making so many great points. As you said, the true number can actually be a lot worse when you consider how much the “median” income can actually range from and how much of that income is eaten up by taxes. Sadly, no matter how you look at it, the cost of childcare is just way too high for most families.

We didn’t have kids but just returned from a big Thanksgiving gathering and my niece was telling us how expensive childcare is. They have 2 kids, live in Florida, and she volunteers at the preschool to get a 50% cut, yet it’s still $750/mo for two. They would like to have a third child but feel they can’t afford it. We compared that to my nephew in California who has a two year old in daycare paying $1200/mo. Yikes!

I had never really thought to compare childcare with college. This list of the variations from state to state is really helpful for people thinking about geoarbitrage.

I didn’t realize how high the costs of childcare were either until I stumbled across this report. It really is incredible and it’s understandable why so many young people are hesitant to have children.

So as one who works in ECE (Early Childhood Edu.) I’d like to shed some light on a couple of factors which the first graph does not easily confer.

Avg. annual cost of care for an infant: In most if not all States there are mandated staffing ratios. In my State, the ratio for infant care is 1 teacher to a max. of 4 infants. In addition children in ECE are allowed to be in care for a max. of 10 hours per day. That’s a lot of staffing hours for a childcare center’s payroll (which are woefully, if not shamefully underpaid to begin with).

It’s been some years since I finished college (at a public university), but I don’t remember any class where there was a low 1:4 ratio, and which I was provided the oversight and direction of my professor for 50 hours a week. Had that been the standard I suspect I would have either graduated on an accelerated timeframe, or my tuition would have been considerably more expensive (vastly more than the State subsidized rate for a public, higher edu. institution).

I’m of the strong opinion that the price of childcare is not the problem. Considering the pitiful wages of ECE teachers, it’s quite a bargain really. Maybe the musings our society is posing regarding the “expensive” of childcare is misplaced.

Brad,

You’re making an excellent point here and hats off to you for choosing this noble career. We need more of you.

Your point about scalability is well taken. That is the reason, for example, why tech workers make large salaries – each unit of labor can be farmed out to the incredibly sized customer set. This is clearly not possible in ECE. Still there is the issue of transparency. Its not clear that all the cost here is going to the teachers. If it were, at least for me, Id consider this a bargain.

In my state, one can set up an in-home daycare after some kind of certification. Taking your numbers – 4 infants max, and the prevailing in-home rate – $1500 – 2000, that anywhere from $6-8000 per month. This translates to about $72,000 or $96,000 per year for the provider. Its true that there are business costs and I’m not the best person to speak to this. Still, I suspect this in home provider is making a reasonable living – lets call it modestly, $40,000 – 50,000. That’s around the median wage in this country. Interestingly, from my last comment, two such providers (living together) would be around or higher than the median wage in Boston.

Now scale is a good thing. So if I were to contract a bunch of people to work for me, rent a place to do the work, and buy supplies (and advertise) in bulk, I should do better. Right? Well that’s the usual approach to business anyway. So why is it that the rates at day care centers are both higher than in-home providers and the teachers make less money?

Again, I have no problem with ECE teachers being paid I advocate for increased pay. It seems to me the problem is with transparency of the operators.