4 min read

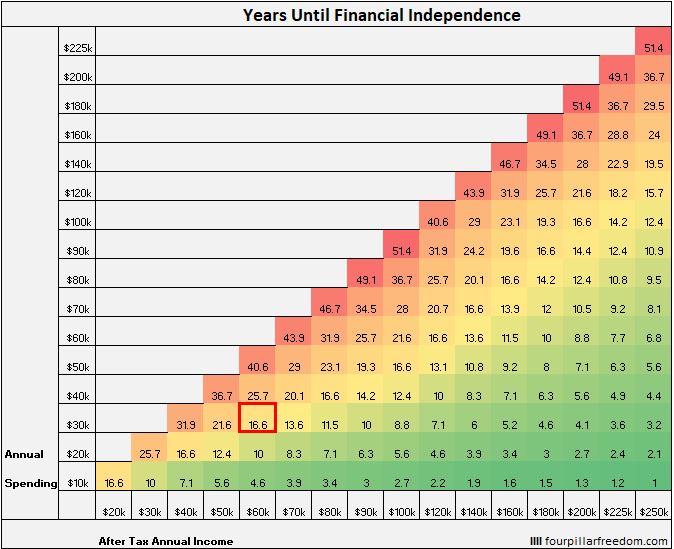

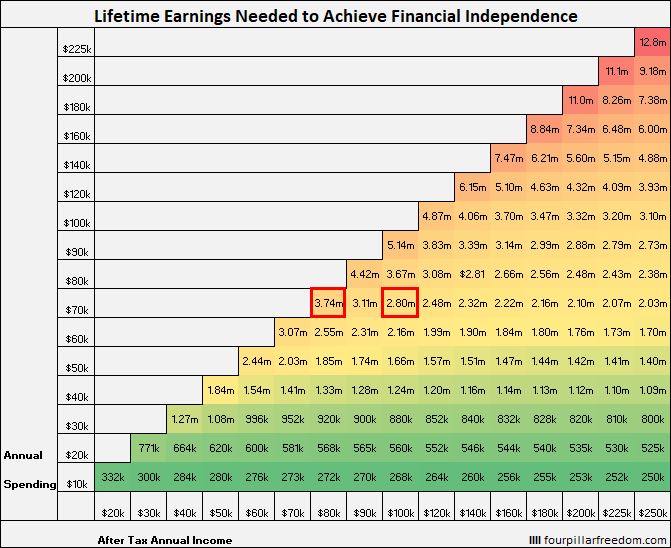

Suppose you earn $60k per year and spend $30k per year. Assuming you start with a net worth of $0 and invest your savings at a 5% return each year, the Financial Independence Grid tells us that it would take you about 16.6 years to achieve financial independence.

Note: I define “financial independence” as having 25 times your annual expenses.

This means that you would need to earn $996,000 (16.6 years * $60,000) during your lifetime to achieve financial independence.

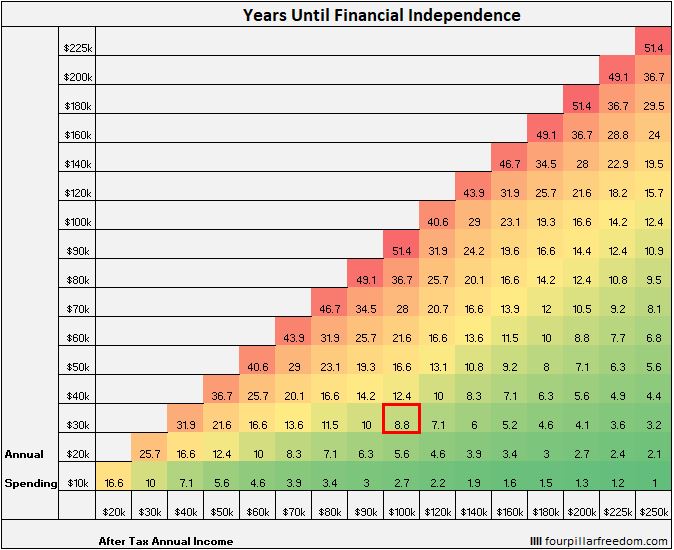

Suppose instead that you earn $100k per year, but still spend $30k per year. According to the Financial Independence Grid, it would only take you 8.8 years to achieve F.I.

This means that you would need to earn $880,000 (8.8 years * $100,000) during your lifetime to achieve financial independence.

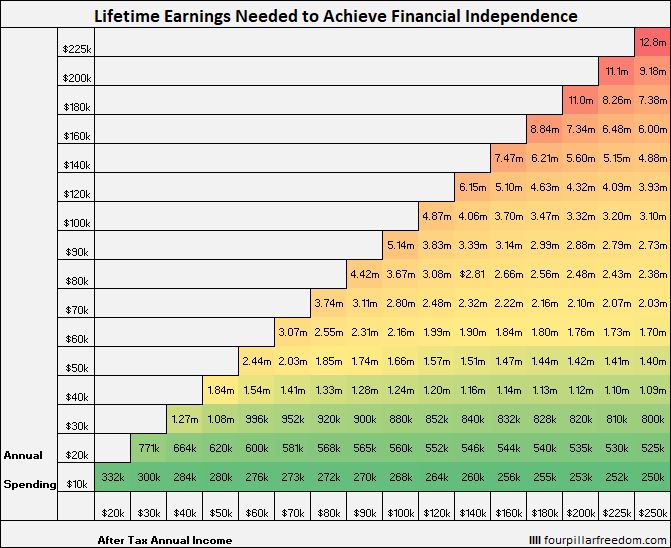

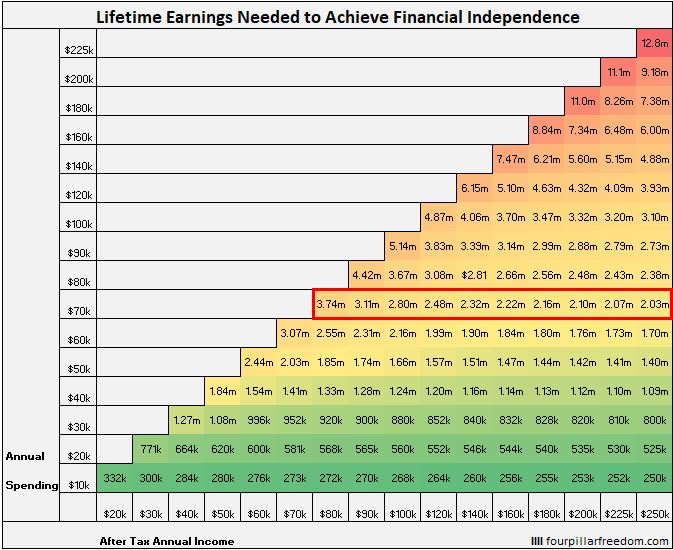

If we perform this simple calculation for every combination of annual income and annual spending on the Financial Independence Grid, we can create a new grid that shows the lifetime earnings needed to achieve F.I. at different income and spending levels:

It’s fascinating to see that a higher savings rate translates to less mandatory working years and less lifetime earnings needed to achieve financial independence.

Some Interesting Observations

If you spend $40k per year, then at every income level you need to earn at least $1 million during your lifetime to achieve F.I.

If you spend $70k per year, then at every income level you need to earn at least $2 million during your lifetime to achieve F.I.

If you spend $100k per year, then at every income level you need to earn at least $3 million during your lifetime to achieve F.I.

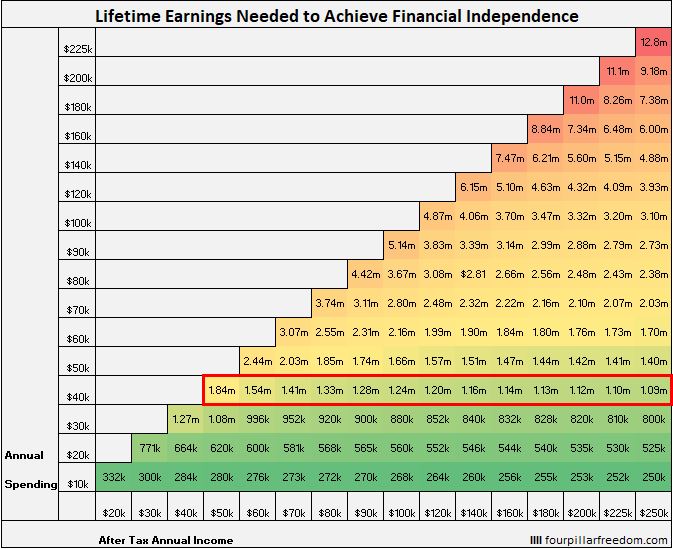

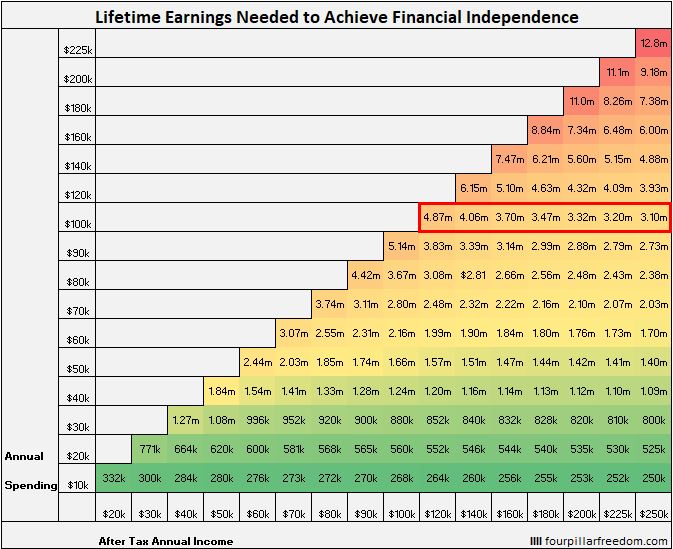

Consider person A who earns $80k per year and spends $70k per year. Then consider person B who earns $100k per year and also spends $70k per year. Person B would need to earn about a million bucks less during their lifetime than person A to achieve financial independence:

Conclusion

These grids teach us a few simple lessons:

- A higher savings rate allows you to achieve F.I. in less time (pretty obvious)

- A higher savings rate means you need to earn less during your lifetime to achieve F.I. Going back to our example from earlier, someone who earns $60k and spends $30k per year would need $750k ($30k * 25) to achieve F.I. and it turns out that they would need to earn $996k during their lifetime to do so. Conversely, someone who earns $100k and spends $30k per year would also need $750k to achieve F.I., but they would only need to earn $880k during their lifetime to do so.

- Increasing your savings rate even by a small amount could allow you to earn hundreds of thousands of dollars less during your lifetime and still achieve F.I.

Download the Excel Genius Toolkit to learn how to create grids like the ones in this post.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

The visuals add a nice touch. I used a 6% inflation adjusted return when calculating our number and hoping to hit our $1.8MM goal in 11 years and be Semi FI in 6 years.

5% seems like a good expectation to me, 6% doesn’t seem unreasonable either. Congrats on being just 6 years away from Semi FI as well. That should come with some increased freedom.

Super cool! I’ve literally never thought of translating savings rates into how much you’ll need to earn overall. A very interesting and fresh way to look at the power of a higher savings rate. I’m motivated to see if I can increase mine more! Thanks so much for your unique thoughts as always.

Thanks APL! Glad you liked this new perspective 🙂

Hey Zach,

Pretty cool way to frame the concept. I probably come in around $30-40k per year in actual expenses, so it looks like I have somewhere around a million that I need to effectively earn to get the job done based on the metrics above.

That said, I don’t see myself ever entirely stopping productive/earning activities and so there will always be supplemental income.

Keep up the interesting reads.

Take care,

Ryan

Thanks Ryan! And agreed – I will never stop doing productive activities, which will likely result in supplemental income even after I quit my day job.