3 min read

If you have a pile of cash you’re considering investing in the market, you have two options:

1. Invest using a “lump sum” approach, meaning you invest all your cash at once.

2. Invest using a “dollar-cost averaging” approach, meaning you invest a fixed amount over time.

For example, suppose you have $12,000 you want to invest.

Using a “lump sum” approach, you would invest $12,000 immediately all at once in the market (in stocks, bonds, real estate, or whatever asset class you want).

Using a “dollar-cost averaging” approach, you would invest $1,000 each month for 12 months in a row.

Which one is a better strategy?

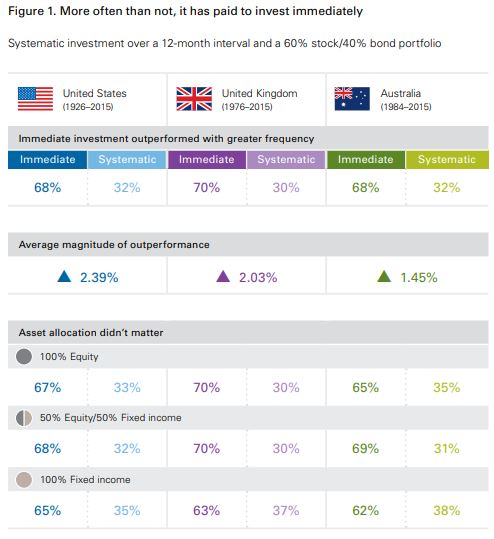

Fortunately, Vanguard did a study in 2016 to answer this exaction question. They looked at investment returns in a 60/40 stock/bond portfolio in the U.S., the United Kingdom, and Australia. They compared the one-year returns of an immediate (“lump sum”) investment vs. a systematic (“dollar-cost averaging”) investment of 12 monthly purchases made over the course of one year.

Their findings:

Immediate (“lump sum”) investment outperformed systematic (“dollar-cost averaging”) investment about two-thirds of the time in all three markets. In Australia, the average outperformance was 1.45% and in the U.S. the average outperformance was 2.39%.

In addition, asset allocation didn’t matter. Immediate investment outperformed systematic investment when the allocation was 100% stocks and also when the allocation was 100% bonds.

And over three-year periods, immediate investment outperformed over 90% of the time.

Here’s the chart that Vanguard provides to summarize the findings:

These results aren’t terribly surprising. In general, markets tend to rise over time. By investing all of your cash immediately, you’re able to participate in more of this increase than if you spaced out your investments over time.

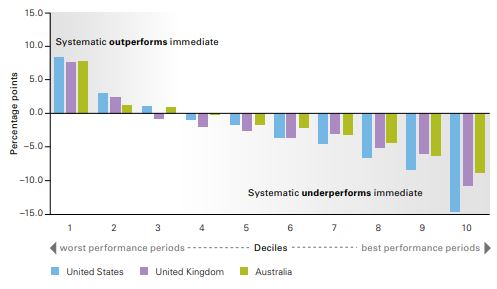

Immediate lump sum investing does come with more volatility, though. The study analyzed the returns of immediate vs. systematic investments during different one-year return periods and found that:

- During the worst 10% of periods, a systematic investment approach outperformed by an average of over 8% in the U.S.

- During the best 10% of periods, a systematic investment approach underperformed by an average of over 14% in the U.S.

They provide this chart to show how systematic vs. lump sum investments performed during various market periods:

Systematic investing delivers better returns in lousy markets, but worse returns during strong markets. It limits your downside but also limits your upside.

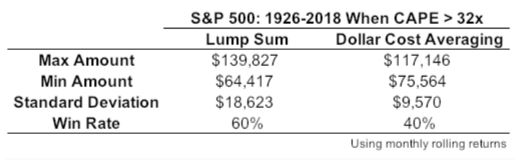

One drawback to this Vanguard study is that it doesn’t take market valuation into consideration. Currently the S&P 500 CAPE (Cyclically adjusted price-to-earnings) ratio sits at over 32, a number only reached in 1929 before the Great Depression and in 2000 in the midst of the Tech Bubble.

How does lump sum investing perform compared to dollar-cost averaging when the market valuations are this high?

Fortunately, Ben Carlson of A Wealth of Common Sense ran the numbers to answer this exact question. He compared a lump sum $100,000 investment to 12 equal monthly investments in the S&P 500 during all rolling 12-month periods since 1926 when the CAPE ratio was at 32 or higher and summarized his findings in this table:

Lump sum investing still outperformed 60% of the time even when the CAPE ratio was above 32, but this outperformance came with substantially more volatility than dollar-cost averaging.

Conclusion

In most cases, lump sum investing will lead to higher returns than dollar cost averaging. The downside, of course, is that this approach comes with a larger range of outcomes, which may or may not be acceptable depending on your ability to stomach volatility.

Investing is not just a game of numbers. It is largely a game of psychology. As an investor, you have to decide if your goal is to maximize your returns, minimize your losses, or a blend of both.

If your goal is to maximize returns, the data tells us that lump sum investing is a better approach.

If your goal is to minimize investment regret, reduce portfolio volatility, and sleep well at night, the data tells us that dollar-cost averaging is a better approach.

As an investor, your job is to choose an approach that aligns with your goals and stick with it.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great post, Zach! You answered an important question!

Thanks Lin! This was actually inspired by your question on a recent blog post a few days ago 🙂

here is a good article I read regarding this debate

https://jlcollinsnh.com/2014/11/12/stocks-part-xxvii-why-i-dont-like-dollar-cost-averaging/

Thanks for sharing Syed! Always love hearing Jim Collins’ thoughts on investing

Excellent information here, Zach. A lot of it boils down to ability to invest lump sums. Since we run things pretty tight here in our household, the only option is to DCA. Main reason? We’re using any extra income to pay down our mortgage in lump sums. Similar theory – avoiding extra interest by hacking away more principal earlier in the pay down.

DCA is great if that works for you financial situation – and it sounds like it does. Thanks for sharing, Cubert!

I am currently facing the same dilemma and this post is helpful in giving me the clarity to move ahead with my decision .

Thanks Zach!