4 min read

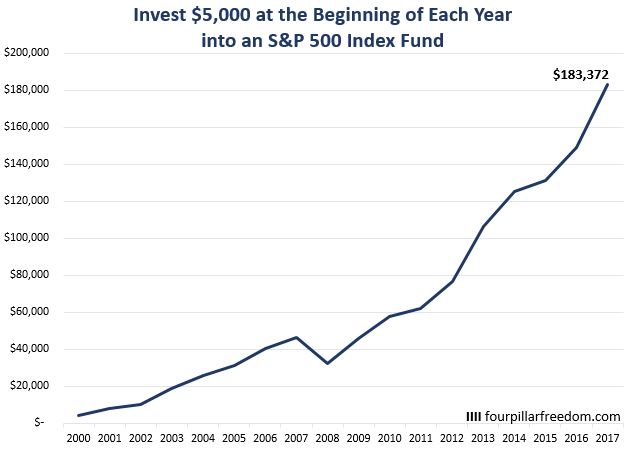

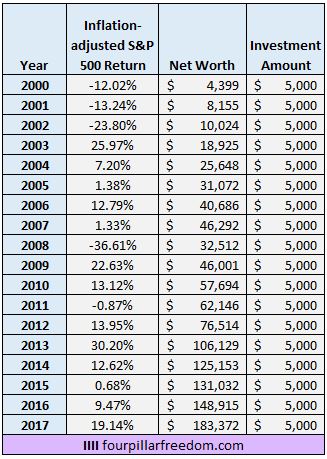

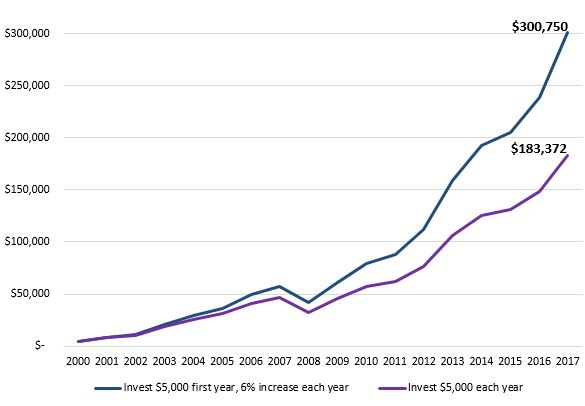

If you invested $5,000 into an S&P 500 index fund at the beginning of each year since 2000, you would have accumulated $183,372 by the end of 2017 (using inflation-adjusted returns)

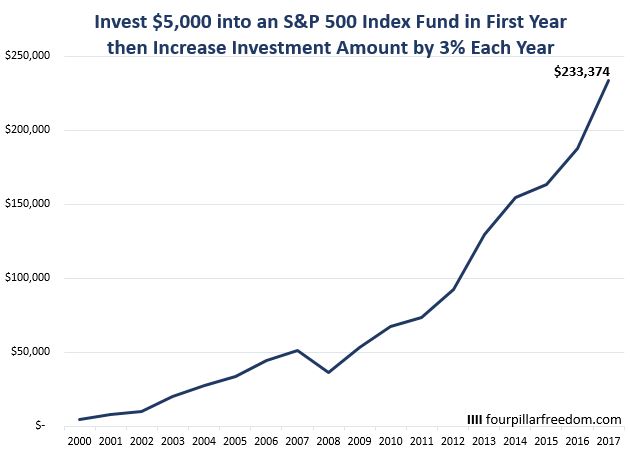

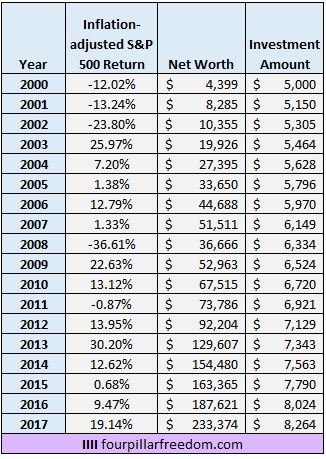

If you instead invested $5,000 into an S&P 500 index fund at the beginning of 2000 and then increased your investment amount by 3% each year, you would have accumulated $233,374 by the end of 2017.

That’s a difference of $50,000 over the course of 18 years by simply increasing your investment amount by 3% each year.

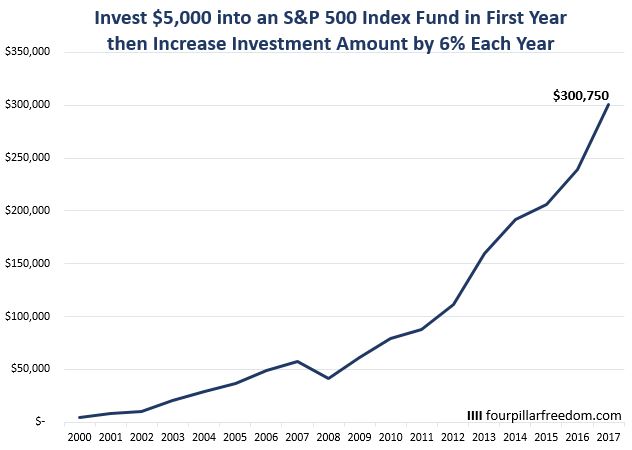

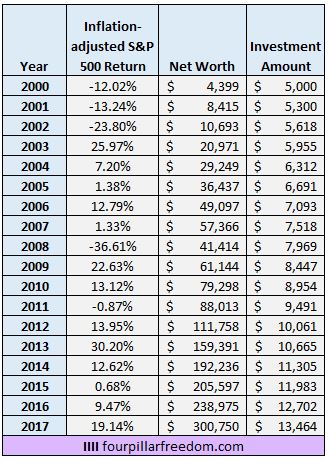

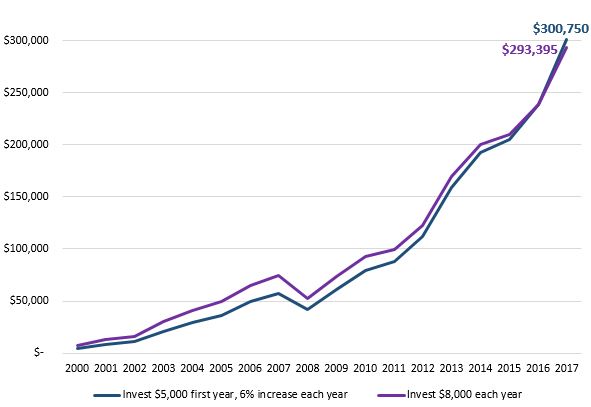

If instead you increased your investment amount by 6% each year, the results are even more incredible:

By increasing your investment amount by 6% each year, you end up with $117,000 more than if you only invest $5,000 each year.

This is the magic of slowly increasing how much you invest each year. The 6% additional investment doesn’t feel like a lot from year to year, but over the long haul it has an incredible impact.

This brings up an important point: it’s okay if you don’t have a lot to invest early on just as long as you’re able to increase your income and subsequently your investment amount each year.

Investing $5,000 might not feel like a lot in year one. And investing $5,300 might not feel like a lot in year two. Or $5,618 in year three. But the fact that you’re able to invest more each year is all that matters. Over time, these incremental increases add up.

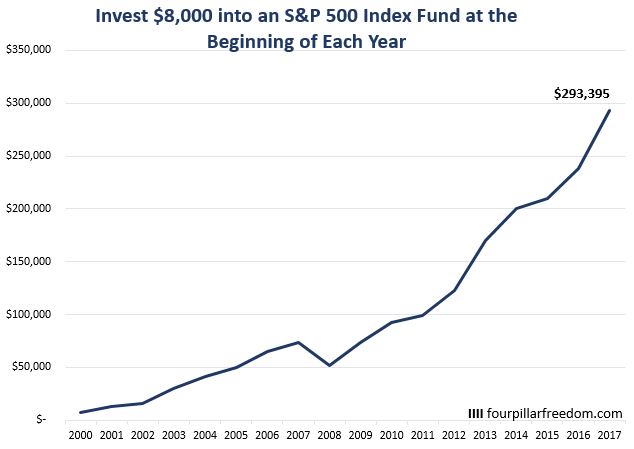

Consider someone who is able to invest $8,000 in year one, but unable to increase their investment amount each year. If they invested $8,000 at the beginning of each year into an S&P 500 index fund, they would have ended up with $293,395 by the end of 2017.

This is less than someone who invested $5,000 in 2000 and increased their investment amounts by 6% each year:

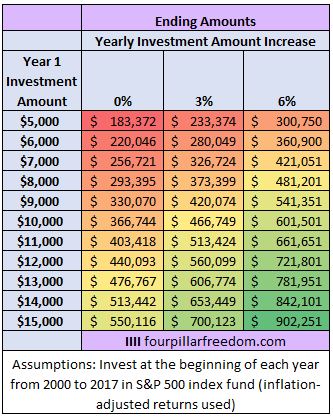

This table shows the ending amounts of various investment scenarios during 2000-2017:

Notice how the ability to increase your investment amount each year can be more important than how much you invest in year one.

For example, someone who invested $11,000 in year one but never increased their investment amount would have ended up with less than someone who invested $7,000 in year one but increased their investment amount by 6% each year.

If there is one takeaway from this analysis, it’s this: increasing the amount you invest each year, even by a small percentage, can have a massive impact on your net worth over the course of many years.

Learn how to make clean charts and grids like the ones in this post using the Excel Template Pack, a downloadable collection of 17 of my most popular Excel data visualizations.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Those graphs are great. Nice job. This is similar to compound interest. It’s pretty amazing how much difference it makes over a long period.

We’ve increased our savings as we made more income over the years and it paid off handsomely. That’s why everyone should prioritize saving first.

Love the math to support your assertions. It’s the little things that compound themselves into big ones later on.

Keep up the great posts, Zach!

This is a great illustration of the growth of an investment by increasing your contributions over time. By slightly increasing your contribution it gives you time to adjust your budget. You won’t even miss the extra money after awhile. Thank you for sharing!

Awesome post Zach, I think this analysis can be very encouraging to people that may not be able to invest much starting out. My advice for people in that boat is always to just get started and then increase over time, because you’re getting over the mental hurdle and getting into the habit of investing regularly.

Thanks Matt! Completely agree – it’s not about where you start, it’s about where you go

Persuasive argument to start with what you can afford and continue to “pay yourself” by making an increasing annual contribution when you receive a raise or promotion at work. The effects compound with time and over the span of an entire career can easily make for a solid retirement nest egg. The best part is with low-cost ETFs, this can be accomplished through an IRA or some employer-sponsored plans and grow tax-free.

Agreed – the tiny, incremental increases have an insane impact over the course of years and decades. The trick is to be consistent.

I like how you’ve simplified it to illustrate a very important point. It’s amazing how money builds up. Thanks for this!

Thanks for the kind words, Ms. K!