7 min read

“As an investor, you have a choice: you can be like the gamblers who try to beat the casino or you can be the casino by investing in total market index funds. It’s an easy choice, once your understand the odds.” -Taylor Larimore

About a month ago, Taylor Larimore emailed me out of the blue and offered to send me a copy of his new book “The Bogleheads’ Guide to the Three-Fund Portfolio.”

I happily accepted his offer and a couple weeks later the book arrived at my apartment.

For those who don’t know, Larimore is often referred to as “King of the Bogleheads”, a name given to him by Vanguard founder Jack Bogle. Born in 1924, he has lived almost an entire century and has seen his fair share of market behavior and investment techniques.

In 1986 he became inspired after reading about Jack Bogle and became a firm believer in low-cost index fund investing. He promptly moved his investments to Vanguard. As he describes in the book:

“In 1986, we moved our family securities from Merrill Lynch to Vanguard. It was a very difficult decision because our broker was a long-time friend who sometimes invited us to go sailing on his beautiful sailboard (which I now realize we helped pay for). After we left Merrill Lynch, our broker never invited us to go sailing again. Looking back, leaving Merrill Lynch and moving to Vanguard was the best financial decision we ever made.”

Larimore has been a proponent of index funds ever since and explains in this book how a portfolio of three total market index funds outperforms most investors with less risk.

Here’s a brief synopsis of the book along with a few of my thoughts.

Why Index Funds?

The U.S. investment industry makes money from commissions, fees, and miscellaneous investment expenses. Rick Ferri, a retired financial adivsor and author of eight financial books, explains why this hurts the ordinary investor:

“Let’s face it: Most investment companies are in business to make money from you, not for you. Every dollar you save in commissions and fee expenses goes right to your bottom line.”

Many investment companies want you to invest with their managers in hopes that you’ll be able to outperform the market. The problem is, nearly all managers underperform the market, yet still earn a living from fees and expenses that you, the investor, fork over for their services.

Larimore explains that it is possible for fund managers to outperform the market for a few years, but very few consistently do over long stretches of time. And the ones who do outperform tend to underperform at some point in the future. He shares an example:

“Bill Miller is a perfect example. Mr. Miller was the manager of Legg Mason Value Trust (LMVTX). His fund is the only mutual fund that was able to beat the S&P 500 Index 15 years in a row. Miller became a celebrity in the mutual fund world, and investors eagerly poured their money into his fund. Unfortunately, like many winning mutual funds, LMVTX plunged to the bottom 1% of its Morningstar category over the next 15 years. Remember: Reversion to the Mean, like gravity, does bring us all back to earth.”

He goes on to share why the financial services industry tends to hate index funds:

“Many in the financial services industry hate indexing because it is difficult for them to make money selling low-cost index funds. The industry spends billions of dollars attempting to convince us that they can help us beat the market by choosing winning individual stocks, bonds and mutual funds for us. (Fact: They cannot)”

So there we have it.

Investment companies want ordinary investors to believe that they can earn above-average market returns by investing with the the right fund manager. Sadly, very few managers outperform the market and yet still charge hefty fees for their services. These fees come out of the pockets of investors and reduce investment returns.

Thus, the need for index funds. A way to minimize investment fees with maximum diversification.

Which Index Funds?

Jack Bogle, founder of Vanguard, created the world’s first retail index fund in 1976, the Vanguard 500 Index Fund, which contained 500 large U.S. stocks. Through purchasing this one fund, investors could obtain the diversification of 500 stocks at a low cost.

Shortly after, he went on to create three nonoverlapping total market funds:

Vanguard Total Stock Market Index Fund (VTSAX / VTI) – introduced in 1992, allows investors to own more than 3,500 U.S. company stocks at extremely low cost. Admiral shares ($10,000 minimum) or the ETF version (no minimum) have an expense ratio of .04%. This means an investor can invest $10,000 at a cost of only $4 per year.

Vanguard Total Bond Market Index Fund (VBTLX / BND) – introduced in 1986, allows investors to own more than 8,000 very diversified, high-quality U.S. bonds. The expense ratio for Admital Shares or the equivalent ETF is .05%

Vanguard Total International Stock Index Fund (VTIAX / VXUS) – introduced in 1996, allows investors to hold more than 6,000 international stocks, including emerging market stocks. Admiral Shares or the equivalent ETF have an expense ratio of .12%

As Larimore notes:

“Thanks to Jack Bogle, for the first time in history ordinary investors can own more than 17,000 diversified, nonoverlapping, world-wide securities at an amazingly low cost.”

The Benefits of Index Funds

Larimore shares 20 benefits of total market index funds. Here are a few of my favorites:

Benefit 5: No Individual Stock Risk

“Unlike mutual funds, individual stocks can plunge to zero. On the 50th birthday of the S&P 500 Index, only 86 of the original 500 companies still remained, showing it is possible to turn a large fortune into a small fortune with individual stocks. On the other hand, it is unheard of for a registered mutual fund to go to zero.”

Benefit 10: Above-Average Return

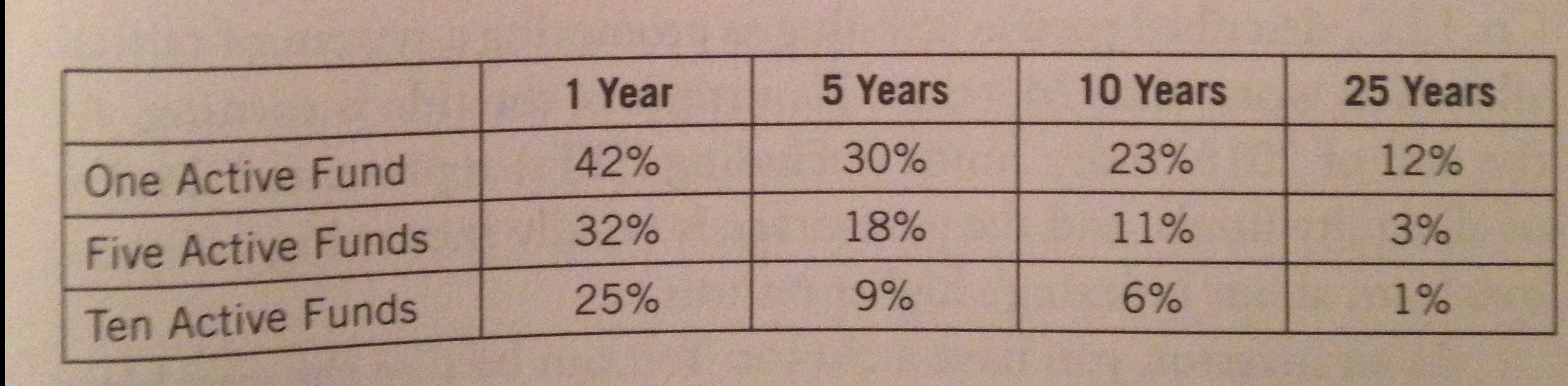

Larimore cites six academic studies that all show that index funds nearly always beat their managed funds counterparts. My favorite study he shared was by Allan Roth, who summarized the probability of a managed fund with an expense ratio of 2.0 outperforming an index fund with an expense ratio of 0.23:

One managed fund had a 42% chance of beating an all-index fund over a 1-year period. As you add more managed funds to the mix and extend your time horizon, the probability of outperforming drops significantly. The probability that a basket of ten active funds will outperform an all-index fund over a 25-year period is only 1%.

Benefit 14: Low Costs

“To give you an idea of the impact of costs, consider this: If stocks gain an average of 6% annually during the next 30 years, someone who invested $25,000 with a 1% yearly fee will forego more than $35,000 in gains because of the fee – more than the original investment!“

Benefit 15: Maximum Diversification (Lower Risk)

“The Lehman Brothers bankruptcy in 2008 is an example of the need for diversification. Lehman Brother was founded in 1850, and in 2000 it was the fourth largest investment bank in the United States. In the 2008 Bear Market, Lehman Brothers went bankrupt, causing thousands of their employees and individual investors who owned Lehman Brothers shares to lose all, or part, of their retirement benefits and life savings.

Vanguard Total Stock Market Index Fund investors also owned Lehman Brothers shares in their fund, but because their fund was diversified with thousands of other stocks, Total Stock Market fund shareholders were little affected by the bankruptcy. This is another advantage for total market index funds: Because all your stocks and bonds are wrapped into one fund, you don’t see the carnage that unnerves other investors, causing them to worry and sell at exactly the wrong time (i.e., during Bear Markets).

Diversification, with its lower risk, is the hallmark of the Three-Fund Portfolio. It protects us from allowing our brain – wired to sometimes flee out of fear – to become our own worst enemy.”

How to Implement the Three-Fund Portfolio Strategy

Larimore lays out five simple steps to set up your three-fund portfolio:

Step 1: Decide what funds to include in your portfolio. Hopefully you’re convinced that the three funds listed above are the only three you need.

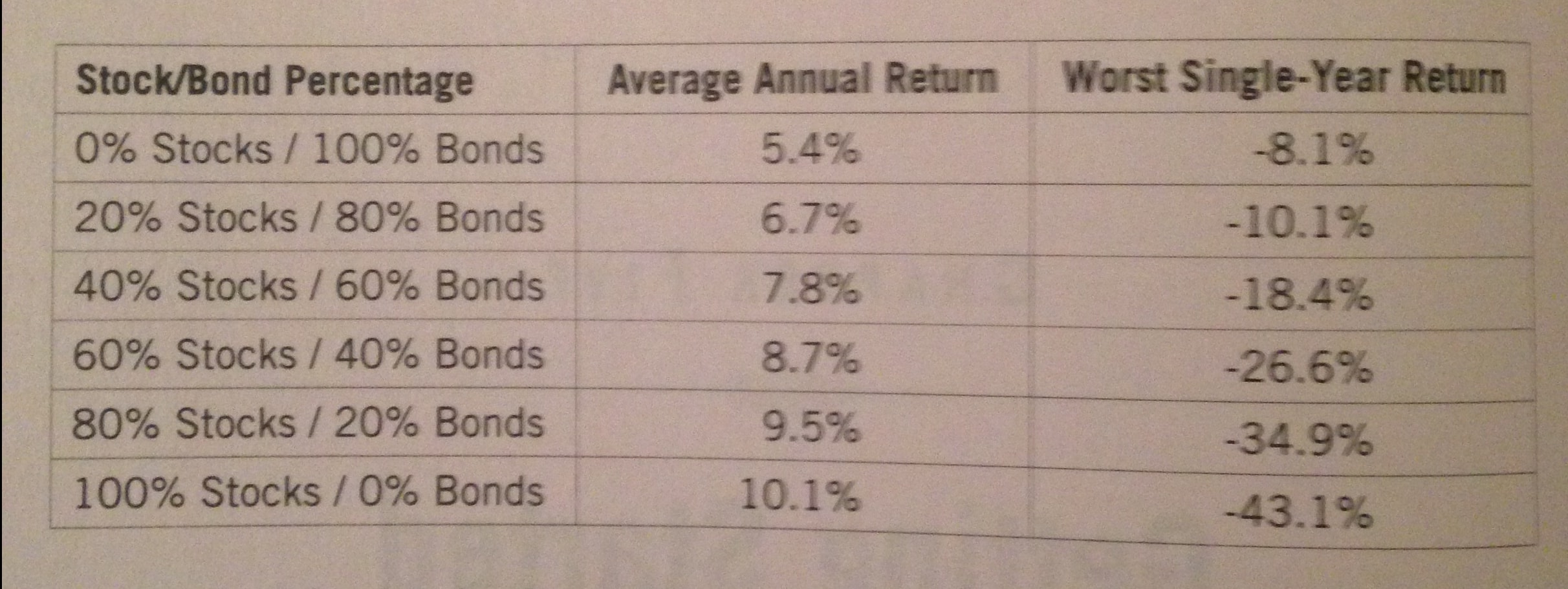

Step 2: Choose an asset allocation. This will determine your expected return and expected risk. A portfolio with a higher stock allocation has a higher expected return with higher volatility. To illustrate this, Larimore shares a table that shows the average annual return and the worst single-year return of various allocations from 1926 to 2015:

If you follow the three-fund portfolio approach, the bond allocation can be composed entirely of VBTLX or BND, the Vanguard Total Bond Market Index Fund or ETF equivalent.

The stock allocation can be composed entirely of VTSAX or VTI, the Vanguard Total Stock Market Index Fund or ETF equivalent. If you would like to add international stocks, you can also include VTIAX or VXUS, the Vanguard Total International Stock Market Index Fund or ETF equivalent.

In reference to international stocks, Larimore references Bogle:

“Jack Bogle says he’s fine with 0% internaional but feels that 20% may be okay for investors who want some international exposure.”

Thus, the decision to include international stocks in your portfolio is entirely up to you. Ben Carlson of A Wealth of Common Sense recently wrote a nice post explaining the potential benefits and drawbacks of owning international stocks: Some Considerations for Investing Globally

Step 3: Decide if you want to use mutual funds or their ETF equivalents. This shouldn’t be a tough decision. Both have the exact same holdings. Mutual funds merely require minimum investments while ETFs do not.

Step 4: Invest in tax-advantaged retirement plans if possible. Contribute to a 401(k) plan if one is available to you. If not, consider an IRA. Larimore shares a simple rule of thumb in deciding between using a Roth vs. Traditional IRA:

Use a traditional IRA if you think your income tax rate is higher now than it will be in retirement.

Use a Roth IRA if you think your income tax rate is lower now than it will be in retirement.

If you have maxed out your retirement plans or don’t have access to any for some reason, you can simply invest in a taxable brokerage account. Larimore notes that Total Stock Market and Total International Stock Market funds are excellent tax-efficient funds that can be held in taxable accounts.

The Total Bond Market Fund, however, is not tax-efficient and should be placed in a tax-advantaged account if possible. If not, it’s a good idea to consider a high quality tax-exempt intermediate-term bond fund such as Vanguard’s Tax-Exempt Intermediate-Term Bond Fund (VWIUX) for a taxable account.

Step 5: Implement your plan.

Set up an account online and start investing. Larimore recommends either Vanguard, Fidelity, or Schwab, as all three companies have the three total market index funds available at low costs.

Stay the Course

Once you have implemented your plan, you simply need to stay the course. Larimore has suggestions for how to stay the course in both bull and bear markets:

“Bull Markets: When stocks are in a Bull Market, there will be a great temptation to increase your stock allocation. A small deviation from your asset allocation plan is permissible, but you should rebalance any time your stock allocation exceeds 10% (some would say 5%) of its desired allocation. If you are in the accumulation phase of investing, you can do this by putting all new contributions into your bond fund or by selling stocks. If you are in the withdrawal phase of investing, you should take withdrawals from your stock funds or exchange stocks for additional bonds in your tax-advantaged account(s).”

“Bear Markets: When stocks are in a Bear Market (U.S., International, or both), you will be strongly tempted to sell at least a portion of your stock funds. DON’T DO IT. This is the time when stocks are on sale at lower prices. Sticking with your allocation means you likely will be buying low and selling higher when you rebalance – the oppositre direction of the herd. Rebalance by adding to your stock funds until you have again met your desired asset allocation. This is the most difficult (but most important) thing you can do in a Bear Market.”

My Reaction

Prior to reading this book, I knew that index funds were a smart way to invest, but the points Larimore made throughout the book drove home some key points for me:

Index funds minimize risk while maximizing diversification.

Individual stocks can (and do) go to zero while index funds never have before.

Index funds outperform nearly all active investment strategies over the long haul.

In the past, I have dabbled in individual stock picking and short-term trading. Moving forward, the bulk of my investments will be in VTI, the Vanguard Total Stock Market ETF. I will likely allocate a small percentage of my investments to the Vanguard Total International Stock Market ETF as well.

As of now, at 24 years old, I have no plans of investing in BND (the Vanguard Total Bond Market ETF) any time soon. I’m still in the early stages of my investing career and I have plenty of time to ride the roller coaster of a nearly 100%-equity allocated portfolio.

I highly recommend checking out the book yourself. It’s only about 60 pages and packed with nuggets of wisdom. Thanks again to Taylor Larimore for generously sending me a free copy.

Footnotes: How to Build a 3 Fund Portfolio

Here are the exact funds you can invest in to build a 3 fund portfolio for three of the most popular brokerages.

How to build a three fund portfolio with Vanguard

U.S. Stocks – Vanguard Total Stock Market Index Fund (VTSAX)

Bonds – Vanguard Total Bond Market Index Fund (VBTLX)

International Stocks – Vanguard Total International Index Fund (VTIAX)

How to build a three fund portfolio with Charles Schwab

U.S. Stocks – Schwab Total Stock Market Index (SWTSX)

Bonds – Schwab US Aggregate Bond Index Fund (SWAGX)

International Stocks – Schwab International Index (SWISX)

How to build a three fund portfolio with Fidelity

U.S. Stocks – Fidelity ZERO Total Market Index Fund (FZROX)

Bonds – Fidelity US Bonds Index Fund (FSITX)

International Stocks – Fidelity ZERO International Index Fund (FZILX)

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Excellent book review. Thanks for sharing. Really enjoy your blog. The H and I had a similar awakening in 2011, moving everything from a traditional brokerage model to Vanguard with the help of a fee-only financial planner. Mr. Bogle is interviewed in this 2013 Frontline episode titled, “The Retirement Gamble” (https://www.pbs.org/video/frontline-retirement-gamble/). It really highlights the long-term negative impact of fees on retirement planning and net worth. Worth a view, IMO. My favorite Bogle quote (paraphrasing from memory): “Why would anyone invest in a program where you put up 100% of the capital, you take 100% of the risk, but you only get 30% of the return.” Indeed.

Taylor is a great guy who gives lots of his time to help others with their investments for free. Especially given his amazing life experience, people would be wise to follow his sage advice. I do!

Yup, investing is a good place for one to strive to be “average” in. Like Roth’s study pointed out, you can be the market average and still beat nearly 60% of actively-managed funds out there every year. And beating 88% of them over the span of 25 years?! That’s amazing and so incredibly effortless.