7 min read

I recently received an email from a reader:

Hi Zach,

I’m an expat Scottish dude, turning 40 this year and married with two young kids about to enter the school system. As you can imagine, I have quite high outgoings! We have had a solid savings regime in place for a few years now, but I know we can do better.

We are planning on relocating from the Middle East to Australia within the next twelve months, and I intend to spend the ‘middle chapter’ of my adult life focused on F.I.R.R.E. (the 2nd R being Relatively…). Would be great to hear back from you and to get some help running some visuals.

Once done, I’m happy for you to share my details to help others in a similar position to mine to plan for a better way of life.

Cheers,

Jock

I thought it would be neat to do a case study using Jock’s financial numbers to help him (and others in a similar position) see where he’s at financially and where he and his family could potentially be 15 years from now when he turns 55.

Let’s jump in!

Background

Jock is 40 years old, married, with two kids. He and his family are originally from Scotland, currently live in Qatar, and plan on moving to Australia within the coming year.

Financial Overview

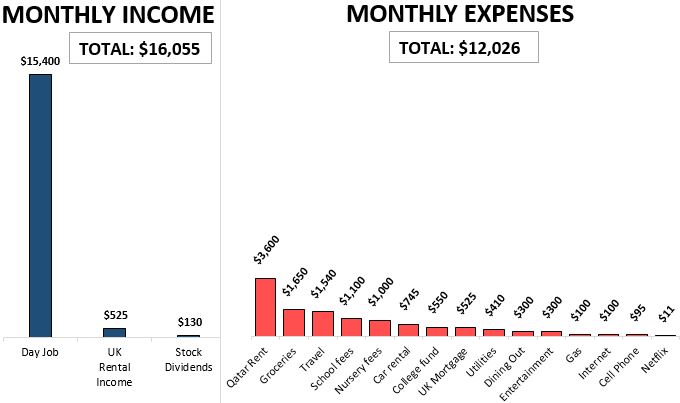

Jock’s salary is his family’s primary source of income. In addition, he also receives stock dividends, which he currently reinvests each month.

He owns a property back in Scotland, which he currently rents out. The rental income covers the mortgage and insurances. The interest rate is low enough that he doesn’t plan on paying off the remaining mortgage balance ($52,500) early.

At this rate, the mortgage should be paid off by 2030. He plans to keep the property until he retires at which point he’ll sell it and throw the proceeds into a mix of stocks and bonds.

He also has a UK pension sitting in a SIPP (self-investment pension plan), which he doesn’t plan on accessing until age 65.

Financial Visualizations

Let’s take a look at Jock’s finances.

Net Worth

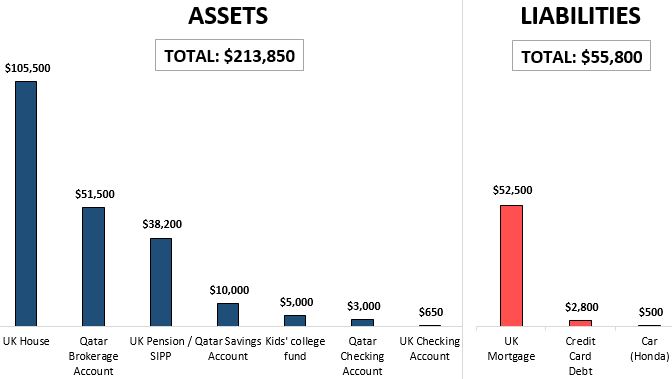

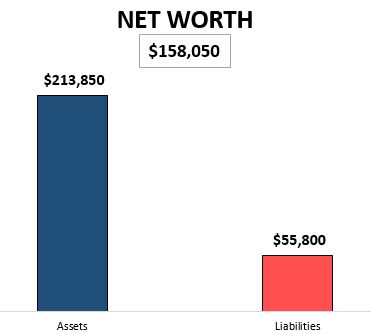

Currently Jock has $213,850 in assets spread across various accounts including his UK house. He has $55,800 in liabilities including the mortgage on the UK house, some minor credit card debt, and his remaining payments on his car.

Subtracting the liabilities from the assets, we see that Jock and his family have a net worth of $158,050.

While net worth is a great metric for measuring where Jock is at financially, to see where he and his family are headed financially, let’s check out their monthly cash flow.

Cash Flow

Here’s a look at Jock’s monthly income and expenses:

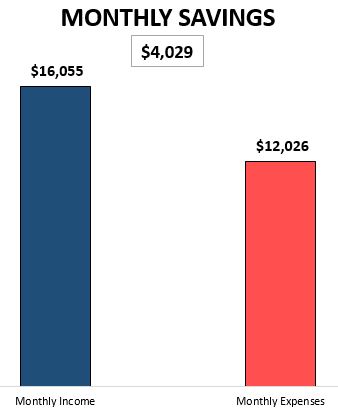

Subtracting the expenses from the income, we see that Jock and his family currently save $4,029 per month, which is about a 25% monthly savings rate.

This means that over the course of an entire year, Jock and his family could save $48,348.

Visualizing the Future

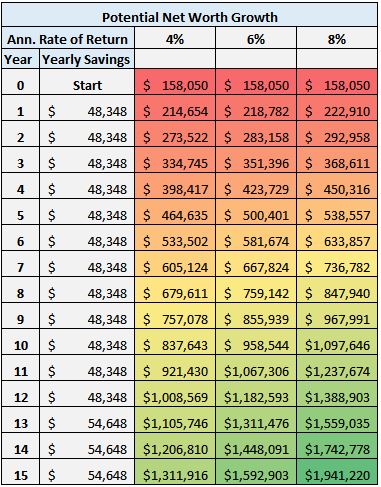

Let’s assume Jock and his family save $48,348 every year for the next 12 years. At that point, once the mortgage on the UK house is paid off, they’ll be able to save an extra $6,300 per year that no longer goes towards mortgage payments. This means they could save $54,648 per year for the final 3 years.

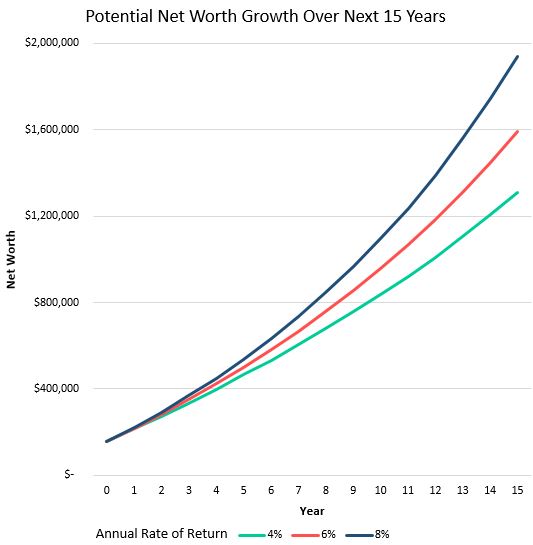

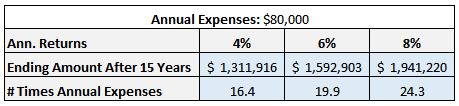

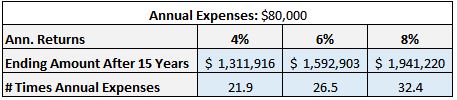

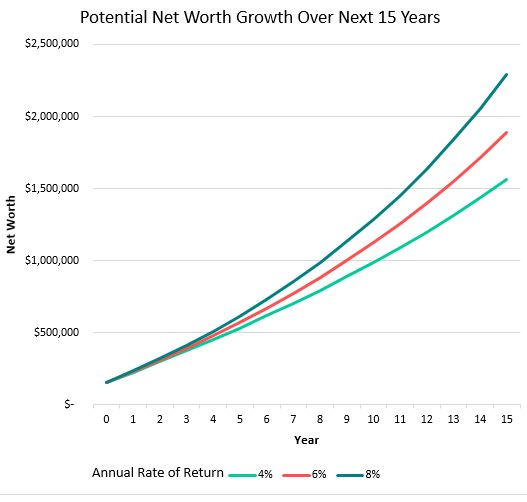

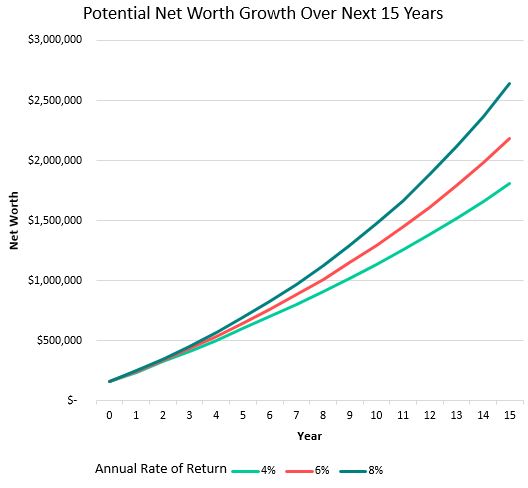

Let’s check out what their net worth could become using a few different annual rates of return on their investments:

And visualizing these potential growths:

Keep in mind the market could potentially deliver returns outside of the 4 – 8 % annual range, but to run these visuals we have to make some assumptions.

Recall that Jock and his family currently spend $12,026 per month, which equates to $144,312 per year. Once the UK mortgage is paid off, their annual expenses will drop to $144,312 – $6,300 = $138,012 per year.

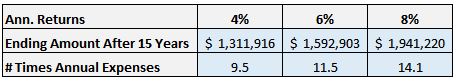

If they plan on spending $138,012 per year in retirement, they won’t quite have the traditional 25 times annual expenses saved up that they would need to be financially independent:

This means they have two options:

Option 1. Spend less in retirement

Option 2. Increase savings rate on the way to retirement

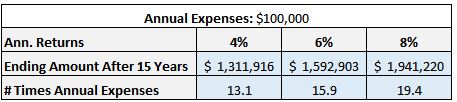

Using Option 1: Suppose at the end of the 15 years that Jock’s kids move out, his overall cost of living decreases, and that his annual expenses drop to $100,00 per year:

Or $80,000 per year:

Or perhaps $60,000 per year:

By dropping his annual expenses in retirement, Jock and his family could achieve the 25 times expenses mark without changing their current annual savings.

Using Option 2: The other obvious choice is to simply cut their spending on the way to retirement over the next 15 years.

Recall his family’s current monthly spending:

The obvious places to reduce spending would be on the rent, the groceries, the car rental, and the travel if possible (travel hacking with credit cards perhaps?).

Even shaving off a few hundred bucks in each of these categories could add up to an additional monthly savings of $1,000 – $2,000. Over the course of 15 years, this would have a massive impact.

Saving an Additional $1,000 per Month

Suppose Jock and his family save and invest an additional $1,000 per month, or $12,000 per year. This means that they could instead save $60,348 for the next 12 years and $66,648 in the final 3 years when the UK mortgage is paid off:

And visualizing these potential growths:

Saving an Additional $2,000 per Month

Or suppose Jock and his family save and invest an additional $2,000 per month, or $24,000 per year. This means that they could instead save $72,348 for the next 12 years and $78,648 in the final 3 years when the UK mortgage is paid off:

And visualizing these potential growths:

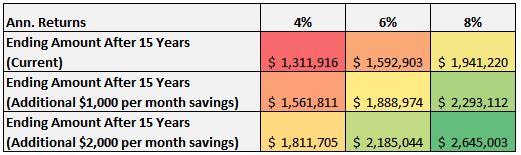

Let’s take a look at the ending net worth amounts based on these different savings levels:

Notice that by saving an additional $2,000 per month over the next 15 years, Jock and his family’s net worth could be over half a million dollars higher in any of the investment return scenarios.

Conclusion

Based on their current monthly savings, Jock and his family would need to spend significantly less in retirement than they currently do to hit the 25 times expenses net worth mark. This could certainly be possible if their cost of living turns out to be significantly lower in 15 years.

Another great idea would be to cut expenses by a few hundred (possibly thousand) dollars in some of the big spending categories like rent, transportation, travel, groceries, etc. and throw those extra savings into investment accounts each month.

In fact, if they were able to cut their spending by more than $2,000 per month I don’t see why they couldn’t achieve retirement in less than 15 years.

Jock and his family have two major variables working in their favor:

1. A high monthly income

2. A time horizon of more than one decade

Due to the high income, they have the potential to save a serious amount of money each month. They currently save 25% of their income, but with a few tweaks they could move this number up to 30 – 40% quite easily.

And thanks to the lengthy time horizon, they have plenty of time to increase their net worth while also experimenting with lower spending strategies.

Perhaps one month they could make it a goal to spend half of their usual amount on groceries. Or another month they could research travel hacking to eliminate their travel expenses. On another month they could research alternative choices to paying $1,000 nursery fees.

By looking for multiple areas to cut down on spending, Jock and his family can ensure that they accumulate 25 times their annual expenses or more by the end of this 15-year period.

Thanks again to Jock for reaching out to me about this idea and being willing to share his personal financial numbers. Hopefully this post is useful to him and his family as well as anyone else in a similar situation looking to reach retirement in 15 years or less 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Very solid well thought financial review Zach (are you sure your are only 24)?

One comment and one question:

Comment: Love the projection spreadsheets. I built one for myself and used it in my 30s and 40s for the same purpose you use here. I called it my “quit now” spreadsheet. I use to play with it every weekend when I was exhausted from working and commuting 60-70 hours a week.

Question: Where in the expenses are income taxes? They are always one of my highest expenses pre and post FIRE. I find many do not consider them in their planning for some reason. If they are not included in expenses, they should be taken out of income to get to an after tax “take home” income. Thoughts?

Tom

Hi Tom, Jock here.

No income tax in the Middle East, although we pay extortionate rent so I guess that’s how they ‘tax’ us!

Thanks Jock. I’m jealous. Income taxes have always been one of our largest expenses over the years here in the states. Best wishes to you and your family. I like to say, if you can envision it, you can achieve it! And you will. Tom

Thats an awesome case study and very informative on how you play with numbers. Thanks to you and Jock for sharing!

Nicely put together! The key is the high income earned. This allows the potential for an increased savings rate, which translates to a bigger pot at the end of 15 years. Hopefully, the income will continue to increase over the years and strategies to decrease expenses (e.g., residence, transportation changes, etc.) combined can help propel this goal! 🙂

I may have missed it; will any of the expense variables change from the move to Australia?

Hi SMM,

Yes, when we move to Oz our primary income will go down, but then so will a lot of our expenses (groceries, school/nursery fees, transportation, travel). As others have said, Zach has done a really fantastic job at visualising the journey my wife and I are on and what we can focus on to reach our goals as fast as possible – thanks again Zach!

I plan to reach out to Zach again once we are settled in Oz, so we can visualise the changed circumstances and what that means for our F.I.R.R.E. journey! It would be great if, in time, this post can become a place for others comment on and share their own journeys toward a better way of life.

Cheers,

Jock

Zach, you did a great job! Perhaps another couple of things to consider: as the kids get older, both parents may choose to work and amp up the income. But…here comes college for those kids, too. I do see the 529, so that’s great.

Did not expect the different hypotheticals with matching visualizations. Wow! Agree that the high income can definitely accelerate their RRE with plenty of room for budget optimization.