3 min read

Today I will be using the Savings vs. Investment Return Calculator to run through some thought experiments. We’ll ignore inflation to simplify the results.

Suppose you are able to consistently save $10,000 every year. How much would you be able to save after 10 years? The answer is $10,000 * 10 = $100,000.

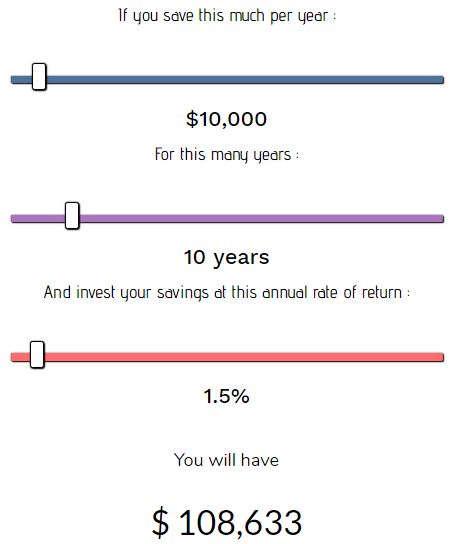

But now suppose you put that $10,000 into an online savings account that pays you 1.5% each year in interest. Now how much do you think you’ll have at the end of that 10 years?

Take an educated guess, then click SHOW ANSWER below to see how close you were.

[showhide type=”pressrelease1″ more_text=”SHOW ANSWER” less_text=”HIDE ANSWER” hidden=”yes”]

How close was your guess?

[/showhide]

Basic arithmetic easily helps us see that saving $10k for 10 years results in $100k. But once we throw a little compound interest in the mix, the math suddenly becomes less intuitive.

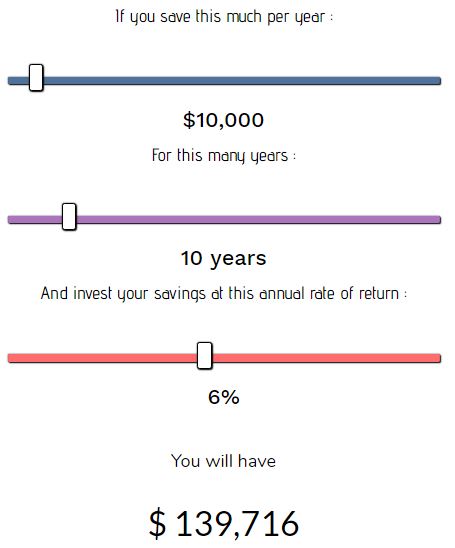

Let’s try another example. Suppose you save that same $10k for 10 years, but this time you invest it in the stock market and it grows at a rate of 6% each year. Now how much do you think you’ll have after 10 years?

[showhide type=”pressrelease2″ more_text=”SHOW ANSWER” less_text=”HIDE ANSWER” hidden=”yes”]

This 6% annual growth rate on your savings leads to an additional $39,716 after 10 years. How close was your guess?

[/showhide]

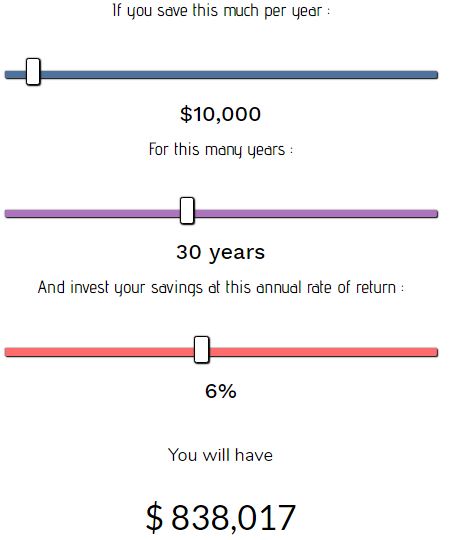

Let’s again suppose you save $10k per year and your savings grow at a rate of 6% each year. How much do you think you’ll have after 30 years?

The math on this one is much trickier to do in your head. Personally, I would start with $10k * 30 = $300,000. That’s how much I would have in raw savings, so I know the ending amount must be higher than that. To factor in a 6% growth rate is very difficult, though.

I know that 6% of $10k is $600, so after one year I’ll have $10,600. But then in year two I add another $10k in savings, which takes me up to $20,600. Now I have to calculate 6% of that…you can see how the math gets absurd very quickly.

Come up with a guess yourself, then click SHOW ANSWER below to see how close you were.

[showhide type=”pressrelease3″ more_text=”SHOW ANSWER” less_text=”HIDE ANSWER” hidden=”yes”]

My personal guess was $650k, which was way off the mark. How close were you?

[/showhide]

Now let’s switch gears and think about percentages.

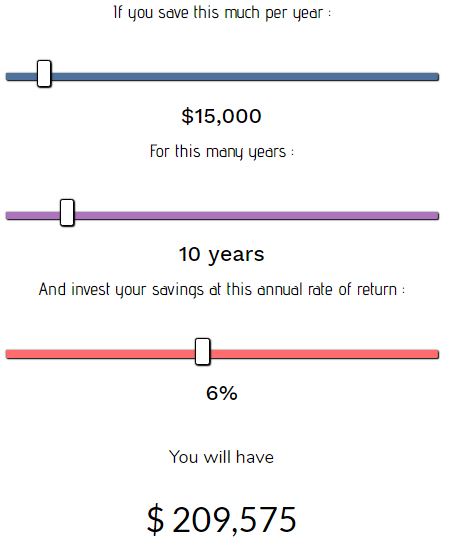

Suppose you save $15,000 per year for 10 years. Your savings grow at a rate of 6% each year. What percentage of the total ending amount will be made up of savings after these 10 years?

For example, we know that after 10 years you’ll have $150,000 ($15k * 10 years) in savings. If you think that your total ending amount will be $300,000, that means 50% of that amount is made up of savings.

Take your best guess, then check out the answer below.

[showhide type=”pressrelease4″ more_text=”SHOW ANSWER” less_text=”HIDE ANSWER” hidden=”yes”]

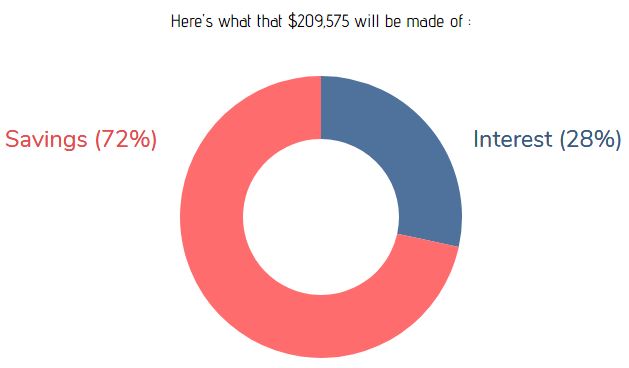

After 10 years, you would have $209,575 and 72% of that would be composed purely of savings. Is this result surprising to you?

[/showhide]

Now let’s consider the same thought experiment, but change our time horizon.

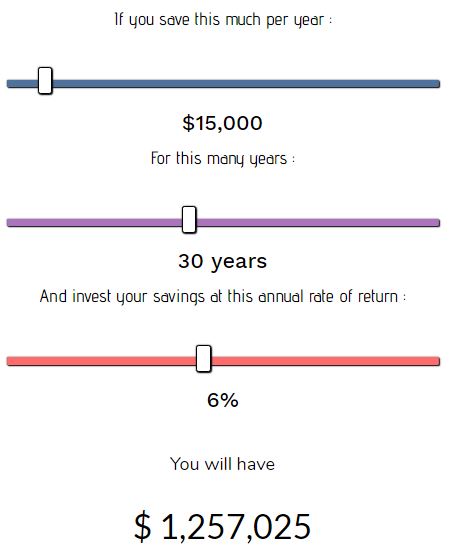

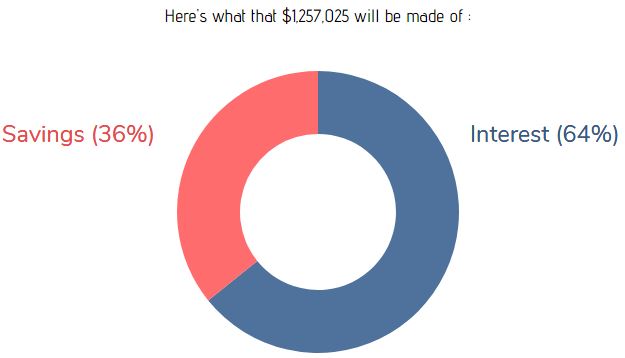

Suppose you save $15k per year for 30 years at a 6% annual growth rate. What percentage of your total ending amount do you think will be composed of savings?

[showhide type=”pressrelease5″ more_text=”SHOW ANSWER” less_text=”HIDE ANSWER” hidden=”yes”]

After 30 years, you would have over $1.2 million, only 36% of which came from your savings.

[/showhide]

For me, these examples illustrate a few important points:

- I have a tendency to overestimate the power of compound interest in the short-term and underestimate the power of it in the long-term.

- The math behind compound interest is not intuitive.

- Because the math is not intuitive, I should sit down and use a calculator when running the numbers and planning for my financial future. My vague guesses for how much money I’ll have in 30+ years based on my current annual savings are probably far off the mark.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

This was an awesome way to trick our brains into coming at compound interest from a different angle! My guesses were pretty off for the dollar amounts, but closer for the percentages.

It’s interesting, because as FIRE proponents, we tend to focus SO much on the huge savings rates up front (and that’s obviously important for speedy FIRE), but it’s also interesting to be reminded how smaller amounts, over time, can have so much power — when invested with consistency.