3 min read

Here’s an interesting thought experiment: can historical stock market returns predict future returns?

For example, does knowing how the S&P 500 performed last year give us any indication of how it will perform this year?

What if we know how it performed over the past 5 years? Or the past 15?

To answer these questions, I went back and looked at yearly S&P 500 returns since 1928.

Looking Back One Year

First, I wanted to see how well the previous year return could predict the following year return.

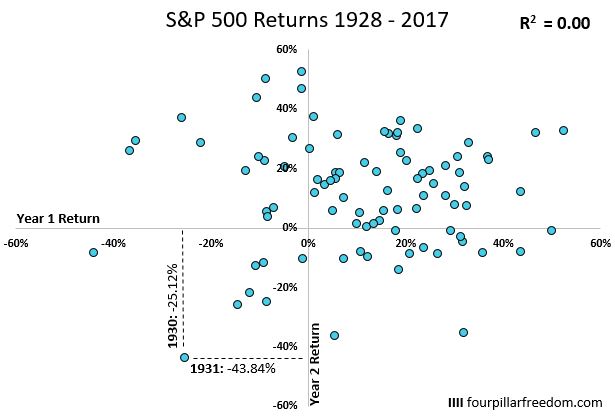

For example, in 1930 the S&P 500 had a return of -25.12%. The following year, in 1931, the S&P 500 had a return of -43.84%. Could we have predicted at the start of 1931 that the S&P 500 would have an awful year, using only the fact that the previous year had been so awful?

In the scatter plot below, I graph every possible “previous year – following year” combination. The x-axis shows the S&P 500 return in year 1 and the y-axis shows the return in year 2.

It’s clear that there is no discernible pattern. The previous year return is a terrible predictor of the following year return.

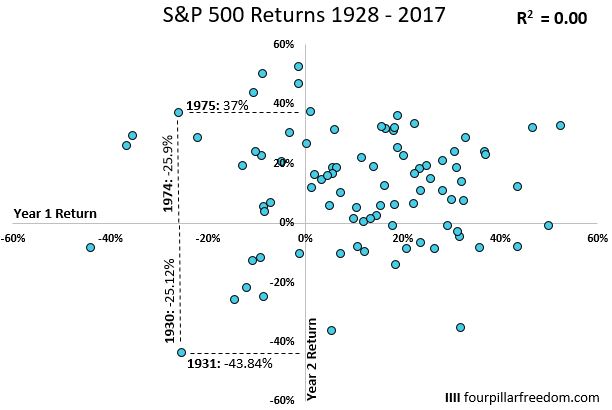

To illustrate this, check out the 1974 – 1975 combination below. The year 1 return (1974: -25.9%) was very similar to the year 1 return of 1930: -25.12%, yet the return in year 2 couldn’t have been more different in 1975 (+37% return) vs. 1931 (-43.84%).

So, if knowing the previous year return isn’t useful, what if instead we know the previous 5-year annualized returns?

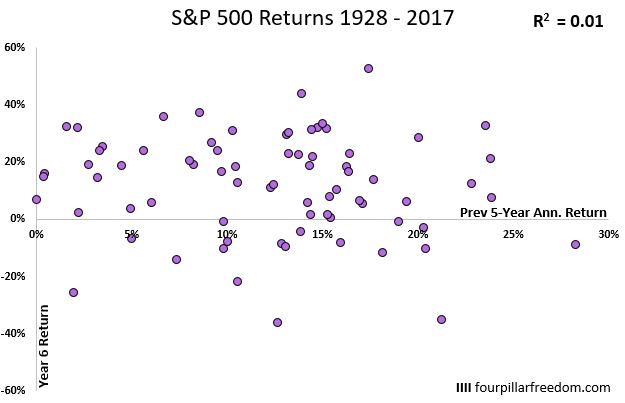

Looking Back Five Years

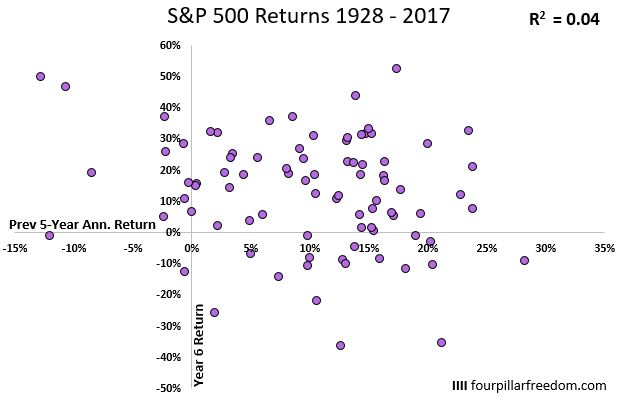

This scatter plot shows the previous 5-year annualized return on the x-axis and the following year (year 6) return on the y-axis:

It turns out that the previous 5-year annualized returns are also a lousy predictor of the following year return, although there is something interesting to note in this chart: In the 11 different scenarios (the blue dots below) where the previous 5-year annualized returns were negative, the following year return was positive in 9 of those scenarios.

That intuitively makes sense. The stock market typically goes up over time. If it has been negative in the previous 5 years, it’s likely to bounce back the following year.

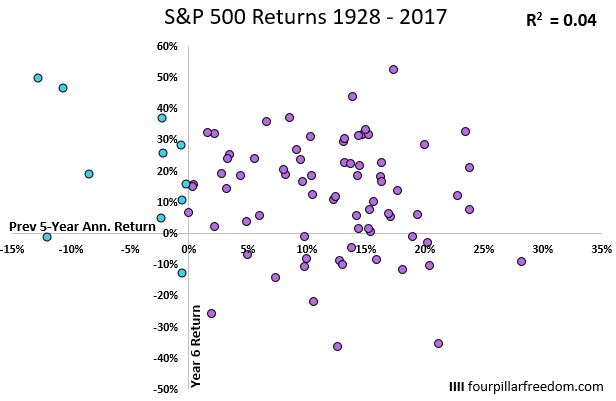

This leads to an interesting question: what if we only look at the years where the previous 5-year annualized return was positive?

Here’s that plot:

In this plot, there’s even less of a pattern. Basically, knowing the previous 5-year annualized returns is no help in predicting how the market will perform in year 6.

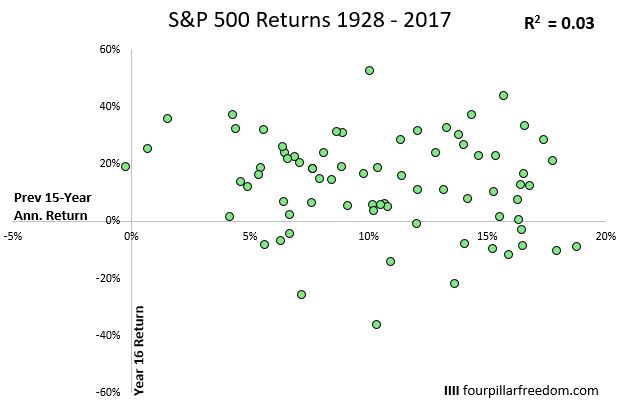

Looking Back Fifteen Years

Let’s extend our “look-back” period to fifteen years. This scatter plot shows the previous 15-year annualized return on the x-axis and the following year (year 16) return on the y-axis:

Again, there’s no clear pattern. This means that knowing the previous 15-year annualized return wouldn’t provide much help in predicting the following year (year 16) return.

Predicting the Future is Hard

These plots all point to the same conclusion: predicting stock market returns is hard. Knowing how the market performed in the past doesn’t tell us how it will perform in the future.

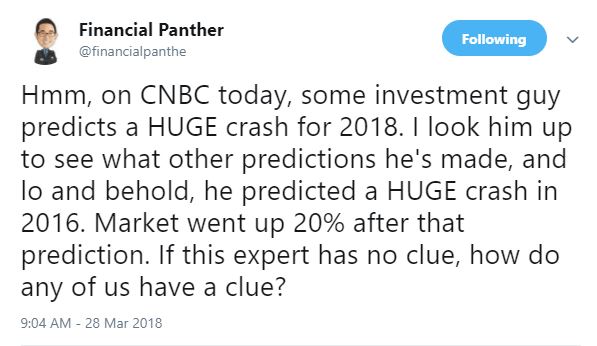

This is why market predictions made by pundits should be taken with a grain of salt. Nobody can predict how the market will perform on any given year, not even the “experts.”

My buddy Financial Panther recently tweeted out my exact thoughts on this issue:

Next time you hear someone make a market prediction, whether it’s an “expert” or your stock-picking coworker, be sure to maintain a healthy level of skepticism.

Spreadsheet: sp500_year_to_year_correlations

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Interesting analysis and not-so surprising result. Thanks for sharing the spreadsheet.

Yeah, I wasn’t terribly surprised at the results myself but it was good to run the numbers just to assure myself. It just proves how unpredictable the market actually is in any given year.

In stats class, when they’re explaining what random scatter plots are…they should just show that!

Haha they actually should, though. These plots look like randomly-generated data points for the most part.

Pretty much exactly what I predicted when I read the post title. Annual stock market returns are like rolling dice — what happened in previous years has no bearing on the current year.

Yet, people still believe that past performance is a predictor of future results. They look at past S&P performance and expect to get a similar result. The 4% rule is yet another good example. *sigh*

Oh well! Thanks for the nice analysis FPF!

It’s amazing how many people, even “experts” think they’re capable of predicting how the market will perform during any given year. This analysis just proves that it’s impossible to predict market returns using historical returns. There’s too much randomness. Thanks for the feedback, Mr. Tako 🙂