3 min read

Consider the following scenario:

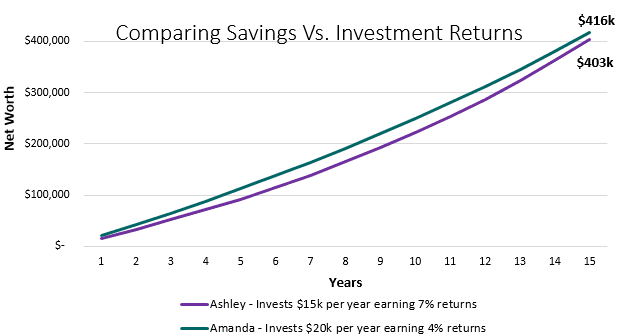

Ashley invests $15,000 per year and earns 7% annual investment returns. Amanda invests $20,000 per year, but only earns 4% annual investment returns.

Assuming they both start with $0, who will have a higher net worth after 15 years?

It turns out that Amanda will, despite earning considerably lower investment returns than Ashley:

The extra $5,000 that Amanda saves each year is what helps her come out ahead by $13,000.

Saving for 15 Years

For many people who discover the concept of F.I.R.E. (Financial Independence / Retire Early), 15 years seems to be the sweet spot for going from $0 to financial independence.

For some, it takes longer, but 15 years is often more than enough time to achieve some type of financial flexibility.

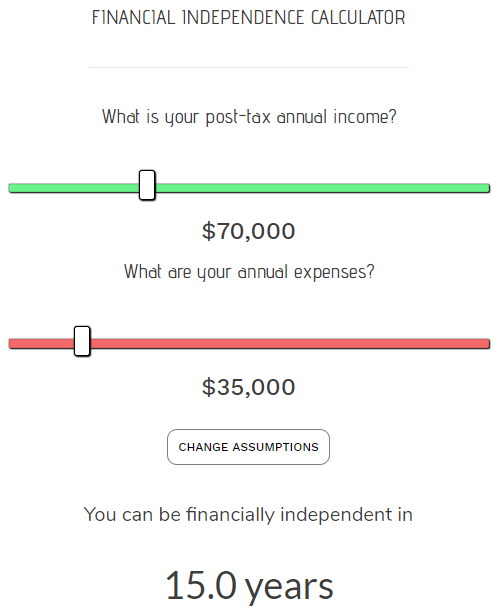

According to the financial independence calculator, if you can manage to save 50% of your post-tax income and earn 7% annual investment returns, you can achieve financial independence (25 times your expenses) in exactly 15 years.

For example, someone who earns $70k per year (post-tax) and spends $35k per year will have $35k left over to invest each year. If they invest this $35k at a 7% annual interest rate, they can achieve financial independence in 15 years:

Keep in mind this works for any income level, as long as your annual savings rate is 50%.

The 15-Year Savings Vs. Investment Return Grid

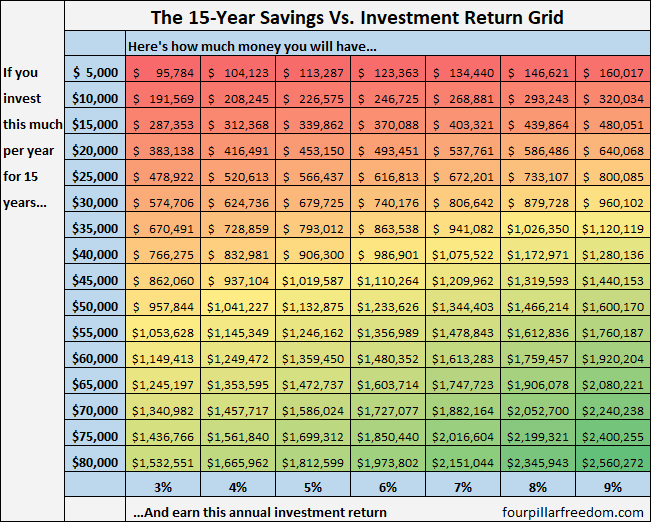

Knowing that 15 years is a reasonable length of time for most people to achieve financial independence or financial flexibility, let’s take a look at how important savings are compared to investment returns over a 15-year period.

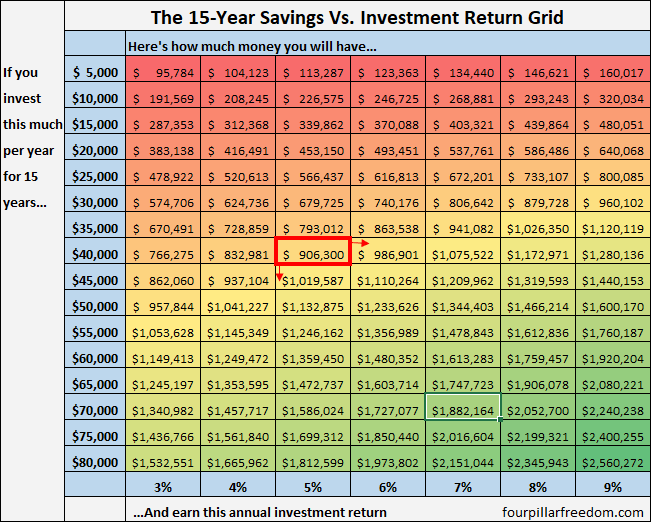

This grid shows how much money you can save in 15 years based on different levels of yearly savings and investment returns:

The colors in the grid help us see which combinations of savings and investment returns lead to similar ending amounts.

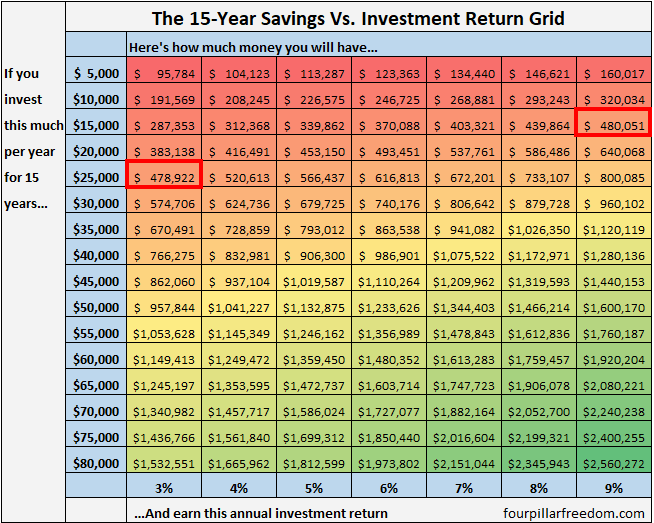

For example, we see that investing $25,000 per year earning a 3% annual return leads to nearly the same result as investing $15,000 per year earning a 9% annual return:

A particularly interesting observation is that increasing your annual investment amount by $5,000 almost always leads to a higher ending result than increasing your annual investment return by 1%.

For example, suppose you currently save $40,000 per year and earn 5% investment returns. By increasing your yearly savings by $5,000, you could end up with $1,019,587 after 15 years.

But if you kept your yearly savings at $40,000 per year and instead increased your annual investment returns to 6%, you would only end up with $985,901 after 15 years:

Focus On What You Can Control

To reach your financial goals as fast as possible, it’s obviously best to increase both savings and investment returns. But the truth is, you have far more control over your savings than your investment returns.

Outside of making smart investment decisions like properly diversifying, minimizing management fees, and re-balancing, you won’t be able to impact market returns.

You can, however, impact how much you save each year. By embracing frugality, minimizing spending on things that bring no joy, and increasing your income through promotions, job-hopping, or side hustles, you can increase your savings rate.

Over a 15-year period, increasing your yearly savings by even a few thousand dollars can have a massive impact on your net worth.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great post, and very interesting to look at the $ increase vs. ROI! There has always been a big debate on whether ROTHs or Traditional IRAs/401k are a ‘better’ choice for investors. What you’ve found and presented in your post coincides with my approach as well. Personally, I have found that having a tax-advantaged account allows me to save much more each year (I take our tax savings and invest those too – once my tax-advantaged 401k is maxed, my wife and I also max our ROTH IRAs, etc).

Thanks for the feedback, Andy! It is pretty incredible to see these numbers all in one place. It just shows how important savings are relative to investment returns.