4 min read

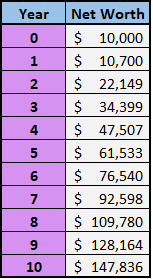

Suppose you have a net worth of $0. If you invest $10,000 each year in the S&P 500 and earn 7% investment returns each year, your net worth will grow to $147,836 after 10 years:

Over this 10 year period, you would have saved a total of $100,000 ($10k each year), which means the other $47,836 came from investment returns.

This means 68% ($100,000 / $147,836) of your net worth would have come from savings and 32% would have come from investment returns.

This example assumes you earn 7% investment returns each year. In reality, S&P 500 returns can fluctuate wildly from one year to the next.

To see how important investment returns have been historically, I went back and looked at actual market returns since 1928.

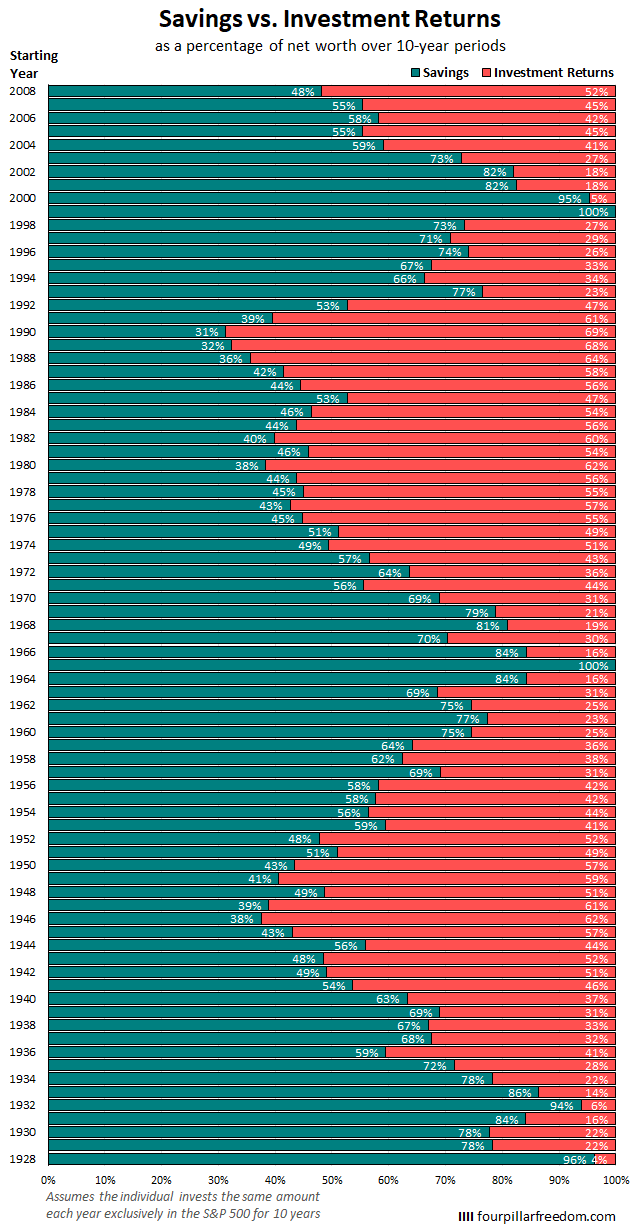

10-Year Investment Periods

The chart below shows how much of your net worth would have been composed of savings compared to investment returns for every 10-year period since 1928. It assumes you start with a net worth of $0 and invest the same amount each year exclusively in the S&P 500.

NOTE: The amount invested each year is irrelevant since we’re only concerned with percentages, not dollar amounts. The percentages are the same whether you were to invest $10,000 or $100,000 each year.

Some interesting observations:

During the two worst 10-year investment periods (1965-1974 and 1999-2008), savings actually accounted for 100% of net worth.

Even during the best 10-year investment periods, savings still accounted for 31% of net worth.

Savings accounted for 61% of net worth, on average, among all 10-year periods.

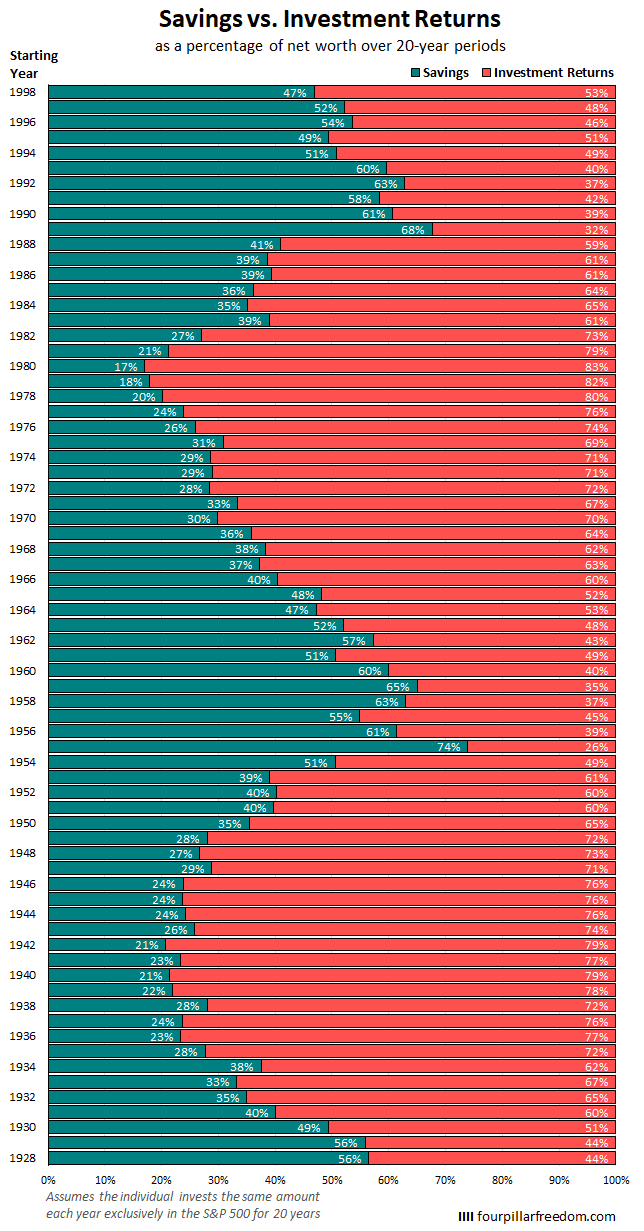

20-Year Investment Periods

Now let’s take a look at all 20-year periods, using the same assumptions as before:

Some interesting observations:

During the worst 20-year investment period (1955-1974), savings accounted for 74% of net worth.

During the best 20-year investment period (1980 – 1999), savings only accounted for 17% of net worth.

Savings accounted for 39% of net worth, on average, among all 20-year periods.

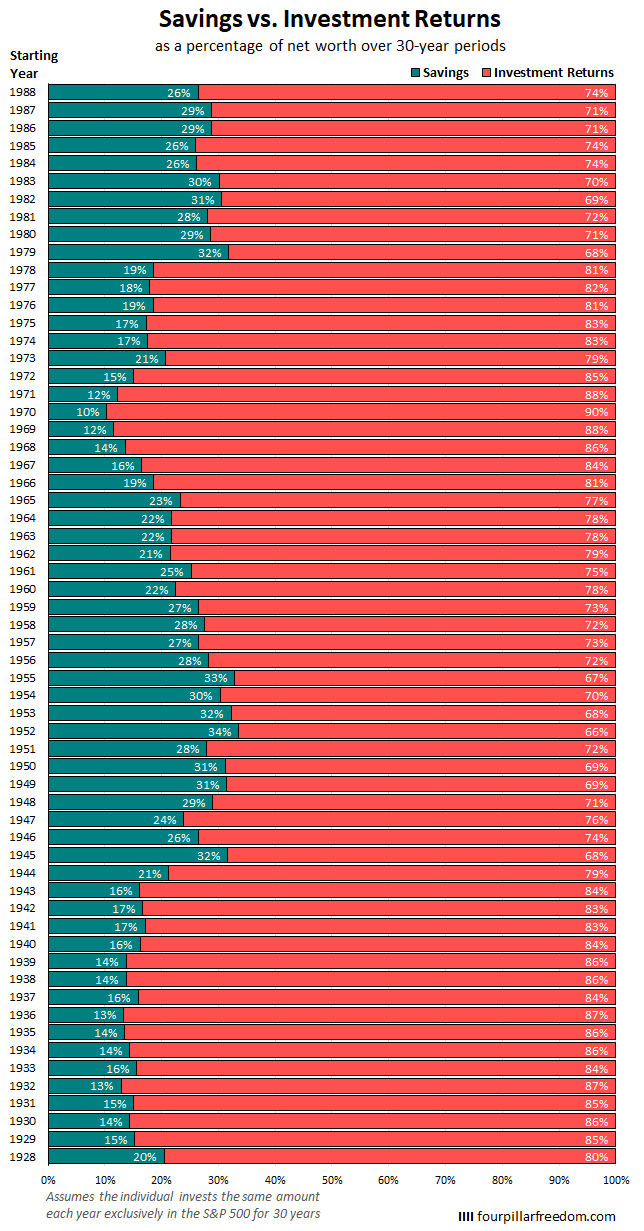

30-Year Investment Periods

Lastly, here’s a look at all 30-year periods since 1928:

Some interesting observations:

During the worst 30-year investment period (1952-1981), savings accounted for 32% of net worth.

During the best 30-year investment period (1970 – 1999), savings only accounted for 10% of net worth.

Savings accounted for 22% of net worth, on average, among all 30-year periods.

Summary

It’s pretty insane how much investment returns can fluctuate during 10-year periods. During a period like 1999 – 2008, you would have received no help from the stock market in pushing your net worth higher.

Contrast that with a period like 1990 to 1999, where investment returns accounted for a mind-boggling 69% of your net worth.

While this might seem alarming for those of us who are trying to go from $0 to retirement in 10 years or less, keep in mind that a high savings rate is more important than spectacular investment returns in the short-term.

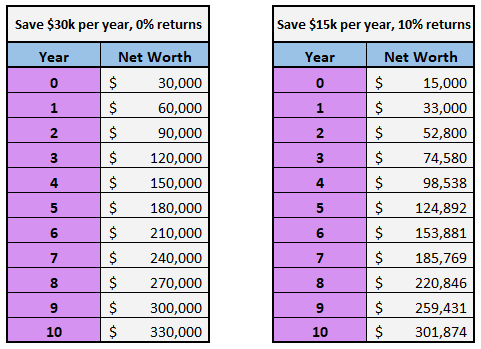

For example, someone who saves $30k per year earning 0% annual returns will have a higher net worth after 10 years than someone who saves only $15k per year earning 10% annual returns.

For anyone trying to go from $0 to retirement in 10 years or less, savings is far more important than investment returns. If your savings rate is high enough, a poor decade of returns won’t crush you. And if you do catch a great decade of returns, that’s just icing on the cake.

Notice, however, how investment returns account for a higher percentage of net worth during 20-30 year time horizons. This is because compound interest becomes incredibly powerful when given this amount of time to do its work.

While savings rate is a powerful tool in the short-term, compound interest is a beast in the long-term.

Nerd Notes: S&P 500 annual returns used for this post can be found here. Annual inflation rates used for this post can be found here.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

True! Saving + time definitely trumps investment return.

Completely agreed!

Great stuff! I love these visuals. It’s crazy to scroll through quickly and look at the difference between investing for 10, 20, and 30 years.

Thanks, Mrs. Farmhouse Finance 🙂 It is super interesting how different time periods have such different results. The main theme holds true that saving is the key to short-term wealth growth and compound interest is the key for long-term growth.