5 min read

I recently received an email from a reader named Kat, who wanted to know if I thought she should keep her stressful high-income job to reach F.I. as fast as possible.

Here’s the full email:

Hi Zach!

I have been reading your blog these past few months and I’m really inspired with your journey. I’m also a twenty-something employee in a third world country, and I’m currently torn between two jobs. I’d like to hear your thoughts about it.

I’m currently working as an Officer in a government agency, and I’m earning a high salary. I’ve been in this job for 1 year and 5 months now, and I have been blessed with a lot of opportunities that I could not have experienced in other jobs (at least compared with my previous jobs).

However, I feel that my creativity has been zapped by this job, as evidenced by my zero creative outputs (which are published journal articles in my own definition) since I started this job.

The job entails a lot of work travel (2-3x per week), a very stressful one, and I have zero work-life balance. I am required to be online/on call 24-hours and I don’t get to have a vacation with my family. If I do, I’d really feel guilty because my colleagues are not using their vacation time for years.

I have been looking for a job, and I got accepted in a university as a staff. On paper, I’ll be demoted to an office-based position with a low salary. But I get to receive a full PhD scholarship, and my job has zero work travel. I also get to enjoy other university benefits such as free library resources and lots of vacation (semestral and christmas breaks).

However, this will really delay my FI target as this job will provide me with LESS THAN HALF of the salary that I’m currently getting from my government job.

I’m really torn right now. I value creativity most of all in my work, but I also like to achieve financial independence as soon as possible.

What do you think? I’d really like to hear your thoughts about it.

Here is my condensed response to Kat:

If your current job isn’t that bad, stick it out for a while, build up your savings, and pursue your creative interests outside of work.

If the job is truly miserable, it’s not worth sacrificing your well-being for the money.

Keep in mind the grass is not always greener on the other side. The worst-case scenario would be switching to a low-income job you dislike.

No matter what you decide, prioritize saving money, building skills, and working on your creative interests.

Here is my extended response…

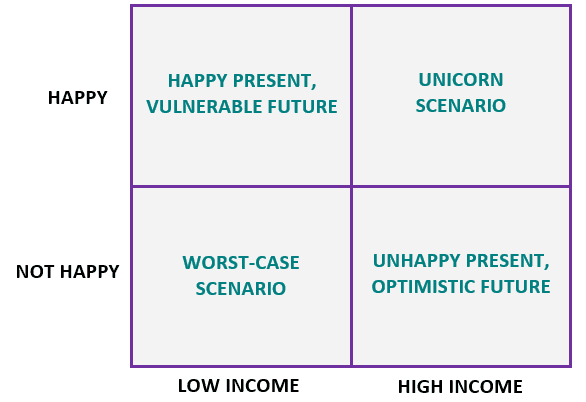

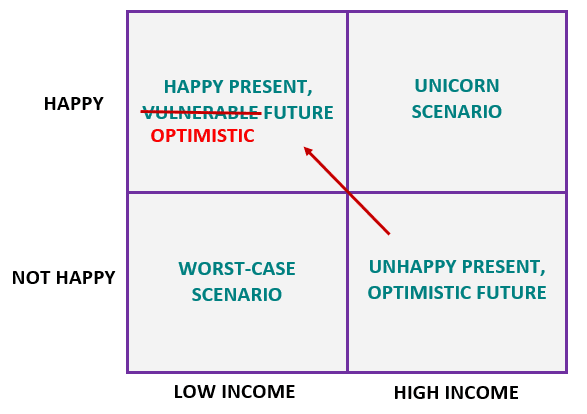

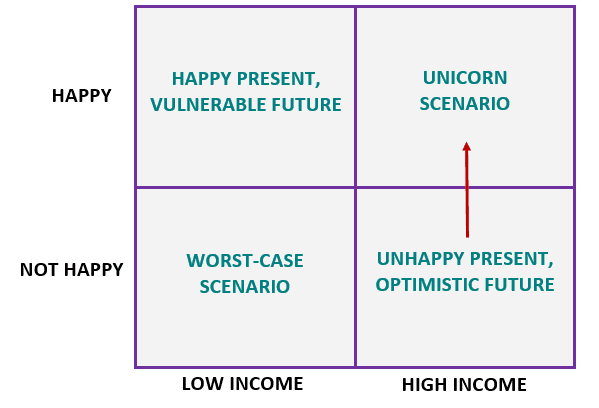

The Income-Happiness Matrix

Imagine there exists an income-happiness matrix that describes every job in the world. This is grossly oversimplified, but entertain me.

Kat is currently in the bottom-right quadrant. She has a high income, but isn’t very happy with her job.

She has four options.

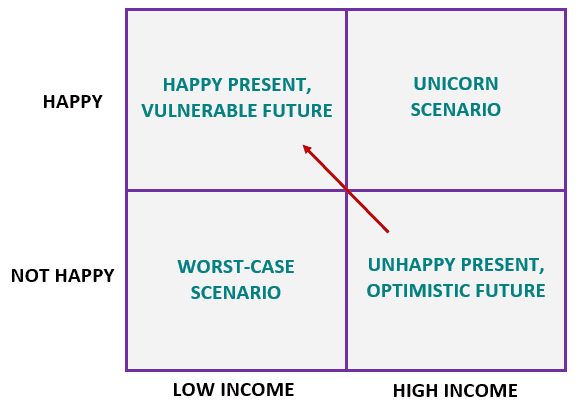

Option 1: The Immediate Switch

Kat could quit her current job immediately and transition to the less stressful, lower-income university position. Effectively she would be moving from the bottom-right quadrant to the top-left quadrant.

The advantage of this approach is that she would immediately gain a better work-life balance. This would likely make her happier in the present moment. She would have more time to spend with friends and family, as well as more time to actually enjoy life.

The drawback of this approach is that there’s no guarantee she would actually like her new role. The demands of jobs can change without warning. Management changes. Projects change. Coworkers come and go. Just because a job is less stressful on paper doesn’t guarantee that it will be an enjoyable job.

The worst case scenario would be if Kat switched jobs and didn’t like her new position as much as she anticipated.

This would leave her in a low-income, unhappy situation. Worst of all, she wouldn’t have enough savings to be financially flexible.

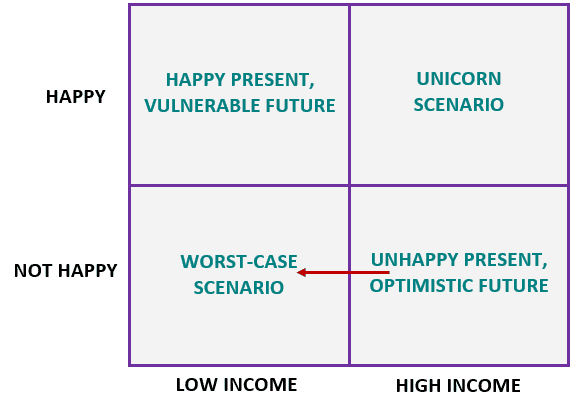

Option 2: The Delayed Switch

Kat could delay her transition and stick with her current job for a couple more years. This way, she could build up her savings quickly and potentially reach a financial launching point. At that point, she could transition to a less stressful, lower-income job, and still pay the bills.

The downside to this approach is that she would be stuck with her current job she dislikes for a couple more years.

Conversely, at the end of those two years she would have a decent chunk of money in the bank. This would give her the freedom to pursue a lower-income job she enjoys and not be so concerned about paying the bills. It would also provide her with a more optimistic future, knowing she has money in the bank if she needs to switch jobs or take time off.

This could be the fastest route to financial flexibility and an enjoyable work situation.

Option 3: Stick it Out

Another option is to simply stick it out at her high-income job for a longer period of time. One way Kat could make this option more enjoyable is to do more creative work she enjoys outside of work. That way, she could satisfy her creative itch and still bring in a high-income through her day job.

This may or may not be doable, given the fact that Kat said:

“The job entails a lot of work travel (2-3x per week), a very stressful one, and I have zero work-life balance. I am required to be online/on call 24-hours and I don’t get to have a vacation with my family.”

Being on call 24 hours per day isn’t ideal for pursuing creative endeavors outside of work. However, I would ask Kat if there are certain times when she is more likely to be called than others. Perhaps there’s a time window each day where her employer rarely calls that she could designate as time to work on her journal articles.

Something else to consider is the fact that she may gain more flexibility and seniority the longer she sticks with her job. Typically job satisfaction and freedom increases as one moves up the ladder. It’s possible that Kat could grow to enjoy her job as she gains experience and younger employees move in to do more of the grunt work.

Option 4: Find a Less Stressful High-Income Job

The last option would be to look for a less stressful high-income job. Perhaps there are other positions she could apply for that are less demanding and have a similar income range.

I’m sure Kat has already considered this option, but it’s still worth pointing out. If she could land a high-income job that has a better work-life balance, she would be in the rare unicorn scenario where she could save money for the future and still enjoy the present.

Considering all the Variables

There are so many variables to consider here that will impact Kat’s final decision. This is ultimately why I can’t tell her exactly what she should do; I can only point out some things to consider.

For example, a full PhD scholarship sounds like a pretty good deal if she wants to pursue a teaching or research position in the future. Does she have to accept this offer immediately or could she wait another year or two and still have the full scholarship?

Also, I have no idea what the economy is like in her country. Will a PhD open up a significant amount of job opportunities for her that she couldn’t otherwise access?

Lastly, there are more ways to achieve a good life than through complete financial independence. Saving up enough money to never work again is only one path to happiness. It’s entirely possible to have a long enjoyable working life without ever achieving F.I.*

*please don’t kick me out of the personal finance community for saying that.

These are all variables to consider.

Do These Three Things no Matter What

No matter what decision Kat makes regarding her job, there are three things she should always prioritize:

Save money

Whether she has a low income or high income, she should try to save at least some of her earnings. This will give her financial flexibility in the future.

Build skills

No matter what type of job Kat holds, she should always strive to improve her skill set. This way, she can demand a higher salary and land more senior positions.

Create

Whether Kat ends up in a stressful time-consuming job or a more laid-back role, she should pursue her creative interests outside of work. This will give her both a happiness boost and a body of work that she can show potential employers. Also, her creative work could turn into a side business that she eventually pursues full-time one day.

Best of Luck, Kat

I wish Kat all the best in her financial journey. The fact that she is even asking these questions in her 20’s is a pretty good indication that she has a bright future. 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Nice analysis and good recommendations, Zach.

It seems a bit similar to a question you wrote about yourself recently 🙂 (https://fourpillarfreedom.com/quitting-my-day-job-being-ambitious-vs-being-realistic/)

Agree with you thoughts, and my comments would be similar to what I shared in the above mention post.

I do bring up some similar points as I did when I discussed my own situation, simply because my situation is fairly similar to hers. Thanks for reading and commenting as always, Mike 🙂

Wow, Zach! You’re how old?? I think you are financially smart beyond your years. Loved your analysis for your reader, Kat.

Haha thank you, Glenda! I have been fortunate to learn from folks much smarter than myself in the personal finance community over the last couple years. Thanks for commenting 🙂

This is a great analysis. I’ve been in all of these quadrants at some point in my career. I always say, “You can be underpaid, and you can hate your job; but you can’t do both at the same damn time.” That is when you find a new job.

And yes to a financial launching point. It’s a great position to be in.

“You can be underpaid, and you can hate your job, but you can’t do both at the same damn time.” What a great quote.

Great feedback. I have found that the higher the salary, the more stressful a job will be. The best move that I made in my career was switching from a for-profit to a not-for-profit business. Not-for-profits tend to allow for a better work-life balance.

I have heard a lot of good things about work-life balance at not-for-profit businesses. Funny how companies that are focused on more than just the bottom line can be less stressful places to work.

This post hit a lot of points that could describe my life so far: I already made the switch from a relatively higher paying but high stress job to a lower paying, lower stress job. I paired my switch with a move to a lower cost of living area too. That pretty much offset the lower income/savings and didn’t really negatively impact my progress to FI. That’s a deal I’ll take every time.

That’s awesome that you were able to move to a lower cost of living area to offset that decrease in income. I think that’s a move most people would be happy to make. That’s also why the idea of minimalism is so appealing to so many people – if you live with less and have low expenses, you don’t have to stress about earning as much to make ends meet.

Great analysis. Sticking it out doesn’t sound like a good option to me.

I’d say keep looking. Maybe she can fine a better position somewhere. Although, getting a PHD might be a good idea too. It really depends on what field she’s in.

Good luck to Kat.

There’s lots of variables in the mix, which makes the best solution not so obvious. I agree though, sticking it out doesn’t sound like a good option given how unhappy she is with her current situation.

That was a great analytical breakdown you did for her.

The best part of your analysis is that we ALL are in 1 of those 4 scenarios at a given time, and generally transition throughout each phase at a certain point in time. Your best advice though is constantly make sure you are saving and growing (build skills). nobody can achieve FI if they don’t first develop effective saving habits. You can’t invest money that you don’t save for first. Also in achieving FI, you constantly need to be improving your skills. A great skill for the present and future for workers right now is to learn coding on the side. I always like to think about my skills like this…If I was fired today, am I confident that I can find a job quickly or will my limited skill set hurt me in the job market?

Thanks for sharing this!

Building skills and saving money definitely helps no matter what situation you’re in or what your plans are for the future. Thanks for the feedback, Sean! 🙂

Nice post. My hubby was in a similar place and decided to take a 60% pay cut and go back to university (to obtain a PhD). It will (probably) not lead to higher paying jobs in the future, but will open up a more interesting career. However he took two years to orchestrate his departure, and in that time we aggressively saved towards FI. We are halfway there and feel like there are so many options now.

Obtaining a PhD doesn’t always have the monetary benefits to justify the time cost, but it certainly puts you in a place to have much more flexibility and freedom in your career, which is hard to put a price on. Best of luck in your financial journey 🙂

Interesting question and I like the breakdown on the answer. I think I would also want to know just how far away from FI that the writer is looking at the current job. If it’s a couple of years, I say stick it out. If it’s a lot longer, then it would probably be prudent to leave. This would be part of info I would need if I were answering.

Best of luck.

I believe the reader is quite young still and has many years until F.I. which is why sticking it out might not be the best option. You’re right though, a F.I. date definitely plays a critical role in making the best decision here.

Sweetness!

One of the variables our friend Kat might consider if she were to find herself back in the states, is the much improved job market.

The trick is to do your homework before jumping into a new job – network with friends, etc., and get a feel for a prospective company’s culture.

I do think you can maneuver your way into a more tolerable income-earning situation, though often it takes experience, confidence, and a heavy dose of resilience.

I like that advice – feel out the market before jumping in. This can be tricky to do if you’re not familiar with the company or know anyone on the inside, but it’s a great thing to do if you’re able. Thanks for the comment, Cubert 🙂

Thank you for this reminder. I’m in somewhat of a lower unicorn situation but have been frustrated this past year. Posts like this one remind me how freaking lucky I am.

“Lower unicorn situation” is such a great phrase. I’m glad this post helped 🙂

I love your quadrant approach, but I think there’s a fifth (and potentially much easier) answer. She says that, “I am required to be online/on call 24-hours and I don’t get to have a vacation with my family. If I do, I’d really feel guilty because my colleagues are not using their vacation time for years.”

First, I’d question whether she’d feel more guilty (guiltier? That a word?) leaving the agency–if she believes in the mission–or in taking her vacation. Assuming she’s contractually obligated to a vacation, and also knowing that ANY job is a marathon and not a sprint, she could avoid lots of issues by first having a discussion with the people who support her (like her supervisor). If she’s a valued employee and they’d like to keep her, they’d potentially lower the stress. If I were in her shoes, I may make this move even if I determine that it’s likely I’ll leave. Why not ask…especially if you’ve already got one foot out the door? It may help everyone’s life become more sane, even if it doesn’t work out for you.

Second, there’s no talk of math here. The first thing I’d accomplish is to figure out the math for independence, which isn’t as hard as most people make it seem. That’ll give her an idea of the amount of time she needs to spend at work, which could change her decision. With numbers in front of me, I may pick differently among your quadrants than without them.

Great piece! Thanks for sharing.

Thanks for the feedback, Joe! You make a lot of great points – potentially the easiest solution would be to find a way to make her current role less stressful. That isn’t an option I explored deeply here. Also, I believe the reader is very young and still quite far away from her F.I. date, which makes sticking it out with her company until F.I. seem like a less appealing option. Glad you liked this piece and thanks for commenting! 🙂

I’m in the unicorn box and would be even further up and to the right, had I more vacation time. Last year I had an extremely high paying job that was insanely stressful and I took a pay cut to still be well paid but be in unicorn territory. I would encourage Kat to find something in between a 50% pay cut and a 100% stressful, no-vacation job. Or, if she wants, take the PHD route and build a side business during her free time. That might actually be preferable if she values her time over money.

A pay cut can be a great path to a less stressful job. That’s awesome that you were able to take a cut and still be well-paid. You must be in a technical industry. Thanks for the feedback 🙂

This is a tough one. I’m not sure how I would have advised her. My initial reaction was, “stick to the high-paying job.” Suck it up. You will survive and look back grateful of all the Benjamins you stacked.

But then I looked at my own life. I took a huge voluntary pay cut to leave private practice and join academia. My wealth still grew since I had time to pay attention to my investments. It gave me a platform that allowed me to meet people who helped my career develop further. I also got a graduate degree while there (almost for free) and that provided future income streams in multiple unexpected ways.

I’m not sure it is healthy for her to continue suffering as she is now. It isn’t all about the destination: there is a joyful journey too.

That’s fantastic that you were able to transition to a lower-paying job and have such an enjoyable career. I agree with you – it’s likely not worth it to stick it out at a job she can’t stand. It’s important to enjoy the journey to wealth.

My opinion:

Live the life you want to live – now. If that means the office gig – do that. If that means sticking it out where you are – do that.

Don’t save it up for the end. Your smart enough to make either situation work just fine.

“Don’t save it up for the end” – complete agree with you on that.

Hey Zach! I just wanted to offer a suggestion. I’m currently taking a break from work to be in an immersive Full Stack Web Development/App Development Bootcamp. I’m only the first week in, but it’s already an amazing experience. I’m learning so much at a rapid pace, all while collaborating with peers! It feels like something you’d be good at, so I thought I’d share. I even found grant funding to get the whole thing paid for. I know you already know some HTML, CSS, JavaScript, and I bet you could find some opportunities that go more in-depth with other languages or the back-end languages and databases (I’m learning PHP and mySQL, for example).

I’m finding that web development is my path to financial independence AND doing the type of work I love (design and creation). It also offers the freedom to work remotely, start my own business, etc. Happy New Year!

Thanks for the suggestion, Sam! I’m really glad to hear that you’ve found something that works for you and that you’re excited about 🙂 It’s funny you mention something like this because I have considered doing something similar before. As you said, I know a fair amount of HTML, CSS, and Javascript. I also know SQL pretty well because I use it at my day job often. PHP is still a language I’m not familiar with, though. Right now I’m trying to learn more about a specific JavaScript library called D3.js to potentially switch fields to data visualization.

Thanks so much for the suggestion and best of luck with the web development path 🙂

Gov’t job with no vacation and always on call? I’m guessing CIA:)

I fall into the unicorn camp as well. It’s stressful, but I love it, so that doesn’t really count!

I would say stick it out as well. As painful as it may be until she has a nice base. Once the assets start to build up the stress slowly erodes knowing you don’t need it anymore.

The grass is certainly not always greener. I would however focus on what a happier role may look like in a couple of years or however long it may take to build stability.

Hi all,

It’s not always the situation whereby a lower paying job entails lower stress. I encountered one such circumstance in which the stress level is lower in the higher paying job than lower one.

I guess that it’s up to the profile of the organisation. My take is that it is more appropriate to move to higher paying job as per se.

Ben