4 min read

I have noticed a recent trend of financial bloggers sharing personal net worth journeys using one chart.

I decided to hop on the bandwagon.

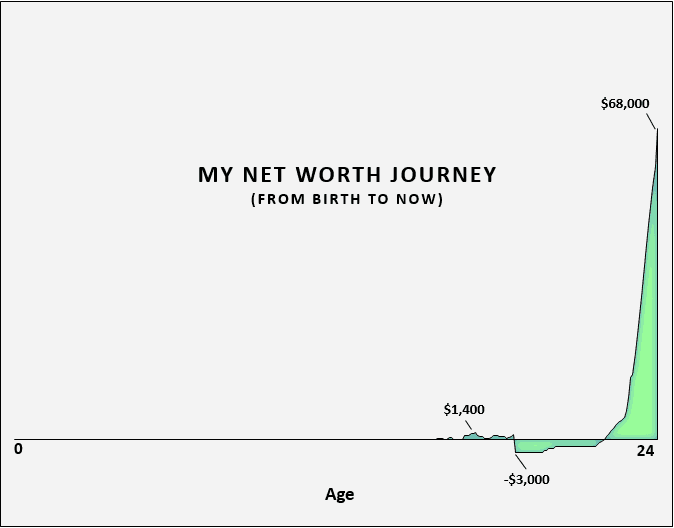

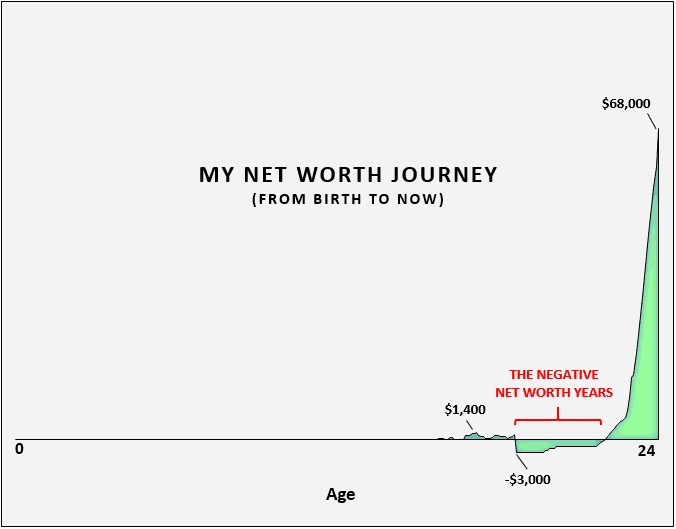

Here’s a look at my net worth journey over the last 24 years:

Now for a bit of explanation…

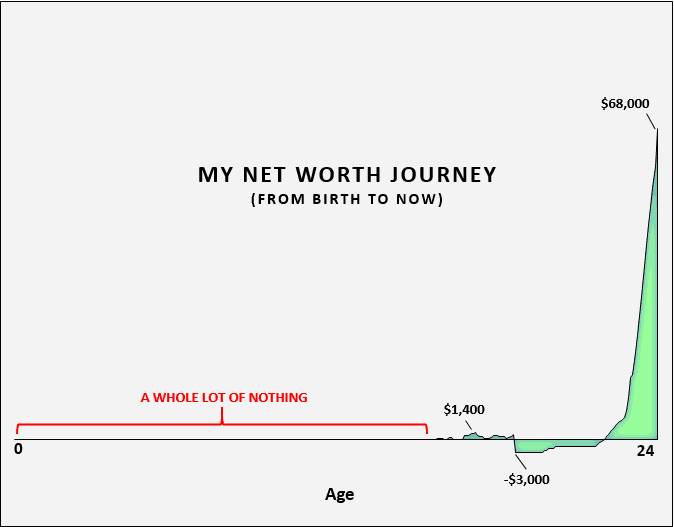

The First 16 Years

My net worth for my first 16 years on earth was a whopping zero dollars. I knew absolutely nothing about money and I could not have told you what “net worth” even meant at age 16.

Do I wish I had known the importance of money during my childhood?

Honestly, not really.

I had a fantastic childhood. I grew up in a middle class family. My dad worked at the post office and my mom stayed home with my me, my twin sister, and my older brother. We never had a lot of money, but it was never a concern either.

I don’t regret being ignorant about money as a kid. I was too busy playing video games, hanging out with friends, and enjoying myself.

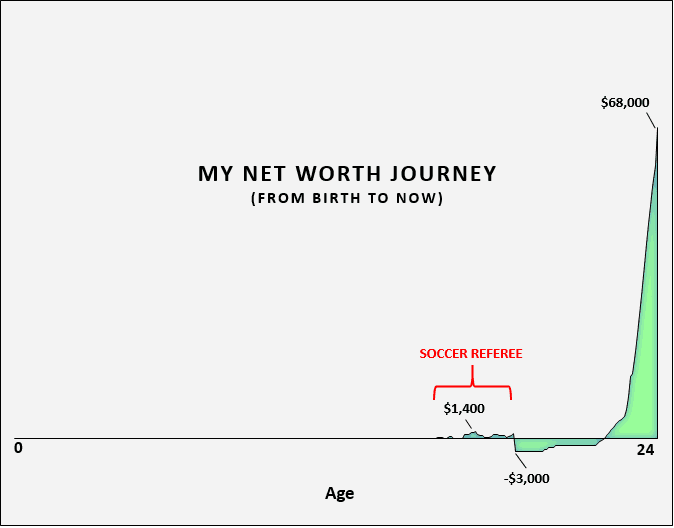

Age 16 to 18: The Referee Days

When I turned 16 I became a soccer referee. This was my first time earning any type of income and it was actually an incredible gig to have as a teenager.

I would typically get paid between $18 – $24 per hour just for being a sideline referee. When I was the head referee in the center of the field, I would make closer to $24 – $30 each game.

Side Note: If you enjoy soccer at all, becoming a referee can be a pretty phenomenal side hustle. I met plenty of fellow referees who would work all day Saturday and Sunday at weekend tournaments and bring home $400 – $500 in a single weekend. That beats working at a retail job earning minimum wage any day.

Even though most of my earnings went towards buying video games and Chipotle burritos, I did manage to save close to $1,400 at the peak of my early net worth days.

Age 19 to 21: The Negative Net Worth Years

When I started college, my positive net worth took a nosedive into the negatives, as I took on student loans.

Fortunately, I made the decision to commute to a college near my hometown and only had to take on $3,000 of student loans. I paid for the rest of my tuition through a combination of referee gigs, retail jobs, and scholarships.

It was during my junior year of college, at age 21, when I first discovered Mr. Money Mustache while sitting in the back of a statistics class. That’s when I first discovered the true power of money. I began to see dollar bills as something that could buy freedom instead of stuff.

I started to save the small amount of income I was earning and began paying off my student loans while I was still a student. Slowly I worked my way up to a positive net worth by age 22.

Age 22 to Now: A Financial Rocket Ship to the Moon

I turned 22 as I was starting my senior year of college. This was when I landed my first real internship as a data analyst at an insurance company and started earning $15 per hour. By living at home I saved virtually every dime I made. This was the starting fuel for my financial rocket ship.

From age 22 to 23 I saved as much as I could, but I wasn’t getting rich making $15 per hour. By time I turned 23 I had about $9,000 in savings. Good, but not great.

Fortunately this is when the rocket ship really took off. I started working full-time at my insurance company, earning a respectable starting salary of $52,000. I continued living at home as I pursued a Master’s degree at the same college.

This is when I started saving thousands of dollars each month and piece by piece began to lay the foundation of my financial future.

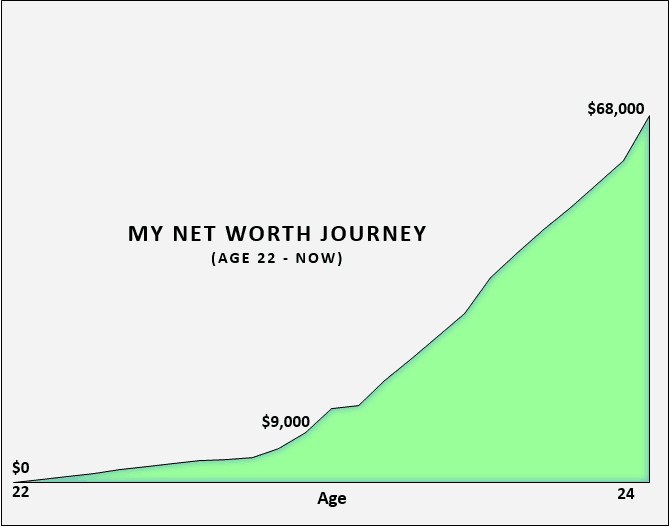

Let’s zoom in on this two year time period:

My net worth was ramping up nicely as I continued to save, picked up stats tutoring gigs, and kept living at home.

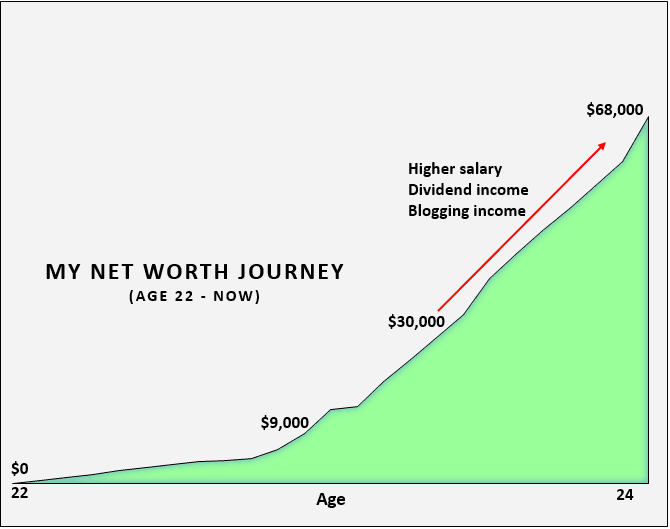

Once I graduated, I had a net worth around $30,000. It was at this point that I learned my next promotion at the insurance company was well over a year away, and I made the decision to pursue a higher-paying job elsewhere.

This past summer I landed my current job as a data scientist and bumped my salary up to $80k. I also started earning some decent dividend income from stocks and REIT’s. My blogging income has steadily risen over the past few months as well.

These three income streams have sent my net worth higher at a faster pace than ever before.

My current net worth is hovering a little over $68,000. I hope to reach $100,000 by time this summer rolls around.

These past two years have been a wild net worth journey for me and I hope the next few years prove to be just as exciting.

Thanks for reading 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Wow that’s some pretty explosive growth. I wish I was where you are when I was your age, haha! Keep chugging along and you’ll be FI in no time 🙂

Thanks so much, Dave, I don’t plan on slowing down! 🙂

Hi Zach! I always look forward to reading your posts. Congrats to your parents for not shoving you out of the family home (as some parents are encouraged to do) so you were able to start your nest egg and repay your schooling debt. What other things did they do right? Thanks, Kate

Thank you, Kate!

In general my parents just provided me with all the tools I needed to be successful. They helped me pay for my first car, bought my first laptop, drove me to college orientation, etc. Knowing that they had my back on everything and would always support me in whatever I pursued was all I needed from them 🙂

Love the quote “I began to see dollar bills as something that could buy freedom instead of stuff.”

I think that quote encapsulates the mindset shift I had towards money that really enabled me to start saving a huge chunk of my income. I just see it as a tool to gain freedom at this point. Glad you enjoyed it 🙂