4 min read

Net worth is the golden barometer of personal finance. In general, the higher your net worth, the better you’re doing financially.

Many of us even use net worth as a number to determine financial independence. It’s widely accepted that once your net worth is equal to 25 times your annual expenses, you’re financially independent.

But net worth doesn’t always tell the whole story. And for some, net worth isn’t the most important financial metric to track.

Sam the Saver

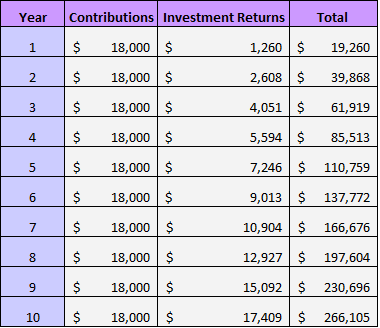

Consider our friend Sam who is 33 and has contributed $18,000 to her 401(k) account for the past ten years. Supposed her contributions have grown at a rate of 7% each year:

This means Sam has $266,000 in her 401(k) account. Let’s pretend Sam has no other savings, except for $2,000 she keeps in a checking account.

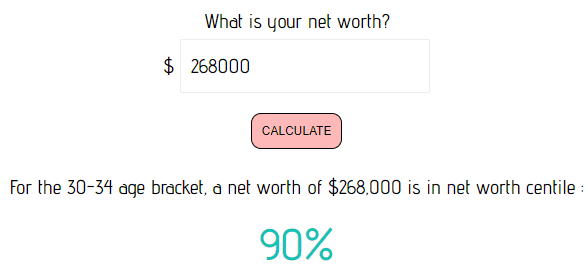

Sam’s total net worth is $268,000. Using the net worth comparison calculator, we can see that Sam has a higher net worth than 90% of her peers:

Simply looking at net worth alone indicates that Sam is doing incredibly well for her age. But does this tell the whole story?

The point of saving money and increasing your net worth is to enhance your quality of life. With enough money in the bank, you can craft a life of freedom. You can decide what type of work you want to pursue, where you want to live, and how you want to spend your time.

Does Sam have freedom?

If she wanted to take a gap year from working, try her hand at freelancing, or take an extended vacation, she actually has very little money available to use. If she does withdraw money in her 401(k) account, she’ll pay a 10% penalty and income tax on the amount she withdraws.

She could use that money for spending, but she would forfeit so much of it to penalties and taxes that it would cancel out a huge chunk of her dedicated savings over the years.

Sam has a high net worth, but not necessarily freedom.

Fred the Freelancer

Consider a different scenario. Fred is a 33-year-old freelance writer who loves his job. He earns $4,000 post-tax each month writing articles for various companies, which is enough to support his family.

Over the years, Fred has managed to save $10,000 in a savings account and $6,000 in a Roth IRA.

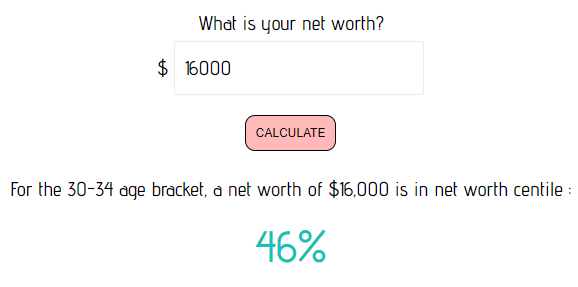

Fred’s total net worth is $16,000. Using the net worth comparison calculator, we can see that Sam has a below-average net worth for his age:

Simply looking at net worth indicates that Fred isn’t doing so great financially. But does he have freedom?

He does work he enjoys and has the flexibility of being his own boss. He lives life on his terms and has the power to set his own working hours.

Fred has a low net worth, but a significant amount of freedom.

Cash Flow is the End Game

These two examples are made-up, but they illustrate an important concept. It’s possible to have a high net worth with very little financial freedom. Conversely, it’s possible to have a low net worth and still have the ability to live life on your terms.

Ultimately, cash flow is what allows you to live a life of freedom.

If you save up enough to be financially independent, your cash flow simply comes in the form of dividends or selling your assets to pay for expenses. If you save up $1 million and receive $35,000 each year in stock dividends, that cash flow allows you to pay the bills.

For the average person, cash flow comes in the form of a 9-5 job. You work 40+ hours per week, collect a paycheck every two weeks, and use that cash to pay for your living expenses.

For some, cash flow comes from owning rental properties. There are plenty of people who have a fairly low net worth but a high monthly cash flow from the properties they own.

For others, cash flow comes from running their own business or website. They earn money from selling products or services.

The Pros & Cons

If cash flow is the key to a life of freedom, should you be concerned with your net worth?

Yes.

It’s wonderful to earn cash flow from a job you love, whether that’s a 9-5 or a freelance position, but this source of income isn’t always reliable. In the case of an economic collapse, you might find that the demand for your freelance work quickly disappears. Or the market might change and no longer need your services. Cash flow is never guaranteed.

Having a high net worth and savings in the bank has some serious benefits. In bad times, you have money set aside that you could access if you need to. Dividends from assets like stocks, bonds, and REIT’s are also fairly reliable long-term. If you’re living purely off dividend income, your cash flow is much more consistent and predictable than if you’re living off cash from your freelancing or side-hustles.

Chase a High Monthly Cash Flow and a High Net Worth

If possible, the best financial decision would be to simply chase a high monthly cash flow and a high net worth.

Strive to have money in the bank, but also work to increase your income streams outside of your day job. If you have income from another source (like blogging or tutoring) combined with some dividend income in a brokerage account, you have some financial freedom even if your net worth isn’t as high as you’d like.

Personally I’m chasing a net worth of $100k or higher over the upcoming months while also building up my income streams outside of my day job. I recognize that cash flow outside of a 9-5 job isn’t always guaranteed, so I’m striving to strike a happy balance between saving money in retirement accounts as well as my brokerage account. I’m on a quest to save money for the long-term with my full-time job while also generating cash flow in the short-term through blogging, freelancing, and dividend income.

A high net worth offers stability and reliability that cash flow can’t always offer. At the same time, cash flow offers freedom to live how you want that net worth can’t always offer. It’s best to pursue both a high net worth and high monthly cash flow to maximize your freedom.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great points, Zach, and I think your strategy is a solid one that’s (as you’ve discussed before) going to let you live a life you enjoy without needing to wait until your savings are enough for a full retirement.

One thing I’d caution your readers against is the assumption from “Sam the Saver” that 401ks lock up your money and maybe shouldn’t be a priority. I know that probably wasn’t your intent, but I could see it being read that way. Joel from FI180 had a good article about why the penalties on withdrawals shouldn’t be too much of a worry: http://fi180.com/2017/07/28/dont-fear-penalty/

Andy, thank you for pointing that out. I have nothing against 401(k)’s and it is true you can withdraw the money at any point. Also, thanks for linking to that article by Joel, I don’t think I’ve ever written about penalties associated with 401(k)’s and how they might not be as bad as they seem. Luckily his article and the Mad Fientist have resources to explain the idea.

“Ultimately, cash flow is what allows you to live a life of freedom.” <= I couldn't agree more. Liquid assets are what enables one to FIRE. The illquid (dormant) assets just make us rich on paper.

As the post mentions, strive for a high income and a high net worth. I am trying to maintain a 40/50 liquid-to-illquid net worth portfolio, just because I want options.

Great post 4IIII !

Thanks, Church! Liquid assets are key. I think it’s easier to overlook this aspect of personal finance when net worth is the metric that so many people obsess over. I aim to maximize my retirement accounts while also keeping my brokerage account at a healthy balance in case I need to access that money in the short-term.

Nice post! I may be biased though, since I’m right there with you on cash flow being more important than net worth. Our preferred means of generating cash flow in early retirement will be a combination of real estate rents, part time gym instruction, and my wife’s chiro practice. Saving up that net worth for old man money. 🙂

My take is at: https://abandonedcubicle.com/build-cash-flow-ignore-net-worth/

Cubert, many thanks for sharing your take on cash flow. Hard to argue with your points, of which, I agree on all.

Thanks again!

Real estate seems to be a favorite income source for many people who are looking for high cash flow and not just a high net worth. I personally like to use REIT’s for my real estate income. And I love that phrase “old man money” – that’s essentially what a high net worth is great for – taking care of yourself when you’re old and no longer want to work 🙂

Having both is the golden scenario. Good luck!

If I had to choose, I’d go with high net worth. There are just more options when you have money to invest. Usually, you can generate cash flow if you have high net worth.

Thanks, Joe! You bring up a good point – if you have a high net worth it’s usually possible to generate cash flow from your savings. The only drawback is that it can take many years to build up a high net worth. For some people it’s much faster to build up a high cash flow. Thanks for sharing your thoughts 🙂

You can tap into your IRA early by setting up Substantially Equal Periodic Payments through Reg 72(t) to avoid the 10% penalty. Some 401(k) plans don’t allow for it.

Great point! Also, thanks for linking to your article on the SEPP, that’s a useful post for readers to check out.