3 min read

Today is December 8, 2017. If you haven’t heard of bitcoin by now, you’re likely living off the grid with no connection to the outside world.

Bitcoin is a digital currency. It’s a form of money that only exists online, unlike a U.S. dollar which you can physically hold in your hand.

This month I have spent far more hours researching bitcoin and blockchain technology than I care to admit. I won’t attempt to explain how it works or why it’s important because there’s far more qualified individuals out there who understand it better than me and have already written in-depth articles on the topic.

But I would like to disclose that I bought $1,000 of bitcoin and $1,000 of ethereum earlier this week. Here’s why I’m dipping my toes in the cryptocurrency world and my general thoughts around this topic.

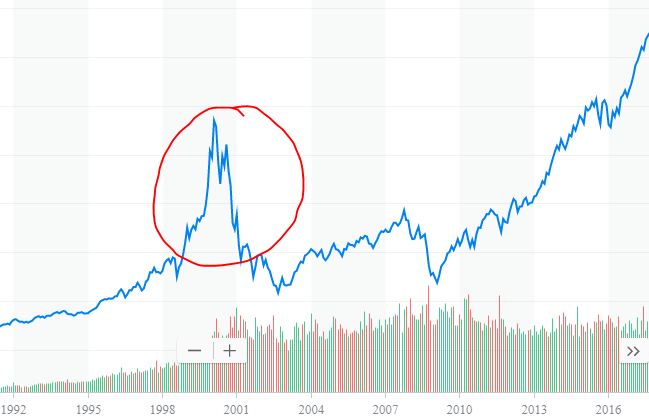

A Repeat of the Tech Bubble?

Bitcoin is one of many cryptocurrencies you can buy online. There are literally hundreds of other cryptocurrencies that have popped up in the last few months alone that have seen their prices increase 100x in a matter of weeks. This sounds eerily similar to the tech bubble of 2000…

In the late 90’s any company who put a “.com” at the end of their name saw their stock soar to the moon in under 18 months, with a subsequent crash that happened just as quickly.

The mania behind the tech bubble seemed well-founded: nobody had even seen something as powerful as the internet and everyone wanted in on the profits being made from internet-based companies.

And while the internet did revolutionize the way we live and the way companies operated, it took a little longer than most people expected. Most of the tech companies that were booming in the late 90’s no longer exist today. An investment in those companies became worth a big fat $0.

There’s a good chance something similar will happen with cryptocurrencies. The blockchain technology these currencies are based on will likely revolutionize the economy and fundamentally change the way companies do business. And there’s a chance that a few of the cryptocurrencies that exist today will go on to become behemoths in ten years.

But nobody knows for sure which cyptocurrencies will survive this mania long-term. Attempting to guess which ones will survive is equivalent to picking a red marble out of a hat filled with hundreds or thousands of blue marbles. Your odds of picking the red marble are not good.

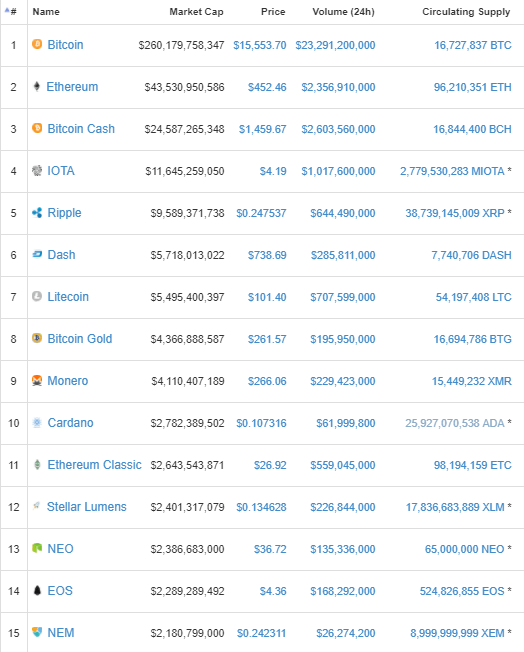

Here are just a few of the most popular cryptocurrencies in circulation:

Which ones will still be around a decade from now? Nobody knows. Possibly none of them.

Minimal Exposure

There is a very, very, very good chance that my investments in both bitcoin and ethereum will be worth zero dollars ten years from now.

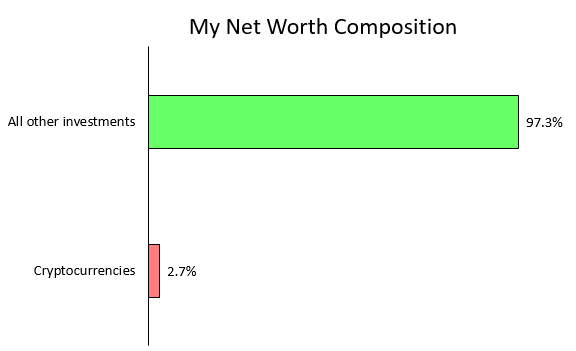

That’s why I am only investing money I am completely comfortable with losing. My investments in these two cryptocurrencies represents less than 3% of my total net worth so I won’t lose sleep at night over them.

As I continue to save money over the coming months and years, bitcoin and ethereum will account for an even smaller portion of my total investments.

If by some act of god these cryptocurrencies become wildly successful over the next decade and actually become viable forms of currency people use, I will be sitting pretty financially. If instead they become nonexistent it will only have a tiny impact on my finances.

In general I consider myself a conservative person. I save a huge chunk of my income. I invest in index funds and reliable dividend-paying companies. I believe in a slow and steady path to wealth. That’s why I’m okay with sprinkling a small percentage of my money in highly speculative investments. The bulk of my money is in diversified assets and my money machine won’t take much of a hit if these cryptocurrencies go to zero.

My Advice

Here is my advice for anyone looking to invest in cryptocurrency:

- Max out your retirement accounts for the year and build up an emergency fund before even considering these highly speculative investments.

- First attempt to understand how blockchain technology works and why it’s important.

- If you feel inclined, invest a very tiny portion of your net worth in a couple different cryptocurrencies with the full expectation that you will lose all your money.

- Let those investments sit untouched for many years. Go about your normal life saving a high percentage of your income and keep investing simple with index funds.

Disclaimer: I am NOT a registered investment adviser, investment professional, brokerage firm or investment company. Readers are advised that information on the website is issued solely for information purposes and not to be construed as an offer or recommendation to buy, hold, or sell any securities. All information, opinions, and analyses included are based on sources believed to be reliable, but no representation or warranty is made concerning accuracy, correctness, timeliness, or appropriateness. Please consult with an investment professional before investing any of your money.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

You definitely need to make regular updates on how these are doing. Given how much wealth you’ve already accumulated, $2,000 doesn’t seem like much, even if you lose it all. I’m excited for you!

Thanks, Jen! 🙂 I’ll be sure to include my account balances when I do my net worth updates each month so people can track my cryptocurrency investments. I also thought $2k was a nice amount to get exposure to crypto if it does go to the moon, but also not enough that I would be crushed if it went to zero.

Nice post and summary, Zach.

I’ve yet to cross the line into Bitcoin, and I’m still uncertain if I will do so at all.

Your point about doing your own thorough research and not putting a significant portion of your net worth seems like a practical way to invest for you based on your respective circumstances.

It’s certainly not an investment I would recommend for most people – in fact, I consider it more of a complete gamble than an investment. But for those who are interested in getting their feet wet, I think the best way is to understand what you’re buying and only put a tiny amount of money in.

We seem very similar. Retirement accounts are maxed along with regular contributions to a taxable account. I went ahead and put $500 into Ethereum two weeks ago.

Nice to hear you’re following a similar approach – focus on maxing out retirement accounts and only put money in crypto you’re completely fine with losing.

My brother just invested in bitcoin and was interested to get my perspective. I said I have none since I don’t know much about this vehicle. But my interest has spiked a little bit given all the buzz here and elsewhere.

It’s a tricky space. Blockchain technology, which is what bitcoin is based on, has a high likelihood of revolutionizing the economy, but it’s nearly impossible to predict which specific cryptocurrency, if any, will survive long-term. That’s why this is such a huge gamble.

Cool Zach. I’m curious, have you considered at what type of price or percent increase you would consider realizing some of the gains? Just an example with this 2017 run but someone who bought 1 Bitcoin at around $768.08 on 12/8/2016 could sell 10% of their Bitcoin today 12/9/2017 or 0.10 Bitcoin for about $1,407.59 and then pay some tax of course. Still 0.90 Bitcoin remaining.

I plan on holding a huge chunk of it (80-90%) for a decade or longer and realizing the rest as gains along the way just so I can guarantee some upside. I’m planning on treating this as a long-term investment and just riding out the volatility so if these currencies do survive long-term I’ll make some serious money. Great question!

I like the idea of investing a small amount in a speculative area too (3-5%). It also makes the news a lot more interesting when you’re a part of it.

I think that’s the best strategy for a highly speculative field like cryptocurrencies. If the prices do shoot to the moon, I have a decent exposure to the upside. If prices go to zero, it won’t crush me financially. And agreed – it makes the new much more interesting and worth monitoring. Thanks for the feedback, Adam!

hi,

you’ve written an in-depth answer to this question.

I’ve read many articles who haven’t included various points as the importance of Ethereum etc.

This is one perfect written guide.

Loved this post! I too have decided to dabble in crypto this month. I have only put in $100 into Bitcoin and $1,100 into Litecoin. I have thought about upping my investment in Bitcoin though. But I’m not sure I want to invest much more than my $1,200. Like you, this is less than 5% of my net worth and take it as a fun gamble investment. Any particular reason you choose Bitcoin and Ethereum vs another crypto? I choose Litecoin simply based on price point and Bitcoin based on history. I’m still not sure If I will hold it for a long time or sell some and let the rest ride. Keep us updated on how it goes.

I think it’s still too soon in the game for me to be comfortable investing more than a small percentage of my net worth in crypto, as well. I mainly chose Ethereum and Bitcoin because they’re the two biggest players in the space so far, and I consider them both to have first-mover advantages. Funny enough, I recently added some litecoin to my portfolio as well primarily because the price point seemed so attractive. I plan on holding all of these cryptocurrencies for the long haul and only occasionally skimming any profits off the top to lock in some gains.