4 min read

4 min read

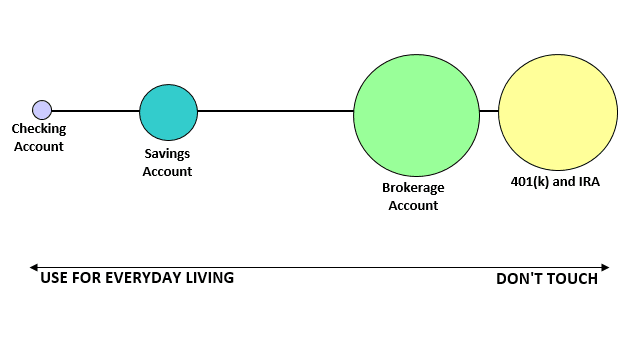

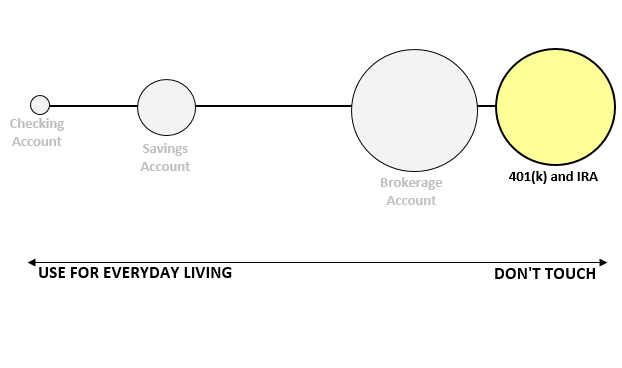

My entire financial life can be summarized by four accounts:

- Checking account

- Savings account

- Brokerage account

- Retirement accounts

Each account has a distinct purpose…

Checking Account

My checking account is my “everyday living” account. I use this account for one purpose only: to pay bills.

I use credit cards for virtually all my spending and I use the money in my checking account to pay off my credit card statements.

I like to keep my checking account balance as low as possible because the money sitting in it earns basically nothing in interest. Also, by keeping the balance artificially low it makes me think I have less money to spend.

I try to keep around $1,000 in this account at any given time. When I receive my two-week paychecks the balance spills over $1,000 and I transfer the excess to my savings account.

Savings Account

My Ally savings account serves one main purpose: my emergency fund. I like to keep the balance around $5,000 – $6,000, which is about 3-6 months worth of expenses for me.

The money sitting in this account currently earns 1.25% in interest each year, which is about $60 – $75 each year and far better than the $0 I would earn in a checking account.

My savings account is also a temporary home for my money before I invest it in retirement accounts. Whenever this account exceeds $5k – $6k I usually throw the excess in my brokerage account because I can earn more than 1.25% in annual interest from stocks and REIT’s.

I like to think of my savings account as a dividend stock that pays a 1.25% dividend yield that never fluctuates in price. It’s a safe place to store my money, but not a great place for it to grow.

Brokerage Account

My brokerage account serves one purpose: to grow my money through a combination of stock price appreciation and dividends from stocks and REIT’s.

In general, I try not to touch the money in my brokerage account. I want this money to grow over the long-term and any dividends I receive are automatically reinvested.

My plan is to eventually quit my day job and live off a combination of dividends from this account along with active income from freelancing and blogging.

So far the dividend growth in this account this year has been pretty incredible:

![]()

Retirement Accounts

Lastly, I have my retirement accounts which include my 401(k) and IRA. These accounts serve one purpose: to grow my money over the course of several decades.

Each paycheck I invest $650 into my 401(k) and occasionally add to my IRA balances as well, so over the course of many decades this money should continue to grow into hundreds of thousands of dollars.

I try not to touch these accounts at all. If I take money out of these accounts before I’m eligible (age 59.5) I would have to pay some penalties, which I hope to avoid entirely.

For the most part I just ignore these accounts. The only time I check the balances are at the beginning of each month when I update my net worth. Other than that I let the index funds in these accounts chug along and automatically reinvest any dividends. I don’t care if the prices of these index funds are soaring or tanking because I won’t be touching this money for another 40 years anyway.

A Simple Plan

To grow my net worth over time I only need to do a few things right:

- Keep my checking account balance fairly low (around $1,000)

- Keep my savings account balance at 3-6 months of expenses (around $5k – $6k)

- Regularly invest in my brokerage account and reinvest dividends

- Max out my 401(k) contributions each year

If I can do these four things it will be hard not to accumulate a huge stack of money over the long haul.

How do you think about your financial accounts? Do they each have a purpose? Do you have a plan for these accounts over the long-run?

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Hi, nice post. Pretty much the same as my plan. Working on getting the savings built back up. After the new year I want to add a second savings for travel and home remodeling. using the same savings for to much got me into trouble this year. Your dividends are doing great. I love seeing my dividends grow too. Keep chugging away!

Lynda

Thanks for the kind words, Lynda! It’s great to hear you’re adding a second savings for specific purposes. I think it does help to have different savings buckets for different savings goals. Best of luck with your savings journey 🙂

Pretty much the same purpose – apart from kid’s 529 plan. I do need to work on putting more cash from savings in a brokerage account. I’m planning to wait til 2018 to put more in my IRAs. Good to have a separate line like this though; it gives us purpose. 🙂

I think it helps when you have a clear idea of what each account is for and a specific target amount you want in each account. It helps you stick to a financial plan that’s unique to your situation. Cheers to a great financial journey in 2018 🙂