![]()

Disclosure: I am not a financial advisor. None of the securities listed in this post should be taken as investment recommendations.

My favorite form of passive income is dividends.

Each month I receive dividends from a combination of stock funds, individual stocks, REIT’s, and interest from my Ally Savings account.

I love this type of income because it requires no effort on my part. After my initial investment I just sit back and watch the dividends roll in each month.

I track these dividends using a simple Excel spreadsheet:

![]()

On the left side I have the stock tickers color-coded according to the type of investment.

The pink names are index ETF’s

- VYM = Vanguard High-Dividend Yield ETF

- VDC =Vanguard Consumer Staples ETF

The blue names are individual stocks

- CVS = CVS Pharmacy

- KR = Kroger

The orange names are REITS (real estate investment trusts)

- WPC = W.P. Carey

- OHI = Omega Healthcare Investors

- JCAP = Jernigan Capital

- LADR = Ladder Capital

The purple is my Ally Savings Account, which currently pays 1.25% annually in interest.

Along the top of the spreadsheet I have the months listed.

The green cells represent the dividends I received each month as well as the dividends I expect to receive in the upcoming months. For example, in December I see that I’ll be receiving dividends from VYM, KR, and my Ally Savings account:

![]()

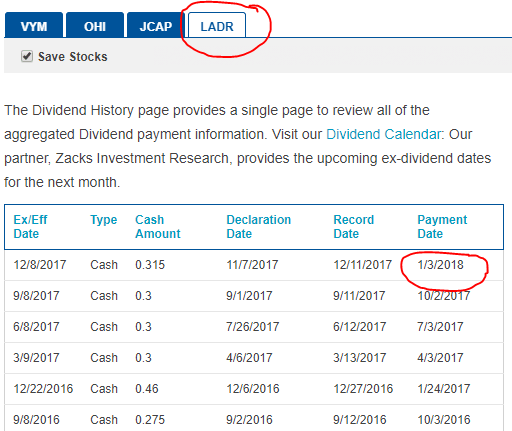

The easiest way to find out when these companies expect to pay dividends is by looking up their stock tickers on Nasdaq’s website:

I like to track my dividends in this manner because it lets me see the individual dividend growth of certain investments over time and the total amount of dividends I receive each month.

For example, I received my first dividend payment from CVS back in May for $9.50 and just by reinvesting the dividends I have increased my dividends to $9.62 in November. Over time this number will only continue to grow larger and larger as CVS increases their dividend payments and I continue to reinvest in the company:

![]()

Also, I can see that the total dividends I’m receiving each month are increasing over time:

![]()

![]()

For me, tracking my monthly dividends is an adrenaline rush. It’s exciting to see the numbers increasing each month so rapidly and it’s fun to watch the dividend growth over time. My monthly dividends will continue to grow over time due to:

- Companies I invest in will (hopefully) declare higher dividends

- I will continue to reinvest dividends

- I will continue to make new investments in dividend-paying sources

Ultimately I plan on using dividends as a source of passive income when I eventually quit my day job.

Is dividend investing part of your investment strategy? Do you track monthly dividends? Do you have your own spreadsheet you use to track dividends? I’d love to hear your thoughts 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great article, Zach! Remember to check out PSEC – over 1% monthly dividend adrenaline rush. I’ve been been trading them for years.

I’ll have to check into CVS and the other stocks.

Do you take cash or reinvest automatically?

Thanks, Robert! I’ll keep an eye out for PSEC. I reinvest automatically – I have all my stocks set to DRIP so as soon as they hit my account they’re reinvested so I avoid any trading fees.

Planning to start tracking my dividends more closely now! Thanks for the details – great Excel sheet to add to the collection.

I recommend it! Tracking dividends is a great way to keep an eye on dividend growth over time and it’s encouraging to see the numbers increase (hopefully) each month.

Hi Zach, I use very similar spreadsheets and charts for a portfolio of dividend stocks I have. So obviously, I like what I see. I’m looking forward to watching your portfolio of stocks grow and that dividend income increasing over time. By starting this at such a young age, you can take great advantage of the power of compounding over time. Wish I had started sooner than I did. Take care.

Great blog, Zach. Really like it!

I use Sharesight (www.sharesight.com) – it’s a great tool for tracking dividends and tracking overall performance.

Cheers,

Duncan