At an old Berkshire Hathaway Shareholder Meeting in the 1990’s, a young man asked Charlie Munger for his best advice on creating wealth. The young man complained that he was having a hard time getting started and that his net worth wasn’t increasing as fast as he would like. This is when Charlie Munger uttered a quote that quickly became famous within the finance industry:

“The first $100,000 is a b*tch, but you gotta do it.”

I couldn’t find the exact words he used to follow up this statement, but it was something like:

“I don’t care what you have to do—if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.”

I love this quote and can relate to it because I am chasing my first $100,000 right now, and I can confirm that it is indeed a b*itch.

Where are my investment returns?

The first $100k is such a pain because most of it is purely based on how much you save. When you have less than $100k, you have very little investment returns helping propel your net worth higher. It’s all about how much money you can throw in your bank account each month.

To illustrate this point, let’s use the Savings vs. Investment Returns Calculator to run some numbers.

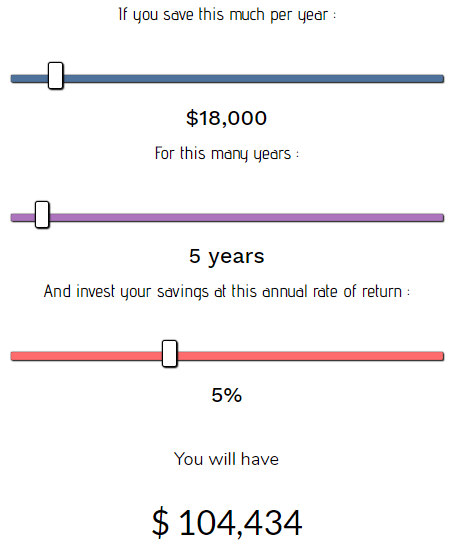

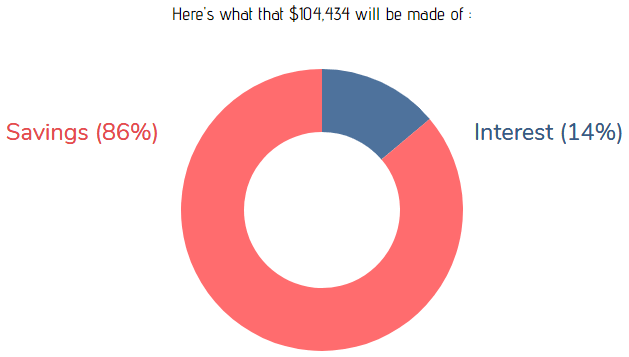

Suppose you want to go from a net worth of $0 to $100,000 in 5 years or less. If you earn 5% investment returns each year, you’ll need to save at least $18,000 per year (or equivalently $1,500 per month) to reach $100k:

A whopping 86% of this entire $100,000 would be composed purely of savings.

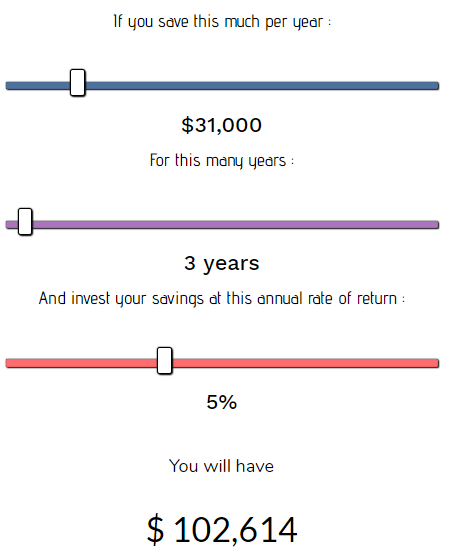

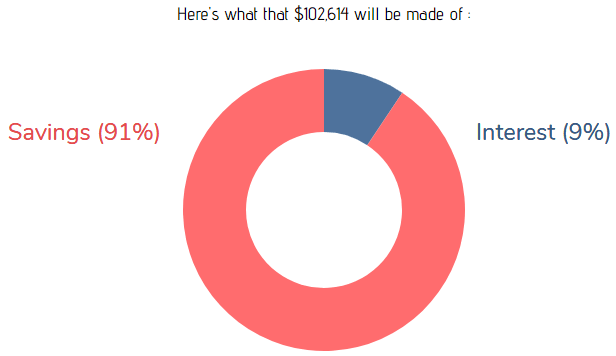

Suppose you’re even more ambitious and you hope to stack up $100,000 in 3 years or less. If you earn 5% investment returns each year, you’ll need to save at least $31,000 per year (or equivalently $2,583 per month) to reach $100k:

91% of this $100,000 will be composed of savings.

This illustrates an important point: the faster you want to save $100,000, the more you rely on savings and the less important investment returns become.

The First $100k: How Much Investment Returns Matter

In the previous examples, a 5% annual investment return is just a number I felt was reasonable. But it’s possible you could earn paltry 1% annual returns. Heck, maybe you can find a way to earn 12% annual returns.

If you earn 1% annual investment returns, you need to save at least $20,000 per year to reach $100k in 5 years or less.

If you earn 12% annual investment returns, you still need to save at least $15,000 per year to reach $100k in 5 years or less.

There’s no way to get around it, you must save a significant amount of money to reach $100,000 in 5 years or less no matter how impressive your investment returns are.

The Beauty of the First $100k

Once you do save the first $100k, investment returns start to make life a little easier. Consider a $100k portfolio earning 4% in annual dividends. That means you get paid $333 every single month without doing any work. That amount of money can make a real difference. That’s over half of my current rent payment.

If these dividends grow at a rate of 7% each year and are reinvested, you’ll be bringing in $371 each month in year 2 without adding any additional money. Each year the dividends will grow larger and larger. It’s just a little flywheel that spins faster and faster each year, paying you more and more without any additional effort from you. That’s why $100k in the bank is so awesome.

The First $100k Offers Flexibility

Having $100,000 in the bank does not make you financially independent, but it does make you financially flexible. Think about it. If you’re earning $300 – $400 each month from your investments, that gives you the option to quit a job you hate and transfer to a new position because you have some money in the bank.

If you want to take time off and travel, you have enough savings to do so.

If you want to take the chance on starting your own business, you have enough money to get things up and running without fear of missing your rent payment.

A smooth $100k isn’t enough money to never work again, but it is still a potentially life-changing amount of money. It gives you options. It also gives you a sense of financial peace. If you were to lose your job, it wouldn’t be the end of the world or a mad scramble to quickly find another source of income. If you blow a tire, you don’t have to stress about whether or not you have the funds to replace it.

So…How Do I Get the First $100k?

You work.

You put your head down, pick up side hustles, gain promotions, live simple, drop your ego, pack your lunch, practice delayed gratification, develop patience, and embrace the grind.

You already know you won’t have investment returns to make the journey easier. You simply have to save a ridiculous amount of the money you earn. If your day job doesn’t pay much, pick up side hustles. If your expenses are consuming too much of your income, look for easy ways to save.

Switch to cheaper cell phone providers.

Live with a roommate.

Live with your parents for a bit.

Drive an older car.

Cook your own meals.

Set up automatic deposits into your 401(k) and your bank accounts.

These tiny lifestyle changes make a huge impact on how quickly you can save your first $100k. Don’t underestimate the financial impact of tiny recurring expenses.

Embrace good ‘ol fashioned hard work, save your first $100k fast, and achieve financial flexibility.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Do you think a $100k portfolio could pay off a 4% dividend overall? Some stock pay and some don’t some high some low and with index funds as well the dividend is relatively low, but overall I haven’t found that return.

It would be a portfolio weighted more towards high-dividend yield stocks, but it could also be a combination of REIT’s that pay as much as 6-8% yields. A 4% dividend yielding portfolio would be more value-based as opposed to growth, but it’s not unreasonable 🙂

I just checked and it took me about 7-8 years to save 100k. But at first, I was just randomly saving with no real goal or anything. And yes, man, once you hit a certain threshold, it all just snowballs, and it’s insane. In three years after that first hundred, I’ve been able to triple my money. Some of that is because my salaries increased, but still.

Do you have a current timeline for when you think you’re planning to reach it?

That’s incredible you have been able to triple your money in only three years! That’s some serious growth. Salary increases combined with increased investment returns are a potent combination for increasing net worth pretty rapidly.

I hope to reach $100k around August 2018, so we’ll see how it goes 🙂

Very good read and a great quote by Mr Munger.

The usd 100‘000 milestone really is amazing, it took me years to cross that number and then in less than one year my portfolio doubled. Okay, we have seen a bull market but the point is that now my portfolio adds almost usd 7‘000 in dividends, which really supports our savings rate we are committed to keep well above 50 % in order to fuel our investment process.

I also like the second part of Mr Munger‘s quote, stating that after having reached the first milestone, one can easy his/her efforts a bit, as money starts to work for you. Saving and investing should be fun and when the compound effect works in your favor, it‘s just wonderful.

Cheers

It’s amazing how long it can take to reach that first $100k, but how the math shows that net worth growth only speeds up after that point. Munger knew what he was talking about. And cheers to you for continuing to save 50%+ of your income!