In no particular order, here’s a list of things that bring me joy:

- Being in nature

- Spending time with family & friends

- Writing

- Coding

- Reading

- Traveling

- Coffee

- Chipotle

All of the purple items on this list cost me zero dollars to enjoy. The blue items actually do require some money to enjoy.

In no particular order, here’s a list of my core monthly expenses:

- Rent

- Groceries

- Gas

- Utilities

- Phone

- Internet

I don’t like this list as much. All of these items cost money and they don’t necessarily bring me a ton of joy.

The Purple-Blue-Red Philosophy of Spending

Using these two lists, I can create what I call a Purple-Blue-Red philosophy for spending my money. This philosophy is simple:

- Spend as much time as possible doing the purple things.

- Spend money on the blue things occasionally without feeling guilty.

- Spend as little as possible on the red things without depriving myself.

The end result is maximum joy with minimal spending. Here’s how I implement this philosophy in my everyday life:

Purple Things

These things are free and they bring me joy

I spend at least some time everyday reading and writing. I spend some time on the weekend writing code. I spend whatever time I have in the evenings and the weekends with friends and family. All these things are free and they all bring me joy. I like that.

Blue Things

These things cost money but they bring me joy

I buy Chipotle probably once a week…sometimes twice. Or three times. Who’s keeping track?

I use my Keurig to make a cup of Barista Prima Italian Roast coffee every morning. I occasionally buy coffee at Starbucks on the weekends too. Sure I could save money by not drinking coffee at all, but I always look forward to enjoying a hot cup each morning and I feel like I do better work when I drink it.

I take mini-trips once or twice a year and over the past three years I have traveled internationally twice. Trips are always worth the money for me.

These three things bring me a ton of joy. Obviously I could cut them all out of my budget, but I’d be sacrificing joy for money. That’s not a trade-off I’m willing to make.

Red Things

These things costs money and don’t really bring me joy

Housing is the largest expense for most people. For me, a big house with a huge yard just has no appeal. In fact, owning a home at all isn’t on my radar right now. I’m perfectly content living in an apartment that requires minimal upkeep and no yard work. Because I don’t care about living in an overly spacious place, I focus on minimizing my housing costs as much as possible so I can save a boatload of money each month and have more to spend on things I actually do care about (financial freedom and Chipotle).

The same goes for all my other living expenses. I keep my phone bill around $20 per month, I have the most basic internet plan, drive an ordinary Honda Civic, and keep my utility expenses and grocery bills fairly low.

I need these red things to live but they don’t necessarily add joy to my life, so I spend as little as possible on them.

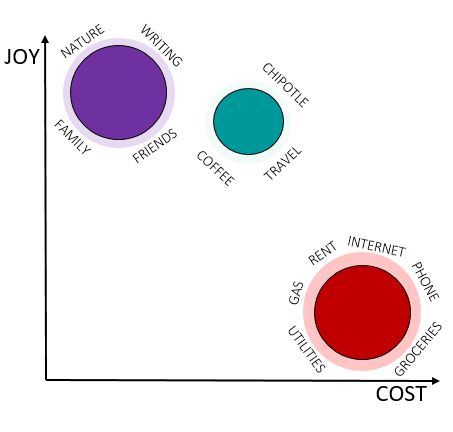

Joy vs. Cost

Here’s how I picture these three categories on a scatter plot:

I’d like to spend most of my day on the purple things. These things give life meaning at the beautiful cost of zero dollars. The blue things are like little treats. They’re great to enjoy every now and then. The red things are just necessary evils. They cost money and bring little joy.

The reason I want financial freedom is so I can pay for the red things without a 9-5 job and spend more time focusing on the purple things.

By following this simple Purple-Blue-Red philosophy I’m devoting as much time as possible to the free life-energizing purple things, using the blue things as mini joy-boosters, and minimizing the necessary evils of the red expenses.

This allows me to cruise towards financial freedom quickly while still enjoying the ride along the way.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Yet again, you nailed financial and life concepts with the use of visuals. I really enjoy these posts, Zach!

Thanks so much, Mrs. Adventure Rich! I always appreciate your feedback, I’m glad you find the visuals so helpful 🙂

Hey, coffee lover here too! Nice. I usually get a Dunkin donuts coffee once a week on Fridays as a treat! It feels better when you are anticipating it and makes it more enjoyable at least for me. Great visual by the way.

I’m the same way, I find that when I allow myself to get these little treats every once in a while I enjoy them and savor them a lot more.

Glad you enjoyed the visuals as well 🙂

This looks like a lot of fun! Where do you put things like saving and investing?

Thanks, Amelia! This is just my philosophy on saving money, so I didn’t really cover my saving and investing techniques here. But for the most part I just invest in index funds through Vanguard and keep the rest in an Ally Savings account 🙂