I think charts, graphs, and visualizations are particularly useful in personal finance. It’s great to know your net worth, monthly spending, monthly income, and your savings rate, but visualizing all these numbers can really help you wrap your head around your financial situation. Seeing your finances turned into graphs and charts can help you understand your money in a deeper way than just staring at raw numbers.

This is why I want to help you visualize your financial situation.

Here’s what I have in mind: You send me an overview of your financial situation including your assets, liabilities, monthly income, monthly spending, and any savings goals you may have. Then I’ll create graphs and charts to visualize your finances and what your financial future will look like based on your current income and spending.

I’d like to start a new weekly series where I visualize one person/one couple’s financial situation every Saturday and share it on the blog.

I’ll give a complete example of what this would look like using my own financial situation:

The Numbers

Part 1: Net Worth

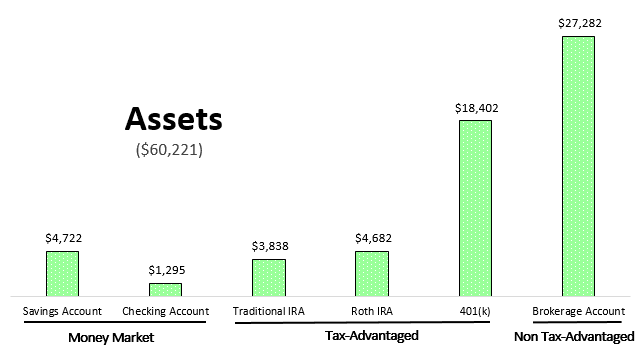

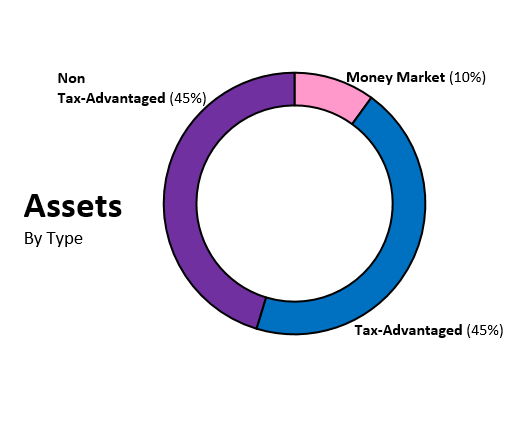

| Assets | |

| Savings Account | $4,722 |

| Checking Account | $1,295 |

| Traditional IRA | $3,838 |

| Roth IRA | $4,682 |

| 401(k) | $18,402 |

| Brokerage Account | $27,282 |

| Total Assets | $60,221 |

| Liabilities | |

| None | |

| Total Liabilities | $0 |

| Net Worth | $60,221 |

Part 2: Monthly Cash Flow

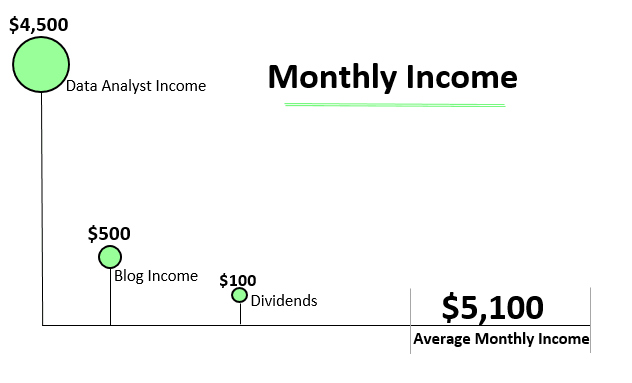

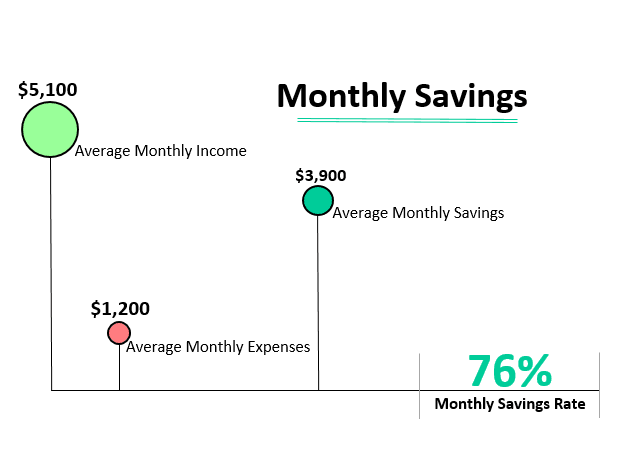

| Income | |

| Data Analyst Job | $4,500 |

| Blog Income | $500 |

| Stock/REIT/Index Fund Dividends | $100 |

| Total Monthly Income | $5,100 |

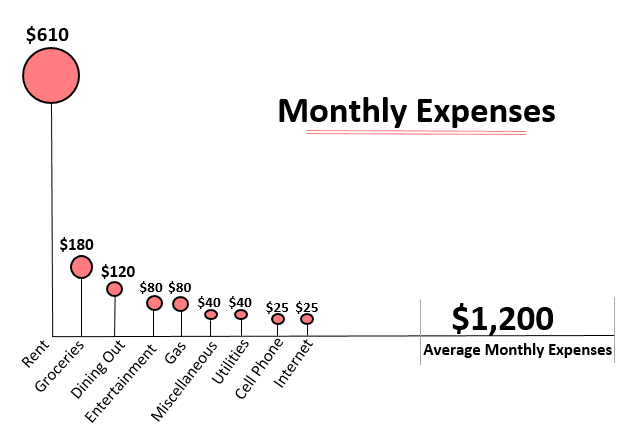

| Expenses | |

| Rent | $610 |

| Groceries | $180 |

| Dining Out | $120 |

| Entertainment | $80 |

| Gas | $80 |

| Miscellaneous | $40 |

| Utilities | $40 |

| Cell Phone | $25 |

| Internet | $25 |

| Total Monthly Spending | $1,200 |

| Total Monthly Savings | $3,900 |

The Visuals

Part 1: Current Net Worth

Part 2: Monthly Cash Flow

Part 3: Visualizing the Future

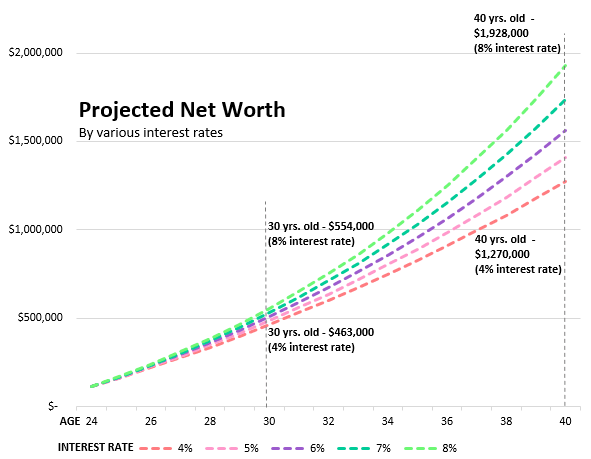

Now that I’ve seen what my overall net worth and monthly cash flow looks like, here’s what my financial future will look like if I continue with this monthly savings rate:

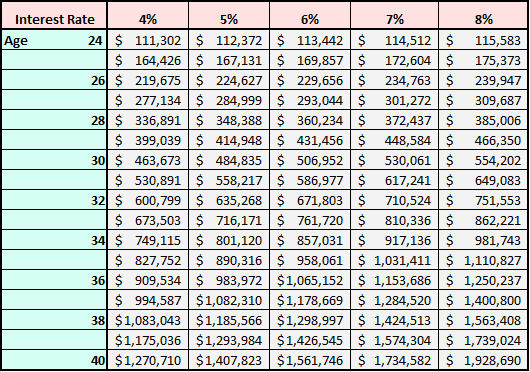

Current Monthly Savings: $3,900

Current Yearly Savings: $46,800

Projected Net Worth by saving $46,800 each year at various interest rates:

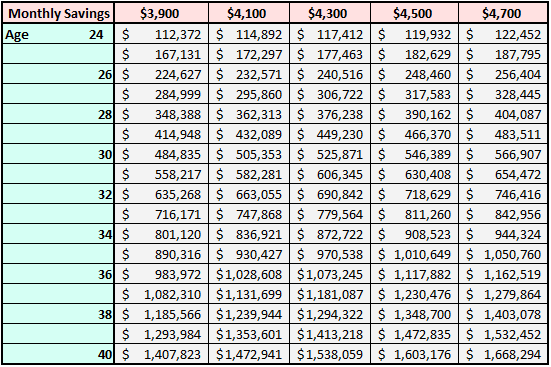

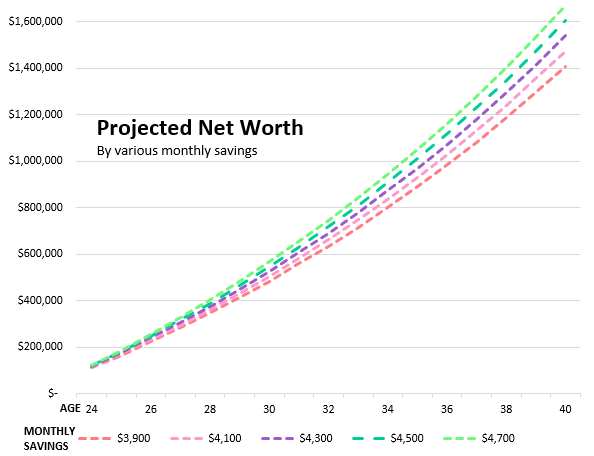

Now let’s try a thought experiment: We’ll assume my savings grow at a 5% annual interest rate (completely reasonable) but let’s see what the impact of saving even more per month would look like on my financial future:

Your Turn

If you would like me to visualize your finances, fill out the contact form below with subject “My Financial Situation” and a short message with your bio like “I’m interested in having my finances visualized. I’m 31 years old, married, no kids, work as a software engineer and I hope to retire by 43, etc.” and I’ll shoot you an email back with a template you can use to fill out your numbers. You can be as anonymous or open as you’d like. Thanks in advance for participating 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Cool idea for a blog post, Zach! I always enjoy the charts and visuals you put together. Your financial situation is outstanding too. Although I’m candid about sharing my dividend income, I haven’t shared my net worth yet. Perhaps once I’m better situated I’ll take you up on this offer. I’m looking forward to visualizing future contributors to this segment. Thanks for sharing!

Thanks, Graham! I love when people share their dividend income, it’s always fun to watch the growth over time so I’m glad you’re a fan of doing so. I’m looking forward to visualizing people’s financial situations as well and maybe you’ll join the list later on down the road! 🙂

This is fascinating!!! I have recommended you to many others over the past few months and you never disappoint! Keep up the good work – you are helping many more people than you know! Kate

Thank you so much, Kate! I really appreciate the kind words 🙂