This week I turned 24.

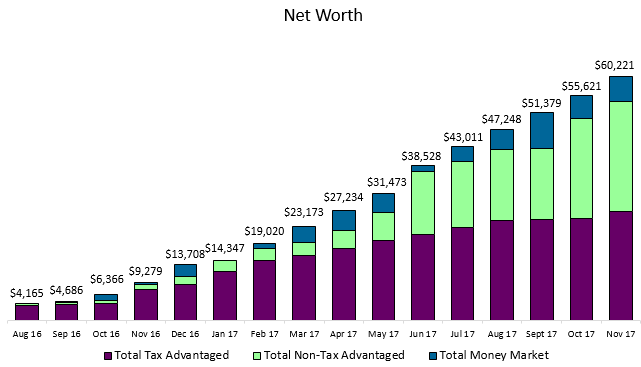

On my last day as a 23-year-old, I added up all the money in my various savings accounts and found out that I had $60,221 in savings.

So how exactly did I save up this much money at such a young age?

I’m glad you asked.

How it All Began

My personal finance journey began during my junior year of college. I was sitting in the back of my stats class scrolling through my phone when I stumbled upon a site called Mr. Money Mustache. I read a post titled The Shockingly Simple Math Behind Early Retirement, which changed my entire view of money and life in a few short minutes.

I proceeded to read every article ever written by Pete at MMM. I also went on to read others blogs that sparked my interest in personal finance even more like Frugalwoods, Mr. Free at 33, and 1500 Days.

I was hooked.

I loved the idea of saving enough money so that I could gain the freedom to live exactly how I wanted to live. I decided that I would start saving as much money as possible immediately.

Side-stepping Student Loans

The first crucial decision I made to accelerate my net worth was to graduate from college debt-free.

At the time I had been working around 30 hours per week at two retail jobs to pay for my tuition. I had a workhorse mentality, but I simply wasn’t earning much. Making $8 per hour meant I only brought home around $200 per week.

I decided to apply for a research assistant position on campus that paid $15 per hour. Although the position was designed for students in their senior year, I applied anyway. I got the job.

I didn’t realize it at the time, but landing that job taught me an important lesson: it was okay to apply for jobs I was slightly under-qualified for. If I got the job, it was a major victory. If I got rejected, it was the same outcome as not applying at all. I used this same mentality to land the job I currently have, which I’m technically under-qualified for on paper in terms of experience.

Following this, I quit both retail jobs, worked as a research assistant 20 hours each week, and picked up a weekend job as a math tutor earning $13 per hour for another 10 hours each week.

In the span of one month I had transformed my weekly earnings from $200 to $400. This additional income combined with a few scholarships was enough to help me pay for my tuition in full each semester.

I also lived at home during my college years. This meant my expenses were limited to my cell-phone, car payments, and the occasional chipotle burrito.

This combination of living at home, working two jobs, and earning scholarships helped me eventually graduate with zero student loan debt. This meant most of the money I earned at my jobs following college could be dropped into my savings accounts instead of paying off loans.

Living Like a College Kid

Once I graduated with my bachelor’s degree, I snagged a full-time job with a corporation near my hometown as a data analyst with a starting salary of $52,000. At the time I was still living at home and decided to do a 4+1 program at the same local college to get my Master’s degree with only one additional year of schooling.

This year was a complete blur for me. Between working 40 hours per week, going to classes in the evenings, and doing homework on the weekends, I had no time for anything else. Only the occasional chipotle burrito.

But during this time I made one simple decision that enabled me to save over $30,000 in under 8 months: I just kept living like a college kid.

I didn’t change my spending habits at all even though I had a corporate salary. I still ate most of my meals at home, packed my lunch for work, and kept driving my Honda Civic. This meant I had not hundreds, but thousands of dollars left over to save each month.

I maxed out my 401(k) contributions each paycheck and invested whatever was left in index funds, dividend stocks, and REIT’s.

Saving a ridiculous amount of money each month didn’t feel like a struggle at all. It didn’t take any meticulous planning or advanced investment strategies. I simply lived on very little and saved the rest.

Climbing the Income Ladder

Once I earned my graduate degree, I tried to negotiate a higher salary with my employer. Unfortunately the company said I needed a minimum of three years experience to make the next jump in the pay scale.

No problem, I thought, I’ll just look elsewhere.

And that’s what I did. I sent my resume to over ten companies in the area for data analyst positions, some of which I wasn’t entirely qualified for. I got rejected or ignored by every company except one, which offered me an interview despite not meeting the experience requirements. I eventually landed the job along with the $80,000 salary.

Jumping from a salary of $52k to $80k was mind-boggling to me. I felt like an imposter earning that much at age 23. Did I really deserve that much? Was I good enough?

Fortunately I have learned that nearly all 20-somethings struggle with imposter syndrome. We all think we’re not good enough, that we’re too inexperienced, that we’re somehow fooling our employers and it’s only a matter of time until they find out we’re fakes.

But I have come to realize that I don’t have to identify with this feeling. If I went through the interview process and was deemed good enough for the job, that’s all that mattered. I didn’t need to be overly self-critical.

This brings up an important point: I think many 20-somethings fail to climb the income ladder quickly because they’re afraid they’re not good enough and they fear rejection. I struggled with this myself for many years.

But now I know that I am the only person tracking my own failures. When I got rejected by 9 companies, I was the only one who knew that. When I eventually landed the new job, I looked like a complete success to all my peers. Nobody was aware of all my rejections.

I have learned that the best way to improve is to allow myself to be vulnerable to failure. I might not be as qualified as some of my peers, but I’m far more willing to be rejected. I’m not deterred by failure anymore. I’m willing to ask for promotions, apply for difficult jobs, and put myself out there.

Odds are, I’ll get rejected more but I’ll also experience more personal victories. This mindset has helped me move up the income ladder quickly at a young age.

Simple Living is the Reason I Can Save So Much

A high income certainly helps to save a significant chunk of money. But even a high income can be offset with high expenses.

The real secret to how I save nearly 80% of my income each month is my ability to live simple. I share an apartment with a roommate and my rent is only $611 per month. I still drive the same Honda Civic, have the same cheap phone plan, and live like an ordinary college student. Although I earn over $80k per year with my day job and side hustles, I’m living on about $15k.

The reason I save so much is simply because I know exactly what I want.

I want the freedom to travel the world, the ability to leave corporate America whenever I feel like it, and the savings to support a lifestyle I crave. I want to be a freelance writer, blogger, and creator. I don’t want a large house, an impressive wardrobe, or a flashy car.

I want time, not things.

This philosophy drives my savings. I don’t view saving money as voluntary deprivation. I view it as gaining freedom. More savings = more freedom.

Some Habits That Helped Me Save $60,000

There are a few habits I developed that made saving $60k simple and stress-free:

1. Tracking my net worth

When I started my blog just over a year ago I started tracking my net worth and sharing it publicly. This has helped me keep a close eye on my savings and has served as a gentle reminder that my day-to-day spending should align with my long-term savings goals.

I track my net worth using a simple Excel spreadsheet. Here’s a look at my net worth progression since I started tracking it back in August of last year:

2. Setting up Money Systems

It’s nice to feel motivated to save money. But motivation is unreliable. It comes and goes. There are days when I feel like splurging. Mainly on chipotle burritos. What helps me save money consistently are my money systems.

I have 401(k) contributions automatically deducted from each of my paychecks. I have monthly investments set up for my brokerage account so I resist the urge to time the market. I also keep my checking account balance artificially low by keeping most of my cash in an Ally Savings account.

These systems run like a well-oiled machine. They ensure that I’m saving and investing most of my income each month, whether I feel motivated to do so or not.

Looking Forward

This post isn’t meant to be boastful. I have always found it encouraging when bloggers share their own net worth journey, so I’m simply putting my story out there to maybe encourage or inspire other young people to start saving money.

I think life is about more than just working a 9-5 job for 40 years, paying bills, and retiring on a golf course. I think to truly live a life that aligns with your values and goals requires a firm financial foundation. Life is a lot more enjoyable when you don’t have to worry about making the rent payment. This is why I have been saving so aggressively and will continue to do so until I have financial flexibility to live exactly how I want.

Thanks for reading 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Hooked is a great way to describe it. It becomes a way of life after a while and gets easier and easier to live simply and then one day you realize this is the way I want to live anyway. 🙂

I can definitely attest that it gets easier and easier as time goes on. Eventually you start saving an incredible amount of money without even trying – it just becomes a lifestyle 🙂

Is 15k a year the figure you use when calculating how much you need to save up in total to reach FI?

I know you plan to earn money after you reach FI and most likely won’t live on so little if you have a family but, as of now is that the dollar amount you are shooting for?

That’s a great question. If I was shooting for complete F.I. I would only need around $375,000 ($15k * 25) but undoubtedly my annual expenses will go up in the future when I have a family. Also, as you said, I plan on working in some capacity even after FI, so it’s tough to say what my FI number is. As of now I’m shooting for $150k – $250k before I consider quitting my job and pursuing my own work. That will likely only take me 1-2 more years of corporate work. So that’s my short-term goal. We’ll see how it goes 🙂

Wow! Congratulations! You are light years ahead of most of your peers. You were very smart to work through college and keep your expenses low once you graduated and started working. As a teacher, I did not make as much as you through my twenties, but because my husband and I didn’t have much student debt (only $10,000 that we paid off years ago), we were in pretty good financial shape when we got married and have been ramping up our savings ever since. I look forward to following your journey!

Thanks so much, Mrs. Farmhouse Finance! Working through college turned out to be a great financial decision and it definitely gave me a leg up on saving money. All the earnings that I would have had to put towards loans I was able to instead put towards investing.

Congrats on paying off your student debt with your husband, that’s a major milestone to pass. Best of luck with your own savings journey and be sure to stay in touch 🙂