10 min read

Exactly two weeks ago I walked into my office and put in my two weeks notice.

As of today, I no longer have a 9-5 day job as a data scientist for a major corporation.

There were several insights, realizations, and some simple math that lead me to make this decision. For those who aren’t interested in the specific details, here’s the short version:

- Ever since graduating college and working at a traditional 9-5 job, I’ve hated many aspects of Corporate America.

- I quickly realized that I wanted to achieve financial independence so that I could walk away from a traditional job altogether.

- However, even with a high savings rate I would likely need to stick it out for about a decade before I had enough money to never need to work again.

- Fortunately, I realized that I could gain personal and financial freedom much quicker if I instead developed my own enjoyable income streams.

- Over the course of three years, I’ve been able to build up my online monthly income streams to nearly cover all of my monthly expenses.

- By quitting my job and working full-time on growing my online income, I can gain the freedom to work for myself and likely grow my online income much faster to a point where I can cover all of my expenses and also have the means to save and invest for the future.

If you’re interested in the long version of this story, grab a cup of coffee and read on.

The Drudgery of Corporate America

I’ve met several people during my time in Corporate America who genuinely enjoy their job and who find meaning in their work.

I, however, have mostly hated working at a corporate job ever since I graduated college four years ago. Just off the top of my head, I get annoyed by the following things:

- Commuting in traffic twice daily, five times per week.

- Being forced to work at a specific place at a specific time.

- Having some, but not all, control over my ability to gain a promotion.

- Having virtually no ability to influence whether the company earns a bonus in a given year.

- Having no control over what types of projects I work on.

- Working with micro-managers.

- Working with incompetent people in general.

- Sitting in meetings where nothing gets done.

- Filling out performance reviews.

I’ve found that I mostly enjoy working by myself on projects that I come up with on my own.

That’s probably why I like blogging so much. I get to decide exactly what I want to work on and I can choose to work from home, a coffee shop, or a library at whatever time works best for me.

I can work for long stretches of time without being interrupted, without being forced to sit in meetings I don’t need to be in, without being forced to give updates on my progress, and without being pulled out of flow state involuntarily.

My friend APL from A Purple Life said it best when she explained that jobs suck because they’re never-ending group projects. This rings true with me. I always hated group projects in high school and college, and having a 9-5 job is essentially being a member of a group project every single day.

Some people work well in groups and thrive in group settings. I do not. I prefer to work alone. This doesn’t mean I hate being in groups. I love hanging out with family and friends. I just don’t want to be a member of a group when it comes to work. I want complete autonomy and flexibility to do my own thing.

For all of these reasons, along with my annoyances listed above, it didn’t take long for me to discover that I hated the corporate work environment and that I wanted to gain freedom from it as quick as possible.

Financial Independence: A Way to Escape the Drudgery

I was fortunate to discover the FIRE (Financial Independence/Retire Early) community while I was still in college. By consuming blogs, podcasts, and books about personal finance, I learned the basics of saving and investing. This allowed me to graduate college with a net worth of $30,000 and put me in an excellent position financially at a young age.

As I read more and more, I learned that the concept of financial independence was actually very simple. If you can accumulate a portfolio that is worth 25 times your annual expenses, you are financially independent. Then, you can follow “The 4% Rule” indefinitely.

The 4% Rule states that you can withdraw 4% of your portfolio during your first year of retirement and in each year that follows, bump up the amount you withdraw to account for inflation. By following this approach, there is a high probability that you won’t deplete your portfolio in retirement.

And it turns out that the key to building up a portfolio of this size as fast as possible is to have a high savings rate.

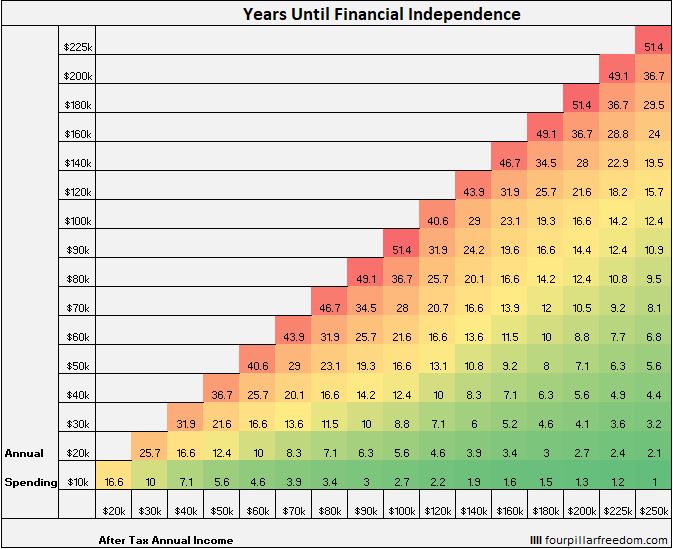

To get an idea of how long it takes to achieve financial independence based on various levels of annual income and expenses, I created a grid that shows the amount of years it takes to achieve F.I. based on your annual income and expenses:

Note: The grid assumes you start with a net worth of $0, earn 5% investment returns on your savings each year after inflation, and that income and expenses remain consistent each year.

So, for example, if I could maintain a 50% savings rate (e.g. $80k after-tax income, $40k spending) then I could achieve financial independence in 16.6 years.

Or, if I could maintain a 60% savings rate (e.g. $100k after-tax income, $40k spending) then I could hit F.I. in 12.4 years.

While this mandatory working period is much shorter than the traditional working period of 40-45 years, I still wasn’t thrilled about the idea of working at a corporate job for a little over a decade to achieve financial independence.

I wanted freedom sooner.

Building My Own Income Streams: The Fastest Path to Freedom

The lightbulb moment that made me realize I could gain freedom from Corporate America far before I’m financially independent was when I realized that the 4% Rule only offers one way to cover your expenses.

Let me explain.

Every individual has a certain amount of expenses they must pay for each year. This includes things like rent, utilities, transportation, food, insurance, etc. The allure of the 4% rule is that it offers a way to pay for these expenses in a completely passive manner.

Using the 4% rule, if you have a portfolio worth $1 million, then you can support a lifestyle of $40k/year simply by withdrawing $40k from your portfolio each year. If you have a portfolio worth $2 million, then you can withdraw $80k each year.

The beauty of this approach is that it doesn’t require you to work at a job you hate just to earn money to cover your expenses. You can simply log on to your financial account, click a button to sell off some stocks or bonds, and use that cash to pay for rent, utilities, transportation, etc.

So, the 4% Rule is a way to cover your annual expenses in a completely passive manner. However, it’s possible to cover your annual expenses through a combination of passive and active income.

For example, consider someone who spends $40k per year. Using the 4% rule, they could cover their yearly expenses with a portfolio worth $1 million.

But they could also cover their yearly expenses by withdrawing 4% of a portfolio worth $975k (which provides $39k in passive income) and by earning $1k per year through active income.

Or they could cover their yearly expenses by withdrawing 4% of a portfolio worth $875k (which provides $35k in passive income) and by earning $5k per year through active income.

Using this logic, each $1k you are willing to earn each year in active income is $25k you don’t need to accumulate in your portfolio.

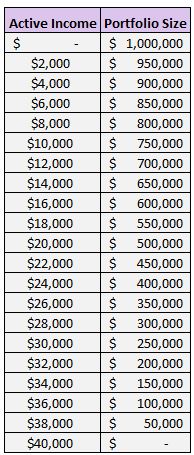

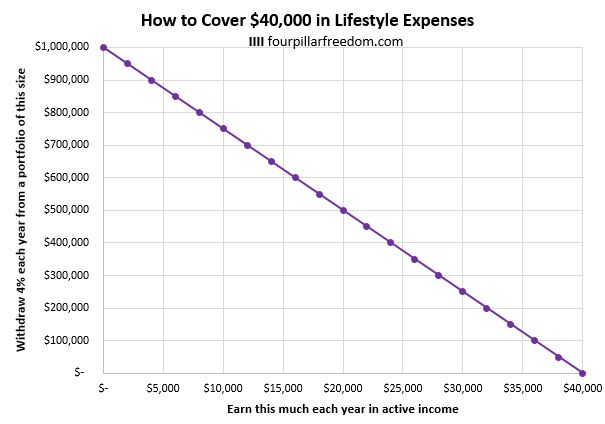

The following table shows the various ways that you could cover $40,000 in yearly lifestyle expenses by withdrawing 4% from different portfolio sizes and by earning the rest in active income:

The following chart helps visualize these numbers:

On the top left end of the chart, we see the scenario where someone could cover $40k in yearly expenses by withdrawing 4% of a $1 million portfolio each year and by earning $0 in active income.

On the bottom right of the chart, we see the opposite scenario where someone could cover $40k in yearly expenses by earning $40k purely in active income without any help from a portfolio.

Directly in the middle of the chart, we see the scenario where someone could cover exactly half of their $40k yearly expenses by withdrawing 4% each year from a portfolio worth $500k and by earning $20k each year in active income.

Running these numbers helped me realize that I could break free from the drudgery of Corporate America long before I had 25 times my annual expenses saved up. I simply needed to be willing to earn active income.

Running Away from Corporate Drudgery while Running Towards Meaningful Work

Realizing that earning active income could help me gain my freedom much sooner convinced me I could quit my job before I was financially independent.

However, there was another important realization that made me drawn towards active work.

As I consumed books, articles, podcasts, and videos by people who had actually quit the rat race at a young age, I noticed a trend: each of these people experienced a void in their life.

The same pattern kept popping up: people would achieve the financial means to quit their day job, then travel for a couple weeks or months…then get bored. This is because everything becomes normal over time. Even constant travel and leisure becomes mundane quicker than one might think.

The solution, in nearly every case, was for these people to pursue work they found fulfilling – starting a business, an agency, a blog, a podcast, building a product, etc. – that used their unique skillset to help others and ironically help them earn income at the same time.

When you have something to work on, to build, and to create, you suddenly kill the void. You have a reason to get out of bed each morning and do work that you find meaningful and that makes a positive impact on other people.

It turns out that work is also correlated with longevity. In a fascinating study on retirement, researchers found that retirees were 51% more likely to have died than their counterparts who continued working, and a 5-year increase in the retirement age was linked with a 10% decrease in all-cause mortality.

As anecdotal evidence, just look at anyone in their 80s or 90s who continues to work full-time like Warren Buffett, Charlie Munger, or Jiro Ono – it’s not about the money for them, it’s about doing work they love.

If you’ve never heard of Jiro Ono, I encourage you to watch the Netflix documentary “Jiro Dreams of Sushi.” Check out the trailer below:

I quickly realized that earning active income would allow me to run from the 9-5 job I hated while also running towards work that I enjoyed, if I could find the right type of work.

Earning Income Online

My first taste of earning income online came when I put ads on this blog a little over two years ago. In my first month, I made $18.75.

Even though that was only enough to buy three Chipotle burritos, it made me realize that I could earn money just by sitting at my laptop, typing out my thoughts, and publishing them on the internet. Ultimately that $18.75 set me off on the path that I’m on today.

Now, on a monthly basis I regularly earn between $1,000 – $1,500 each month on this blog through advertisements, affiliate links, The Excel Genius Toolkit, The Data Scientist Resume Pack, and The Elements of Freedom ebook.

In addition, I have two other sites that are monetized with ads that are both slowly growing each month, and I have a new site I’m working on to build out my portfolio of income-earning sites even more.

Over the past two to three years, I’ve realized that I have a unique ability to write quite a bit without really getting bored or tired. For me, working on websites feels like a game. It’s fun, not drudgery. I also find it to be meaningful and interesting work. This gives me an edge in this type of work.

Simply realizing that I’ve been able to create a $1,000+ monthly income stream in my free time outside of my day job makes me think that I can ramp up this income much higher and faster if I could work on it full-time, which is exactly why I’ve decided to do so.

Also, I typically earn $100 – $200 each month in the form of dividends and interest, which adds another boost to my monthly income.

My Cash Flow Situation

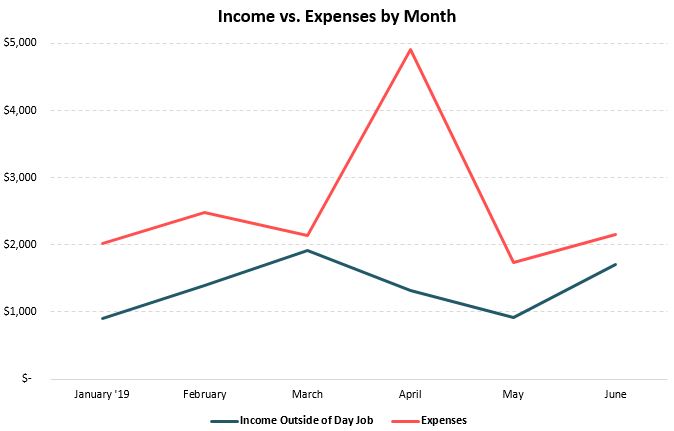

Over the past six months I’ve been able to cover around 70-80% of my expenses just through my income streams outside of my day job:

Note: The bump in April expenses is from paying my annual taxes.

I feel confident that if I can work on building these income streams full-time that I’ll be able to boost my monthly income to $2,000, then $3,000 and beyond.

Even if I have to tread water for the next 12 months or so, I have plenty of money in savings to hold me over. As I shared in my financial update yesterday, here are my current account balances:

Cash: $29,310

Tax-Advantaged Accounts: $53,711

Brokerage Accounts: $57,460

Alternative Investments: $2,945

Net Worth: $143,426

Typically I spend about $2,000 each month. This means that even if I earned zero dollars each month online, I could pay my bills for at least the next two years just with cash.

Looking Ahead

My plan moving forward is to earn enough income through my websites and dividends/interest to cover all of my monthly expenses.

As usual, I’ll keep providing financial updates on the first day of each month to share how I’m doing with this new lifestyle both financially and personally.

Lastly, here are a few questions I anticipate receiving via Twitter or email that I’ll go ahead and answer here:

What if you’re not able to grow your income online as much as you think?

Because of the nature of website growth that I’ve observed on my own sites over the past couple years, I feel confident in predicting that my income from my sites will only steadily increase over time.

However, if the actual growth doesn’t meet my expectations, I can always get more heavily into freelance writing and statistics tutoring, two side hustles that I have had success with online in the past.

In the worst-case scenario that I’m simply unable to generate as much income online as I thought, I can always get another 9-5 job, given my experience, educational credentials, and skillset.

Why did you decide to go full-time on your online income instead of just working part-time for a company?

I did consider dropping down to part-time work instead of quitting altogether, and it’s perhaps something I would consider in the future, but I really wanted to give myself the complete freedom to work for myself and see how far I can take this online income.

I feel confident that I can grow my portfolio of sites into something seriously impressive, but only if I have the ability to work on them with all my mental strength and energy.

Won’t you get bored working by yourself?

I seriously doubt it. I’m an introvert, I love working alone, and as mentioned earlier I dislike working in groups. Also, I don’t get bored easily.

The nice part about working for myself is that I can work for as long or as little as I like, take breaks when I want to, and determine my own schedule. This means if I feel like going for a long walk, driving to the gym, reading a book on my balcony, watching a documentary, or laying by the pool, I can do that whenever I need to recharge from working.

Conclusion

To everyone who has followed my personal and financial journey up to this point: Thank you. I’m excited to share updates on this next stage in my life.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.