Today’s guest post comes from Benjamin Davis, a financial blogger at From Cents to Retirement. Check out his story below about how he is using rental real estate to fuel his path to financial independence.

My name is Benjamin Davis and I am a blogger at From Cents to Retirement, a scientist, entrepreneur, author and coach. I do science for a living, I am an entrepreneur at heart but since I can’t work much, I realized that my biggest shot at inspiring the largest number of people was through an inspiring blog and personal coaching. This year, I published my first book, called “My strategy to retire early” which is basically a compilation that answers many questions that I’ve gotten over the years, on the feasibility of retiring by 33 – my current mission in life.

Being born to an Italian and Canadian family, I always liked to explore and get in touch with different cultures. I was actually born and raised in Portugal, as my family decided to move there, due to my father’s job. In 2010, I decided to immigrate to Germany, in the pursuit of a PhD. Sadly, I was exposed to a very stressful environment and my direct co-workers were very difficult to deal with. This marked a lot, and made me dislike Germany.

Living in a very stressful, non-pleasant environment, I ended up developing a terrible disease that goes by the name of ME/CFS (Myalgic encephalomyelitis / Chronic Fatigue Syndrome). When you read the name of this disease, you may think it means that you are tired all the time. And you are. The main problem is that you are also dizzy every day, you feel sick and you suffer with anxiety, low mood and chronic muscle tension and pain. It ain’t no fun!

I still remember the day in which I decided I was going to beat CFS by adapting my life to it. Working on a regular basis was becoming a problem, as I had to drag myself to the office. So, I decided that I’d have enough passive income to live off of. Saying it like this actually makes it look like simple, but if you want to retire early yourself, you know this is very hard to accomplish. Yet, I had a major reason to achieve financial freedom and I set out to retire early by executing a plan that I wrote in my book. In between, I read over 100 books on personal finance, which I eventually put together in a list and started providing reviews and summaries on my blog (for example, check out my rich dad poor dad summary), started to read blogs on early retirement and personal finance, and changed my lifestyle to factor this plan in.

The plan touches on several aspects of life, and I even spent a few months choosing the country I was going to retire in. Although my entire family lives in Italy now, I decided to go with Portugal because it offers magnificent quality of life, thus taking advantage of geographic arbitrage. You may have never visited Portugal, but I can tell you that I literally live where you vacation!

Real Estate

When I first started to think about setting up a portfolio that would yield enough passive income to live comfortably, I previously only had contact with the stock market, as far as investments are concerned. However, reading so many books and being exposed to so many ideas, I looked to real estate as a better investment vehicle for a few reasons. First, the real estate market in Portugal was tanking and it seemed like a good time to buy in. Second, I could leverage easily, due to my relatively sized paycheck from Germany. Third, the demand for rentals grew very fast in Portugal in the years before, as a consequence of the 2008 crisis, where many people had their homes foreclosed, which fostered a mentality shift toward renting.

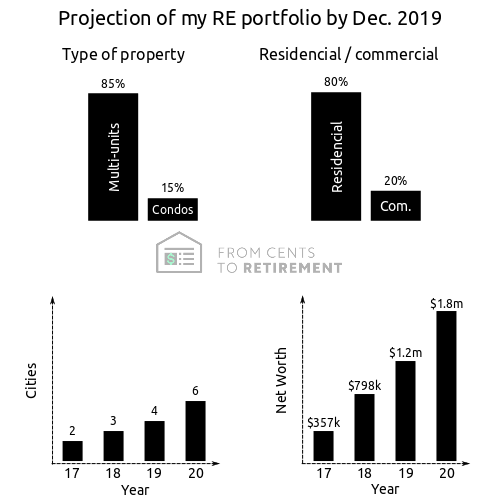

I decided to invest 70% of my paycheck (and then some, due to my small consulting business that I set up in between) towards rental properties in Portugal. I actually ended up buying one property in all cash, which actually went on to become instrumental to build the 14-unit portfolio that I own today. There are a lot of changes on my portfolio right now, but I project to hit €2,000 (or $2,380) per month of rental income and a net worth of about €300,000 (or $357,000) by December 2017, i.e. in 3 months from now.

What I like the most about Real Estate is the fact that I can see value in properties that nobody finds appealing and add tremendous value to them, by renovating them like this:

I ended up liking real estate so much that I set up a consulting business that helps foreign investors investing in Portugal. The business gained more traction this year when we partnered up with a real estate company to offer totally passive, ensured-return investments. Today, we work with a number of investors from the US, Canada and the UK on this model.

My goal is to own 100 rental units before I turn 40. In fact, I recently started to work on a master plan to escalate my portfolio, which will more than double (in units) next year:

If you like real estate yourself, make sure you check out my blog, because I post often on real estate resources. For instance, check out this list of free real estate books and some land-lording tips such as dumping couches and what not.

I must say that I never dreamed of being rich. Before CFS, I was very happy with a life that didn’t include investments and was lived paycheck to paycheck. Yet, I was vulnerable to something like a disease. CFS was really a game changer for me, and it’s the reason I even thought about early retirement. Today, I see many people living their lives without any concern on the financial side. I see a lot of struggle too. And it doesn’t have to be that way! Over time I have become a big advocate of financial education.

My goal with this post is to inspire you to achieve your best. If I can do it, having to deal with CFS on a daily basis, you can certainly do the same. I hope this post inspired you and you found it valuable. If you did, feel free to pass by my blog or read my book. I wish you all the best in your own journey.

Benjamin Davis, PhD is the guy running the show at From cents to Retirement, a blog about early retirement and real estate investing. Ben is also the author of the book My strategy to retire early and runs several businesses, despite the fact he has to deal with CFS/adrenal fatigue on a daily basis. He plans to build a 100-unit real estate portfolio before he turns 35 and make From Cents To Retirement a reference blog for early retirement through Real Estate, inspiring others with his own story.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Very good stuff. It makes me thing of the consulting opportunities where I live (New Hampshire, United States) There’s no sales tax here, and foreigners want to do business in the US.

The one thing I will add, because it’s one of my life goals is that you seem to have come from money. To be worth 1/3 million at 17, someone helped you out.

Still a great article and you have done well with your opportunity, but an ill of society and great inefficiency.

Hey Robert, those consulting opportunities certainly seem like great ways to earn extra money, especially with the appeal of no sales tax.

As a quick note, Ben is 28, not 17.

Hey Zack, I am going to retract my last statement.

I was under the impression, through my own fault, that “Year 17” was age. I now know 2017, 2018 etc. Sorry!

I checked out his blog and found a rather interesting article about breaking down couches instead of spending the money to dump the whole thing. Good stuff. Keep it coming!

Haha no worries, I can see how you would think that! His blog has some solid content, it’s definitely worth checking out.