Contributing a portion of each paycheck to a 401(k) is a wonderful way to build wealth. In my previous job I had the opportunity to contribute to my first 401(k) ever. I chose to deduct $650 from each two-week paycheck, which was a third of my total earnings every two weeks.

In only 10 months my 401(k) account balance grew to $17,000. Now that I have completed the first two months at my new job I’m finally eligible to start contributing to a 401(k) plan again.

The 401(k) plan at my current workplace automatically places new employees in Target Date Funds unless the employee chooses a different investing strategy.

A Target Date Fund is a fund that has a stock to bond allocation based on the age of the employee and when they expect to retire. For young employees, these funds hold mainly stocks.

The reasoning for this is simple: younger employees have many decades until retirement, so it makes sense to be invested in more volatile assets like stocks because they have years to ride out the volatility. Also, stocks have higher expected returns in the long-term compared to bonds.

I have a love-hate relationship with Target Date Funds. For most people who know very little about investing, this fund actually does offer a good strategy. It’s like a robo-advisor, automatically investing your money in stocks and bonds according to your age. Truthfully, it will do just fine for most investors over the long-run.

But there’s one glaring problem: these funds almost always have higher expense ratios than simple index funds. For example, the default Target Date Fund for my age bracket has an annual expense ratio of 1.01%. This means if I max out my contributions at $18,000 per year, I’ll have to pay $181.80 in management fees no matter how well my investments perform.

As I contribute more to the 401(k) plan over time and my account balance grows, this could mean paying tens of thousands of dollars purely in investment fees over the years.

Unfortunately, most 401(k) sites are set up to make the Target Date Fund seem like the best possible investing strategy. For example, when a new employee enrolls in a 401(k) plan there are typically two options they’re given that look something like:

Invest in Target Date Fund (recommended)

Choose Your Own Investing Strategy

It’s no wonder most people elect to invest in Target Date Funds. If I knew nothing about 401(k) plans I’d surely avoid creating my own “investing strategy” too.

For the few employees who do know what an expense ratio is, it can still be difficult to actually find it. For example, on the homepage of my 401(k) site it lists all the available funds for employees to contribute to, but the expense ratios and the specific details of each fund are on an entirely different page. The expense ratio itself is listed in italics at the very bottom of the fund description page.

But I have good news: most people can easily replicate (or beat) the performance of a Target Date Fund just by investing in simple index funds, with only a fraction of the expense ratio. This is what I have personally decided to do.

The One Fund Approach

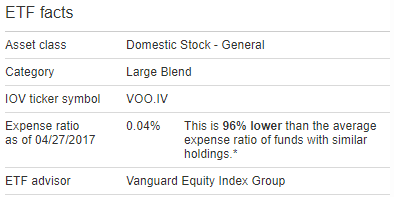

I have decided to invest all of my 401(k) contributions in my new plan in an S&P 500 index fund. This fund has an annual expense ratio of 0.2%, which still isn’t great, especially compared with the S&P 500 ETF that Vanguard offers with a minuscule expense ratio of 0.04% :

But this fund actually has the lowest expense ratio of any fund I have to choose from and over the long haul I expect it to outperform nearly any other investment option.

To quote the investing advice that Warren Buffet gives to his heirs:

“My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers.”

I’m happy to invest in a fund that Warren Buffet so strongly believes in.

For most young investors, they’d be wise to “choose their own investment strategy” in their 401(k) plan rather than selecting a Target Date Fund. It could potentially save tens of thousands of dollars in expense fees over the years.

The best part of handling your own retirement investing, in my opinion, is that you know exactly what you’re invested in and your investment returns will likely match or beat the returns offered by robo-advisor style investments because you’ll be paying considerably less in management fees.

This strategy of investing your own money mirrors the advice offered from Brandon at Mad Fientist in my post where 30 bloggers shared tweet-sized advice they would give to their 23-year old self:

Take Control of Your Investing

Virtually every 401(k) plan offers an S&P 500 index fund option to invest in. For some plans it might be called something different like “Large Cap Stock Fund”.

As a disclaimer, I’m not a financial advisor so always choose investment options that make sense for you. I’m in my early 20’s and I have a high tolerance for volatility and many years ahead of me to ride the wild wave of stocks. For older investors, it might make sense to invest a larger portion in bonds, which will offer a “smoother ride” as Jim Collins often says.

No matter what investment choices you make, just keep in mind that you can often avoid paying excessive fees by choosing to invest in stock index funds and bond index funds yourself. Happy investing 🙂

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Zach,

Smart choice in my opinion. A fee of 1.01% is too much, so you did the best you could with the S&P 500 index at 20 bips. As a teacher, my index fund choices are usually well over 100 bips once you add in the variable annuity insurance wrapper. The 403b market is beyond reform. Any way, great job! Ed

Thanks for the kind words, Ed!

Anything over 1% just seems ridiculously high to me, especially with the way Vanguard and Schwab are both reducing fees more and more each year (some funds have expense ratios as low as .03%).

Good recommendation. I think a lot of retirement plans take advantage of people’s ignorance of the effect of fees on their long-term balance. Honestly, $181 doesn’t sound like much compared to your contributions. But they don’t put into perspective the opportunity cost of those fees not compounding over decades. Total stock market funds are straightforward and simple – exactly what people want from target date funds.

Most people have no clue about the fees, and if they do they don’t seem like a big deal, as you mentioned. 1% doesn’t sound like much, but the key is the compounding over time. Like most people, if you don’t touch your 401(k) contributions until 65 that 1% could easily become tens of thousands of dollars in fees over the years.

What a coincidence. I’m working on a very similar post (work in progress). I have been a victim of target funds for years – because I was too nervous trusting myself to my primarily retirement fund. But very recently I’ve moved away from it and, fortunately, my organization offers several vanguard index funds from small, mid, int’l and large cap. So I allocated my existing balance and all future contributions there. People should know how much they can save 🙂

Like I said, target date funds aren’t the worst investment choice one could possibly make, but there’s certainly better alternatives if you do your research. Nice job moving into some simple index funds, that choice will benefit you for many years into the future 🙂