Your savings rate is the number one factor that determines when you will be financially independent. But in order to actually calculate how long it will take to achieve financial independence you have to make some assumptions.

(Just as a heads up, I am defining financial independence as having 25 times your annual expenses.)

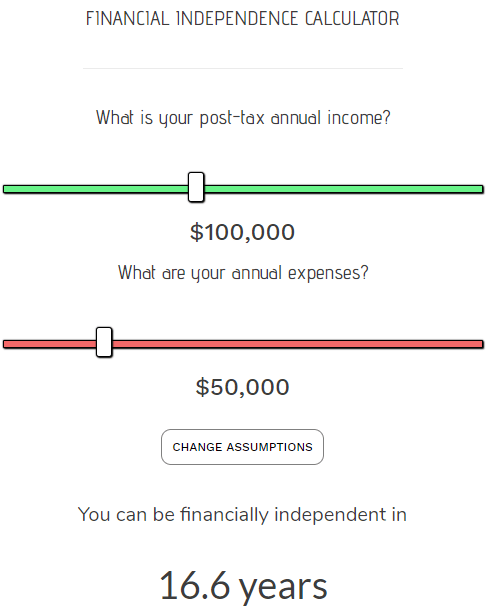

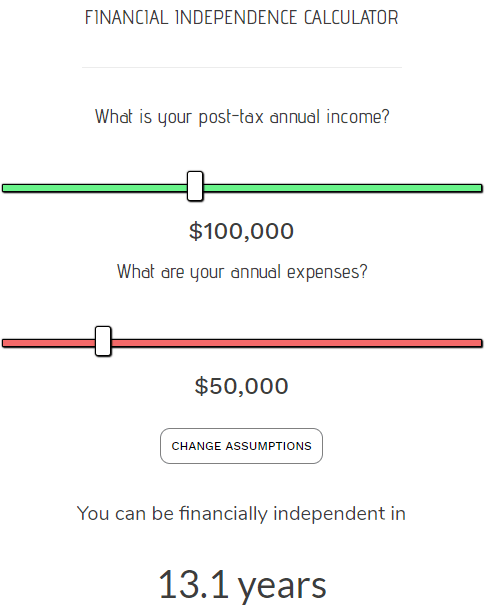

For example, using the F.I. calculator we can see that someone who saves 50% of their income can achieve F.I. in 16.6 years assuming they earn a 5% annual return on their investments:

But what if we change the assumptions of the calculator and say we actually earn a 7% annual return on our investments?

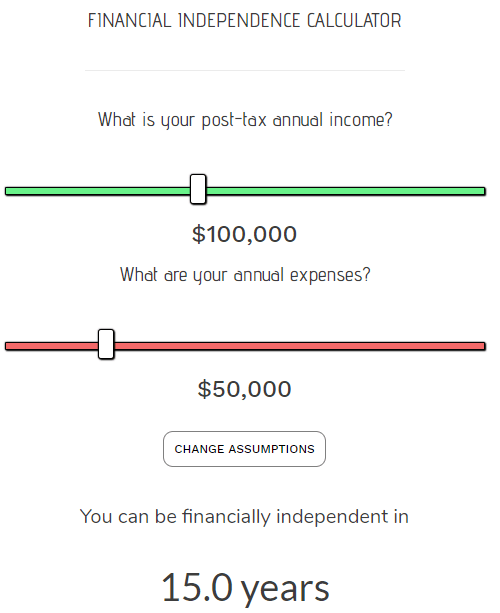

Now suddenly it will only take 15 years to reach financial independence:

But what if we become even more optimistic and instead assume we’ll earn 10% annual returns on our investments?

This would allow us to achieve F.I. in just 13.1 years!

Clearly investment returns can make a difference. And while it’s difficult to predict what investment returns will be in the future, there is something we know for certain: the exact investment returns of the past.

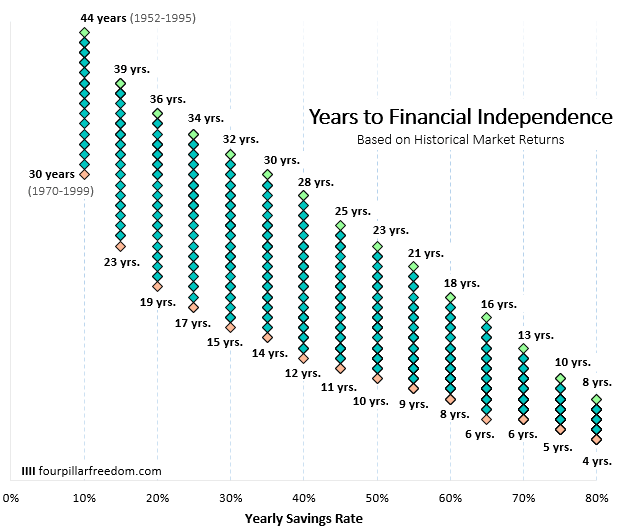

I went back and used the inflation-adjusted yearly returns of the S&P 500 since 1950 to calculate exactly how long it would have taken to reach financial independence based on various savings rates.

Here’s the result:

How to interpret this chart: The green and red diamonds represents the longest and shortest amount of time it would have taken to achieve F.I. respectively for each savings rate. The blue diamonds represent every other unique amount of time it would have taken to achieve F.I.

An Example: With a 10% savings rate, the longest amount of time it would have taken to achieve financial independence would have been 44 years (from 1952 to 1995). On the flip side, the shortest amount of time it would have taken to achieve F.I. would have been 30 years (from 1970 to 1999).

NOTE: This chart assumes every dollar you saved was invested specifically in the S&P 500.

Some Interesting Observations

- The higher your savings rate, the less variation in the amount of time it takes to reach F.I. This is because when you have a high savings rate, a higher portion of your net worth is composed of savings instead of investment returns.

- The higher your savings rate, the less you actually have to worry about investment returns impacting your financial independence date.

- With a 20% savings rate, the difference between the longest and short amount of time to F.I. was an unbelievable 17 years. Moral of the story: When you only save a small percentage of your income, your countdown to F.I. can be at the mercy of the market.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

In a lot of the mainstream articles I read, Financial Advisers say that people should save 10% of their income for retirement. We’d have to do that for ~40 years. Apart from blogs, many don’t talk about how to supercharge savings in order to retire early. I’m wondering if that is on purpose because it may slow down the economy as people would save more, spend less, retire early, and maybe continue to spend less since they’d be so used to the minimalist lifestyle. 🙂

Traditional retirement advice is definitely aimed towards the masses who plan to retire around age 65, but early retirement requires a far higher savings rate. And minimalism is still an underground movement but it seems to becoming more popular every month. It will be interesting to see how widespread it becomes over the years 🙂

I am not stats minded and I stared at it for a hot minute before I figured it out… it’s a graph about stuff!!!

Just kidding :p what I not give to go back to the 70s! Ack! We could be done in 4-8 years.

You nailed it!! So much stuff in this graph 🙂 And you’re right, it’s pretty incredible how soon you can achieve F.I. with a savings rate of at least 70%

So based on past performance, if you reach Financial Independence in under 10 years, save at least 50% of your income. Nice!

That’s right! 50% is the minimum savings rate needed to retire in 10 years or less, and in most cases it actually required a higher savings rate. Good observation 🙂