Your savings rate is the number one factor that determines when you can reach financial independence. But investment returns can play a factor as well.

Most F.I. calculators assume 5-7% annual returns on investments, but we all know that market returns can fluctuate wildly from one year to the next. It’s actually pretty rare for the market to return between 5-7% in any given year.

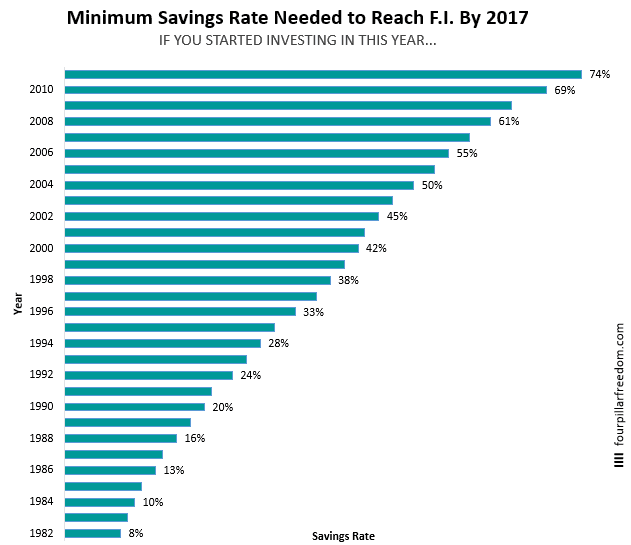

So I was curious, using historical S&P 500 returns, what was the minimum savings rate needed to reach F.I. by 2017 over the last 30 years?

Here’s the results:

How to interpret this graph: If you started with no savings in 1982 and invested 8% of your income each year, you would have had enough money by 2017 to be financially independent.

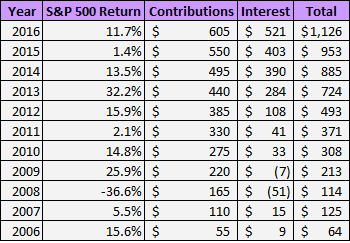

For all you nerds out there, here’s an example of the math behind this graph.

Suppose you started investing in 2006. To keep things simple, pretend your annual income is $100. With a 55% savings rate, you’re saving $55 each year and spending $45 each year. To reach financial independence, you need 25 times your annual expenses. So you need to accumulate $45 * 25 = $1,125.

A 55% savings rate is the minimum savings rate that would have allowed you to reach your mark of $1,125 by the end of 2016.

Some Interesting Observations

- One of the worst times ever to start investing was in 2000. You would have experienced the bursting of the tech bubble, followed by the housing market collapse and yet if you consistently saved 42% or more of your income each year, you still would have reached financial independence by 2017.

- Over long stretches of time, retirement calculators are pretty accurate. For example, if you started investing in 1990 with a 20% savings rate, most retirement calculators would assume a 5-7% annual rate of return and predict that you would reach financial independence in about 30 years. According to actual historical data, it would have taken about 27 years.

- Even if you’re late to the investing game, a high savings rate can allow you to reach F.I. surprisingly quickly. Consider a 40 year old who just started investing in 2004. By investing 50% of her income, she could have reached financial independence by age 53. It’s never too late to start!

Sign up to have my most recent articles sent straight to your email inbox for free ?

[jetpack_subscription_form subscribe_text = “” title=””]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Ha, try convincing people that it is not too late or to start early for retirement planning. No matter how many times I leave flyers on bullentin boards at work and mention IRA’s or 401K’s, coworkers still are naive about the future. Some are in their 30’s and say they don’t have time to think about this. They are in the here and now. Some are in their 40’s and 50’s and think “Well, I didn’t start it before, so why start now”. This is just plain laziness and not wanting to make a lifestyle change.

A few have woken up and have started something. Maybe it starts as a trickle…

I know the feeling, there are several people I work with in their early 30’s who even say they “started too late” to begin to think about financial independence. I think it’s a problem of awareness. Some people just aren’t aware of the math behind savings rates and how a high savings rate = shorter mandatory working life.

I really like this outline… you are right, its never too late to start!

Thanks, Mrs. Adventure Rich 🙂

This is definitely reassuring-even through potential bad market times ahead, investing will still get us to financial independence.

Great message and post!

That’s right! If your savings rate is high enough, you’ll reach F.I. so quickly that your investment returns won’t matter nearly as much as you might think. Thanks for the comment 🙂

It is never too late too start! I like that… It gives us hope.

Indeed – it’s reassuring that no matter how old you are, the best day to get started saving and investing is today. It can make a huge difference in only a decade.

The graphs and charts are like little crystal balls. Not sure why some people continue to ignore, today, what they could be building for the future when they can actually see it.

Thanks for sharing, Zach.

I think visualizations can sometimes convey a message better than words can – I’m glad you liked the charts! And you’re right, most people simply don’t prioritize saving, but for those of us who do the benefits are incredible. Saving money = gaining freedom.

Thanks for the feedback 🙂

Thanks for sharing Zach! I really appreciate that you used actual data on returns instead of just putting an assumed rate of return into the calculator.

I used actual data mainly because I was curious if the assumptions used by retirement calculators were accurate according to historical data, and unsurprisingly they’re pretty accurate over long stretches of time. It’s also interesting to see how a high savings rate is the cure for a late start to the investing game. Thanks for the comment, John 🙂

Wow only 10 years to reach FI that’s amazing. Putting in the effort here and now can create a lifetime of freedom to do what you want. It’s really true in order to gain something, you need to be willing to lose something too. Nice!

Thanks, SMM! Just goes to show that a high savings rate is far more important than investment returns in the short run.