The biggest mistake I made when I first discovered the field of personal finance was thinking that I needed to become an investment guru to make my net worth climb as fast as possible. I thought if I could just piece together the perfect stock portfolio that I could outperform the market and reach financial independence infinitely faster.

I was sorely mistaken.

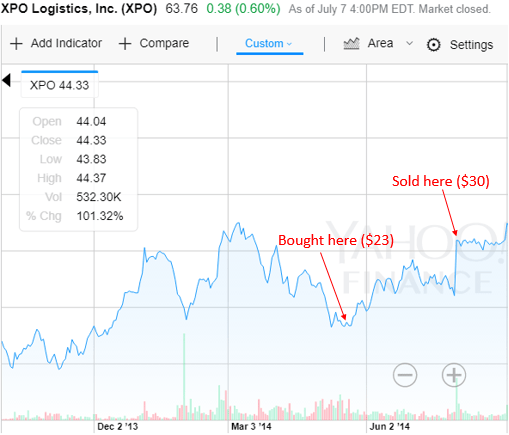

One of the first stocks I ever bought in my early years of college was XPO Logistics. I bought shares in May 2014 at $23 and promptly sold two months later at $30. In only two months I had made a 30% return on my investment! Impeccable.

Was I destined to be the next Warren Buffett? Hardly.

At the time, I was using TD Ameritrade as my online broker (I have since wised up and switched to Vanguard), so I spent $10 to buy the stock and $10 to sell. On top of this, I only invested $500 total and had to pay short term capital gains tax since I held the stock for less than a year. So my actual return was:

$650 (total with capital gains) – $20 (trading fees) – $22.50 (short term capital gains tax) = $607.50

Percentage return: (607.50 – 500) / 500 = 21.5%

Dollar return: $107.50

I still walked away with a 21.5% total return on my investment, which is impressive for only two months.

But this illustrates the biggest problem with investing while young: even with amazing returns, I didn’t have enough capital invested to make the investment worthwhile.

Consider an even more extreme scenario. What if I had invested 10 times this amount? If I had instead invested $5,000, my total dollar return would have been $1,075. That’s still not a life changing amount of money. And most college students don’t even have an extra $5,000 laying around to invest.

It’s All About Earnings

So if you’re not trying to be the next Warren Buffett or Charlie Munger, where should you focus your energy?

On increasing your earnings!

20-somethings should focus on becoming income machines. This means learning new skills, gaining work experience, and finding ways to make people pay you for your knowledge.

This could mean learning Excel, PowerPoint, or a programming language. It could be improving your writing skills to pick up freelance writing gigs, or maybe learning a niche subject to tutor. Or it could be babysitting, mowing lawns, or dog sitting. The more skills and experience you acquire, the more money you can earn. The more money you earn, the more you’ll have to invest.

With my side hustle of statistics tutoring I could earn close to $10,000 this year alone. If I was trying to bring in this same amount with a dividend income portfolio I would need around $300,000. Or if I invested my entire net worth of $43,000 I would need outrageous 25% returns to earn close to $10,000.

Cake first. Then Icing.

When you’re young, income is the cake. Investing is just the icing. Focus on building a massive cake before even thinking about the icing.

Sometimes constructing the cake can be ugly. When you first start out, learning new skills and getting people to pay you for your skill set can be difficult. You’ll feel incompetent when you first start learning a new programming language. Or write for the first time. Or attempt to find clients.

The first time I ever tutored someone I literally drove 25 minutes to meet them at a library and tutored them for two hours for free just to get my foot in the door. Later I made people meet me at a place closer to my home. Eventually I became more savvy and figured out how to tutor from the comfort of my own home on my laptop.

When you first try to increase your income you’ll make all sorts of mistakes, but it’s the only way to learn. Over time, you’ll figure out how to optimize your side hustles and learn to command more money for your time. I’m sure I’ll figure out ways to earn even more money through tutoring with even less work.

I also recently switched jobs to garner a 50% higher salary. Instead of looking for ways to increase my investment returns, I just found a way to increase my earnings.

I no longer obsess over reading every investing book I can find at Barnes & Noble. That’s just icing. Instead, I’m finding ways to earn more money through both my day job and my side hustling.

Become an Income Machine

As I get older and my net worth grows, investment returns will start to contribute more and more to my net worth. But just starting out, it’s all about income. I’m focusing on building my skill set, on how I can get people to pay me more money for my skills. I need to build up a decent lump of cash before my investment returns can even begin to matter. A high income with average investing returns will always beat a low income with phenomenal investing returns.

Related: One of the easiest ways to increase your income through flipping items for profit.

My personal strategy for wealth accumulation is simple: Increase my income as much as possible and throw a huge chunk of it in index funds. This lets me focus most of my energy on earning money while I’m young and keeps my investing strategy nice and simple. This isn’t a fancy strategy, but it will work beautifully over time.

When I first started out, I had it completely backward. I ignored income and focused entirely on investing. Now I focus almost entirely on income and only give investing a little attention when I need to. I used to check Vanguard frequently to keep a close eye on my investments. Now I check PayPal frequently to make sure I’m getting paid by my tutoring clients. This approach to wealth accumulation is so much more effective.

To all the young people out there looking to get rich: become an income machine, not an investment guru.

Sign up to have my most recent articles sent straight to your email inbox for free ?

[jetpack_subscription_form subscribe_text = “” title=””]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great advice! Increasing income is a more reliable skill, plus it has both short and long term benefits!

Agreed, increasing income is far more reliable because it’s something you can actually directly control. Investing returns are far less controllable, especially in the short term.

I don’t think there’s anything wrong with getting started early with investments. But it helps tremendously to boost your income. It can be used to pay off debt, build an emergency fund, and then invested. But it’s much easier to invest when you have a higher cash flow!

I definitely think investing plays a role in wealth accumulation, but for young people just getting started out, it shouldn’t be their primary focus. It should be all about generating income when you’re young.

Thanks for the feedback 🙂

I really like this concept, especially the cake in the icing analogy! It really pays off to invest in increased income so that you have more available resources to invest going forward.

Exactly! Investing becomes so much more powerful when you actually have a significant amount of money to invest 🙂

When I started my ROTH two years ago, I obsessed about what funds/ETFs to choose. I put a ton of stress on myself that was completely unnecessary, but I didnt know that at the tim . It was a fantastic learning experience though and led me to find many of the FIRE and personal finance blogs that I still frequent today.

Speaking of sucking at side hustles, just Saturday I drove my neighbors 30 year old John Deere into a creek while mowing is 8 acre property! I’ve been cutting his lawn and doing landscaping on the side for almost 5 years now, so I guess you never truly master the hustle. Hahaha

Great analogy, and you are right.

Now that we are a little “older” (early 40), we switched our focus to having the life we want. We are late starters on the FI journey.

You are 20 something and know a lot more than me. I am sure you will make it big someday.

I appreciate the kind words, Subbu! 🙂