To invest in the stock market, you have two options: actively invest or passively invest.

Active investing involves buying and selling individual stocks in an attempt to beat the market. Or more commonly this means paying a mutual fund to actively invest your money for you. Passive investing involves buying an index fund that holds all the stocks available in the market and holding this fund for a long time.

To someone who is unfamiliar with the stock market, they might think active investing sounds like a better idea – why buy an index fund when you can simply pick individual stocks you’re confident will outperform the market?

But it has been shown that very few actively managed funds are able to outperform the market. In fact, simply buying an index fund that tracks the entire stock market will almost always outperform an actively managed fund in the long term.

A great example of this is when Warren Buffett famously made a bet ten years ago that a S&P 500 index fund would outperform any actively managed fund over a 10-year period. Over the course of the 10 years, the S&P 500 index fund easily crushed all other actively managed funds in the competition, further proving the point that passive investing is superior to active investing over the long term.

But what makes it so difficult to outperform a passive index fund?

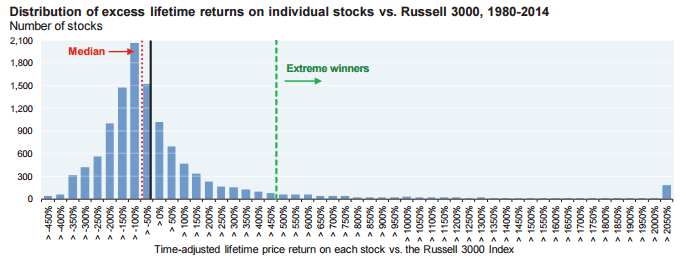

The answer to this comes from a fascinating discovery made in a 2014 paper by J.P. Morgan which revealed that the majority of investing returns actually come from a small group of stocks in the market. Researchers went all the way back to 1980 and looked at stock returns for all stocks that have been in the Russell 3000 (an index that tracks the entire stock market) and compared them to the market average:

Two thirds of all stocks under-performed the market average during this time period, while a select few “extreme winners” (about 7% of stocks) beat the average return by more than two standard deviations.

This illustrates an important point: Most actively managed funds were highly unlikely to pick only the extreme winners, but an index fund would have held all these extreme winners simply because it holds all the stocks in the market. This helps explain why index funds have a tendency to outperform. They will always have the extreme winners in their portfolio, while very few of the actively managed funds will.

Thought Experiment

Consider this simple example to illustrate why index funds outperform most actively managed funds:

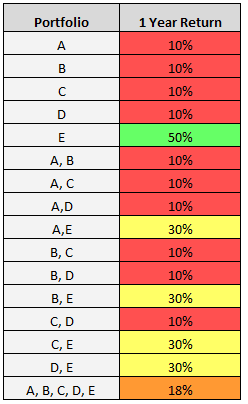

Suppose there are only five stocks in the universe. Based on the study I mentioned earlier, we know that most of these stocks will under-perform compared to the market average, while a small minority will turn out to be “extreme winners”.

Suppose four of the stocks (we’ll call them stocks A, B, C, and D) have a 1 year return of 10% while the fifth stock (stock E) is the extreme winner with a return of 50%. Next, we consider all the possible one stock and two stock portfolios that could be made based on these five stocks and their corresponding 1 year return:

The last portfolio containing all five stocks represents the index fund, which holds all the stocks in the market. All the other portfolios represent the actively managed funds, which attempt to pick a smaller group of individual stocks from the entire market. The 1 year return is just the average of the stock returns in the portfolio.

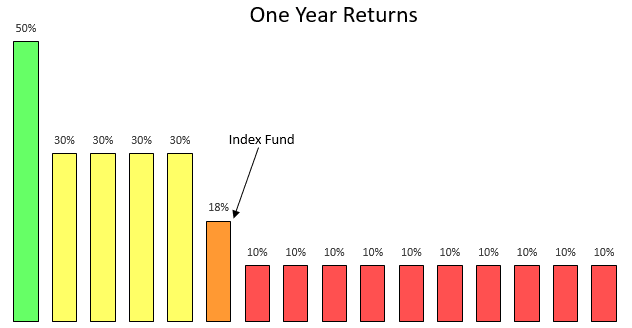

We can see that the index fund beats 10 out of the 15 actively managed funds. Here’s a graph of the one year returns for each fund:

Two thirds of the actively managed funds were beat by the index fund, which confirms the findings of the research study by J.P. Morgan: since only a small group of stocks account for most investing returns, very few actively managed funds are likely to pick these stocks.

In our example, our index fund held the extreme winner stock E, but most of the actively managed funds did not. Simply having this one stock allowed the index fund to outperform two-thirds of all the funds. This is the beauty of index fund investing – you don’t need to spend hours researching to find the next Netflix. When you hold all possible stocks in the market you’re guaranteed to own Netflix.

Of course it’s possible for actively managed funds to beat the returns of an index fund over the course of one year, but the odds are not in their favor. Picking the “extreme winners” is extremely difficult even for the “professionals”.

Conclusion

If you’re still not convinced that index fund investing is superior, consider the fact that there are far more fees and expenses associated with active investing:

- Each time you buy and sell a stock, you pay a trading fee

- Each time you sell a stock for a profit, you pay a capital gains tax

- If you invest in an actively managed fund, you pay a much higher management fee

This means even if you do find an actively managed fund that can match the returns of an index fund, you’ll still lose because of all the fees and expenses.

If you’re looking to be a savvy investor, keep things simple. Investing in index funds will allow you to beat most actively managed funds.

I strongly suggest using free financial tools like Personal Capital to track your net worth, spending habits, and cash flow to help keep an eye on your money. The more you track your finances, the better you get at growing your wealth!

You can also sign up to have my most recent articles sent straight to your email inbox for free

[smlsubform]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I’m a big fan of index fund investing as well. It frees up a lot of time as well to be able to focus on life and not money :).

I completely agree – aside from index fund investing outperforming active funds, it’s also the most stress-free way to invest 🙂

Index Funds = Winning!

I love investing in and writing about Index Funds. I hate that when I was an advisor most people only wanted to pick single stocks (ex: penny stocks) or more complicated investments like futures/options. They thought they could pick the next Amazon or Google. Their hope of winning the stock lottery and emotion got in the way of good ‘boring’ investing.

I am glad to see index funds starting to take hold for the average person. Warren Buffett even commented many ties that large endowments and pensions should just hold index funds, and he says they never listen to him….

Thanks for the graphic and article!

I think the main reason people don’t use index funds is because they seem so simple…too simple. It’s hard to believe that such a simple investing strategy can perform so well over time but it does. I agree, index funds for the win 🙂

I agree that index investing is the best path. I’ve retained ~90% of my investments in Vanguard funds for over a decade with no regrets. And I also make it a point to just leave things be (already 100% stocks) with the exception of occasional tax-loss harvesting where I switch assets from one similar vehicle to another (ex, European int’l fund to Global int’l fund). Having said, I do occasionally purchase individual stocks. It’s not something I recommend to others though. It has taken me over a decade working in finance and studying others work to develop an adequate skill set to screen what matters and what doesn’t in 10-Ks and 10-Q, as well as learning to accept the fact that you can only see a sliver of any information and have no idea what the future will bring. But, over stretches of years and many inconclusive analysis, I’ll occasionally stumble upon a nice business that I can understand (rarely tech, mostly industrials) and which has been hammered for reasons attributed to market panic. I’m not trying to pick from indexes, just picking off the rare opportunistic spot where I believe the upside will far outweigh further downside over the course of many years. That strategy has worked out very well. Better than had I put that same $ in my indexes. However, it’s important to note that this is not comparable to the indexing I do or even to active mutual fund managers. I will often go years without finding something that fits the bill. In the interim, cash flow continues to come in from my job and has to go somewhere. So most of my money continues to go into Vanguard index funds. All around, the combined strategy has been very lucrative. And fun!

HBFI, I think your individual stock picking is reasonable since it seems to only be a small percentage of your portfolio and you hold these stocks for an extended period of time. I admit I also like to keep my eye out for individual stocks on the rare occasion that a company stock I like gets beaten down pretty badly. I think the most important aspect of investing is simply that you have a long-term view and you don’t attempt to jump in and out of stocks often to beat market returns – I think this is generally what leads to poor investor performance. Thanks for the feedback 🙂

It’s hard but not impossible (which is the point that many people miss). I took me years to develop my models to the point that over the long run, they can beat the S&P 500. Of course in the short run it might underperform the S&P, but that doesn’t really matter to me.

I’m getting into index funds too lately. They offer so much more diversification too since you’re invested in soooo much! So if you sell an index fund for a profit, there is no capital gains tax?

You would still have to pay capital gains tax, but if you follow a strategy of buying an index fund and holding it for many years you would only have to pay long term capital gains tax once you sell instead of short term capital gains tax, which are higher. For people who choose to buy and sell stocks frequently they must pay short term capital gains tax if they hold the stock for less than a year. This is what I mean when I say buying and holding an index fund is more tax effective.

Lucid explanation. Add to the graphic the psychology of active trading (selling too soon\late and buying too soon/late) and indexing has an additional edge. As a stock increases/decreases market cap the index fund automatically adjusts the proportion, buying winners and selling losers.

Great point, Rob. Active trading has considerably higher fees and you’re far more likely to sell and buy at inopportune times. No matter which way you slice it, index fund investing has the upper hand.