One of the biggest decisions we have to make in life is to rent or buy a home. Financially speaking, this could be the biggest choice we ever make – and we may have to make it several times in our lifetime.

So how do we typically make this massive decision? More often than not, we compare the financial pros and cons of renting vs. buying.

We consider the total cost of a house over the long run based on the monthly mortgage payment, interest rate, property taxes, expected maintenance costs, and a myriad of other factors.

Then we consider the cost of renting and how much we could earn through investing the money left over each month after paying for rent.

While we can get a general idea on rent costs, the truth of that matter is that the average rent in one place may be completely different than the average rent in another. For instance, if you were looking at the Burnsley hotel apartments in Denver. According to Rent Jungle, the average rent for an apartment in Denver is $1,591. However, in San Francisco, an apartment averages $3,828 per month. To accurately gauge the feasibility of renting, you must first take into account the area in which you plan to rent.

We compare the cost of renting vs. buying over the long term and – wah lah! We have our answer. One choice leaves us better off financially than the other. The New York Times even has an impressive Rent vs. Buy Calculator that shows whether it’s financially smarter to rent or buy, based on a huge list of factors.

And while it’s certainly important to consider the financial implications of this choice, there are two factors that often go unmentioned in the Rent vs. Buy debate: our emotions and our time.

How Much Does Peace of Mind Cost?

Consider the following thought experiment:

Bob currently rents an apartment for $800 per month. He has one roommate he absolutely can’t stand, a landlord who constantly bugs him about something, and tenants in the apartment above him who are obnoxiously loud. Bob hates his current living situation, so he begins to research houses to buy in his area.

After finding a house he loves, he throws in all the appropriate numbers into the Rent vs. Buy calculator and finds out that renting will save him $20,000 over the course of the 10 years he plans to stay in his current city. Financially speaking, even though Bob hates his situation, it is better for him to keep renting for the next 10 years.

But should Bob really continuing living in a situation he hates just because it’s financially smarter?

The real question should be: Is Bob willing to pay a premium of $20,000 to have his own place where he doesn’t have to deal with the headache of an awful roommate, a needy landlord, and obnoxious tenants?

Of course a home may bring its own potential headaches with maintenance and repairs, but to Bob this might be a completely satisfactory trade-off in order for him to have greater peace of mind. And it’s hard to put a price tag on peace of mind.

Bob may be far better off buying than renting, even though this isn’t the optimal financial decision.

This little example illustrates an important concept: sometimes what’s best for us financially isn’t always best for us emotionally.

We should keep in mind that the point of life is to find fulfillment, meaning, and inner peace. If we’re so obsessed with making smart financial choices that we completely ignore the choices that will bring us a greater sense of well-being, we’re missing the point. Making smart financial choices is supposed to increase our happiness, not detract from it.

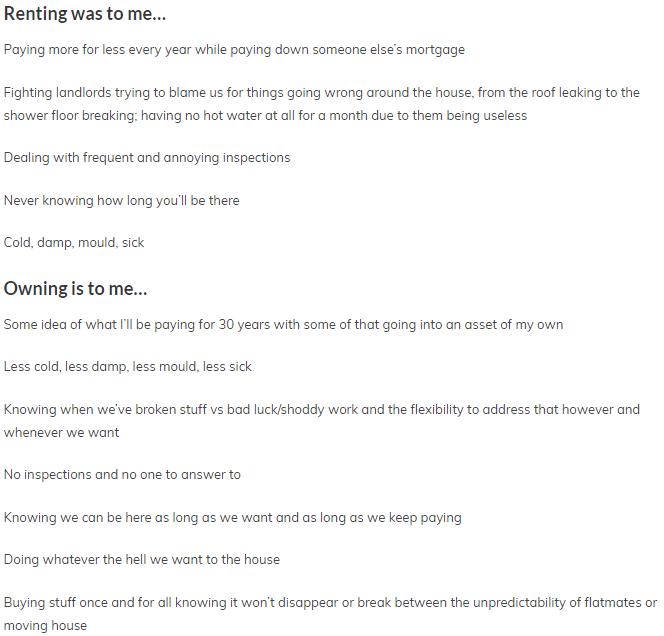

For some people, buying a home simply offers a greater sense of well-being than renting. I recently read an article from NZ Muse in which she outlined all the advantages she experiences from owning a home as opposed to renting. Here’s a snippet from the post:

Clearly the emotional benefits of owning a home far outweigh the cost of renting for her. In her situation, a home offers less stress, more independence, and greater peace of mind. It’s difficult to put a price tag on any of these.

How Much Does Freedom Of Time Cost?

Now suppose Bob has a friend named Owen who lives in a different city. Owen lives in a 3,000 square foot home with a massive backyard. Owen loved the idea of having so much space when he purchased the house, but after only a year of living there he has come to despise all the time he must spend cleaning the house, mowing the lawn, and fixing broken appliances around the house.

He looks for a place to rent and finds a great apartment complex near his house. He then uses the Rent vs. Buy calculator and finds that renting will actually cost him $20,000 more than keeping the home he currently lives in.

So the real question is not whether buying or renting is a financially smarter decision – Owen already knows he will lose money renting. The real question is whether or not he is willing to pay a $20,000 premium in order to gain control of all the time he currently spends maintaining his house.

To Owen, renting might be worth losing money simply because he values his time so much. In his situation, renting would greatly increase his sense of well-being.

For some people, there are benefits that come with renting that are simply worth paying extra for: more flexibility to move, less housework, less yard work, less maintenance, etc.

Conclusion

So while we shouldn’t neglect the financial implications of buying vs. renting, we also shouldn’t neglect the time investment and emotional impact this decision may have on us as well.

Maybe you’re someone who enjoys doing work around the house and making your yard look nice. Or maybe you’re someone who absolutely hates house maintenance and would rather have a landlord take care of the dirty work for you.

Maybe you’re someone who values the independence and sense of privacy that comes with a house. Or maybe you’re someone who isn’t ready to be tied down to one area for several years.

There are no right or wrong preferences when it comes to what you value. What matters is that you consider these personal preferences when making the decision to rent or buy.

Let’s strive to place importance on the emotional impact and the time investment of renting vs. buying before making it a purely mathematical, financial decision.

I strongly suggest using free financial tools like Personal Capital to track your net worth, spending habits, and cash flow to help keep an eye on your money. The more you track your finances, the better you get at growing your wealth!

You can also sign up to have my most recent articles sent straight to your email inbox for free ?

[smlsubform]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

I completely agree with this! The sad thing is (from my experience), there is a lot of outside influence of “oh you’ll save so much more money if you buy than if you rent”. But there are tons of other factors other than financial that go in to making the decision of buying. Couldn’t agree more to your points.

Brandon, exactly! The common argument is that renting is “throwing away your money” but the math behind it just doesn’t support this claim. There are plenty of situations where renting will leave you better off than buying a home. In particular, there are many tiny recurring costs that are associated with owning a home like maintenance, property tax, etc. that people typically fail to account for.

I agree that rent vs own, has to be personal and financial. I HATE renting, but I also wouldn’t overextend myself in a mortgage. I am a real estate investor, so I have bought every property with the intention that it might become an income property for me. That keeps me from getting into financial troubles. 🙂

It sounds like you have found a sweet spot between combining personal and financial considerations into your home buying – you’re aware that you hate renting but you’re also aware that it’s foolish to overextend yourself in a mortgage. Kudos to you!

I completely agree that it isn’t always just about the numbers. Even though house prices are crazy here, I’ll still be buying a home one day so I can raise a family without worrying about the landlord deciding they want to sell, or having to ask to get things fixed (hello my roof is still leaking!). I’ll enjoy the freedom of painting if I wish and if I hate doing yard work the I could consider hiring a contractor to do it for me.

Now I’m rambling…+1 for considering emotions in money decisions

Those are all fantastic points. It sounds like in your unique situation buying a home is a much better choice for many reasons other than financial. Kids are certainly a huge factor to consider when buying a home as well. And you’re right – hiring a contractor is always an option to do work around the house as well, which can making home maintenance a little less stressful and time consuming 🙂

Totally agree that the decision is far more than a calculation. Though I often don’t see people underestimate the cost of ownership in those calculators by missing expenses that are less frequent or apparent (HVAC replacement, various closing costs, various local taxes, etc.). Many people also tend to buy a bigger home than they rent, so it’s not always an apples-to-apples. The financial decision alone also varies greatly by geography. In some areas it is heavily tilted one way or the other. Frankly, I think too many people consider themselves real estate experts. I’m afraid that looking at Trulia doesn’t make one an educated buyer. Personally I think the real estate market is very poorly structured with mostly uneducated buyers and sellers surrounded by agents who are there to push volume for fees, not give you the best deal (Freakonomics did a great chapter on that). I for one don’t know crap about real estate. Talking to friends who do focus on it and are educated confirms it regularly. That doesn’t mean I won’t buy someday, but I’m eyes wide open and fast to admit it.

I have been in my city for ~13 years and despite knowing I would try to stay here when I first arrived, I made the decision to rent. The math I ran estimated that owning would be better if I stayed at least ~10 years. That assumed inflation level increases on housing prices, which in light of the real estate price decline may have been rosy. Regardless of the bubble, in hindsight I’m very happy I rented. I ultimately wanted to retain more flexibility by renting in the event I lost my job. While that never occurred, I realize looking back that my preferences changed over time and I wouldn’t have been satisfied with where/what I would have bought. So I likely would have ended up moving which would have incurred more fees and expenses, thereby negating much of the benefits from ownership.

I’ve lived in numerous places since, which has allowed me to live in different, cool areas of my city. Many of the places I lived are condos that the owner used to inhabit. So they aren’t dumpy places by any stretch. Though I’ve learned you can’t know the kinks in a place by walking through it, you have to live there for a few months to discover the “hidden gems” that all places have to some degree. I also like being able to just call something when things break (happened to the HVAC – pricey stuff). And I’m glad I don’t have to replace floors, windows, or deal with unexpected costs. Cheers on a great post!

HBFI, As always you bring up so many great points. I think your point about renting because you wanted the flexibility is a common reason many people lean towards renting as opposed to buying, especially if you’re unsure of how long you’ll be living in a single location. I definitely agree that the vast majority of people have very little knowledge about how the real estate market truly works, myself included.

I think it’s important to be open to both renting and buying – each has it’s own benefits and drawbacks. It seems so easy for us in the personal finance community to take a headstrong, unwavering stance on one side or the other and we forget that this housing decision impacts more than just our financial well-being.

100% agree that it’s important to avoid taking on dogmatic views, particularly on topics such as this where most of the time there isn’t necessarily a “right answer”. Circumstances vary for everyone and at different times. Like you say, the psychological aspect is every bit as important as the financial.

Thanks for the mention! The equation gets even more complex here in NZ, because the terrible quality of rental housing is a HUGE factor that needs to be accounted for (it’s literally a health issue). I am not exaggerating, there’s lots of coverage about this lately, and I have travelled all around the world and stayed in many average apartments and houses, and have seen first hand the difference. Rents are also climbing at crazy rates, which is another financial factor to think about. Seniors here who don’t own houses and are at the mercy of the rental market find themselves in a really hard place currently, and that is only going to get worse.

Wow, I wasn’t aware the rental housing was actually a health concern, I thought it was just unaffordable. That makes the situation even more complex. Certainly the rent vs. buy debate is different for every location – but for NZ it seems renting can have huge potential downsides.