5 min read

Back in 2012, Mr. Money Mustache took the personal finance world by storm when he revealed the shockingly simple math behind early retirement.

He shared that the amount of time it will take you to reach financial independence is purely dependent on your savings rate – that is, the percentage of your income you save and invest each year.

The higher your savings rate, the faster you can build up a portfolio that can provide enough growth that will allow you to be financially independent indefinitely.

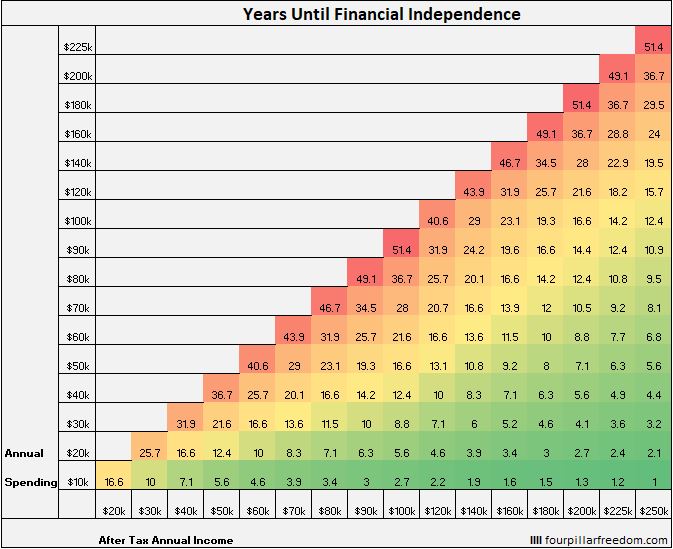

To visualize the numbers behind this idea, I created The Financial Independence Grid – a simple grid that shows how long it will take you to achieve financial independence based on your annual income and spending, using the following assumptions:

- “Financial Independence” is defined as having a portfolio worth 25 times your annual expenses.

- You start with $0 and earn 5% annual investment returns.

- You will withdraw the inflation-adjusted equivalent of 4% of your portfolio each year once you achieve financial independence.

The grid shows that a higher savings rate leads to a shorter path to financial independence.

For example, someone who earns $80k after taxes and spends $40k each year can achieve financial independence in 16.6 years. Conversely, someone who earns $80k after taxes and spends $70k each year will have to work for 46.7 years to hit F.I.

And while using a high savings rate to achieve financial independence in 10-20 years is certainly better than the traditional approach of working 40-50 years before retiring, it still requires a massive time commitment. Even a household that can reach a 40% savings rate will have to work for over 20 years to achieve F.I.

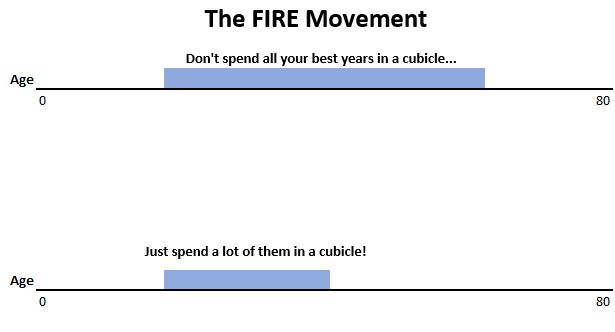

For this reason, I’ve always felt that the FIRE movement has identified the correct problem, but provided a lousy solution:

Problem: Life is too short to spend most of it in a cubicle.

Solution: Spend 10-20 years in a cubicle accumulating 25x annual expenses, and only then give yourself permission to leave.

Fortunately, for anyone who wants to achieve financial independence without sacrificing a couple decades or more in a cubicle, there are two alternative approaches:

Coast FIRE: Accumulate enough money at an early enough age that you no longer need to invest any more to achieve financial independence by age 65 (or whatever age you define as a retirement age).

Barista FIRE: Withdraw 4% of your portfolio each year to cover a percentage of your expenses and work at a job you enjoy (e.g. as a barista) to cover your remaining expenses.

Since I’ve already written about Coast FIRE extensively, I’ll spend the rest of this post explaining the ins and outs of Barista FIRE.

Barista FIRE: A Simple Example

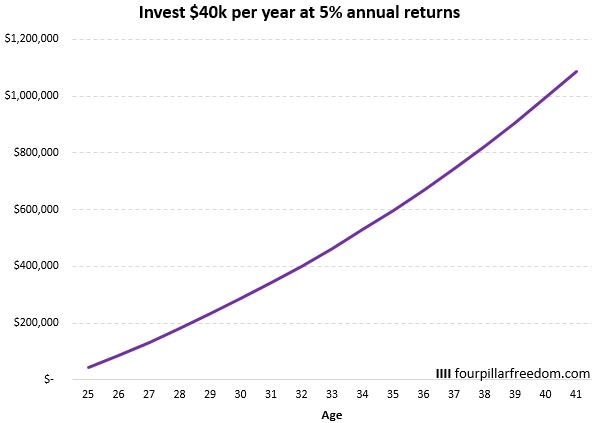

Suppose Jessica spends $40k each year and would like to become financially independent one day by accumulating a portfolio worth $1 million.

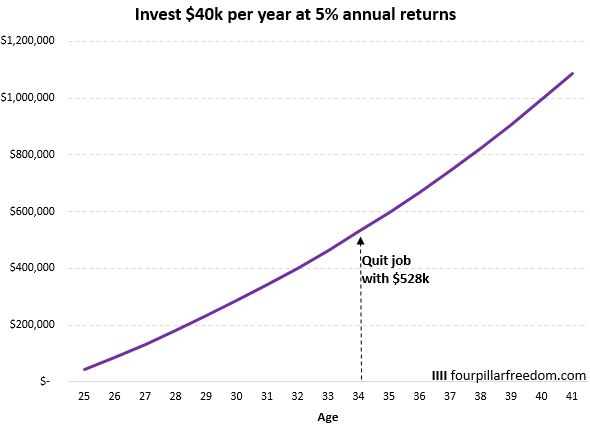

Assume she earns $80k each year after taxes. After spending $40k, she is able to invest $40k each year. Starting from age 25, she would be able to hit $1 million by age 41:

This approach certainly beats working until age 65, but it requires committing to a full-time job during all of her late twenties and the entirety of her thirties.

If she happens to work at a job that she loves, this might not be a bad approach. Unfortunately, data shows that most people don’t love their jobs and only 20% feel very passionate about their work.

If Jessica falls among the 80% of individuals who aren’t very passionate about their work, she may want to transition to a different work situation much sooner than age 41.

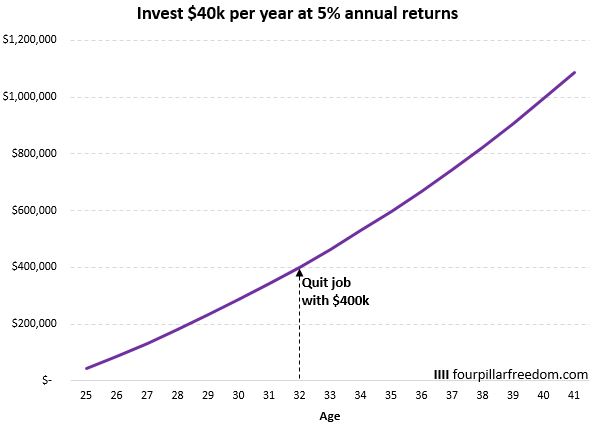

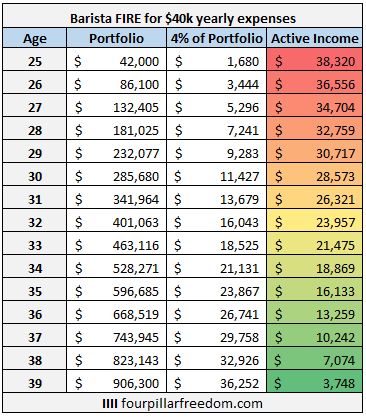

Using the Barista FIRE approach, she could do so. For example, suppose she quits her day job at age 32, after building a portfolio worth roughly $400k. She could withdraw 4% of her portfolio each year, which would cover $16,000 of her yearly expenses. She would then need to generate just $24,000 per year through active work to cover her remaining expenses.

Or, if she waits until age 34 to quit then she would have a portfolio worth $528k. By withdraw 4% of her portfolio each year, she could cover about $21,000 of her yearly expenses and would need to earn just $19,000 per year to cover her remaining expenses.

Obviously the longer she stays at her job, the higher her portfolio value will be once she quits. The following table shows how much her portfolio would be worth at various ages along with how much she would need to generate in active income if she quit her day job at those ages:

While an $80k-per-year job might come with a significant amount of stress, she could likely find a part-time job, a low-stress full-time job, or a freelance gig where she could earn a fraction of that per year doing something she actually enjoys.

By using this approach, she could quit her full-time job and enjoy much more freedom in her daily life long before she achieves financial independence. Best of all, by only withdrawing 4% of her portfolio each year, there’s a high probability that she will never deplete her portfolio.

Things to Keep in Mind

If you do choose to pursue Barista FIRE, keep the following things in mind:

1. You have to strike a balance between sticking it out at your job to build your portfolio and leaving sooner to gain freedom.

The longer you remain at your job, the higher your portfolio value will be when you quit, which means you’ll have to earn less money through active work to cover your remaining expenses.

If your job is soul-sucking, it may make sense to leave sooner rather than later. On the other hand, if you enjoy your day job and you have a healthy work environment, it may make sense to stick it out longer to build up your portfolio.

2. If you want to achieve complete financial independence at some point, you’ll need to earn more than just “enough” from your barista-type gig.

In our example from earlier, Jessica could quit her day job with $400k and withdraw $16,000 from her portfolio each year while earning just $24,000 to cover her yearly expenses.

However, she would need to earn more than $24,000 per year if she slowly wants to add to her portfolio each year so that it could eventually grow to a point where it could cover all over her expenses.

The Best Barista Fire Jobs

The term Barista FIRE became popularized when it became known that Starbucks offers a corporate healthcare plan for part-time employees. By working around 20 hours per week, employees can qualify for a healthcare plan that is typically much cheaper than one they could find on the open market, which made barista gigs appealing to many people looking for a simple part-time job.

Depending on your interests, though, there are tons of different barista FIRE-type jobs that you pursue. Here are a few:

Tutors: You can make $50 per hour or more tutoring students in specific subjects that you have knowledge in. This could be in any field like music lessons, astrophysics, statistics, foreign languages, programming languages, etc.

Part-time gigs: You could work part-time as a barista to earn healthcare benefits, part-time at a ski resort or golf course to earn discount tickets and admission, part-time at a botanical garden just to enjoy time outdoors in nature, part-time at a home improvement store to earn discounts on supplies, etc.

Seasonal gigs: You could work seasonal gigs like being an usher at sports games to get discount tickets or dress up as a Santa Clause during the winter months to earn extra cash at holiday-themed events.

Side hustles: You could do a number of different side hustles including food delivery services, Uber driving, electric scooter charging, Ebay item-flipping, etc.

Conclusion

It’s certainly possible for some people to actually save 70% of their income each year working at a job they don’t despise and achieve financial independence from scratch in under a decade.

Unfortunately, these people are outliers. Most people don’t love their jobs and the thought of sticking it out for a couple decades or more to achieve F.I. just isn’t appealing. For these people, Barista FIRE offers an approach that allows them to gain freedom much sooner in life.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.