5 min read

“As credit markets regain their footing and investor confidence rebounds, equity valuations should improve in 2008, allowing the bull market to continue.”

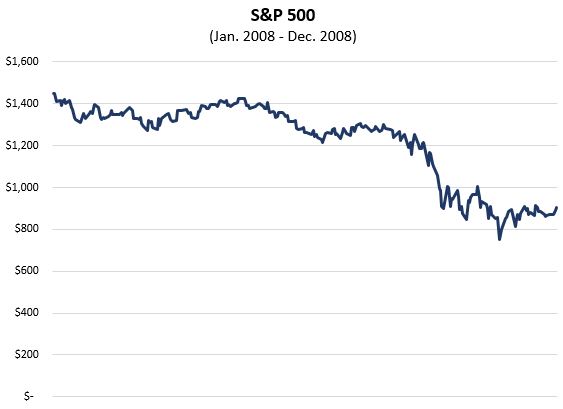

That’s a snippet taken from a Business Wire article in which Robert C. Doll, Vice Chairman and Chief Investment Officer of Global Equities at BlackRock, famously predicted that U.S. stocks would rally to record highs in 2008.

U.S. stocks went on to shed nearly 40% of their price in the coming 12 months:

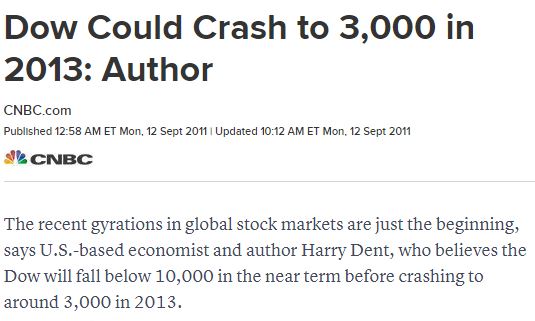

Fast forward three years to 2011. Harry Dent, CEO of the economic research company HS Dent, boldly predicts in a CNBC article that the Dow would drop below 12,000 in the near term before crashing all the way down to 3,000 in 2013.

The Dow soared higher through 2013 and went on to nearly triple in value in the five years that followed.

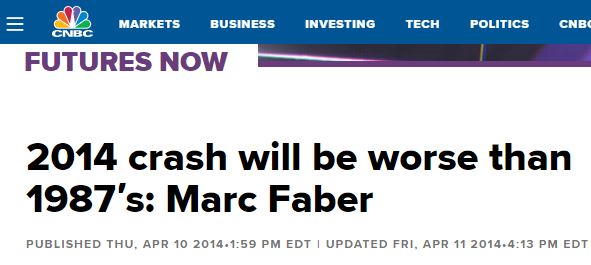

Fast forward to 2014. Renowned Swiss investor Marc Faber goes on CNBC and claims that the coming 2014 crash will be much worse than the sudden crash of 1987.

Needless to say, the 2014 crash never occurred. Stocks actually went on to have an excellent year, gaining over 13%.

Fast forward to 2015. MarketWatch columnist Paul Farrell tells readers to plan on an epic market crash that is reminicent of 1929, 2000, or 2008.

“It’s time to start the countdown to the crash of 2016. No, this is not a prediction of a minor correction. Plan on a 50% crash.”

Once again, another incorrect prediction. Stocks gained over 11% in 2016, followed by another 21% in 2017.

These are just a handful of famous incorrect market predictions that we’ve seen in recent history.

Whether it’s predicting bull or bear markets, most investors (including professionals) are pretty lousy at it. Unfortunately, financial media outlets require attention to earn revenue, so they constantly produce articles that make wild stock market predictions just to reel in pageviews.

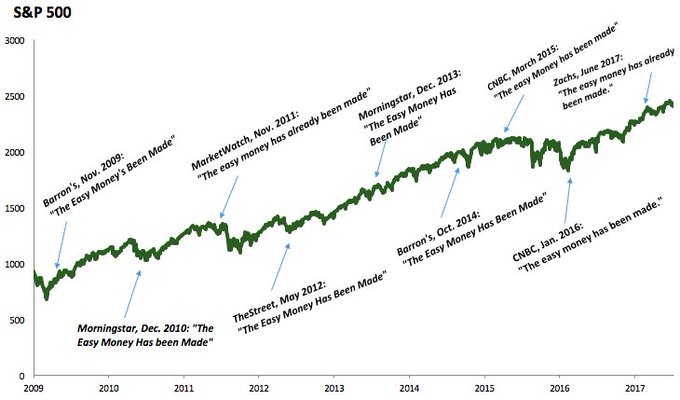

One of my personal favorite phrases that seems to pop up in the news every three to six months is “the easy money has already been made.” Financial writer Morgan Housel once tweeted out the following chart that shows how prevalent (and how wrong) this phrase has been over the years:

These types of headlines cause the average investor to constantly question whether or not now is the right time to invest.

Wouldn’t it be prudent to wait for a crash so that you can invest at lower prices?

Yes, it would! Unfortunately, nobody knows when that crash will come. Not even the “experts,” as the examples above have proven.

Fortunately, you don’t have to be an expert at predicting future stock market behavior to be a successful investor. Instead, you just need to understand two simple ideas:

1. As long as your asset allocation reflects your risk tolerance, you don’t need to attempt to buy and sell stocks at the right times.

2. Buying stocks at all-time highs isn’t as risky as you’d think.

Let’s dig into these two ideas further.

The Importance of Asset Allocation

The whole point of investing money now is to have more money later. And what you invest in is dependent on when you’ll need the money.

While there are many different types of assets you can invest in, two of the most common ones are stocks and bonds. In general, stocks are more volatile and offer higher returns over the long run while bonds are less volatile and offer lower returns over the long run.

Because of this, if you don’t need to touch the money that you invest for several decades, advisors will often tell you to invest a higher percentage of your portfolio in stocks. Conversely, the sooner you will need to access your investments, the higher percentage of your portfolio should be in bonds.

One common rule of thumb used to determine what percentage of your portfolio should be invested in stocks is as follows:

% of portfolio invested in stocks = 100 – your age

So, if you’re 30 years old then you should have 100 – 30 = 70% of your portfolio invested in stocks.

If you want to be a bit more aggressive, you can modify the rule to be 120 – your age. So, a 30-year-old would instead have 120 – 30 = 90% of their portfolio invested in stocks.

The bottom line is that you want your asset allocation to match your risk tolerance.

The only people that should be fearful of a potential market crash are the ones who need to access their investments soon. But these are exactly the people who should have a conservative asset allocation, e.g. a higher percentage of their portfolio invested in less volatile assets like bonds.

The people who should not fear a potential market crash are the ones who don’t need to access their investments for several decades because they have plenty of time for their investments to ride out the crash and soar to higher highs.

So, the way to overcome your fear of a market crash is to simply make sure that your asset allocation reflects when you need to access your investments.

Why Buying Stocks at All-Time Highs Isn’t That Risky

Even for people who understand the logic behind asset allocation, it can still be a bit scary to invest in the stock market when it’s at all-time highs. And because the stock market has a tendency to increase over the long haul, it’s often at new all-time highs.

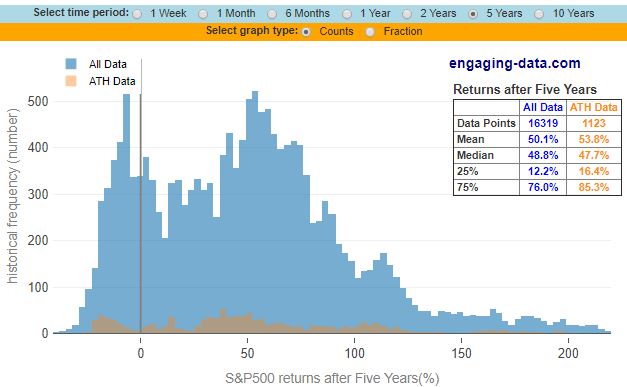

The good news is that historical data tell us that investing at all-time highs isn’t any riskier than investing at any other time. As evidence, check out the interactive data visualization created by Engaging Data that displays the distribution of S&P 500 investment returns when you invest at all-time highs compared to investing on any given day.

The following chart shows the distribution of five-year investment returns for both scenarios:

The box in the top right corner displays some fascinating numbers: The median total five-year return of an investment in the S&P 500 was 47.7% when the investment was made at an all-time high, compared to a median return of 48.8% when the investment was made on any other day. So, there is very little difference in investment returns whether you invest at an all-time high or not.

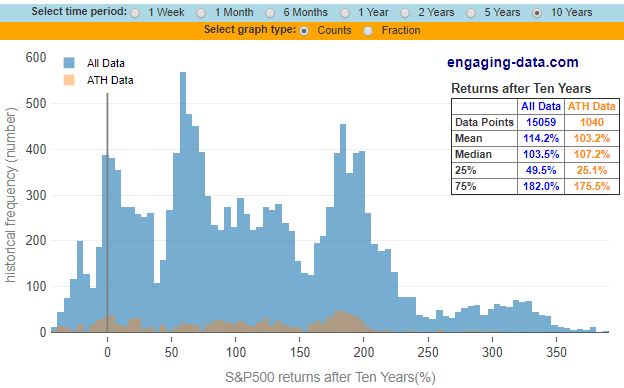

The 10-year investment return distributions tell a similar story:

The median total ten-year return of an investment in the S&P 500 was 107.2% when the investment was made at an all-time high, compared to a median return of 103.5% when the investment was made on any other day.

Even after seeing this data, it’s natural to feel hesitant about investing at all-time highs. One way to combat this hesitation is to set up an automated investment plan that invests a certain amount of money each week into your investment accounts. Over the course of years and decades, this will ensure that you take part in the long-term gains of the market.

If you’re sitting on the sidelines waiting for prices to drop, you could be waiting longer than you think. The data tells us that all-time highs are nothing to be feared because more often than not, all-time highs are followed by more all-time highs.

Conclusion

The answer to the question “Should I buy stocks now?” is basically always yes. The only question you need to answer is what percentage of your portfolio to invest in stocks. In general, the sooner you need to access your investments, the lower this percentage should be.

To eliminate the need to constantly question whether or not you should invest in stocks, simply decide on an asset allocation and set up automated investments that align with this allocation.

Then, spend the rest of your time focusing on things you can control, such as:

Managing your spending: Adopt a frugal (not stingy) mindset and spend exclusively on things that bring you utility or joy. Use tools like Trim, a free financial app that negotiates lower cable, internet, and phone bills with any provider on your behalf.

Increasing your income: Focus on acquiring in-demand skills and along with assets that will allow you to increase your income.

Minimizing investment fees: Ensure that you’re investing in low-fee funds to minimize the amount of money you have to pay in management fees. I personally use the free financial tool Personal Capital because it automatically tracks how much I’m paying in investment fees and even recommends similar alternative funds that I could invest in to lower my total fees.

Resist the urge to time the market, ignore dramatic financial news headlines, and focus on the things you can control. You’ll sleep better at night and you’ll likely end up with better investment returns.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.