6 min read

The Merriam-Webster dictionary defines stingy as:

Stingy: not generous or liberal : sparing or scant in using, giving, or spending

By contrast, frugal is defined as:

Frugal: characterized by or reflecting economy in the use of resources

Both words could be used to describe someone who pauses before spending money, but stingy tends to have a negative connotation while frugal has a more positive one.

In this post, I explore why frugal living is a much better way to achieve your financial goals compared to stingy living.

The Perks of Spending Less

People who are stingy with their money and people who are frugal with their money both have a similar objective: to spend less.

The benefit of spending less is that you’ll have a shorter path to financial independence for two reasons:

1. The less you spend, the more you can save and invest.

2. The less you spend, the less total savings you need to achieve financial independence.

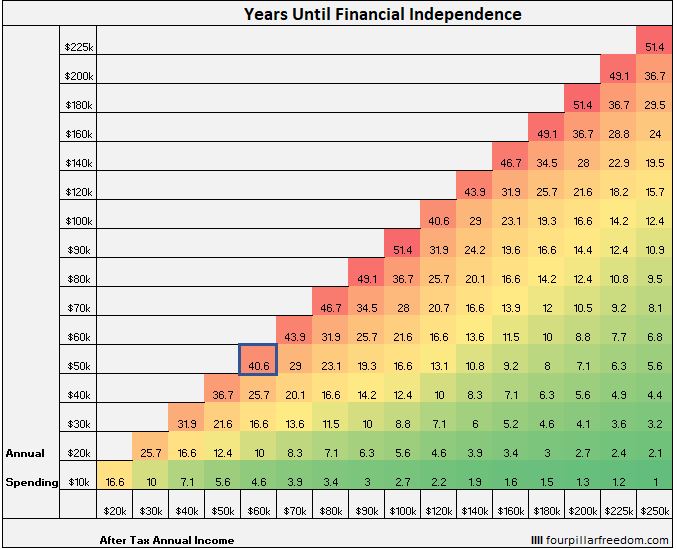

I’ve shared the math behind this several times before, but one more example won’t hurt. Consider a household that earns $60k per year after taxes and spends $50k per year. According to The Financial Independence Grid, it will take them a little over 40 years to achieve financial independence.

Assumptions: The household starts with $0, earns 5% annual investment returns each year, and maintains consistent income and expenses each year.

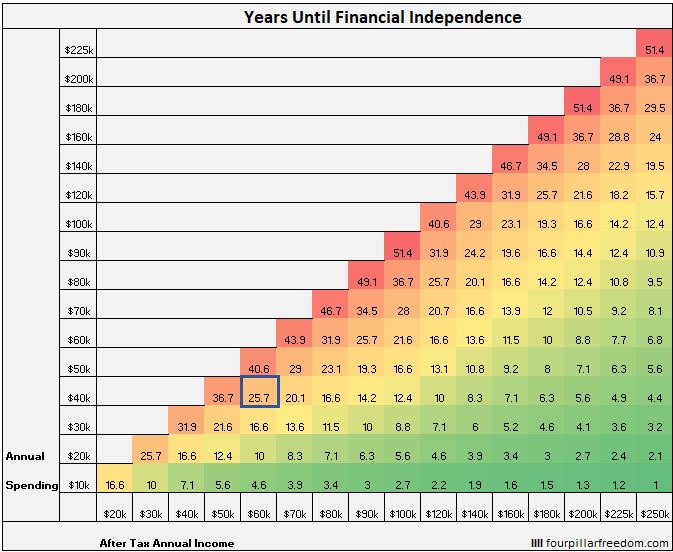

Now consider the same household that earns $60k per year after taxes, but instead spends just $40k per year. Through reducing their annual spending by $10k, they can achieve financial independence a whopping 15 years sooner:

The reason for the massive difference goes back to the two reasons I listed above:

1. The less you spend, the more you can save and invest. Instead of saving and investing just $10k per year, this household can instead invest $20k per year.

2. The less you spend, the less total savings you need to achieve financial independence. Instead of requiring $50k * 25 = $1,250,000 to hit F.I., this household only needs $40k * 25 = $1,000,000.

For these reasons, it’s no wonder why the idea of spending less money is financially appealing.

However, the ways in which you go about spending less are important.

The Fine Line Between Stingy and Frugal

I’ve always liked the way that one Reddit user described the difference between stingy and frugal:

“Stinginess might be when your frugality is to the point that you refuse to take part in basic social activities to save a little money. I would say it is when saving an extra few bucks is more important than making friends or getting to know others. When money is valued over relationships. When you care more about a broken item than the person who bumped into it.”

To be stingy means to prioritize saving money over basically everything else. When your desire to save as much money as possible forces you to turn down dinner with friends, social events, opportunities to travel, and any other activity that entails spending money on things other than the absolute necessities, you’ve arrived at stingy living.

To be stingy means to reduce your spending, even at the expense of reducing your quality of life.

On the other hand, to be frugal is to reduce your spending without reducing your quality of life. A frugal lifestyle is one that optimizes both money and quality of life.

When it comes to the differences being frugal and being stingy, a few categories come to mind:

Dining Out

- A stingy person may decline an invitation to dine out, even at a fairly cheap restaurant, just to save money by eating at home.

- A frugal person may give themselves permission to dine out once per week (or however often is reasonable for you) so that they can enjoy a nice meal with their significant other, friends, or family.

Tipping

- A stingy person may leave a pathetic tip or no tip at all when they do decide to dine out.

- A frugal person realizes that waiters and waitresses have tough jobs and that their livelihood depends on tips, so they’re more likely to leave a respectable tip.

Gifts

- A stingy person is more likely to buy the cheapest gift possible or avoid buying gifts at all for friends and family on special occasions just to save money.

- A frugal person is likely to use sales and discounts when buying a gift, but is still prepared to pay full price for a high quality item.

Social Events

- A stingy person is more likely to turn down invitations to social events just to save money.

- A frugal person realizes that social events (not all, but some) are where many memories are made that can be cherished years later, so they’re more likely to attend.

Quality Items

- A stingy person is more likely to buy the cheapest item possible, even if it is low quality.

- A frugal person is more likely to pay full price for a high quality item, but use it or wear it for years to come to maximize the utility of their purchase.

To Be Frugal is to Prioritize Your Time

One of the biggest advantages of being frugal compared to being stingy is that frugality actually has the potential to save you time.

In this article, Trent Hamm shares a couple excellent examples of how frugality can actually save you time in the long run:

There are many frugal activities that end up paying dividends in both time and money.

For example, if I spend half an hour assembling a smart meal plan based on the grocery flyer and then building a good grocery list based on the meal plan and the contents of my cabinets, I’m trimming at least half an hour off of the time I’m going to be in the grocery store plus I’m drastically reducing the amount of money I’m going to spend in there.

Another example: if I spend fifteen minutes swapping a bunch of light bulbs in our house for LED bulbs, I’m going to make that fifteen minutes back each time an incandescent bulb would have burnt out. Since an LED bulb lasts about twenty times as long as a comparable incandescent, I’m swapping 15 minutes of time now for 15 minutes of time every three months or so for the next few years. Plus, I’m cutting back on our energy use from our light bulbs.

When you choose to be frugal, you choose to save both time and money. Conversely, when you choose to be stingy, you merely choose to save money.

Stingy Living Prioritizes the Wrong Metric

Stingy living prioritizes one metric only: the amount of money you save.

And while this might be the fastest way to achieve your financial goals, it’s not the best way to actually enjoy the path towards your financial goals.

In the example from earlier, we saw how a household that spends $60k per year post-tax and spends $50k per year could shorten their journey to financial independence by 15 years through reducing their annual spending to $40k.

The same household could chop another 9 years off their F.I. journey by reducing their spending to $30k per year. However, reducing it this low might cause their quality of life to decrease since this might entail living in a house far too small for them or cutting out expenses that actually bring them joy.

How to Avoid Stingy Living

There’s one factor that causes people to live stingy more than any other: the idea that reaching a certain level of savings as fast as possible is the best way to maximize happiness.

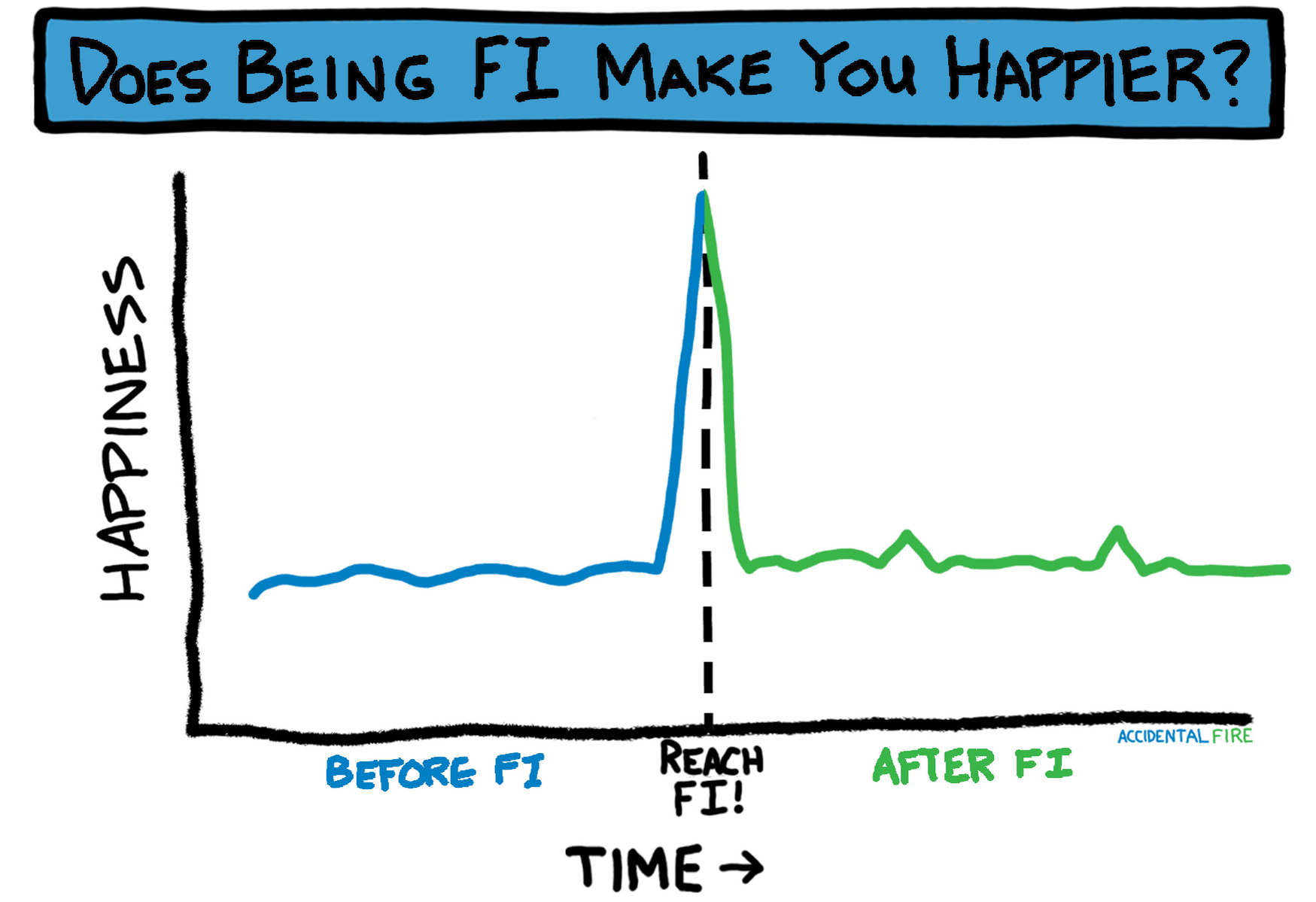

In particular, most people believe that they’ll be permanently happy once they achieve their goal of financial independence. Based on this belief, it makes sense to reduce your spending as much as possible to reach F.I. as fast as possible.

Unfortunately, goals have inherent drawbacks:

- A goal is something that goes away when you hit it.

- When you set a goal, you set it for the person you currently are as opposed to the person you will be when you reach the goal.

- Leading up to a goal, you are in a state of continuous failure since you haven’t reach the point you have defined as “successful.”

For all of these reasons, financial independence will feel great once you hit it, but that feeling will quickly go away and you’ll be forced to figure out how to spend your time in meaningful ways once you have that newfound free time.

This chart from Accidental FIRE illustrates this idea perfectly:

Don’t get me wrong: financial independence is an excellent goal to strive towards. However, perhaps it’s better to take a slow, enjoyable path to financial independence instead of a fast, miserable path.

There’s a name for this strategy: Slow FI. It emphasizes a simple tradeoff: A longer path to F.I. in exchange for a more enjoyable path to F.I. This means that you can give yourself permission to have a lower savings rate so that you can actually enjoy life more on the road to financial independence. Thus, you don’t have to be so uptight with your money. Frugal, yes. Stingy, no.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.