6 min read

Financial independence is typically defined as having 25 times your annual expenses saved up.

So, if you spend $40k per year then you need ($40k * 25) = $1 million to be financially independent.

If you spend $100k per year, then you need ($100k * 25) = $2.5 million to achieve F.I.

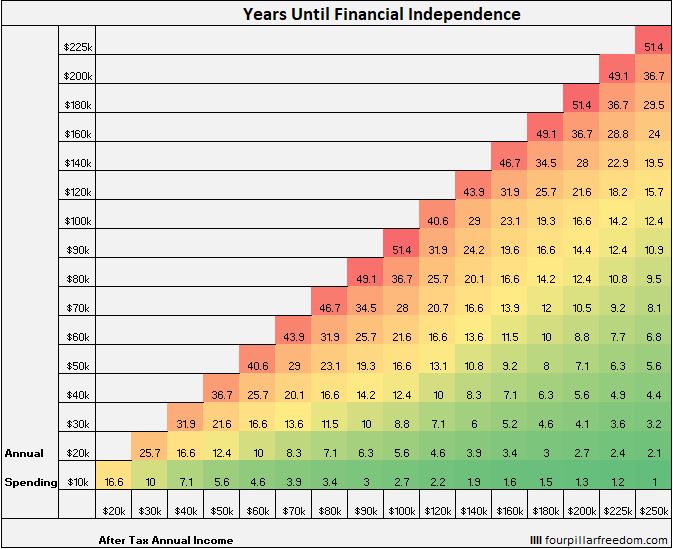

Simple math tells us that the higher your savings rate, the faster you will reach financial independence. To illustrate this, I created the following grid a couple years ago that shows how long it will take to achieve F.I. based on various levels of annual spending and post-tax income:

Note: The grid assumes you start with $0 and earn 5% annual returns.

From the grid you can see that a 50% savings rate (e.g. annual spending of $40k, after tax annual income of $80k) will allow you to achieve F.I. in 16.6 years.

A 60% savings rate (e.g. spending of $40k, income of $100k) will allow you to hit F.I. in 12.4 years.

The higher your savings rate, the shorter your journey to financial independence.

Should You Sprint to Financial Independence?

When I first created the grid shown above, I used a subtle color scheme to emphasize an underlying idea: the smaller numbers on the grid are shown in green while the larger numbers are shown in red.

Since most people associate green with “good,” it’s natural to assume that a shorter path to F.I. = good.

Conversely, since most people associate red with “bad,” it’s assumed that a longer path to F.I. = bad.

However, I’ve recently begun to question this idea. Perhaps it’s better to take a slow, enjoyable path to financial independence instead of a fast, miserable path.

Perhaps it’s better to work at a low-stress job that allows you to leave your work at the office when you physically leave the office.

Perhaps it’s better to work part-time so that you have more free time and flexibility built into your schedule.

Perhaps it’s better to work for yourself, even if that means sacrificing a cushy corporate salary. (This is what I’m doing!)

Granted, low-stress, part-time, and (at least early on) entrepreneurial work often comes with a lower income, which means a longer path to F.I., but maybe that’s okay. After all, if you enjoy the work that you do, then achieving financial independence as fast as possible doesn’t really make sense.

The big idea that I want more people to ponder is this:

Perhaps you should prioritize how enjoyable your journey to financial independence is rather than prioritizing how fast you can get there.

I recently tweeted out my thoughts on this topic:

This idea that it might be best to take a slow, enjoyable journey to F.I. has been given a name by my friends Jessica and Corey from The Fioneers: Slow FI.

In this post, I want to put some numbers around Slow FI.

Putting Some Numbers Around Slow FI

Slow FI emphasizes a simple tradeoff: A longer path to F.I. in exchange for a more enjoyable path to F.I.

When you pursue Slow FI, you typically experience a lower savings rate for two reasons:

1. You give yourself permission to embrace part-time or low-stress work, which typically comes with a lower income.

2. You give yourself permission to spend more on things that bring you joy, whether that means physical possessions, experiences, or a combination of both. (e.g. for me this means more Chipotle, a nice laptop, and more traveling)

But even if you choose to embrace this low savings rate path, odds are that you’d still like to achieve financial independence some day.

So, let’s put some numbers around Slow FI. Specifically, let’s quantify how low your savings rate can be while still allowing you to achieve F.I. some day in the future.

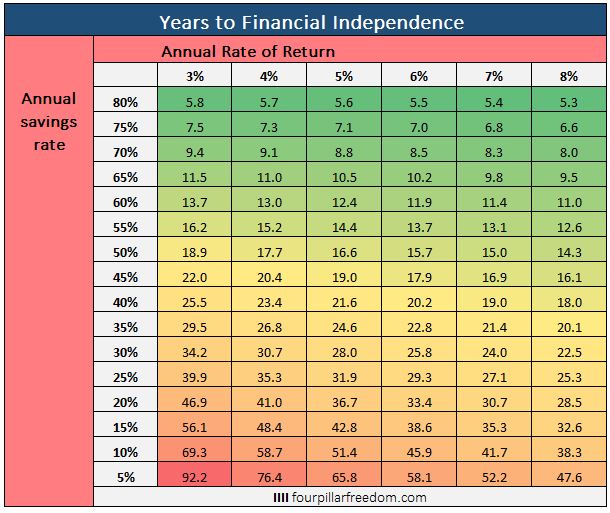

The grid below shows how many years it will take you to achieve financial independence based on your savings rate, assuming you start with $0:

Notice that there does seem to be a limit on how low your savings rate can go while still being able to achieve F.I.

For example, if you only save 5% of your post-tax income each year, then it will take 47.6 years to achieve F.I. even with 8% annual investment returns. And if you don’t start your financial journey until age 25, then you’d be over 72 years old by time you achieve F.I.

So, assuming you start saving in your 20s and you want to embrace a lifestyle with an annual savings rate between 20 to 30 %, you’re looking at a journey of somewhere between 25 to 35 years to financial independence (depending on investment returns):

Depending on what age you start investing at, a journey of 25 to 35 years might be a reasonable amount of time. For example, if you save and invest 30% of your income each year starting at age 20 and earn 6% annual returns, you could hit F.I. by roughly age 45.

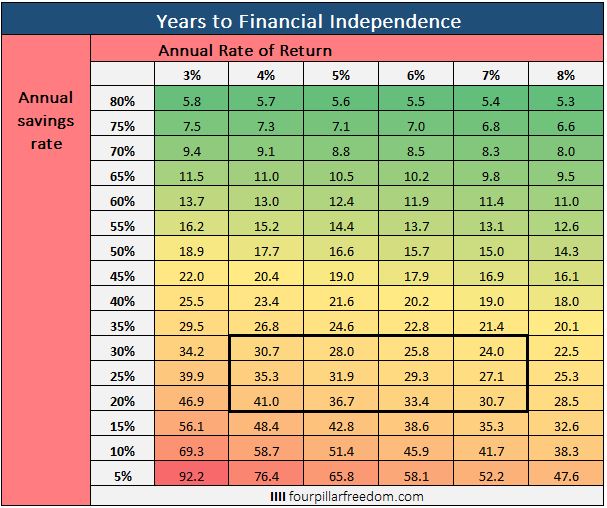

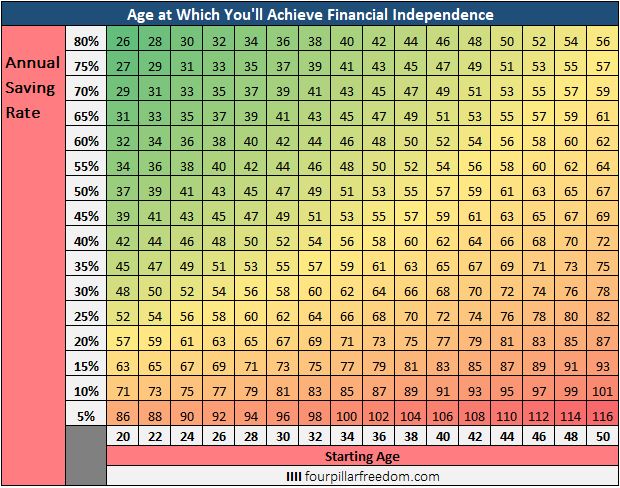

The following grid shows what age you’ll achieve financial independence at based on how old you are when you start along with your annual savings rate:

Note: This grid assumes you start with $0 and earn 5% annual investment returns.

Notice that if you start saving and investing in your early 20s, you can achieve F.I. in your 40s with only a 30-35% annual savings rate.

The older you start, though, the higher your savings rate must be to achieve F.I. before age 50. For example, if you wait until age 30 to start saving and investing, you’ll need a savings rate of at least 45% to hit F.I. by 50.

The Interactive Financial Independence Grid

I had to make some assumptions about your starting net worth and your annual investment returns to create the grids above.

However, the interactive grid below allows you to change the assumptions on your starting amount, your annual returns, and even the definition of “financial independence” (default is set to 25 times annual expenses) to see how many years it will take you to achieve financial independence.

Feel free to change the numbers underneath the pink boxes on the left-hand side of the grid to see how different numbers impact the amount of time it takes to hit F.I.

The Beauty of Slow FI

For those who aren’t aware, the title of this post was inspired by the famous Mr. Money Mustache post The Shockingly Simple Math Behind Early Retirement. In that post, MMM reveals the fact that the amount of time it takes anyone to achieve financial independence comes down to one simple metric: your savings rate.

The higher your savings rate, the shorter your journey to F.I. Thus, it makes sense that people would want to pursue a high savings rate so that they can be financially free as soon as possible.

Unfortunately, for many people it’s simply not feasible to maintain a savings rate of 60%+ and for others it involves holding down a job that, despite offering a high income, makes them miserable and stressed out.

This is why Slow FI is starting to gain popularity throughout the financial blogosphere: More people are beginning to see that it’s possible to have an immense amount of freedom and flexibility in life without being financially independent.

Through trading a high-income, stressful job for a lower income, but more enjoyable work situation, you can begin to enjoy life more today while also inching towards financial independence over the long haul.

Related Posts:

When Work Feels Like Play, Retiring Doesn’t Make Sense

Why I Traded a High Income with Low Growth for a Low Income with High Growth

Life is About Finding Fulfilling Work, Not Saving Up Enough Money to Never Work Again

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.