6 min read

No matter how many personal finance books you read, you’ll always come across the same big idea:

Spend less than you earn.

Invest the difference.

Repeat until wealthy.

To spend less than you earn is pretty straightforward. However, the next step – invest the difference – can be a little more complex.

There are tons of different things you can invest in likes stocks, bonds, REITs, commodities, and more. Even within the “stocks” category there are large-cap stocks, mid-cap stocks, small-cap stocks, micro-cap stocks, growth stocks, value stocks, international stocks, emerging market stocks, and more.

The investment landscape is massive.

On top of this, your coworkers, neighbors, family members, and Jim Cramer might have a tendency to throw unsolicited investment advice your way.

“You should buy Nike, they’re gonna crush it next year!”

“Starbucks is a no-brainer stock to buy.”

“I wouldn’t invest at all in stocks if I were you. The market is too risky!”

“If you buy anything other than Bitcoin, you’re an idiot.”

Given the sheer number of investment options along with the number of different opinions out there, it can be tough to know where to start.

Fortunately, it’s possible to ignore all the noise and look purely at historical market data and professional research to identify the simplest way to invest.

One of my favorite finance books titled Stocks for the Long Run makes a compelling case for buying and holding stocks for several decades. Author and finance professor Jeremy Siegel makes the following points in the book:

- From 1802 to 2012, U.S. stocks averaged a 6.6% annual return, even after inflation.

- During this 200-year stretch, the U.S. economy changed dramatically from an agrarian to an industrial society, went through several major wars, experienced the Great Depression, the tech boom, and most recently the 2008 financial crisis. Despite all of this, stocks marched on to higher highs.

- Investing in stocks has been a winning long-term investment over the years and stocks have outperformed all other asset classes over long periods (30+ years) of time.

- The world is more globalized and connected than ever before, and it’s reasonable to expect that innovation, invention, and advancement will continue to occur. Thus, it’s likely that stocks will continue to deliver long-term returns in the future that are similar to those in the past.

In essence, stocks have turned out to be wonderful long-term investments in the past and are likely to continue to be in the future.

Index Funds for the Win

Once you’re convinced that stocks are a strong-performing asset class over long periods of time, the next step is to simply decide which stocks to invest in.

Should you invest in Apple, Disney, Walmart, Costco, or Visa? Perhaps some lesser-known companies like Varian, Leidos, or Aramark?

Fortunately, you don’t have to sift through the financial statements of thousands of different companies to decide which stocks to invest in. Instead, you can simply invest in stock index funds that hold hundreds or thousands of individual stocks.

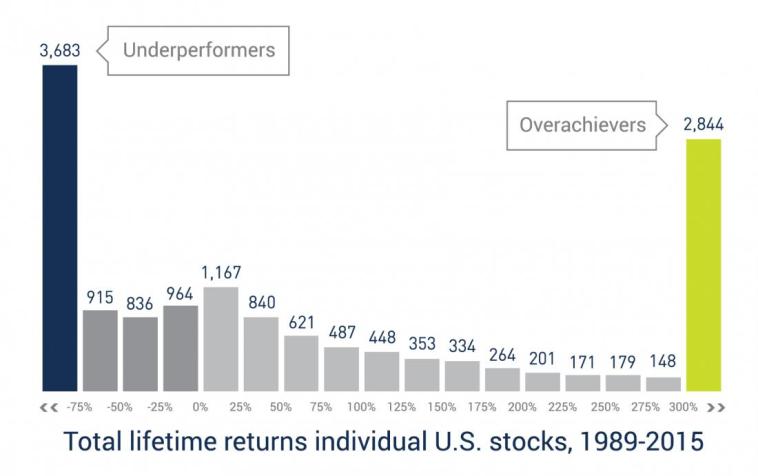

The good news is that index funds tend to outperform individual stocks over the long run. In a fascinating study on stock performance, Longboard Capital Management analyzed the annual returns of 14,500 individual stocks during the period 1989 through 2015.

The key findings from the study illustrate why investing in individual stocks is so risky:

The top-performing 20% of individual stocks accounted for all of the gains; the bottom-performing 80% of stocks provided an aggregate total return of 0%. So, if you failed to invest in the 20% most profitable stocks from 1989 to 2015, your total gain would have been 0%.

Along with the fact that index funds outperform individual stocks over the long run, author and investor Taylor Larimore shares a couple more benefits of investing in index funds in The Bogleheads’ Guide to the Three-Fund Portfolio:

Individual stocks can (and do) go to zero while index funds never have before.

“Unlike mutual funds, individual stocks can plunge to zero. On the 50th birthday of the S&P 500 Index, only 86 of the original 500 companies still remained, showing it is possible to turn a large fortune into a small fortune with individual stocks. On the other hand, it is unheard of for a registered mutual fund to go to zero.”

Index funds minimize how much you pay in management fees.

“To give you an idea of the impact of costs, consider this: If stocks gain an average of 6% annually during the next 30 years, someone who invested $25,000 with a 1% yearly fee will forego more than $35,000 in gains because of the fee – more than the original investment!”

For all of these reasons, index funds make excellent investment vehicles for the average investor. And it turns out that the index fund that will give you maximum diversification for the lowest cost is a total stock market index fund, which is a fund that holds every publicly traded stock in the market.

In particular, one of the most popular total stock market index funds out there is VTSAX – the Vanguard Total Stock Market Index Fund.

In this post, I’ll share the following:

- A brief overview of VTSAX

- A look at the historical performance of VTSAX

- How to buy VTSAX

- How to automate investments in VTSAX

- What to do after you’ve invested in VTSAX

Let’s jump in!

Overview: What is VTSAX?

VTSAX is a total stock market index fund that holds every publicly traded stock in the U.S.

Specifically, it is a Vanguard mutual fund that requires a minimum investment of $3,000 and has an expense ratio of 0.04%. This means that for every $10,000 you invest into the fund, you will pay $4 each year in management expenses.

Because VTSAX holds every individual stock in the United States, it provides diversification across every market sector including:

- Basic Materials

- Consumer Goods

- Consumer Services

- Financials

- Health Care

- Industrials

- Oil & Gas

- Technology

- Telecommunications

- Utilities

This is good news for investors because, as this fascinating chart shows, it’s nearly impossible to predict which stock market sector will perform best from one year to the next

If you don’t have at least $3,000 to invest, you can simply invest in the ETF equivalent VTI that has no minimum investment.

Analyzing the Historical Performance of VTSAX

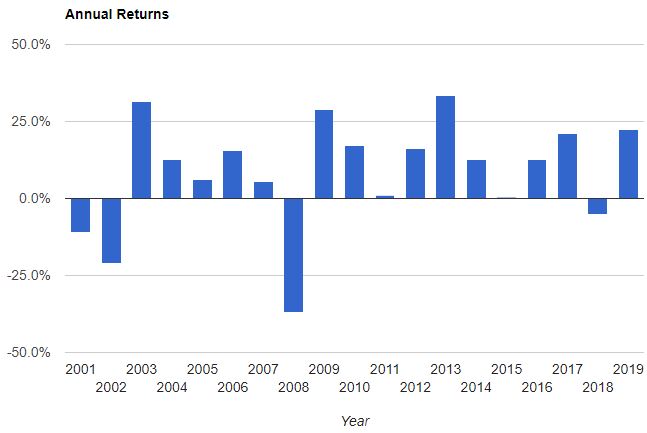

Using Portfolio Visualizer, we can take a look at the annual returns of VTSAX since its inception in 2001:

As shown, VTSAX took a huge hit in the early 2000s when the tech bubble burst, then again in 2008 during the financial crisis, but has since delivered mostly positive returns in the years following the crisis.

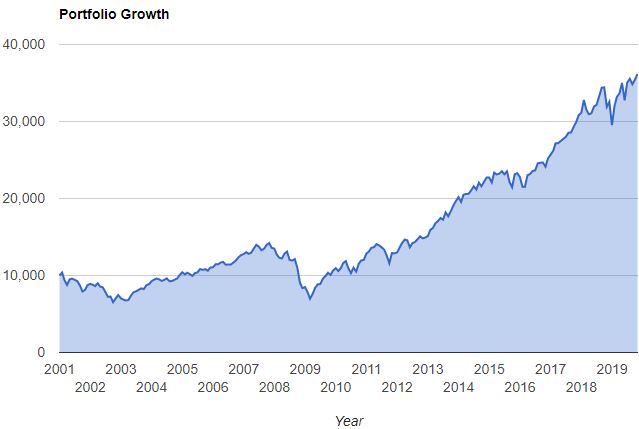

We can also check out how an initial $10,000 investment in VTSAX grew over time since 2001:

A $10,000 investment in 2001 would now be worth roughly $35,000 today.

VTSAX has only been around since 2001, but historical data for the total stock market goes back much further so it’s helpful to see how the total stock market has performed over longer periods of time.

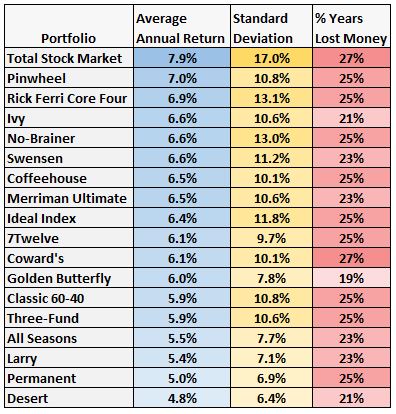

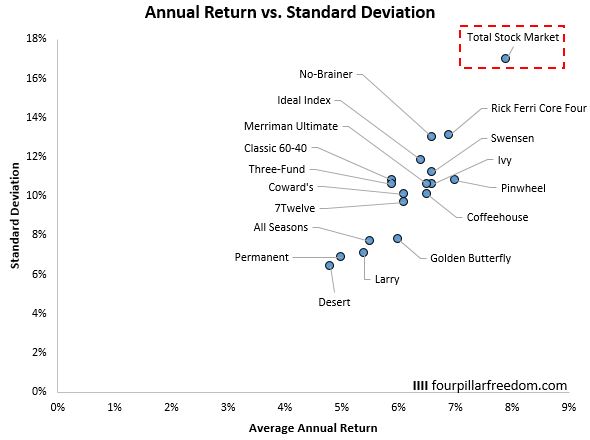

In an older article I looked at the annual returns and volatility of 18 different portfolios since 1970:

A simple plot of the average annual return relative to the average standard deviation shows that a total stock market portfolio has delivered both the highest annual returns and the highest volatility since 1970:

This data lines up with the message preached in Stocks for the Long Run: investing in stocks has been a winning decision in the long-term.

Related: Visualizing the Best & Worst Investment Periods in History

How to Buy VTSAX

To actually buy VTSAX, you’ll first need to set up a free account on Vanguard. This is as simple as choosing a username and password.

Next, you’ll need to purchase at least $3,000 worth of shares in VTSAX. Follow the straightforward instructions that Vanguard provides on this page to do so.

How to Automate Investments in VTSAX

Once you’ve made an initial investment in VTSAX, you can then automate future investments. This is a good idea if you want to invest a specific amount of money on a regular basis. This way you don’t have to remind yourself to invest every so often; you can simply automate the process.

Automating your investments is also a great way to ensure that you don’t attempt to time the market, which is almost a sure-fire way to reduce your investment returns.

To set up recurring automated investments in VTSAX, simply follow the instructions that Vanguard provides on this page.

What to Do After You’ve Invested in VTSAX

After you’ve made your initial investment in VTSAX and automated your future investments, the last step is to do…nothing.

That’s right. Do nothing at all.

Don’t check your account balance every day. Don’t even check it once a week. Probably not even once per month.

The more frequently you check your portfolio, the more likely you are to panic and make an irrational decision whenever the stock market experiences a short-term gyration.

As Dan Egan explains in this article:

It’s a statistical artifact of the stock market that the more frequently you monitor your portfolio, the more likely you are to see a loss since you last looked.

An investor who checks his or her portfolio quarterly instead of daily reduces the chance of seeing a moderate loss (of -2% or more) from 25% to 12%. And that means he or she is less likely to feel emotional stress and/or change allocation.

He uses the following chart to show how the more frequently you log in to check your portfolio, the higher the likelihood that you’ll observe a loss:

And when investors observe losses, they assume that they need to make a change in their portfolio. Unfortunately, this leads to increased trading fees and short-term taxes. Also, as Carl Richards explains in The Behavior Gap, due to fear, greed, and irrationality, most people buy and sell at precisely the worst times and lose money.

The best investment strategy is often the simplest strategy. Purchase a stock market index fund that offers diversification and low fees. Then, automate future investments. Lastly, sit on your hands and do nothing. This is the boring, yet effective path to wealth.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.