4 min read

It’s no secret that investing in stocks is a great way to build wealth over the course of several decades. However, it’s important to note that investing in individual stocks can be quite risky.

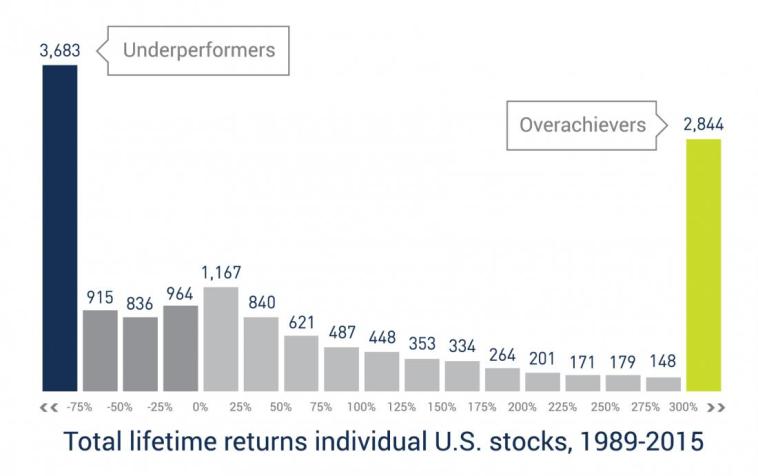

In a fascinating study on stock performance, Longboard Capital Management analyzed the annual returns of 14,500 individual stocks during the period 1989 through 2015.

The key findings from the study illustrate why investing in individual stocks is so risky:

976 stocks (6.8% of all active stocks) underperformed the S&P 500 by at least 500%

3,431 stocks (23.7% of all active stocks) underperformed the S&P 500 by at least 200%

3,683 stocks (25% of all active stocks) lost at least 75%, even before inflation

6,398 stocks (44% of all active stocks) lost money, even before inflation.

Nearly two-thirds of all stocks provided no real return, even before taxes.

Only 1,120 stocks (7.7% of all active stocks) outperformed the S&P 500 Index by at least 500% during their lifetimes.

The best-performing 2,942 stocks (about 20%) accounted for all the gains; the worst-performing 11,513 stocks (about 80%) provided an aggregate total return of 0%.

This last point is especially shocking. If you failed to invest in the 20% most profitable stocks from 1989 to 2015, your total gain would have been 0%.

It’s certainly possible that you could have picked a few of the winners, but the odds were not in your favor. A better strategy would have been to invest in an index fund. Longboard explains why index funds tend to perform well, despite poor performance from most individual stocks within the index:

“Successful companies with rising stock prices carry larger weightings in the index. Likewise, unsuccessful companies with declining stock prices receive smaller weightings. Companies with continued declines are eventually delisted to make way for growing companies. So, despite the fact that the average annualized return for all stocks on the S&P 500 index is negative, the index can still deliver an overall positive rate of return.”

Index funds reward successful companies with larger weightings. Unsuccessful companies receive smaller weightings. And if they’re awful enough, they’re removed from the index entirely to make room for growing companies.

This is why it’s generally a good idea for most investors to invest in index funds as opposed to individual stocks.

Investing in VTI vs. VTSAX

Once you’ve been convinced that index funds are the most efficient way to invest, the only decision you need to make is which index fund to invest in.

For most investors, the way to gain maximum diversification for minimum cost is to invest in a total stock market index fund. For U.S. investors in particular, this means investing in a total U.S. stock market index fund which holds every single publicly traded stock in the U.S. – more than 3,500 individual stocks.

While you can invest in this type of index fund on any major financial platform (Fidelity, Charles Schwab, Merrill Lynch, Vanguard, etc.) I personally use Vanguard so I’ll cover their two choices available to investors:

- VTI – Vanguard Total Stock Market ETF

- VTSAX – Vanguard Total Stock Market Index Fund Admiral Shares

Here’s a brief overview of both funds:

| VTI | VTSAX | |

|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Mutual Fund |

| Expense Ratio | 0.04% | 0.04% |

| Minimum Investment | The price of one share | $3,000 |

As you can see, both funds have the exact same expense ratio of 0.04%. That is, if you invest $10,000 into either fund you will pay $4 each year in management expenses.

However, there are a few differences between the two funds.

Difference #1: Minimum Investments

The first difference between the two funds is that VTSAX requires a minimum investment of $3,000 while the minimum investment for VTI is simply the current price of one share (at the time of this writing that would be $147).

The good news for investors with less than $3,000 is that they can simply invest in VTI until their balance crosses the threshold of $3,000 and then automatically convert their VTI shares tax-free into VTSAX shares if they wish to do so.

Difference #2: Real-time Pricing

One other subtle difference between the two funds is that VTI provides real-time pricing since it’s an exchange traded fund, which means you can see its price change throughout the trading day. On the other hand, since VTSAX is a mutual fund it isn’t priced until the trading day is over, so you don’t know the price until after you’ve placed your trade. As Vanguard explains on their investment page:

“Regardless of what time of day you place your order, you’ll get the same price as everyone else who bought and sold that day. That price isn’t calculated until after the trading day is over.”

This means that if you want to trade stocks quickly in real-time then an ETF would be a better investment vehicle. For investors who invest in ETFs for the long haul and don’t attempt to time the market, this doesn’t make a difference.

Difference #3: Automatic Investments & Withdrawals

The final difference between the two funds is that Vanguard only allows automatic investments and withdrawals for mutual funds. That is, if you’d like to automatically invest a certain amount each week or month, you can only do so with VTSAX, not VTI.

For example, if you’d like to invest $100 from each two-week paycheck you receive from your employer, you can do so with VTSAX. However, you’d have to manually invest this much in VTI every two weeks.

As a matter of convenience, VTSAX offers an edge over VTI if you’re someone who likes to set up automatic recurring investments.

VTI vs. VTSAX: Identical Investments

As an investment, VTI and VTSAX are completely identical. They hold the exact same collection of stocks (every individual publicly traded stock in the U.S.), they have the exact same dividend yield, and they earn the exact same annual returns. In addition, Vanguard allows automatic reinvestment of dividends for both funds.

If you want maximum diversification among U.S. stocks, it doesn’t matter if you invest in VTI or VTSAX. You will get identical results.

Is One Fund All You Need?

If you’re an investor who has several decades until you need to touch your investments, you could literally buy a total U.S. stock market index fund and call it a day. Historically, this type of investment strategy has offered high annual returns, but also high volatility relative to other portfolios.

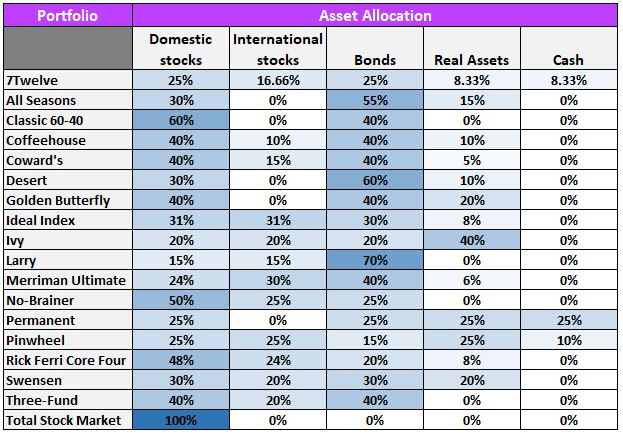

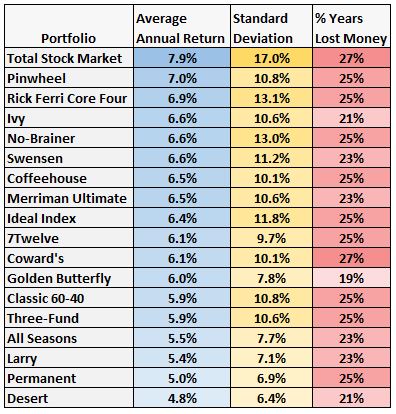

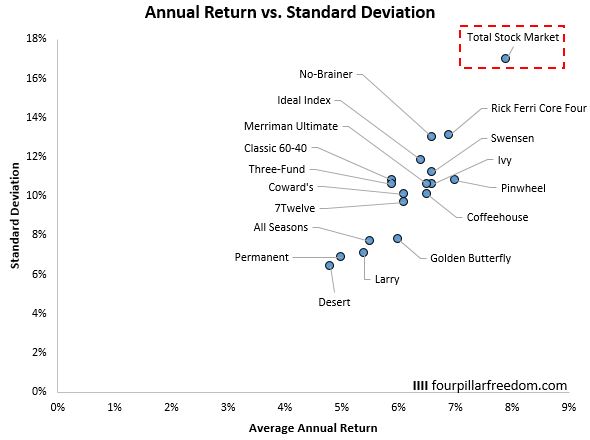

To illustrate this, in a post titled Here’s How 18 Different Portfolios Have Performed Since 1970 I looked at the annual returns and volatility of 18 different portfolios since 1970:

It turns out that the total stock market portfolio delivered the highest annual return, although it had the highest volatility:

A simple plot of the average annual return relative to the average standard deviation shows that a total stock market portfolio is simply in a league of its own:

For investors who are willing to embrace high volatility, an investment in a total stock market index fund is likely to deliver the highest annual returns relative to any other portfolio over the long haul.

It’s important to note, though, that bonds and international stocks offer some diversification to a portfolio for investors who aren’t comfortable with a 100% U.S. stock-based portfolio.

If you’re interested in investing in bonds and/or international stocks, I recommend reading the following two posts:

Should You Invest Internationally? – An analysis of a Meb Faber tweetstorm in which he argues that U.S. investors should invest internationally.

The Bogleheads’ Guide to the Three-Fund Portfolio – A summary of a wonderful little investment book written by Taylor Larimore on how to build an entire investment portfolio using only three funds.

No matter which funds you decided to invest in, I recommend using Personal Capital to track your investments with their free Investment Checkup tool and Retirement Planner. It’s a completely free platform and it’s the only one I personally use on a monthly basis.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.