6 min read

A few weeks ago Meb Faber shared an excellent tweetstorm on international investing that covered three main points:

- Most U.S. investors are highly concentrated in U.S. stocks.

- This high concentration will likely lead to sub-optimal returns over the long-run.

- An easy solution to this problem is to add foreign stocks to your portfolio.

Let’s take a look at Meb’s tweetstorm along with the dozens of cool charts he shared to emphasize his points.

Most U.S. investors are highly concentrated in U.S. stocks.

Meb starts off by pointing out that most U.S. investors allocate 80% of their portfolios to U.S. stocks.

He points to his book on global asset allocation as evidence for this number.

I must admit that I’m guilty of being part of the crowd on this one. In fact, I invest all of my 401(k) contributions into a low-fee total U.S. stock market index fund. This allows me to get maximum diversification (within the U.S) for the lowest fee. Although I do have the option to invest in a total international stock market index fund, I had never previously considered it (more on this later).

Related: Why It’s So Hard To Outperform Index Funds

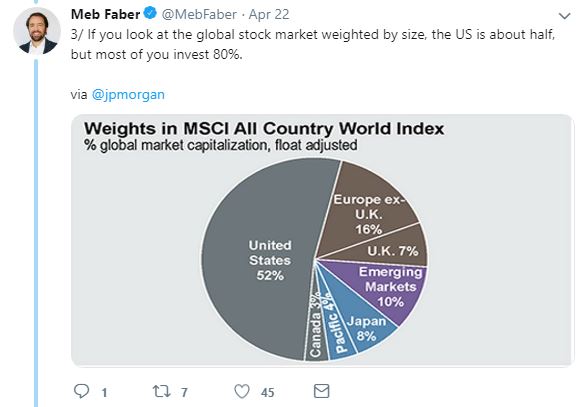

Meb goes on to point out that the U.S. does account for a little over half of the entire global stock market, but this still doesn’t justify investing 80% of a portfolio in U.S. stocks.

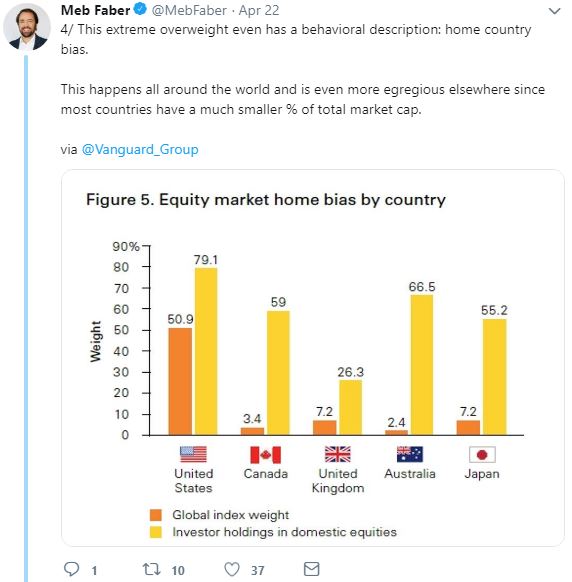

In fact, this tendency to over-invest in one’s home country actually has a name: home country bias.

Investors in countries outside of the U.S. actually fall prey to this bias even more since their home countries compose an even smaller portion of the global stock market.

For example, the chart shows that Australians invest 66.5% of their portfolio in Australian stocks even though Australian stocks only account for 2.4% of the global stock market.

Home country bias will likely lead to sub-optimal returns over the long-run.

Once Meb has established that home country bias is a widespread phenomenon, he then goes on to share why it often leads to sub-optimal investment returns over the long-run.

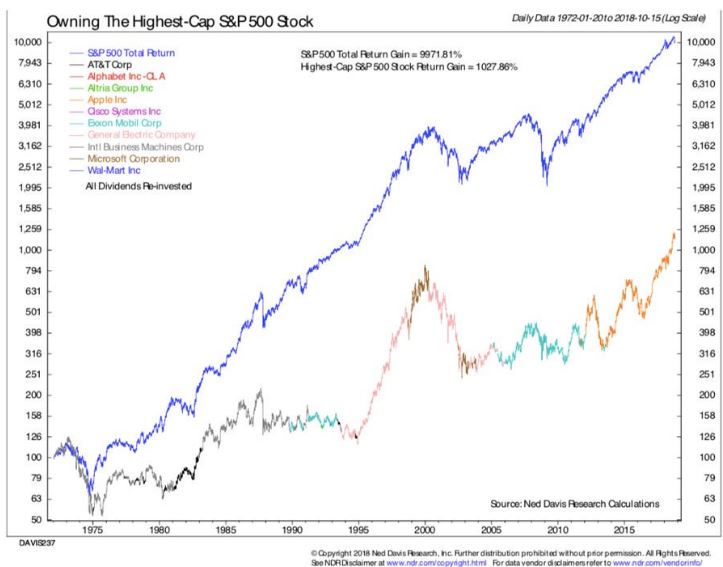

This outperformance by U.S. stocks relative to international stocks is why the U.S. stock market accounts for over half of the total global stock market. However, as Meb notes, the largest stocks/countries/sectors usually underperform. To illustrate, he shares a chart that shows how the S&P 500 performed since the early 1970s relative to how an investment in each of the largest stocks in the S&P 500 at the time would have performed.

Let’s take a closer look at that graph because it’s fascinating:

The total S&P 500 return (with dividends reinvested) during this time frame was 9971.81% compared to just 1027.86% if you had always invested in the largest S&P 500 stock at the time.

Meb tacks on a couple more tweets to round out his thoughts on why larger stocks tend to underperform:

Here’s the link to the podcast episode he mentioned with Rob Arnott.

An easy solution to home country bias is to add foreign stocks to your portfolio.

Once Meb has established the problem (home country bias) and its side effects (underperformance), he then goes on to share the simple solution: add foreign stocks to your portfolio.

Meb shares that you should use some type of weighting strategy so that your home country doesn’t carry too much weight in your portfolio. This is especially important for U.S. investors right now as U.S. stocks are fairly expensive according to almost any metric.

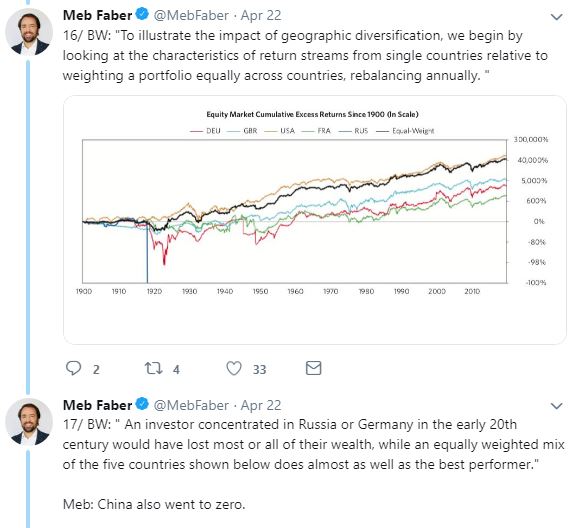

To further prove his point, he cites research from a Bridgewater Associates paper titled Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated.

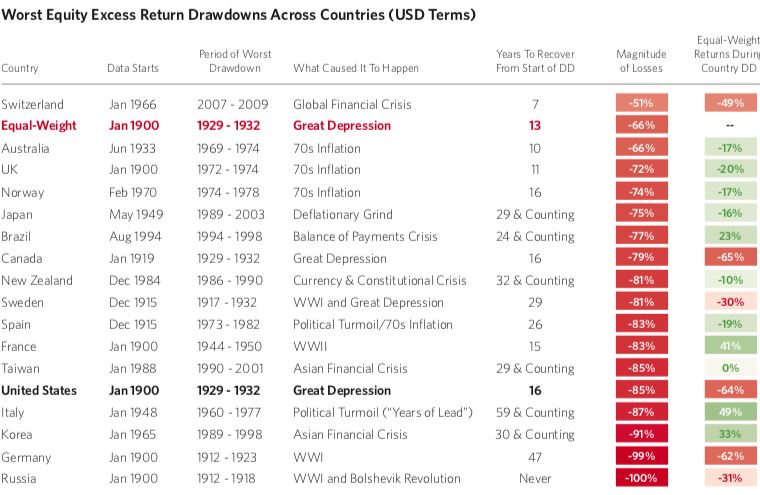

By investing all of your portfolio in one country, you run the risk of your portfolio experiencing a massive drawdown or a complete loss in the worst-case scenario. By diversifying internationally, you can eliminate this risk.

This point reminds me of a similar point made by Taylor Larimore in The Bogleheads’ Guide to the Three-Fund Portfolio in which he points out that individual stocks can go to zero while index funds cannot (unless an entire stock market collapses):

“Unlike mutual funds, individual stocks can plunge to zero. On the 50th birthday of the S&P 500 Index, only 86 of the original 500 companies still remained, showing it is possible to turn a large fortune into a small fortune with individual stocks. On the other hand, it is unheard of for a registered mutual fund to go to zero.”

Meb points to a real-life example in which investors in Russia, Germany, or China could have lost most of or all of their wealth by failing to diversify outside of their home country as recently as the 20th century:

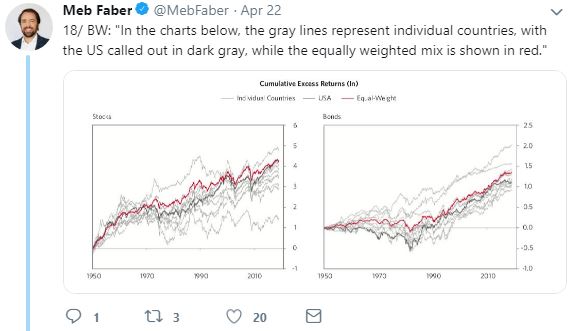

Next, he shares a neat chart that shows the returns of individual countries, highlighting the performance of an equal-weight portfolio of all the countries along with the U.S. stock market performance since 1950:

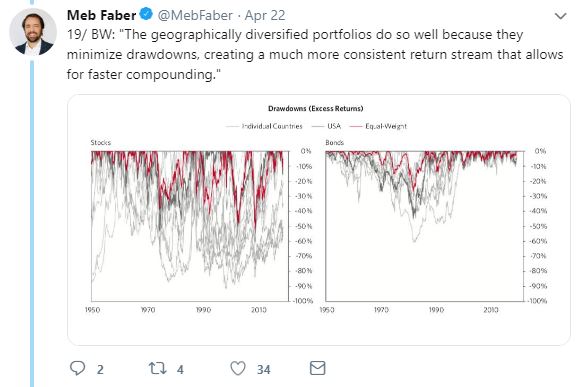

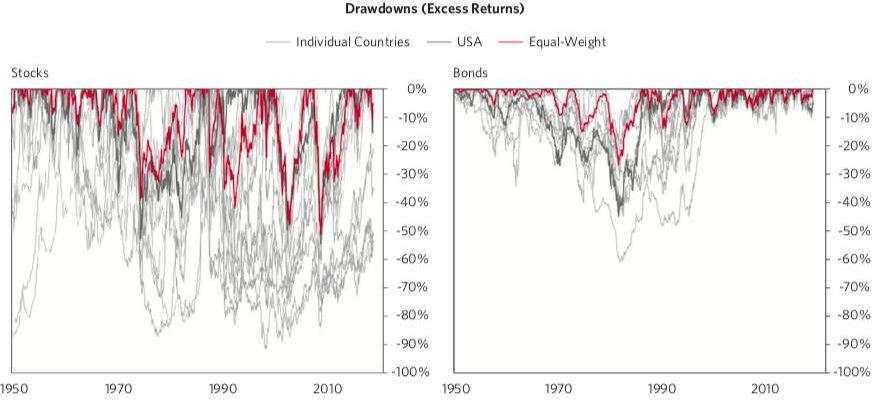

For both stocks and bonds, an equal-weight portfolio outperforms and does so with less volatility relative to a U.S. portfolio. The reason for this, as explained in the next tweet, is that a geographically diversified portfolio minimizes drawdowns, which allows for outperformance:

Here’s a closer look at those charts:

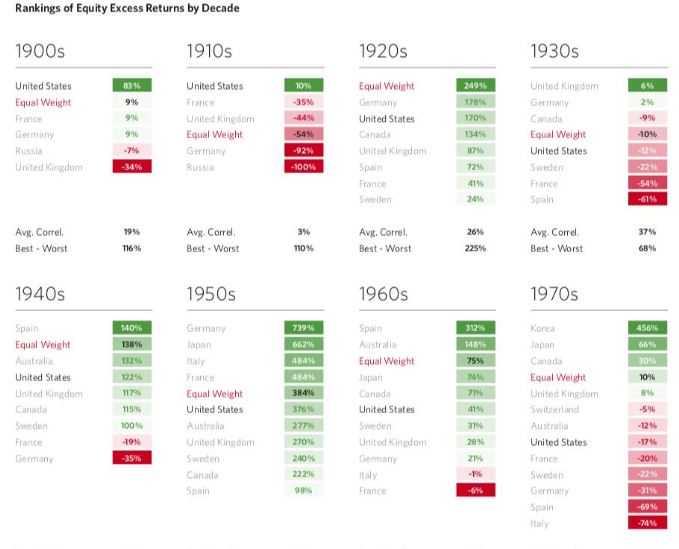

Meb shares another chart that shows the performance of individual countries by decade:

The U.S. has outperformed in this most recent decade, but it hasn’t done so very often historically.

In fact, as Meb shares, the U.S. underperformed an equal-weighted portfolio in 8 out of 12 decades.

He shares one final chart that shows how geographic diversification has been a lifesaver, preventing wealth from being wiped out during the worst times for various countries:

Conclusion

Prior to reading this tweetstorm, I had assumed that investing purely in U.S. stocks was all I needed to do to gain sufficient diversification. After reading these tweets, though, I’ve changed my mind.

In fact, I’ve decided to switch from allocating 100% of my 401(k) contributions into a total U.S. stock market index fund to now allocating 50% to a total U.S. stock market index fund and the other 50% to a total international (ex-U.S.) stock market index fund.

As a disclaimer, I am not a financial advisor and you should always invest in ways you’re comfortable with and consult a professional for specific investment advice for your unique situation. I simply wanted to share the research presented by Meb along with what I’ve decided to do with this information.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.