4 min read

One of the most basic concepts in investing is rebalancing. In this post, I want to answer some common questions about rebalancing including:

- What does it mean to rebalance a portfolio?

- How often should you rebalance your portfolio?

- Does rebalancing improve investment returns?

- Should you rebalance your portfolio?

tl;dr

- What does it mean to rebalance a portfolio? To buy and sell certain investments periodically to maintain your chosen asset allocation.

- How often should you rebalance your portfolio? As often as you’d like, but the most common method is to rebalance once per year.

- Does rebalancing improve investment returns? No.

- Should you rebalance your portfolio? If you want your asset allocation to consistently match your risk tolerance, then yes.

For detailed answer to these questions, read on!

What Does it Mean to “Rebalance” a Portfolio?

One of the first steps of investing is to choose your asset allocation. This simply refers to the mix of investments in your portfolio.

For example, suppose you’re a young person with a long investment time horizon and a high risk for tolerance. Your asset allocation might be 90% stocks and 10% bonds.

Conversely, suppose you’re someone with a short time horizon and a low risk for tolerance. Your asset allocation might be 40% stocks and 60% bonds.

Depending on your investment time horizon and your risk tolerance, your asset allocation within your portfolio can vary widely.

To rebalance a portfolio means to buy and sell certain investments periodically to maintain your chosen asset allocation.

For example, suppose your asset allocation is 60% stocks and 40% bonds. In a given year stocks may increase significantly while bonds barely budge. Because stocks increased so much, your portfolio allocation may now be 70% stocks and only 30% bonds, which doesn’t match your desired allocation.

Two basic ways to rebalance your portfolio back to your 60/40 allocation are as follows:

- If you don’t have new money to invest, you can sell some stocks and buy some bonds to get your allocation back to 60/40.

- If you have new money to invest, you can simply use that money to buy enough bonds to get your allocation back to 60/40.

Both methods of rebalancing allow you to get your portfolio back to your desired asset allocation of 60% stocks and 40% bonds.

How Often Should You Rebalance Your Portfolio?

You can technically rebalance your portfolio as often as you’d like, but the most common method is to simply rebalance once per year.

It’s important to keep in mind that if you choose the method of selling your winners that you may incur trading fees and capital gains taxes if you do so outside of a tax-advantaged account like a 401(k) or an IRA. In this case, rebalancing too often may result in excessive fees and taxes.

Does Rebalancing Increase Investment Returns?

One common question people have about rebalancing is whether or not it has the ability to increase investment returns. After all, if you’re always buying more of the assets that have recently underperformed, it makes sense that those assets have “more room to run” and thus your portfolio has the potential to earn higher returns.

To answer this question, we can analyze historical returns to see if portfolios that rebalanced performed better or worse than portfolios that did not rebalance.

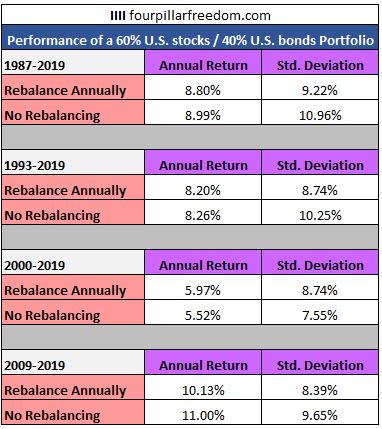

Using Portfolio Visualizer, I analyzed how a portfolio composed of 60% U.S. stocks and 40% U.S. bonds performed during various time periods both with and without annual rebalancing.

Nerd Notes:

For U.S. stocks, Portfolio Visualizer uses the AQR US MKT Factor Returns (AQR Data Sets) for 1987-1992 and the Vanguard Total Stock Market Index Fund (VTSMX) for 1993-2019

For U.S. bonds, Portfolio Visualizer uses the Vanguard Total Bond Market Index Fund (VBMFX)

The results of the analysis are shown below:

During three out of the four time periods shown here, rebalancing actually lead to lower overall returns. However, in three out of the four time periods, rebalancing lead to lower overall standard deviations in returns.

At first, this result might feel counter-intuitive: Shouldn’t buying more of the asset that underperformed lead to outperformance over the long run?

The answer turns out to be no because the stock market tends to experience long runs of positive returns several years in a row before eventually experiencing a sudden crash. One glance at a long-term chart of the S&P 500 confirms this:

Related: Here’s How the S&P 500 Has Performed Since 1928

During bull markets when stocks deliver positive returns for several years in a row, buying more of the thing that is underperforming (e.g. bonds) means you’ll generally earn lower returns over the long haul.

Should You Rebalance Your Portfolio?

So, what’s the point of rebalancing if it doesn’t increase investment returns?

The point of rebalancing isn’t to improve investment returns, but rather to ensure that your asset allocation consistently matches your risk tolerance.

For example, suppose you decide that you’re comfortable with a 60% stocks / 40% bonds portfolio. This allows you to enjoy the positive growth of stocks over the long haul while limiting your downside risk during crashes. And even though you’ll likely earn lower returns than a 100% stocks portfolio, this portfolio allows you to sleep at night knowing that you’ll experience lower volatility.

Now consider the scenario where you’re invested in a 60/40 mix at the start of 2009, but you haven’t rebalanced at all since then. Due to the crazy bull market we’ve experienced over the past decade, your allocation would now be almost 85% stocks and just 15% bonds.

While nobody knows when the next crash will come, it’s possible that it could arrive without warning (and likely will) which means that your portfolio would be hit much harder than you’d like because your current stock/bond allocation of 85/15 doesn’t match your risk tolerance of 60/40.

Thus, the point of rebalancing is to ensure that on a yearly basis your asset allocation matches the type of risk that you’re willing to take with your investments.

A Few Things to Keep in Mind

In regards to rebalancing your portfolio, here are a few things to keep in mind:

Some years it might not be worth the hassle. For example, in 2015 the stock market delivered roughly 1.4% while the bond market delivered 0.6%. A portfolio of 60% stocks and 40% bonds thus would have a mix of roughly 61% stocks and 39% bonds by the end of the year. In years like this, it might not be worth the time and effort to rebalance.

You can automate your rebalancing. Many funds such as target date funds offer to automatically rebalance your portfolio each year for you. In addition, most brokerage platforms offer automatic rebalancing either annually or semi-annually if you’re invested in certain funds. This makes the process simple since you don’t even have to think about it on an annual basis.

Be wary of fees and taxes. As mentioned earlier, if you choose the method of selling your winners to buy the losers, you may incur trading fees and capital gains taxes if you do so outside of a tax-advantaged account like a 401(k) or an IRA. For this reason, one popular way to rebalance while avoiding paying capital gains taxes is to simply buy the losers with new cash instead of selling the winners.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.