5 min read

FIRE is one of the most commonly used acronyms in the personal finance community. It stands for Financial Independence, Retire Early.

In most cases, people use the 4% Rule to determine whether or not they are financially independent.

This rule states that once you have 25 times your annual expenses saved up, you can consider yourself financially independent and can withdraw 4% of your portfolio each year to support your living expenses. This means you technically no longer need a day job to earn income, since your portfolio alone can support your lifestyle.

Lean FIRE: A Minimalist Approach to FIRE

One popular variation of FIRE is known as Lean FIRE. This is basically FIRE with low annual spending. The Lean FIRE Subreddit commnunity typically places this annual spending at $40,000 or lower and uses the following description to explain who this approach is for:

For those that want to approach the problem of financial independence from a minimalist, stoic, frugal, or anti-consumerist trajectory.

This approach to FIRE places emphasis on lowering your spending through embracing minimalism, stoicism, and frugality so that you don’t actually have to save up millions of dollars to achieve financial independence.

In fact, if you’re able to spend less than $40k per year, you don’t even need to save up $1 million to achieve F.I. using the 4% Rule.

The appeal of this path is that you don’t need to save a ton of money to achieve F.I, which means you don’t even necessarily need a high-stress job that offers a high income. A modest income from a less stressful job is often sufficient to achieve Lean FIRE in a reasonable amount of time.

The biggest criticism of Lean FIRE is the fact that, although you may be financially independent, you don’t actually have the means to spend on anything beyond the bare essentials. Depending on how much of a minimalist you are, this may or may not bother you.

How Much Do You Need Saved Up to Achieve Lean FIRE?

The amount you need to save up to achieve Lean FIRE is largely dependent on your family size. The larger your family, the higher your annual expenses, and thus the more you need to save to actually hit F.I.

While it’s possible for any household to lower their spending significantly through frugality and minimalism, there exists a natural limit on just how low your spending can go.

The obvious point which may be defined as too low for annual spending is the federal poverty line. If you spend below this amount each year, there’s a good chance you’ve crossed the frugality line and have entered deprivation territory.

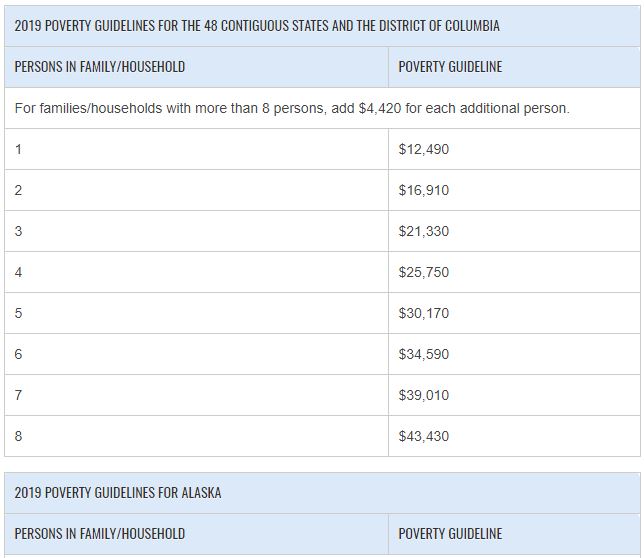

The following table from The U.S. Department of Health & Human Services shows the poverty guideline for families of various sizes:

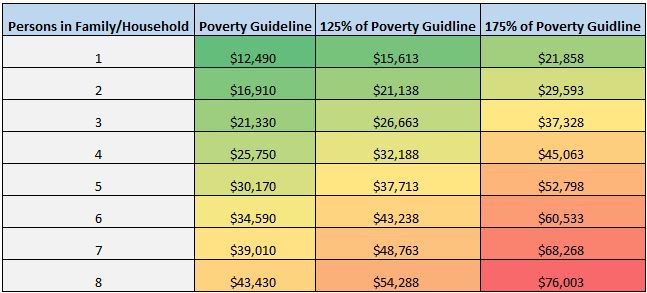

Within the Lean FIRE Subreddit, I’ve seen people define the annual spending of Lean FIRE as anywhere between 125% and 175% of the Federal Poverty line. Here’s a look at those numbers:

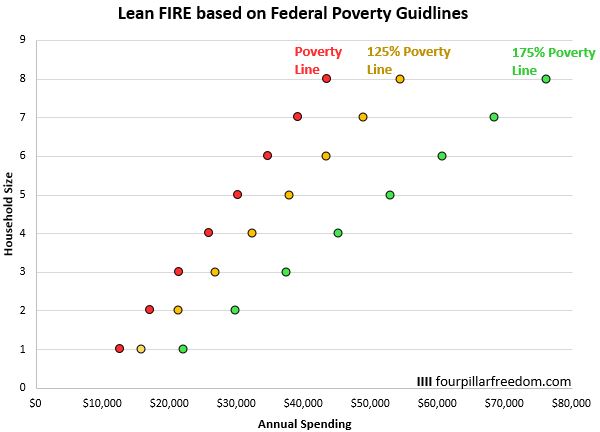

And here’s a visualization of those numbers:

Obviously the amount that you need to save to achieve Lean FIRE will vary from state to state, as some places are more costly to live than others. These numbers provide a nice nationwide baseline, though.

How Long Does it Take to Achieve Lean FIRE?

The amount of time it will take to achieve lean FIRE depends on your savings rate.

For example, let’s consider a family of four. In the chart above, the annual spending for a family of four that hopes to achieve Lean FIRE ranges from about $30k to $50k.

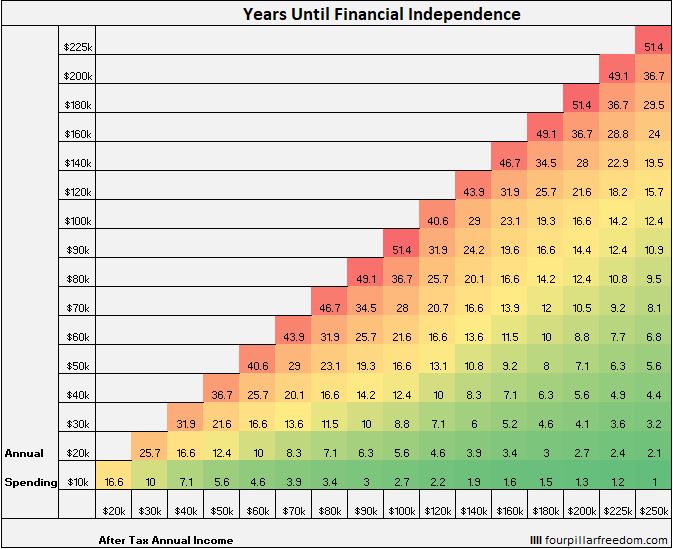

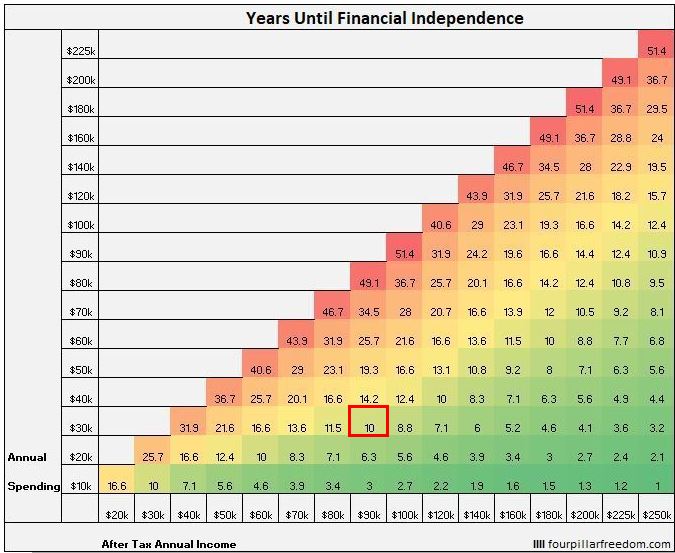

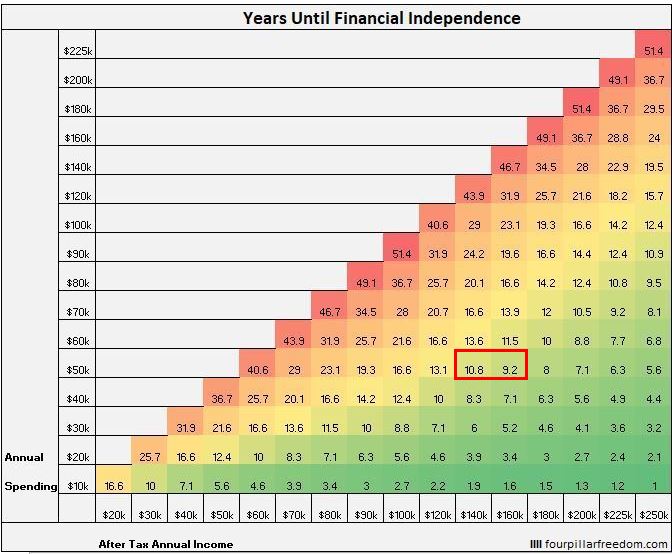

We can take a look at the Financial Independence Grid to see how long it will take a family of this size to save up 25 times their expenses.

Note: This grid shows how long it will take to achieve F.I. (25x annual expenses saved up) based on your post-tax annual income and expenses. The grid assumes you start with a net worth of $0, earn 5% investment returns on your savings each year, and that income and expenses remain consistent each year.

On the low end, for a family who plans on only spending $30k per year, they would need to earn at least $90k per year post-tax to achieve Lean FIRE in 10 years or less.

On the higher end, a family who plans on spending $50k per year would need to earn at least $150k per year post-tax to achieve Lean FIRE in 10 years or less.

Clearly, the way you define Lean FIRE makes a huge difference in the amount of money you actually need to earn to achieve financial independence in 10 years or less.

Is Lean FIRE Right For You?

Deciding whether or not to pursue Lean FIRE depends on your family situation and your personal preferences for spending. If you’re a hardcore minimalist or someone who tends to be naturally frugal, Lean FIRE might be ideal for you.

On the other hand, if you want to have more flexibility with your spending once you achieve financial independence, then Lean FIRE might not be the best route.

I’m personally not aiming for Lean FIRE because I don’t plan on ever reaching a point where I have to rely 100% on a portfolio to support my living expenses. I’m a big believer in the idea that meaningful work plays an important role in living a good life, and so it doesn’t make sense to ever stop working entirely.

Related Post: When Work Feels Like Play, Retiring Doesn’t Make Sense

For people who do hope to achieve Lean FIRE, one way to expand their spending flexibility is to work part-time once they quit their day job. In one post titled Working One Day a Week Can Be Worth $100,000, I shared an example of how much part-time work could positively impact your finances:

In college I used to work at a math tutoring center where tutors got paid $12 per hour. One of my coworkers was a guy in his 40’s who only worked on Saturday mornings. He told me he did it just because he loved math and helping students.

Each Saturday we would work a six-hour shift, which meant we earned about $60 after-tax. This guy worked every Saturday which meant he earned an extra $3,120 ($60 * 52 weeks) in income each year.

To put that in perspective, that’s the same as earning dividends from a $104,000 dividend stock portfolio with a 3% dividend yield. By working one day a week at a job he loved, he had the same spending power as a $100k portfolio.

For those who want to pursue Lean FIRE but have concerns about maintaining a low spending rate, pursuing part-time work could be the perfect solution.

Deciding whether or not to pursue Lean FIRE is a personal decision. Run the numbers, consider your options, and keep in mind that part-time work is always a tool you can use to expand your flexibility and freedom.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.