4 min read

As an investor, it’s natural to crave high returns and low volatility. Unfortunately, no single asset class can provide both high returns and a smooth ride.

Stocks generally offer higher returns compared to bonds over the long-term, but they experience higher volatility. Conversely, bonds tend to offer lower returns compared to stocks over the long-term, but they experience lower volatility.

This is why, based on your desired investment returns and your risk tolerance, it’s common to use a mix of stocks and bonds to achieve your investment goals.

For example, one popular portfolio allocation is known as The Classic 60-40, which is a mix of 60% stocks and 40% bonds. Although the Classic 60-40 portfolio offers lower returns compared to a 100% stock portfolio, it offers a smoother investment ride, which can help an investor sleep well at night.

This brings up an important point: not every investor wants to maximize returns. Some investors prefer to earn slightly lower returns if it means that their portfolio is less volatile.

Using the Classic 60-40 portfolio is one way to achieve a less volatile portfolio with just two asset classes: stocks and bonds. However, there exists another portfolio that offers an even smoother ride, although with slightly lower returns: The Permanent Portfolio.

Introducing the Permanent Portfolio

The Permanent Portfolio is an investment portfolio proposed by Harry Browne in his 1980s book Fail Safe Investing. The portfolio is composed of:

- 25% Total Stock Market

- 25% Long Term Bonds

- 25% Cash

- 25% Gold

Browne argued that this type of portfolio could offer investment growth and a smooth ride for investors. He had a specific reason for including each asset class:

Total Stock Market – offers strong returns during times of economic prosperity.

Long Term Bonds – offers acceptable returns during times of economic prosperity and during times of deflation.

Cash – offers a way to hedge against recessions.

Gold – offers protection during times of inflation.

Since each asset class performs a different role, Browne argued that the portfolio would perform well in any economic environment, allowing an investor to sleep well at night no matter how the economy performed.

Essentially, an investor could give up some investment returns in exchange for peace of mind.

How Has the Permanent Portfolio Performed?

The following table, taken from Portfolio Visualizer, shows how the Permanent Portfolio performed during every 5-year period from 1978 to 2017 compared to the 60-40 portfolio and a 100% stock portfolio:

| 5-Year Period | Permanent Portfolio | 60-40 Portfolio | 100% U.S. Stocks |

| 1978-1982 | 15.94% | 13.50% | 15.69% |

| 1983-1988 | 9.60% | 13.08% | 14.64% |

| 1989-1994 | 7.02% | 10.58% | 14.48% |

| 1995-2000 | 8.25% | 15.53% | 19.67% |

| 2001-2006 | 7.82% | 5.16% | 4.11% |

| 2007-2012 | 9.01% | 5.28% | 2.72% |

| 2013-2017 | 3.51% | 9.51% | 14.74 |

| 1978-2017* | 8.69% | 10.26% | 11.50% |

From 1978 to 2017, The Permanent Portfolio earned an average annual return of 8.69%, compared to 10.26% for The Classic 60-40 Portfolio and 11.50% for the 100% U.S. stock portfolio.

During that time period, The Permanent Portfolio outperformed the Classic 60-40 and 100% Stocks in three different five-year periods:

| 5-Year Period | Permanent Portfolio | 60-40 Portfolio | 100% U.S. Stocks |

| 1978-1982 | 15.94% | 13.50% | 15.69% |

| 1983-1988 | 9.60% | 13.08% | 14.64% |

| 1989-1994 | 7.02% | 10.58% | 14.48% |

| 1995-2000 | 8.25% | 15.53% | 19.67% |

| 2001-2006 | 7.82% | 5.16% | 4.11% |

| 2007-2012 | 9.01% | 5.28% | 2.72% |

| 2013-2017 | 3.51% | 9.51% | 14.74 |

| 1978-2017 | 8.69% | 10.26% | 11.50% |

These results aren’t too surprising.

During the 1980s and 1990s when the U.S. stock market was booming, The Permanent Portfolio couldn’t keep pace.

However, following the blow up of the tech bubble in 2000, The Permanent Portfolio offered higher annual returns from 2001 to 2006.

And again during the years following the financial crisis in 2008-2009, The Permanent Portfolio offered significantly higher annual returns.

Then, since the recovery from the financial crisis, The Permanent Portfolio has been unable to keep pace with portfolios that have higher stock allocations.

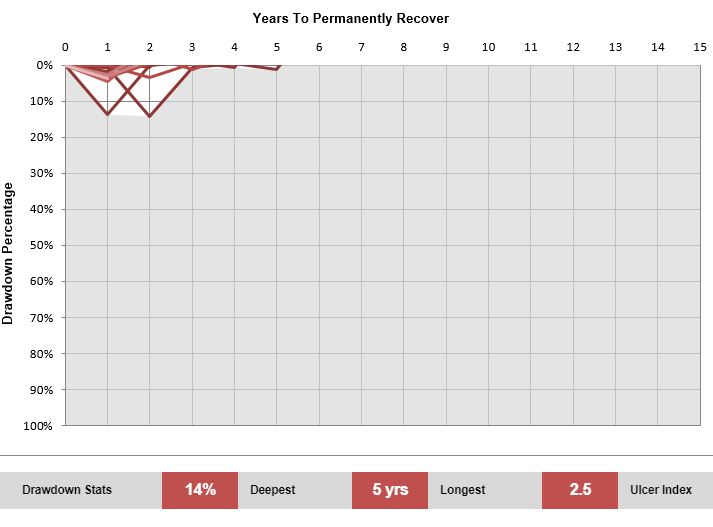

One more neat chart I found regarding The Permanent Portfolio comes from Portfolio Charts, which shows all of the drawdowns The Permanent Portfolio has experienced since 1970:

The worst drawdown was just 14% and the longest amount of time it took for the portfolio to recover from a drawdown was just 5 years.

These numbers are encouraging for investors looking for an investment strategy that minimizes downside risk. This illustrates that The Permanent Portfolio is able to avoid the worst of economic crashes, and is able to recover relatively quickly when it does experience drawdowns.

How to Construct the Permanent Portfolio

There are many different ways to construct the permanent portfolio using ETFs. One potential way to construct the portfolio is as follows:

- 25% Total Stock Market – VTI (Vanguard total stock market ETF)

- 25% Long Term Bonds – TLT (iShares 20+ Year US Treasury Bond ETF)

- 25% Cash – any money market fund or savings account

- 25% Gold – GTU (Central Gold-Trust) or IAU (iShares Gold Trust ETF)

The benefit of using ETFs to construct this portfolio is that you can minimize investment fees.

It’s also important to note that this portfolio is designed to be rebalanced once per year so that you can retain the 25% allocation for each of the four assets.

One Downside of the Permanent Portfolio

We’ve already seen the major benefit of The Permanent Portfolio: It offers a smooth investment ride in virtually any economic environment. This is especially enticing for investors who want to avoid the worst of major market crashes.

However, there is one downside of The Permanent Portfolio that often goes unmentioned: When the stock market is thriving, The Permanent Portfolio underperforms.

Just as it’s difficult to maintain a 100% stock allocation during market crashes, it can be just as hard to maintain a Permanent Portfolio allocation during market booms. It’s not easy to see your portfolio underperform the market significantly for several years in a row.

So, The Permanent Portfolio does offer a smooth investment journey for those who are willing to stick with the allocation during good and bad times, but the key to making this strategy work is to actually stick with the allocation.

Conclusion

For some investors, the goal is to maximize returns even if that means embracing volatility. For others, the goal is to earn acceptable returns while being able to sleep at night.

If you’re someone who is looking for a smooth investment journey and you’re willing to trade some investment returns in exchange for reduced volatility, The Permanent Portfolio may be an excellent option for you.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.