4 min read

Recently Meb Faber shared an excellent tweetstorm on international investing that covered three main points:

- Most U.S. investors are highly concentrated in U.S. stocks.

- This high concentration will likely lead to sub-optimal returns over the long-run.

- An easy solution to this problem is to add foreign stocks to your portfolio.

Check out this post where I explore Meb’s tweetstorm in greater detail.

Based on the research presented by Meb, it’s clear that adding international stocks to your investment portfolio is likely to lead to higher returns and lower extreme drawdowns over the long haul.

In fact, after reading the research I personally decided to switch my investment allocation in my 401(k) (that is, when I still had a job) from a 100% total U.S. stock market fund to a 50/50 split between a total U.S. stock market fund and a total international ex-U.S. stock market fund.

Rather than buying several individual funds that gave me exposure to specific regions like European stocks, Asia Pacific stocks, etc. I decided to buy one total international ex-U.S. stock market fund that gave me exposure to all international stocks, not including U.S. stocks.

If you want to invest in international stocks yourself, the simplest way to do so is through buying a total international ex-U.S. stock market fund.

And no matter what portion of your portfolio you decide to allocate towards international stocks, you’ll have to answer a simple question: Which international fund should you invest in?

Today I want to explore two potential total international ex-U.S. stock market ETFs that you can invest in through Vanguard, my preferred investment platform.

Comparing VEU vs. VXUS

Vanguard offers the following two international ex-U.S. stock market ETFs (exchange traded funds) on their platform:

VEU – Vanguard FTSE All-World ex-US ETF

VXUS – Vanguard Total International Stock ETF

First, let’s get a brief overview of both funds:

| VEU | VXUS | |

|---|---|---|

| Fund Type | Exchange Traded Fund (ETF) | Exchange Traded Fund (ETF) |

| Expense Ratio | 0.09% | 0.09% |

| Minimum Investment | The price of one share | The price of one share |

| Number of Stocks | 2,857 | 6,414 |

| Net Assets of 10 Largest Holdings | 10.0% | 8.8% |

We can see that both funds have the same expense ratio of 0.09%. That is, if you invest $10,000 into either fund you will pay $9 each year in management expenses.

We can also see that the minimum investment for both ETFs is simply the current price of one share. So, at the time of this writing you’d need a minimum of $51.02 to buy one share of VEU and $52.76 to buy one share of VXUS.

The biggest difference between these two funds is their composition: VEU holds 2,857 stocks while VXUS holds a whopping 6,414.

So, let’s take a look at this difference in composition and see if it impacts performance at all.

VEU vs. VXUS: Differences in Composition

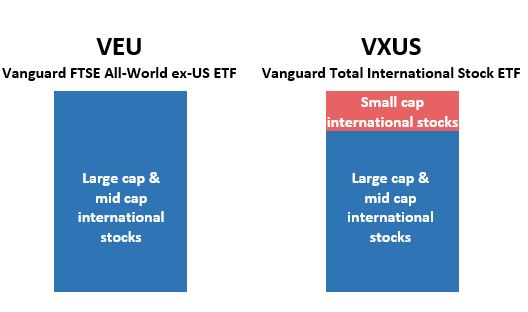

The reason that VEU only holds 2,857 stocks is because it only holds large cap and mid cap international stocks.

Conversely, VXUS holds 6,414 stocks because it also holds large cap and mid cap international stocks, along with small cap international stocks. Specifically, VXUS holds 3,557 small cap international stocks.

This means that VEU is just a subset of VXUS. That is, VXUS includes all 2,857 stocks that are in VEU as well as an additional 3,557 small cap stocks.

It’s important to note that since VXUS is market-cap weighted, the 3,099 smaller stocks actually only compose a small portion of the total fund. Nevertheless, the two funds do have slightly different compositions so let’s see if this difference impacts the annual returns.

VEU vs. VXUS: Differences in Performance

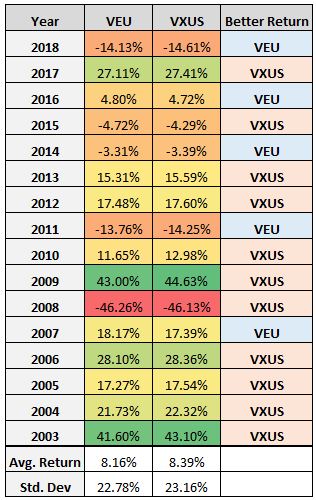

The following table shows the annual returns for the index that each ETF seeks to track since 2003:

As you can see, the two ETFs offer extremely similar returns. They both experience years of positive and negative returns in lockstep.

In general, VXUS offered slightly higher annual returns during this time frame along with slightly higher volatility. This makes sense considering VXUS contains small cap stocks that are known to offer higher returns over the long haul with higher volatility than large cap or mid cap stocks.

VEU vs. VXUS: Which Should You Invest in?

The numbers don’t lie. VXUS will likely offer slightly higher returns along with slightly higher volatility compared to VEU simply because it contains small cap stocks. It’s up to you if you would like to stomach slightly more volatility for higher returns over the long haul or not.

I personally prefer to invest in VXUS since it offers more diversification with small cap stocks. Also, I don’t plan on selling my shares for several decades (if ever) so it makes sense for me to choose the ETF that is likely to offer slightly higher returns.

It’s nice to keep in mind that if you’re even debating whether you should invest in VEU or VXUS, that’s a good indication that you have your financial life in order and that you’re ahead of 90% of people financially.

One last thing to mention is that most major investment platforms like Fidelity, Merrill Lynch, Schwab, etc. all have ETFs that are similar to the Vanguard ETFs I wrote about in this post. I simply chose to use the Vanguard versions of these ETFs since it’s my investment platform of choice. No matter which investment platform you decide to use, you should easily be able to find low-cost total international stock market funds to invest in.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.