7 min read

There are two pieces of financial advice I give to pretty much everyone I know:

1. Track your net worth.

You should have a good idea of how much money you have in all of your financial accounts including 401(k)s, IRAs, brokerage accounts, checking accounts, and savings accounts. These are your assets.

You should also have a good idea of how much you owe on your house, car, credit cards, student loans, and any other loans. These are your debts.

Your net worth can be calculated as: total assets – total debts.

I like to think of net worth as where you currently are financially.

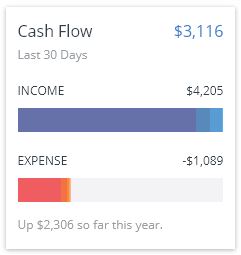

2. Track your cash flow.

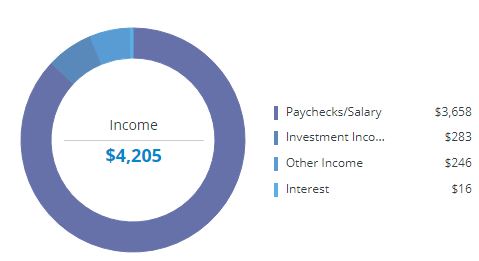

You should have a good idea of how much money you earn each month. This includes income from your day job, side hustles, and any dividends/interest.

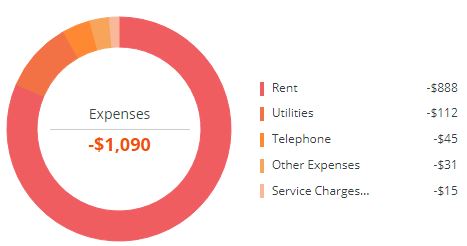

You should also have a good idea of how much you spend each month. You can choose to break your spending down by category so you can see exactly where your money is being spent each month, or you can simply track your total monthly spending. What’s important is that you know how much money is flowing out the door each month.

I like to think of cash flow as where you are headed financially. If you earn far more than you spend, then you can’t help but increase your net worth and improve your financial standing. On the other hand, if you spend just as much as you earn, your net worth will remain stagnant.

How to Track Net Worth & Cash Flow

While it’s possible to track both your net worth and your cash flow manually each month, there are much easier ways to keep an eye on your finances thanks to technology.

Specifically, there are two popular free financial platforms that allow you to see all of your finances in one place: Mint and Personal Capital.

Mint is an online platform that syncs all of your financial accounts including checking, savings, investing, credit cards, and loans all in one place. This allows you to track both your net worth and your cash flow easily in one spot.

Similarly, Personal Capital is also an online platform that syncs all of your accounts in one place. One extra perk of Personal Capital, though, is that it has several tools to analyze your investments, analyze how much you’re paying in fees, and determine whether or not you’re on track to hit future financial goals.

Today I’ll give an overview of each platform along with their strengths and weaknesses, which will hopefully make it easier for you to decide which platform is right for you.

Are These Platforms Actually Free?

The first hesitation you might have in using these platforms is getting over the fact that they are free to use. How is that possible? Don’t they have to earn money somehow?

Yes, they do have to earn money somehow. The secret to how both platforms are able to offer free services is in their freemium model approach. In particular, here’s how both platforms earn money:

Mint

- Earns money through recommending various financial services to users from which they get a referral fee.

- Earns money through banners ads placed on the site.

- Earns money by offering an optional premium credit report.

- Earns money by selling aggregated financial data (not your individual data) to various providers. This data is anonymous and cannot be tracked back to individual users.

Personal Capital

- Earns money by offering a paid financial advisor service.

Thus, both services are able to offer free personal finance platforms since they’re able to earn money in ways other than these platforms.

What is the Set Up Process for Both Platforms?

You can get up and running with both platforms in literally less than five minutes by following two steps:

1. Create an account. This is as simple as choosing a username and password.

2. Link your accounts. This includes bank accounts, credit cards, investment accounts, retirement accounts, etc.

That’s it.

Your accounts should link up in a matter of seconds. Then, you’re able to see all of your account balances and cash flows in one simple dashboard.

For some small credit unions or other less-known financial institutions, it may take a little longer for the accounts to link to each platform. I personally had no problems linking up any of my financial accounts on either platform, though.

Budgeting

Once you’ve linked your credit card accounts, both Mint and Personal Capital are able to track your spending automatically.

Mint Budgeting

Mint is first and foremost a budgeting platform. Personal Capital, on the other hand, is more of an investment platform. This means that Mint has a bit of an edge on Personal Capital in terms of budgeting capabilities.

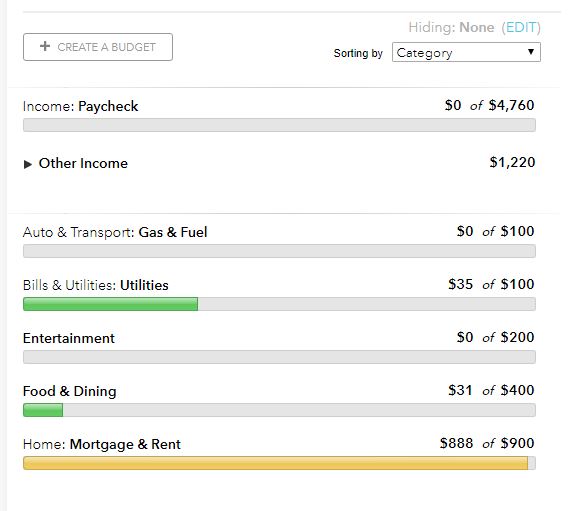

Specifically, Mint has a full-featured budgeting section that shows you a breakdown of your total spending by category. It also allows you to set limits on your total spending for each category so you can see if you’ve spent more than your set limit in any given month.

I personally love the way you can visually see how your spending aligns with your budgeted spending with these horizontal bar charts. As a data viz nerd, I approve of this layout.

Mint also has a neat feature that notifies you of any upcoming one-time bills and recurring bills like rent, utilities, internet, etc. This makes it less likely for a bill to sneak up on you without you being aware of it in any given month.

Personal Capital Budgeting

Personal Capital also offers a tool that lets you monitor your spending habits. You can get a list of expenses by category and you can set a total monthly spending budget, but you cannot break it down by category.

In this sense, Personal Capital offers more of a spending report than a detailed budgeting tool. For people who prefer to just see how much they spend each month without worrying about creating a budget, this may actually be preferable.

Investing

Once you’ve linked your investment accounts like your 401(k)s, IRAs, and brokerages, both Mint and Personal Capital are able to track your investment performance.

Monitoring Investments with Mint

As mentioned before, Mint is designed to be a budgeting tool, not an investment tool. So, as you’d might expect, its ability to track your investments is actually quite poor.

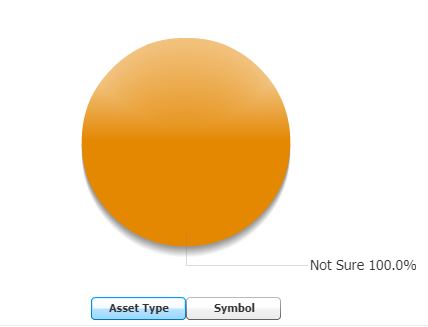

It has a feature that allows you to supposedly see your portfolio allocation, but unfortunately it struggles to identify what asset classes various investments fall under. For example, it displays my allocation as “100% Not Sure” which is very unhelpful.

In addition, it is able to tally up my total investments across all my accounts and provide me with a total investment value, but unfortunately it’s only able to show my investment value starting from the date I signed up for Mint. This means I can’t see how my investments have grown historically if I haven’t been a member of Mint for very long.

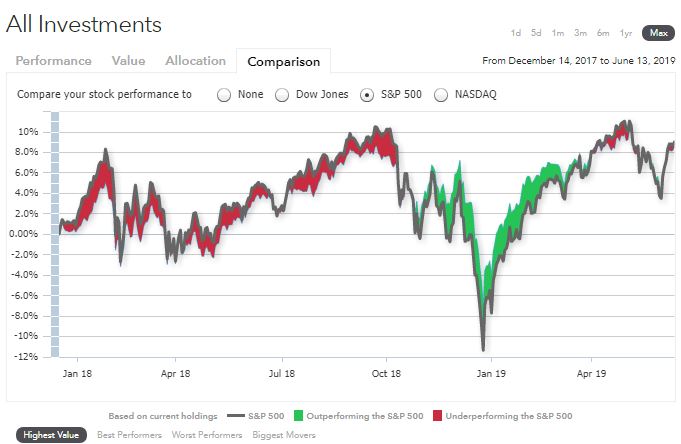

It also displays a chart that shows whether or not my investments have been underperforming or overperforming relative to the S&P 500:

While some investors may find this useful, I suspect that this comparison chart causes more harm than good. Whenever you see that you’re underperforming the index, you’re more likely to feel an urge to change up your investments in an attempt to keep up with market performance. I feel that this chart isn’t useful for most investors.

Monitoring Investments with Personal Capital

Personal Capital offers a much better experience for monitoring investment performance.

First off, it is able to determine your portfolio allocation quickly and easily, and even provides a nice treemap so that you can visualize your portfolio allocation, i.e. what percentage of your investments are in stocks, bonds, real estate, etc.

This is useful because if your goal is to maintain a 90% stock allocation (or whatever amount), this chart helps you see if you’re at, or near, this desired allocation. If you see that you’re far off from your desired allocation, you can make necessary adjustments.

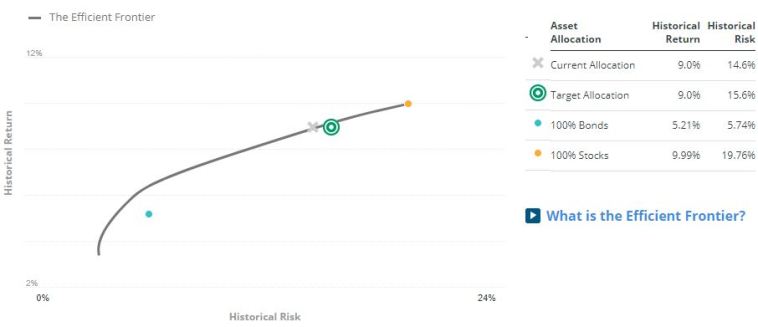

Another neat visual that Personal Capital offers is an Efficient Frontier Curve, which lets you see whether or not your current allocation offers you optimal returns relative to the risk you’re taking.

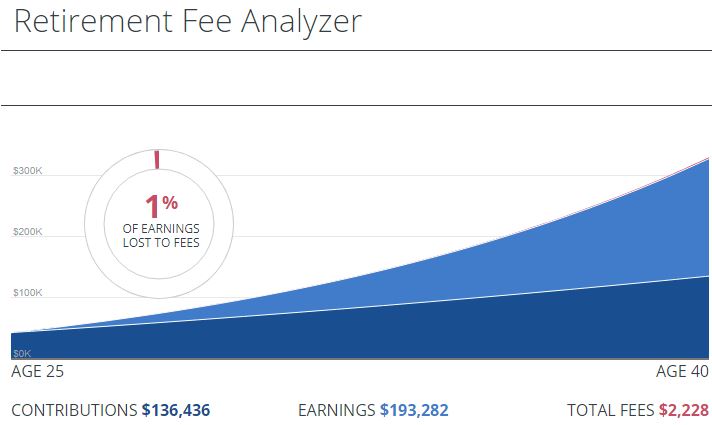

Personal Capital also has a neat Retirement Fee Analyzer that lets you see how much you’re paying in investment fees based on your current investments across your accounts. This is an incredibly helpful tool because it helps you see if you’re overpaying in fees on any of your funds. This tool also shows you exactly how much you’ll lose due to fees over the course of several decades.

As mentioned before, Personal Capital is designed to be an investment tool first and foremost, which makes it no surprise that it handily beats Mint for tracking investment performance.

Mobile App Access

Both Mint and Personal Capital offer a mobile app for Apple iOS and Google Android. This makes it easy to check in on your account balances and cash flows easily from a mobile phone on the go.

For both platforms some features are exclusive to just mobile or desktop, but in general they both offer a great user experience no matter how you access their platform.

Security

For security, Mint offers a two-factor authentication while Personal Capital requires you to register your computer before using the platform. This means you can’t log in unless the computer is registered via a PIN that is sent to you via email or phone call.

Both platforms are simply reporting tools. That is, you can’t transfer cash out of your banking accounts or execute trades in your investment accounts.

In addition, the data downloaded on both platforms does not include account numbers or any other sensitive information in the scenario that your account is compromised.

Should You Use Mint or Personal Capital?

So, should you use Mint or Personal Capital?

To be honest, the answer doesn’t have to be one or the other. In fact, I use both. Mint offers an edge for budgeting, but Personal Capital clearly has an edge for investment performance. You can get the best of both worlds by choosing to use both platforms.

I find that Mint is better at classifying my transactions into categories, which is nice for when I want to see just how much I spent in different areas. However, I find that Personal Capital is much better at tracking my investment performance along with letting me know if I’m paying too much in fees on any fund.

By using both tools, I can get access to each of their best features.

If I had to choose only one platform, I would choose Personal Capital because I don’t mind the fact that it doesn’t have a robust budgeting tool. I personally only care about seeing how much I spend in total each month, along with how much I spend by category. I’m not interested in setting strict monthly budgets for each category, so Mint’s category-by-category budgeting ability isn’t too appealing to me.

No matter which platform(s) you decide to use, you’ll find that using an online platform is an excellent way to simplify your financial life.

Instead of logging into a dozen different accounts to check your brokerage accounts, 401(k) account(s), IRAs, checking accounts, and savings accounts, you can simply link all of your financial accounts to one platform and gain the ability to see all of your account balances in one simple dashboard. This is a huge time saver. Also, it’s helpful to get a holistic view of your overall financial life so you know where you’re doing well and where you have room to improve.

Use this link to create a free account on Mint.

Use this link to create a free account on Personal Capital.

It takes less than five minutes to get up and running on both platforms and you’ll find that using one or more of these platforms will greatly simplify your financial life.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.