6 min read

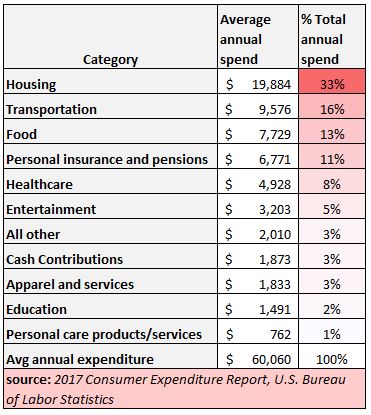

According to the most recent version of the Consumer Expenditure Report from the Bureau of Labor Statistics, the average consumer unit* spends about 33% of their total annual income on housing:

*Consumer unit: include families, single persons living alone or sharing a household with others but who are financially independent, or two or more persons living together who share major expenses.

This makes housing the largest expense for most families, which also makes it the most important expense to keep under control.

This brings up the question: how much should you spend on housing?

The data tells us that the average family spends 33% of their income on housing, but is that the right amount? Is that percentage too high?

The answer to this question depends on a couple of factors:

- Where you live

- What percentage of your income you’d like to save and invest

Let’s take a closer look at each of these factors.

Factor 1: Where You Live

Housing prices are largely determined by where you live.

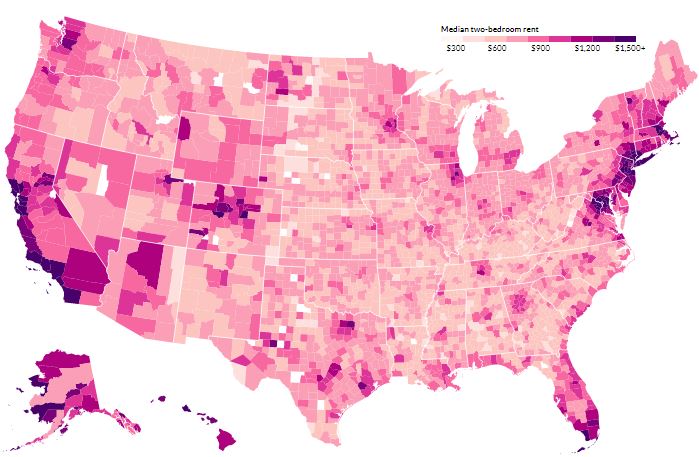

Look no further than this interactive map that shows the median two-bedroom rent for every county in the U.S. to see just how much rent prices can vary from one region to the next.

On the expensive end, the median two-bedroom rent in Arlington County, Virginia is $2,127.

On the cheap end, the median two-bedroom rent in Mellette County, South Dakota is just $277.

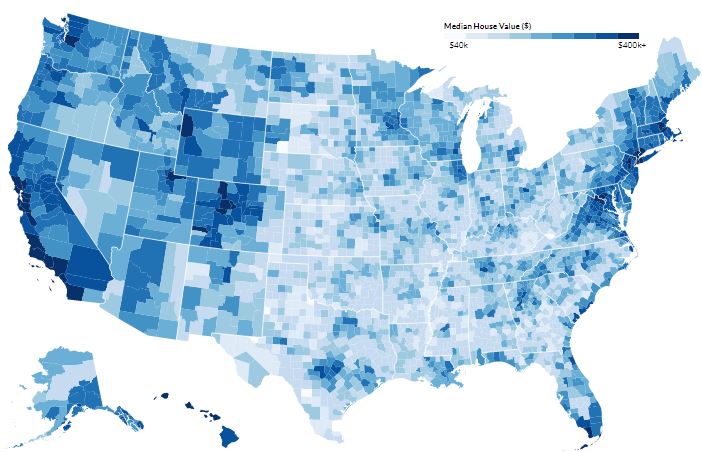

The same applies to housing prices, which can be seen in this interactive map that shows the median house value in every U.S. county.

On the expensive end, the median house value in Nantucket County, Massachusetts is $966,600.

On the cheap end, the median house value in Oglala Lakota County, South Dakota is just $19,800.

From a purely financial perspective, the way to minimize your housing expenses is to live in a place where you can earn a high income relative to the housing prices in your area.

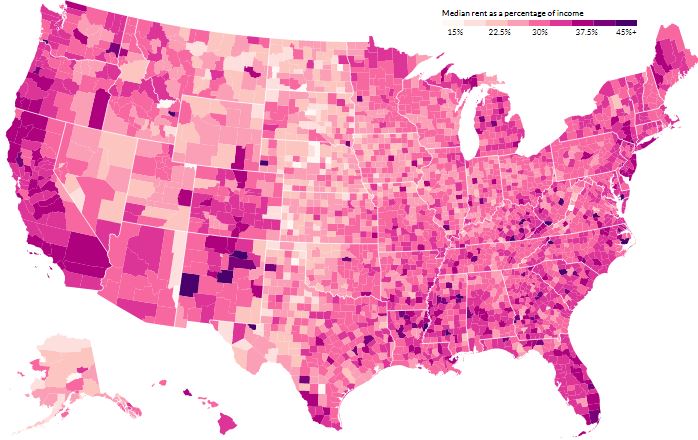

For example, this interactive map shows the median rent as a percentage of the median pre-tax income for every U.S. county.

On the expensive end, the average family in Quitman County, Georgia spends a whopping 50% of their monthly pre-tax income on rent.

On the cheap end, the average family in Greenlee County, Arizona spends just 10% of their monthly pre-tax income on rent.

This means the median income you can earn in Quitman County, Georgia relative to the rent prices is very low. Conversely, the median income you can earn in Greenlee County, Arizona relative to the rent prices is very high.

So, should you sprint to Greenlee County, Arizona as fast as possible to minimize your housing expenses?

Probably not.

Deciding where to live is not purely a financial decision. While it helps to live in an area that offers a high income relative to the median rent prices, there are other factors to consider. Specifically:

- Where your family and friends live

- The environment, culture, and “fit” of a particular city

I can’t even begin to count how many blog posts I’ve read over the years by people who relocated to a new city and were shocked by how much they missed having regular interactions with their parents, siblings, and close friends. That’s not to say that you can’t make new friends or join new social groups in a new city, but if it’s possible to live in a city you love and where all of your family and friends happen to be, that’s the best of both worlds.

The other factor to consider is how well you “fit” into a particular city. For example, suppose you love spending time outdoors hiking, running, and kayaking. While you might be able to live more cheaply in a city that offers none of these amenities, your overall happiness will likely take a hit. Even if you have to spend a little more to live in a place that offers these outdoor activities, it’s likely worth the price if it has a positive impact on your overall happiness.

Ideally, your goal should be to keep your housing expenses relatively low while also living in a city that is a good fit for you where your family and friends are all close by. That’s a formula for saving money without sacrificing quality of life.

Factor 2: What Percentage of Your Income You’d Like to Save & Invest

One common rule of thumb thrown around is that you should spend 30% of your pre-tax income on housing.

So, if you earn $4,000 per month (before taxes) then you should spend $1,200 per month on rent.

If you earn $6,000 per month (before taxes) then you should spend $1,800 per month on rent.

If you earn $8,000 per month (before taxes) then you should spend $2,400 per month on rent.

And so on, and so forth.

However, this doesn’t take into account how much you want to save and invest. If you blindly follow the 30% rule then you might not be able to hit your savings goals.

To better understand this, I’ll walk through an example using my own finances.

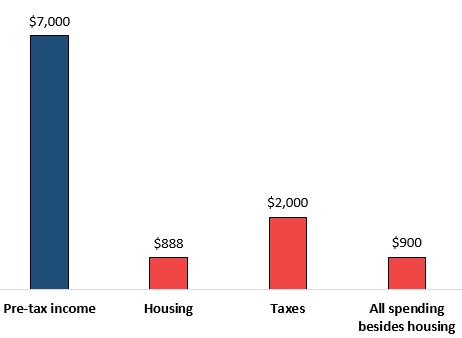

I earn about $7,000 each month before taxes.

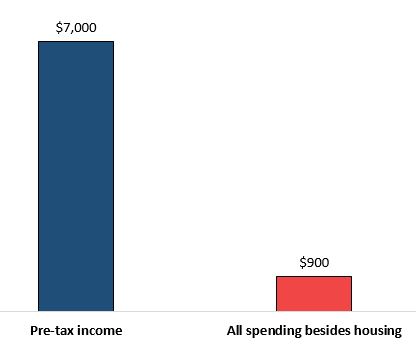

Each month I spend about $400 on food, $100 on entertainment, $150 on utilities, $50 on internet, $50 on gas, and $150 on miscellaneous. That’s a total of $900 each month not including housing.

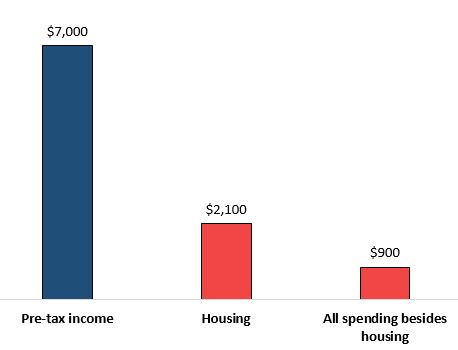

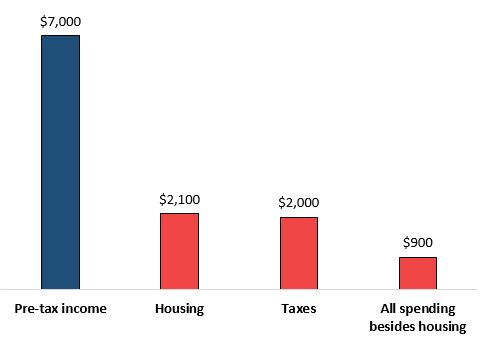

Now, if I do decide to follow the 30% rule then that would mean I’d spend $7,000 * 30% = $2,100 each month on rent.

Keep in mind I’d also pay about $2,000 each month in taxes:

So, I would be able to save and invest $7,000 – ($2,100 + $2,000 + $900) = $2,000 each month. Or equivalently, $24,000 each year.

In reality, I actually spend much less than this so I’m able to save and invest even more. Currently I spend $888 per month on rent.

This means I’m able to save and invest $7,000 – ($888 + $2,000 + $900) = $3,212 each month. Or equivalently, $38,544 each year.

Instead of spending 30% of my pre-tax income on housing each month, I only spend about 12.6%. This difference allows me to save and invest over $14,000 more per year.

To decide how much you should spend on housing based off of how much you want to save and invest each year, you can use the following steps:

Step 1: Decide how much you want to save and invest each year.

For example, suppose you want to save and invest $10,000 each year. That means you need to save and invest about $833 per month.

Step 2: Determine how much you earn each month, how much you pay in taxes each month, and how much you spend one everything besides housing each month.

For example, suppose you:

- Earn $4,000 each month

- Pay $1,000 in taxes each month

- Spend $1,000 on everything besides housing each month

This means you have $4,000 – $1,000 – $1,000 = $2,000 available to put towards housing and saving each month.

Step 3: Calculate how much you can spend on housing while still being able to hit your saving and investing goal.

You have $2,000 available each month after paying taxes and all expenses besides housing.

You want to save and invest $833 per month.

This means you can spend a max of $2,000 – $833 = $1,167 on housing each month and still hit your saving and investing goal.

Optimizing Happiness & Finances

Deciding how much to spend on housing is both an emotional and financial decision.

From a purely financial perspective, spending less on housing means you have more money left over to save and invest. Personally I’m able to save and invest $38,544 each year by choosing to pay $888 in rent per month rather than follow the 30% rule and pay $2,100 in rent per month. While the 30% rule may be a nice rule of thumb, you can put yourself in a much better position financially by choosing to spend less than 30% of your pre-tax income each month on housing.

Keep in mind the nature of hedonic adaptation. No matter where you decide to live, you’ll become used to it quickly. Last year I moved into an apartment that is 300 sq. feet larger than my old apartment and within a matter of weeks it felt like the new “normal” to me. As humans, we adjust to our surroundings incredibly fast. This means paying more each month for more space is unlikely to make a material difference on your overall happiness.

Keep “fit” in mind. You should strive to live in an area that is a good “fit” for you. Whether you enjoy going to parks, forests, coffee shops, libraries, bars, or concerts, you should try to live in an area that offers these amenities, even if housing prices are slightly higher than elsewhere. Keep your overall happiness in mind when deciding where to live and how much to spend.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.