4 min read

A quick Google search for “What is financial independence?” reveals the following definition from Wikipedia:

Financial independence means you have enough wealth to live on, without working.

In most cases, “enough wealth to live on” is typically defined by the 4% rule: If you have a portfolio large enough so that you can withdraw 4% of it each year and cover all of your living expenses, then you’re financially independent.

Financial independence is a goal that many people chase, yet very few step back to actually ask why they are chasing that goal in the first place.

The “Why” Behind F.I.

If you ask most people why they are chasing financial independence, they’ll likely provide an answer that hits upon at least one of the following points:

- “I hate my day job.”

- “I don’t have enough time in the day for leisure, hobbies, exercise, or family time.”

- “I don’t want to stress out about money anymore.”

These answers provide clues to what people really want: a way to pay the bills without sacrificing mental health, physical health, and time away from family.

Accumulating a portfolio large enough so that you never need to work again is one way to gain back time and health, but it’s likely not the fastest nor the most optimal way.

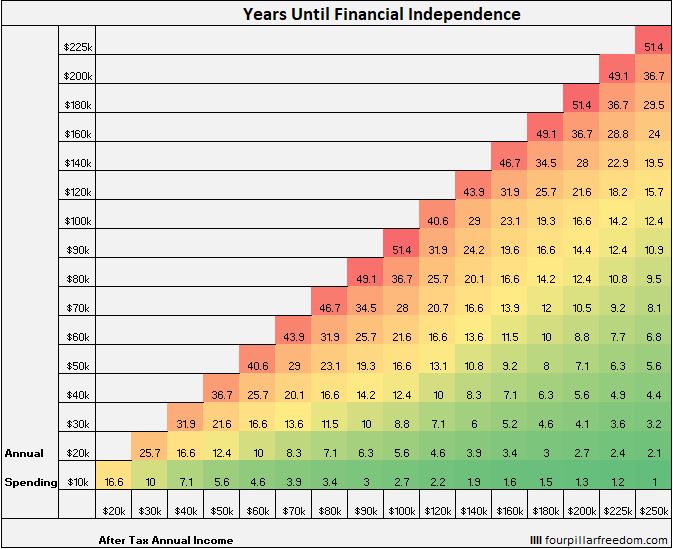

For example, according to the Financial Independence Grid, a family that starts with a net worth of $0 and saves half of their income each year (at any income level) can achieve financial independence in a little over 16 years, assuming they earn 5% annual investment returns:

Granted, 16 years is a much shorter path to financial independence than most people take, but it still represents nearly two decades of work. For a family who is only able to save 20% of their income each year, the time it takes to hit F.I. balloons all the way up to 36 years.

Of course there are ways to boost your savings rate higher, namely through growing your income and keeping your big three expenses in check, but even for extreme high-savers it will likely take at least a decade to hit F.I.

For those who are patient and who are in a decent work situation, sticking it out with a high savings rate for a decade or two might not seem too bad. For me personally, though, I’m more interested in creating a situation where I can cover my expenses through enjoyable income streams as soon as possible.

Related: Why I Can’t Imagine Enjoying Any Corporate Job

Income Growth vs. Net Worth Growth

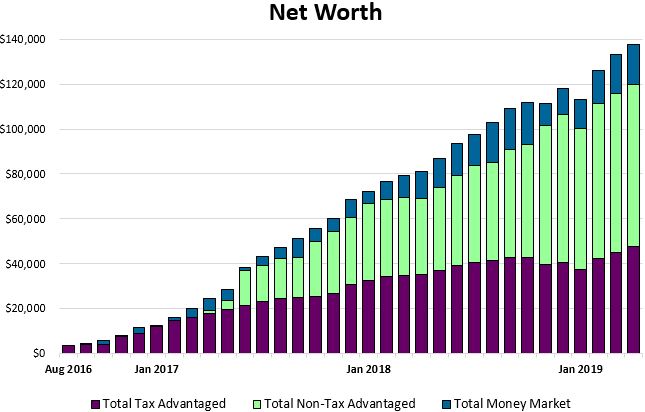

For those of you who have been following my financial journey since I started this blog, you know that I share a net worth update on the first day of each month. Here’s a look at my net worth growth since I started tracking it back in August of 2016:

In a little over two years, I’ve been able to grow my net worth from $0 to about $140k.

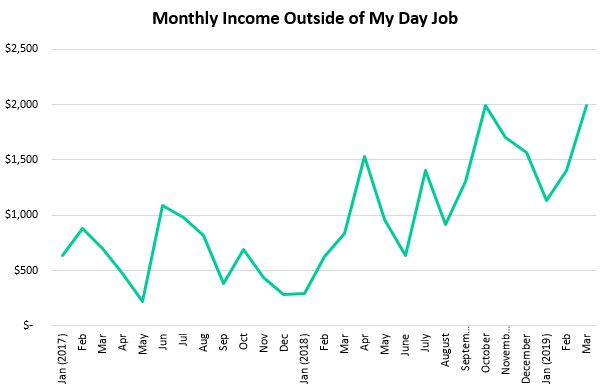

During roughly that same time period, I’ve been able to grow my income outside of my day job from $0 to about $2,000 per month from a combination of dividends, stats tutoring, and income from my websites:

Note: Currently I run three websites: Statology, Collecting Wisdom, and Four Pillar Freedom.

In any given month I typically spend around $2,000 – $2,500. This means I’m close to covering all of my monthly expenses purely from income streams outside of my day job.

Based on my current trajectory, I believe that I can grow my monthly income outside of my day job to around $3,000 per month by the end of this year and likely much higher in the following years. Effectively, this would allow me to quit my day job far before I have achieved financial independence because I would have the ability to generate my own income in ways that are enjoyable for me.

Conclusion

In the future, I expect that my monthly expenses will be closer to $4,000-ish per month once I have a family. This means I would need a portfolio with a value around $1.2 million in order to execute the 4% rule and withdraw enough money each year to support our annual expenses. According to the Financial Independence Calculator, it would take about 13 years for me to achieve F.I. based on these assumptions.

Conversely, based on my current income growth trajectory outside of my day job I believe that I could hit close to $4,000 per month in post-tax income in about two years. That eliminates the need for me to stick it out in cubicle-land for another decade just to build a portfolio large enough so that I would never need to work again.

There are many ways to cultivate enjoyable income streams that allow you to gain back time and freedom over your life. The 4% Rule only offers one way.

For me personally, I have found that I enjoy working when I have complete control and freedom over what I work on. This is why it makes sense for me to build up my income streams outside of my day job and step away from Corporate America far before I have enough money saved up to be financially independent.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.