3 min read

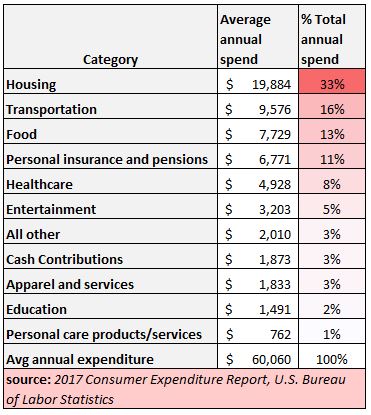

Each year the Bureau of Labor Statistics releases a consumer expenditure report, which summarizes how the average consumer unit in the U.S. spends their money each year.

A consumer unit “include families, single persons living alone or sharing a household with others but who are financially independent, or two or more persons living together who share major expenses.”

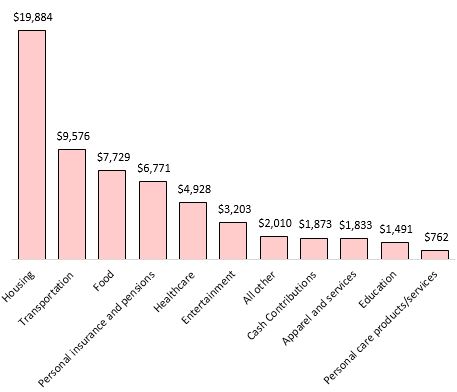

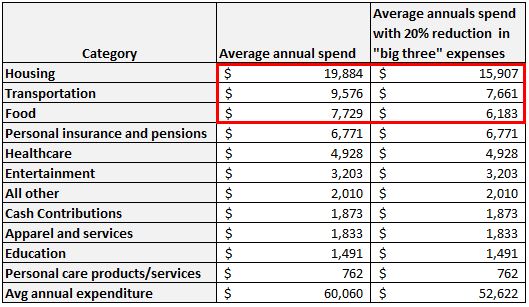

According to the most recent version of this report, the average consumer unit spent a total of $60,060 in 2017. Here’s the breakdown of that spending:

A few numbers jump out right away:

- Housing accounts for one-third of total spending

- Housing, transportation, and food alone account for 62% of total spending

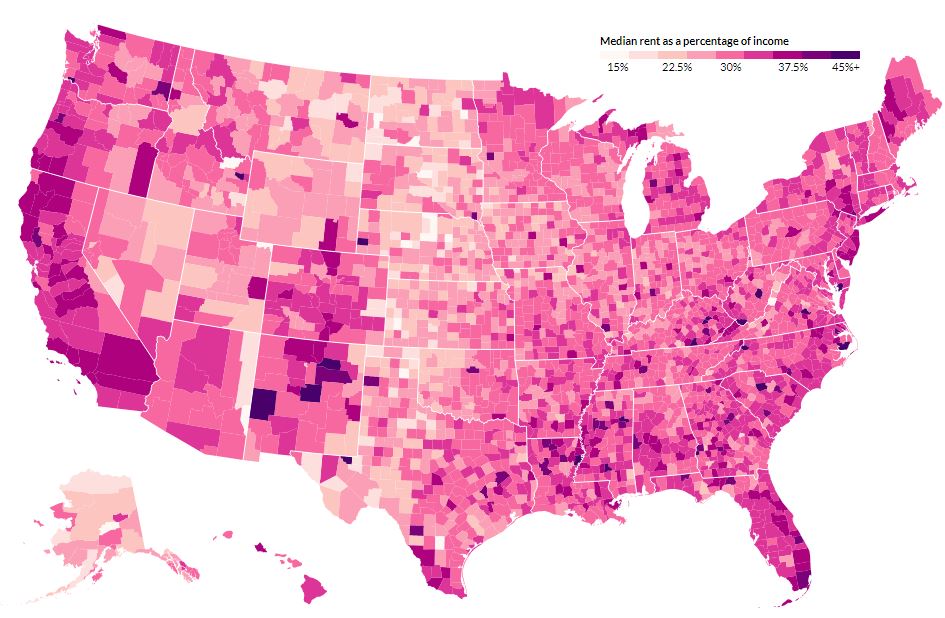

Keep in mind that these numbers are averages. Your own household may spend more or less than the average on some of these categories. For example, we know that the median monthly rent as a percentage of income varies wildly across the U.S. In some counties, the median monthly rent is only about 15% of the median monthly income, while in others it can be as high as 45% or more:

Original Post: Visualizing the median rent price as a percentage of income in all 3,000+ U.S. Counties

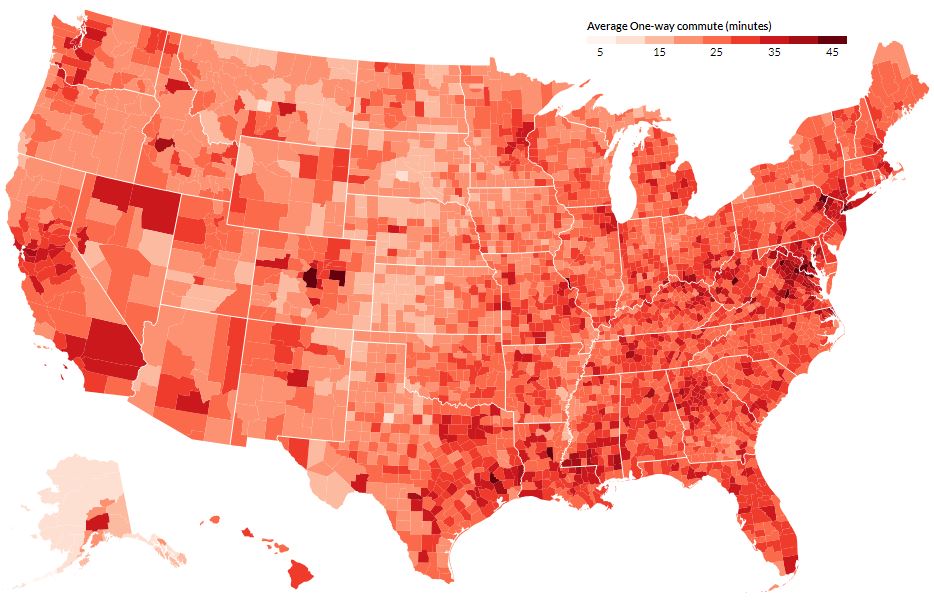

The same holds true for transportation. Average commute time and thus average gas expenditure can vary significantly from one county to the next. Some counties have an average commute time of less than 5 minutes while others have an average of more than 45 minutes.

Original Post: Visualizing average commute times in all 3,000+ U.S. counties

Putting variability aside, the biggest three expenses for most households is still housing, transportation, and food. This is why, for most households, the way to drastically reduce spending is to minimize these big three expenses.

In particular, understanding human psychology can help you minimize housing and transportation expenses without sacrificing well-being. Research shows that people tend to become accustomed to new things in their life quite quickly.

Bigger houses and newer cars bring a boost in happiness, but only for a short while. Over time, they become normal. This is known as hedonic adaptation.

This is why the best way to reduce housing and transportation costs is to live in a place that suits your needs and drive an affordable car. You will become used to both your house and your car quickly, no matter how big or new they may be. And since these two expenses alone account for half of your total spending, you’ll be able to drastically reduce your spending without sacrificing your well-being.

To reduce the third big expense of food, it helps to develop a cooking habit. Personally I meal prep my lunch on Sundays for the week ahead so I can easily pack my lunch at least four out of five days each week at work. Most nights I cook dinner too. This simple approach helps me keep my food expenses decently low.

When I do choose to dine out, I typically do so with friends or family. After all, I’m not enough of a spartan to avoid Chipotle altogether.

Big Financial Wins

I would consider reducing housing, transportation, and food expenses to be big financial wins. Consider the average consumer unit who could cut each of these categories by just 20%, i.e. instead of spending $19,884 on housing they instead spend 20% less ($15,907), and the same with transportation and food:

They would be able to reduce their yearly spending by over 12% even if they kept their spending the same in every other category.

The first step to building wealth is to spend less than you earn. And for most Americans, the best way to spend less is to minimize the big three expenses of housing, transportation, and food.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Nice topic. Family of three, we just spent $100 on dinner today. Last week, we bought $100 on groceries for lunch and dinner all week. I discussed this with my 17 yo daughter. Great timing. Ha ha.

We enjoyed the dinner tonight and have achieved FI, so it didn’t hurt the bottom line.

Great example, RE@54! Potential food savings from groceries vs. dining out can be huge for families in particular. Congrats on achieving FI! And cheers to enjoying family dinners without worrying about the bottom line.