4 min read

Last week I attended my first FinCon, a massive conference where 2,000+ money nerds meet to talk about all things personal finance.

Here are my four biggest takeaways from chatting with hundreds of fellow money nerds.

Most People Don’t Want to Fully Retire and Sit on a Beach Forever

Nearly every person I met who had already achieved financial independence (and there were dozens) was still working in some capacity, whether full-time or part-time. Some were working for a corporation 20 hours per week, some were freelancing full-time, some had started their own small business, and others were doing podcasting or blogging purely for fun.

I have written before that meaningful work plays an important role in leading a good life, but to actually talk with people who had enough money to never work again and who still chose to work really drove home this point for me.

Most people who are on the road to F.I. don’t actually hate work. They just hate the traditional work environment and the annoyances associated with it. Most of the people I talked to said they simply wanted more freedom to define what “work” looked like, to choose exactly what projects they spent energy on, and to have the option to work less hours if they felt like it.

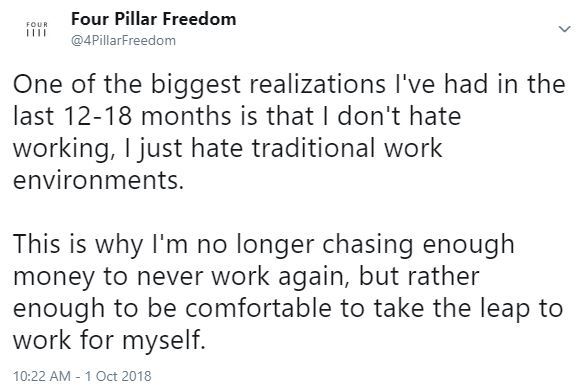

I recently tweeted out my own thoughts on this topic:

Of the people I talked to who had not yet achieved F.I., many said that they too enjoyed doing work as long as it was the right type of work that brought them fulfillment. And for this reason, many people were not actually chasing complete F.I. (saving up 25 times their annual expenses or more), but rather enough to be comfortable with taking the leap to a new work situation that allowed more flexibility and independence.

For many, the end goal is not to fully retire and sit on a beach forever. Rather, it is to have the financial means to pursue a work situation that doesn’t completely engulf all their time and energy.

Part-Time Travel > Digital Nomadism

Most people I talked to loved to travel, but had no desire to be digital nomads. Instead, they craved to have a “home base” city where they could live most of the year and travel for 1-3 months each year, often during times when the weather is worst in their area.

In particular, I talked to dozens of people from Minnesota who said the state was gorgeous during warmer months, but could be a bit of a tundra during the coldest months. Many said they enjoyed where they lived, but would love to have the financial means to pursue extended travel during these coldest months.

This trend kept popping up in conversations. Most people had no desire to travel full-time. They liked having a home base. They liked being a member of a community. They enjoyed living near friends and family.

Just as meaningful work plays an important role in leading a good life, having strong social connections also plays a crucial role. And digital nomadism (traveling full-time) can make it challenging to form lasting social connections.

I share this sentiment. I love the idea of traveling for a few months each year, but I also want to be close to my friends and family. Maintaining a “home base” city and traveling for a few months each year seems to be the perfect hybrid approach to getting the benefits of both travel and community.

Related: Great News: You Don’t Have to Be a Digital Nomad to Find Bliss

Learn as You Go

In regards to creating blogs, podcasts, books, or small businesses, most people said they learn as they go. They don’t have a grand plan mapped out, they just work on their passion project a little bit each day and see where it takes them.

On one of my favorite podcasts, How I Built This, Guy Raz interviews people who have successfully built multi-million or billion dollar businesses. A trend I have noticed in these interviews is that most of the entrepreneurs never had plans to build a massive business. They were simply solving a problem they faced in everyday life. They were scratching their own itch, pursuing their own curiosity. Over time, they picked up small wins here and there, and eventually a tiny business grew into a behemoth.

I noticed this same trend among a few people I talked to at FinCon who had built successful brands and were earning a full-time income online. Nearly all of them started writing or podcasting in a niche they found interesting. Over time, it grew into something much larger than they could have predicted and they simply picked up the necessary skills over time to grow their brand.

I think this mentality can be applied to any new endeavor. You don’t need a grand vision ahead of time. You don’t have to see the finish line (often there is none) when you start, you simply need to get started, follow your curiosity, and be a voracious learner as you go. Everyone you look up to who is successful was once in your position.

Creation is Contagious

Being around so many people who were creating amazing things made me want to create even more. This made me realize that creation is contagious and that I want to surround myself with people who are creators in my everyday life.

I met people who were working on e-books, financial apps, websites, podcasts, and a host of other cool things. The more I hung out with these people, the more I felt the desire to create. And although I know very few people in my everyday life who are creators, I plan on surrounding myself with fellow creators via the internet.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Great post! Would you recommend FinCon to novice bloggers or is it targeted mostly toward established bloggers?

In my opinion it’s great for all bloggers. If you’re a novice blogger in particular, you will learn a TON about blogging, SEO, building a brand, etc. from the talks given by more established bloggers. Outside of learning about blogging, it’s great to just connect with so many like-minded people.

Love your 2nd takeaway!

Although I am by no means old (26), when I first graduated college 4 years ago, I thought to myself I would love to travel full-time. Not having to be tied to a certain place was a thrilling idea in my mind.

As I have gotten older though, I have come to truly appreciate embracing a city and a place to call my own. The feeling of driving up to your own home that is paid in full (my biggest financial dream) is one that keeps me motivated.

While it would be nice to travel all the time, sometimes there is no greater feeling then simply staying at home and being lazy for awhile (just not too long haha). Traveling when you want then becomes almost even better because you can get that excitement build up, knowing that there is a trip right around the corner!

Couldn’t agree more. I think there’s a happy median between traveling and being a homebody. It’s nice to travel and see what’s out there, but it’s also a great feeling to be grounded in one place with family, friends, and familiar settings around you.

It was great to meet you in person, Zach.

I was one of those Minnesotans who plans on extended travel, particularly during the winter months, but absolutely plans on keeping a home base. With a family, it’s particularly helpful to have a place you and your kids can call home.

This concept, of course, is nothing new. Retirees throughout the U.S. who live “up north” have been snowbirding it down to Florida, Arizona, and other warm places for months at a time since before aeroplane travel became commonplace.

Keep doing what you do!

-PoF

It was great to meet you as well, PoF! You;re right – travel during cold months isn’t exactly a new concept, but combining travel with financial independence at an early age is certainly a novel idea. I personally love the idea of having a home base mixed in with occasional extended travel, and it sounds like many other people do as well.

Thanks for the kind words!

I love your four takeaways and agree wholeheartedly. Being early retired for 8 years, I find that my husband and I are constantly working (but for free now) and love our travel trailer and our home base. I have found that I love learning, trying new things and yes, being around creators is infectious. So far I have launched into new endeavors about every year or so, from Taiko drumming to tackling a foreclosure home, taking courses at community college and now to blogging.

I briefly said hello at FinCon and wish we had had more chance to chat. It was my first and I found it hard to read badges sometimes, which caused me to miss a few people like you that I have enjoyed reading. What a great experience it was!

That’s awesome to hear, Susan. It sounds like early retirement has been a great opportunity for you and your husband to try tons of new things. I do remember meeting briefly at FinCon, I wish we could have talked longer! I agree it was a great experience as a whole 🙂

Thanks for the recap! Once you achieve financial independence, you just get on with your life and don’t talk too much about financial independence anymore. So I actually think there is an inverse correlation with financial independence and how much you talk about financial independence.

Could it be that the more you talk about financial independence, the less secure you are about your financial Indy? it’s like the person who constantly tells everybody how much they make. Why do you think that is?

Great point. I have noticed that as well among people who achieve F.I. Once they hit that mark, money no longer becomes so important to obsess over and increasing your net worth is no longer such an important goal. I don’t think that’s a bad thing at all, though. Money, after all, is only a tool to enable you to spend your time doing things you enjoy.

Totally agree with you both, here.

I think there’s a real possibility of hitting financial independence after striving so long, and then waking up and saying, “now what?”

Achieving goals can often be a double-edged sword, as you get immediate elation and then the let down right after. But, you get on with life and find new goals and things to do with your time.

The fact that people that are F.I. are not retiring on a beach shows us that have not reached F.I. how important it is to have other projects and hobbies for when we do reach our money goals.

Anyway, great article Zach. Love the part about traveling 1-3 months vs year-round, also.

“The fact that people that are F.I. are not retiring on a beach shows us that have not reached F.I. how important it is to have other projects and hobbies for when we do reach our money goals.” Exactly this.

Wonderful post, Zach! I agree with your last observation so much. As a writer myself, I find that it is important to feed off the synergy of artists who gather, or who at least stay in touch. That, combined with solitude to create, is a winning combination! Glad you got to go.

Thanks, Lin! I agree with you – feeding off the synergy of fellow artists and creators combined with the ability to sit and create in solitude is a winning combination. Thanks for the kind words!

Zach – loved this post and hanging out with you at FinCon. Chatting about the pursuit of financial independence while sitting in a pool isn’t the worst way to spend an afternoon 😉

I’m glad we both agree on the point of having a home base but traveling throughout the year. Here’s to hoping the both of us get to that point soon – I’m already itching to get to my next destination!

If you are ever in the Minneapolis area, make sure you hit all of us Minnesotan’s up! We would love to hang out with you again.

Thanks Krystel! It was great meeting up with you and all the other Minnesotan’s – you’re an awesome bunch. I’ll be sure to hit you guys up if I’m ever in Minneapolis.

I think the home base mixed with intermittent travel is the strategy that most appeals to me as well. I think it’s a great way to be a member of a community while also allowing yourself to get out and see new places.

Thanks for the comment 🙂

“They liked having a home base.”

I love this. I know there’s a little bit of resistance to home ownership, but having a fully paid off home without all the upgrades is a great way to achieve this on the path to FI. This part of our goal to achieve in the next 10 to 15 years. We’re in our early 30s and we still travel 3 to 4 times a year. Life. Is. Good.

Can’t wait to for my first FinCon next year!

I mousey’d over to check out what happened at FinCon this year to see what to expect for next yr. Still thinking, thinking, thinking even tho I’ve already bought the ticket .

I’m pretty much in the exact same camp as most FI-ers.

Looking forward to days of reduced work, more flexible work, and charting some direction rather than purely executing a board of directors’ grander vision though the large cogs will always have the capital and supply chain to scale.

I’m def part of the camp living in those regions with the cold, dark, dreary winters and looking for a few mths somewhere south and sunny while maintaining my well established community home base in fatFIRE times.

For now I’m still working FT in the cog. Group extended health care is a great thing when you start using more of it down the road.

It’s refreshing to read about people who truly understand FIRE esp with a recent retired celebrity misunderstanding FIRE and spreading all over the media like wild fire. It hurts their own credibility if you ask me.

Speaking of credibility, I’ve heard tons of excellent testimonies of you from other blogger friends.

Keep up the great work!