According to psychology, there are three conditions needed for lasting happiness. They are connection, competence, and autonomy.

Connection means having relationships with those around us and feeling part of a community. This community could be three people or it could be three hundred. Being connected with others has been shown to improve our well-being and incredibly enough our life expectancy (check out The Village Effect by Susan Pinker).

Competence is defined as “taking on challenges and experiencing mastery”. It’s working on challenging problems, mastering a craft, and creating stuff to put into the world.

Autonomy is the freedom to do whatever we want whenever we want. It’s having control of our time.

When we have these three conditions in place, it’s a beautiful recipe for happiness.

So how does personal finance fit into this puzzle? In other words, how do we use money to better master these three conditions?

The most popular idea is early retirement. Save a ridiculously high percentage of your income and retire in 10 years or less. That way you’re guaranteed to have complete control of your time (autonomy) and can spend it working on whatever you like (competence) while hanging out with whoever you want (connection). This satisfies the three conditions above quite well.

But it’s entirely possible to achieve early retirement and be miserable. You might have control over your time (autonomy), but if you spend it living a lonely life (no connection) without working on anything meaningful (no competence), the end result won’t be happiness.

On the flip-side, it’s possible to have a traditional job and be completely happy. If you have complete control over the projects you work on and a flexible schedule (autonomy), you find the work you do meaningful and you’re good at it (competence), and you work with people you’re friends with outside of work (connection), you actually have all the ingredients necessary for a happy life.

We Need “Flow”

The problem with the above scenario I just described for the traditional job is that most of us don’t actually have complete control over our work or our schedule, and odds are we aren’t best friends with the people we work with.

This is why early retirement is such an appealing idea for many people. The idea of having enough money to never work again sounds like a gift from above. Most of us have been crammed into a 40-hour, commute-heavy, deadline-filled work environment for so long that we have learned to associate work with drudgery and dullness.

But what most of us forget is that doing work we enjoy can actually offer a huge boost to our happiness. Psychologist Mihaly Csikszentmihalyi wrote a wonderful book called Flow, which explains how doing work we enjoy can enable us to enter a “flow state”, which is a highly focused mental state that brings us deep satisfaction. By working on projects we care about and find meaningful, we can experience this flow state and find a ton of satisfaction in our work.

The problem is that most of us don’t have the financial freedom to step away from work we hate and step towards work we love. But gaining this freedom might not take as long as you’d think.

A Mix of Active and Passive Income

Financial independence is having enough passive income to cover your expenses. Many people think this is the best way to achieve maximum happiness, and in many cases this may be true. But I’d argue that there is a way to achieve maximum happiness with a mix of passive and active income.

For example, consider a family of four that lives on $40,000 a year. To be financially independent, they need roughly $1 million (25 times their annual expenses).

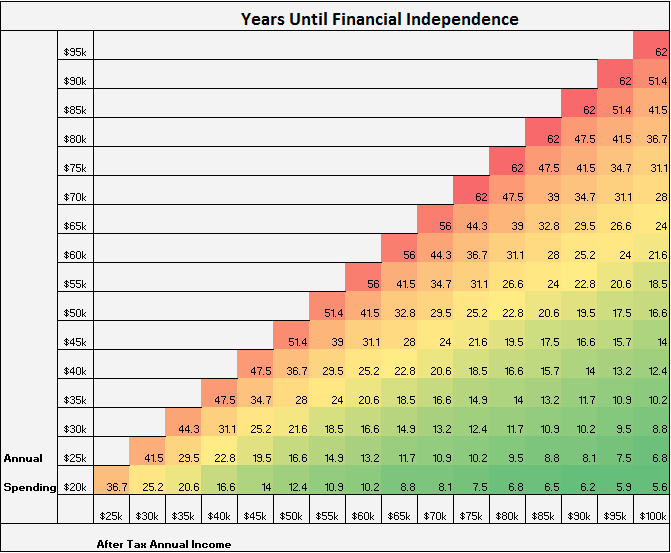

Perhaps both parents work stressful 9-5 jobs and earn a combined $100,000 per year. After taxes they take home maybe $75,000. This means they have $35,000 left over each year to save and invest. According to the Early Retirement Grid, they’ll achieve financial independence in a little over 18 years:

But what if they just discovered the concept of financial independence, they’re in their early 30’s with two young kids and don’t want to work full time for the next 18 years? This is an example where complete financial independence might not be the best way to maximize their happiness.

Instead, this couple might be better off working for 3-5 more years, building up a stash of $150,000 – $200,000 and transitioning to part-time work or starting their own side business. During the 3-5 year window they could start working on a side business on the evenings or weekends so by time they leave their full-time jobs they have a nice foundation built for the business.

Even if the part-time work or business doesn’t work right away, thanks to their savings they have plenty of time to figure out how to earn money without immediately needing to seek out full-time jobs again.

Find Your Mix

For many people, complete financial independence can be the best route to achieving the three conditions for maximum happiness. Namely, high-income professionals and people who master the art of frugality can achieve F.I. in only a few years.

But it’s just a fact that some people are in situations where they’re not able to save a huge percentage of their income and achieving F.I. is significantly harder. For these people, just having enough savings set aside to pivot to a new job, work part-time, or start their own business is actually a better (and faster) route to achieve maximum happiness.

Recently I tweeted out my thoughts on this:

It’s great to have passive income, but if you can create a work situation where you earn active income and enjoy it, you can experience autonomy, connection, and competence all without being financially independent. And for many people, this is much faster and easier to achieve than complete financial independence.

There doesn’t exist an income formula that works best for everyone. Whether it’s 100% passive, 100% active, or something in between, there are all kinds of blends that can enable you to live a happy life. Just know that it’s possible to achieve maximum happiness without achieving 100% passive income. Active income is not the devil.

Find the mix of active and passive income that works best for you.

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Hey Zach!

I read a lot of FIRE related blog but I particularly enjoy reading yours. Your perspective and your story are so interesting and refreshing. We can clearly see that you put a lot of time and effort in your writing. I’m also a big fan of your visuals, graph and charts.

Keep up the good work ! 🙂

Thanks so much Julien, I really appreciate the kind words 🙂

This hits home for me perfectly. I’m living in the Netherlands, and had this discussion with other Dutch FIRE seekers a couple times. Where we live it’s harder to reach FI than in the US due to regulations and taxes. This would mean we can reach our way of happiness way sooner than the ‘regular’ way. Thanks!

It’s nice to hear a perspective from someone outside of the U.S. I know there are many countries that have much higher taxes than the U.S. that make it considerably harder to have a high savings rate. In those countries, it’s almost always easier to find a blend of passive and active income to optimize your lifestyle considering how many years it could take to reach a point of surviving on 100% passive income. Thanks for your insight 🙂

I agree with Divnomics. We had that discussion during a meetup. Great to read a similar story here.

I’m not sure if the conditions are in the order of importance but I’d have to say that connections may be the most important. We MUST be connected to others in order to be happy. All the money in the world won’t mean anything unless we have people we interact with and care about to share it with. And not the connecting with 200+ people on social media while we are alone in the corner of a coffee shop 🙂

Connections are incredibly important. In the book I mentioned in the post, “The Village Effect”, Susan Pinker actually points out that the “closeness” of our social circle is the number one factor that determines life expectancy, which is mind blowing. It just proves how important connecting with others truly is to our health. That’s one reason I love personal finance – it teaches us how to create a financial situation that enables us to spend MORE time with people we love and stay connected 🙂

Hi Zach,

Thanks for this post. We look at it this way could be more morale lifting or put it another way, trying to lie to yourself that you are secure when you really are not.

I see it as mediating the idea that what if you try so hard to be financially independent, reach that point, and realize you have a void inside you because you missed out on connection and autonomy is not such a big factor.

We undervalue living life or #yolo in the FIRE world quite a lot.

My leaning is towards semi-retirement or batch working. It feels more balance.

What we are doing is front loading the wealth for security.

“What we are doing is front loading the wealth for security” – I like this idea a lot. The point of money is not necessarily to have so much that we never have to work again…it’s to have enough peace of mind financially to live in a way where we don’t have to stress about money or be strapped to a job we hate just to earn money. I think the F.I.R.E. community is a little too obsessed with the idea of “not needing to work”. Obviously that can be a great situation to be in, but for many people they can achieve a happier lifestyle just by reaching a point of “financial flexibility”.

Dude, you totally crush it every time. I absolutely agree with everything you said about autonomy, competence, and connection.

And I’ve recently thought about approaching financial independence with a mix of passive and active income. The hope is that I can grow the passive income with the extra time to achieve full coverage of my expenses.

Keep up the great work!

I appreciate the kind words, Ernie! I think a mix of passive and active income can be a far more efficient way to achieve a good life than complete F.I. for many people. It takes less time and still leads to happiness.

Thanks for the feedback 🙂

Zach

Excellent perspective on what I feel FIRE is really about. The word ” retirement ” has unfortunately become synonumus with “unemployment”, conjuring up visions of sandy beaches and tall frosted drinks without a cell phone or deadline in sight. However, its perfectly possible to be actively employed and at the same time retired. All it requires is 1) a true passion for and enjoyment in what you do and 2) the financial ability to walk away when you no longer have that passion. I know many physician friends who continue to practice well beyond the point where they reach FI. They are still employed, but essentially are mentally retired.

You bring up a ton of great points. Another interesting phenomenon I’ve noticed is that when people do achieve F.I. and no longer need their current job for income, they actually begin to enjoy the job far more. I think many people would benefit from realizing that “not working” is not the main ingredient for living a good life. It’s about having freedom and flexibility to do what you want when you want, whether that means working or not.

Thanks for the feedback 🙂

Great post. Articulates the idea I try to share with clients.

i.e. Retirement doesn’t have to be binary. The choices don’t have to be 1) working 40hrs/wk or 2) retired = zero work.

I know of a financial advisor who runs his own firm with 2-3 support people. He takes off 80+ days every year. He’s designed it that way.

He still makes a net $500k+. He’s putting a good chunk of that into passive investments.

But he doesn’t NEED to . He’s basically semi-retired. He only does the work he enjoys. He travels A LOT.

That’s the beauty of getting a time-independent side hustle or small biz going. (or a couple of them)

You can get all three of your areas covered: connection, competence and autonomy.

Keep up the great writing!

Time-independent (and location-independent) side hustles and small businesses are a fantastic way to gain both time and freedom while still earning money. I agree with you, I think the whole idea of retirement has been distorted into “working full time” or “not working at all”, which is ironic because neither of those choices necessarily result in the most happiness. Work allows for connection and contribution, both of which are necessary to live a fulfilled life.

Thanks for the feedback, I really appreciate it!

I am targeting FI more than the RE. I know some of my dream jobs (that I’ve never tried) make less than what I make now. I’m going to work and save and gain skills and experience now. Then when I ask for a flex work schedule, or my industry hits a bubble, or I’m ready for something new I have the stability of my finances to take the new job and not worry about the pay. 🙂

I love that plan – save up a nice cushion of money to give you the flexibility to pursue a different path, a different industry, start your own small biz, or whatever else! There’s no need to wait until retirement to start doing work you love. Best of luck with your financial journey 🙂

Zach, Nice post. This is why I often say that FI is mandatory, RE is optional. I wrote even an article with that title on my website. The problem with the “cubicle prison” narrative that many FIRE bloggers embrace is that once given the ER that they so clearly aspire to, they often find that too brings its share of problems, just of a different kind. There are a few notable exceptions of course, but that’s because they knew exactly what they will do to occupy the 8-10 hours a day of time absence of structured work provides. Work defines a big part of most people’s lives, and gives meaning to their lives as much as family and friends do.

New to your blog. Stumbled upon it browsing the web. Keep up the great work. I am hoping you update it regularly.

Thank you!!

While this post has been most inspirational in helping one to achieve success and happiness. I have to agree with you when referencing “the force”. While I have been at me current job for a little over 2 years now, I have to say, I have experienced this “force”. It is a state of mind unlike any other, it’s working with a purpose, it’s waking up and realizing you have a greater plan in action but that this work you’re about to endure is a means to that end. This is how I’ve come to not only appreciate, but also enjoy my daily work. Happiness is the key to success. Be it financial, emotional, physical, etc. without it, we will soon start to lose interest and drive, resulting in us chasing one thing after the next.