A couple weeks ago I explained the concept of financial independence using tiny red and green blocks. I’d recommend reading that post before you read this one. But if you’re at your kid’s soccer practice reading this on your phone and you only have 5 minutes until practice ends, here’s a 30 second recap of that post:

Pretend this red block represents $1,000 in yearly spending:

![]()

Now pretend this green block represents $1,000 in savings:

![]()

For every tiny red block, you need 25 tiny green blocks to be financially independent:

![]()

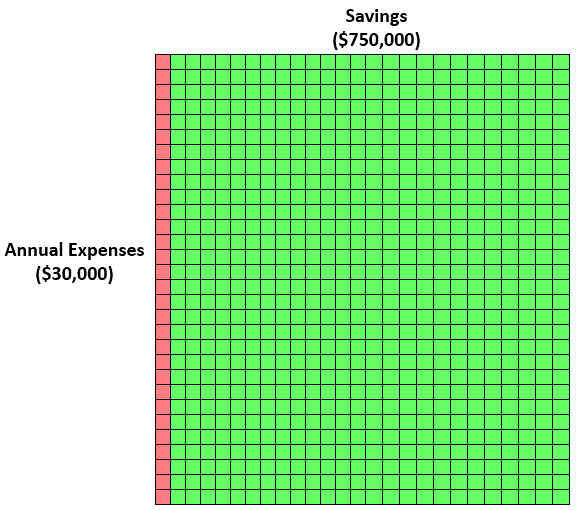

So if you spend $30,000 each year, you need $750,000 ($30,000 *25) to be financially independent, which looks like:

Sweet, you’re all caught up.

Now today I want to add a new dimension to these block charts: the number of years it will take you to reach financial independence.

So let’s pretend this blue block represents $1,000 in yearly savings:

![]()

If you save $10,000 in one year, it looks like:

![]()

Or if you save $20,000 in one year, it looks like:

![]()

Let’s assume you invest the money you save each year and it grows at a 7% interest rate.

Let’s also pretend this tiny purple block represents $1,000 in interest:

![]()

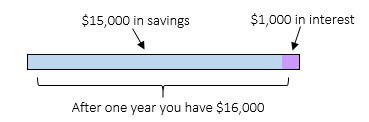

So if you save $15,000 in one year, you’ll earn just over $1,000 in interest (specifically $1,050, but I’m rounding to $1,000 for simplicity).

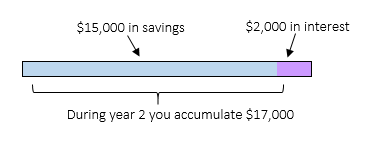

But something magical begins to happen as you save and invest more money. In year 2, you might save $15,000 again, but now you have a grand total of $31,000 earning 7% interest ($15,000 in savings from year 1 + $1,000 in interest from year 1 + $15,000 in savings from year 2)

This means you’ll earn roughly $2,000 in interest in year 2:

As you keep saving more and more, you’ll earn more and more interest on your savings. This will help accelerate you to financial independence faster and faster as time goes on.

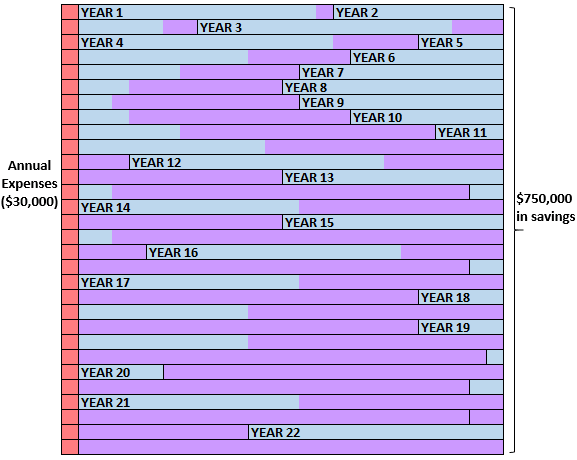

Let’s go back to our example from earlier. Let’s say you earn $45,000 a year (post-tax) and you spend $30,000 each year, so you have $15,000 left over to save and invest.

You need $750,000 to be financially independent. Let’s see how long it will take to accumulate $750,000 by saving and investing $15,000 each year at a 7% interest rate:

It will take 22 years to save up $750,000.

It’s incredible to see how much interest (the purple blocks) starts building up over time. In fact, around year 10 the interest you’re earning from your savings is already more than the $15,000 you’re able to save each year. Notice in the early years, you’re dependent more on your savings (the blue blocks), but as time goes on the interest begins to dominate.

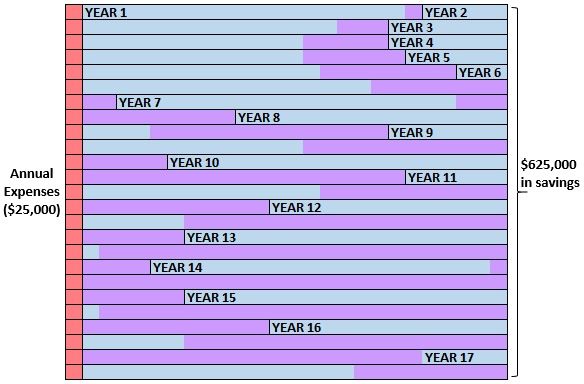

Now consider this thought experiment: how long would it take to reach financial independence if you reduced your yearly spending to $25,000? This means you can now save $20,000 per year on your same income. It also means you only need to save $625,000 to reach F.I. ($25,000 * 25). Here’s what that looks like:

It only takes 17 years to save up $625,000. In this case, cutting your yearly expenses by $5,000 allows you to reach financial independence 5 years sooner.

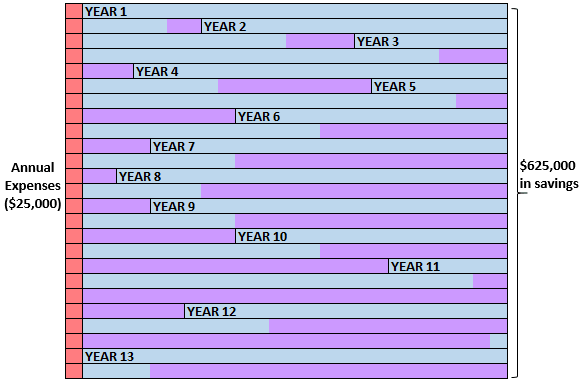

But why stop there? What would it look like if you were able to keep your yearly spending at $25,000 but then also find a way to make an additional $10,000 per year either from switching jobs, getting promoted, or starting your own side hustle?

If you’re able to increase your yearly income to $55,000 (post-tax), you can now save $30,000 per year. Here’s how long it would take to reach F.I. in that case:

Now with $30,000 in yearly savings you can achieve financial independence in only 13 years! That’s incredible.

The Big Takeaways

The numbers used in these examples are arbitrary. Maybe you actually earn $100,000 a year and spend $70,000 a year. Or maybe you only earn $20,000 a year and spend $15,000 a year. Regardless of your financial situation, the following two ideas apply to all levels of income and spending:

- The single best way to achieve financial independence as fast as possible is to simply reduce your yearly spending. If you need less money to live on, you have to spend less time accumulating 25 times your yearly expenses.

- The second best way to achieve F.I. quicker is to increase your yearly income. This allows you to save more in a shorter period of time.

Sign up to have my most recent articles sent straight to your email inbox for free ?

[jetpack_subscription_form subscribe_text = “” title=””]

- The Ad Revenue Grid - August 6, 2021

- Attract Money by Creating Value for a Specific Audience - July 13, 2021

- The 5-Hour Workday - March 26, 2021

Full Disclosure: Nothing on this site should ever be considered to be advice, research or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.

Love the visualizations again on this one. Really shows the power of compounding and keeping expenses low.

Thanks Dave! Glad you’re enjoying the graphics 🙂

Nice charts! And in the first example after year 10 (the big hurdle), it’s smooth sailing as the power of interest really comes into play and is working harder and harder for you. Time can either be our friend or our enemy and the choice is ours 🙂

The compound interest really starts to get wild in the later years. That’s why it’s all about saving in the beginning and letting investing do the heavy-lifting near the end.